What is financial software?

Financial software platforms allow businesses to track their assets, expenses, liabilities, and other financial information in real-time. The software provides extensive analytics for users to measure their financial performance against set KPIs/goals.

Finance software for businesses

The finance industry uses a variety of software programs. Financial analysts and investors often use specialized software (like FP&A software) to help them make budgets and reports, develop financial forecasting, and perform other financial planning and analysis (FP&A) tasks.

This software can track spending, support effective budgeting, and even make investment decisions. The umbrella term “finance software” can include:

- Budgeting applications

- Financial planning software

- Financial statement and report programs

- Accounting platforms

- Payroll, payment, and invoicing software

- Expense tracking tools

- Inventory management platforms

Or, a lot of those in one! Finance software is often multifaceted, so it's essential to look at each solution and see where its strengths lie.

Types of business finance software

Now, let’s get a little more in-depth into the various types of financial software for businesses.

Accounting software

This software helps you keep track of your income and expenses, prepare financial statements, and manage your accounts receivable and payable. You can also integrate your accounting software with your business credit card and bank account to receive real-time updates regarding your business’s day-to-day accounting activities.

Budgeting software

Budgeting software helps you track your spending and create a realistic budget you know you can stick to. You can use budgeting software to set financial goals and track your progress over time. As your business grows, budgeting software is a great way to see how you’re spending money and gain control of business finances.

Financial planning software

This type of software helps you plan for your financial future. Financial planning software can track your investments, set goals, and develop a plan to reach those goals. Good financial planning software lets you see possible risks and opportunities during your planning process. This allows you to make informed decisions about the future of your business and optimize financial strategies.

Financial management software

Financial management software can help you streamline and automate your businesses' financial processes. It typically has modules for expense management, payroll, invoicing, tax compliance, and financial reporting.

These tools can also integrate with other business software (like Customer Relationship Management (CRM) and Enterprise Resource Planning (ERP) software), enabling organizations to manage their finances on a centralized platform.

Beyond simplifying daily financial operations, financial management software allows you to maximize profit and ensure the long-term growth of your business.

Investment software

Investment software can help you track your investments, monitor the stock market, and make investment decisions. Its key features include comprehensive asset allocation, real-time updates on investments, and robust reporting capabilities. These features enable you to make well-informed investment decisions and manage investment portfolios effectively.

Tax management software

This software can help you prepare your taxes, find deductions, and file your return electronically. They’re usually customizable templates and documents that you can personalize to meet your business requirements.

Using tax management software helps you to comply with all tax procedures and standards established by the law.

Key features of financial software for businesses

You’re probably wondering what key features to consider when choosing financial software for your business. The best software should have these features:

Financial health monitoring

As a business, financial health is the most essential factor to internal and external stakeholders in your organization. For example, if an investor wants to put money into your business, they would first consider the business's financial health through your financial statements.

To ensure you accurately report your financial status, you need to track key financial metrics such as revenue projections, cash flow, profit or loss statements, and financial position statements.

Financial software for businesses provides clear insights into your financial health. It can help automate the manual part of this process and aggregate all business financial data on a centralized platform. Financial software also allows you to identify trends, forecast future performance, and quickly see drops in the company’s financial health.

Financial models and predictions

The best financial software can analyze business historical data and trends and leverage them to create financial models and predict future financial outcomes (e.g., income, expense, cash flow, revenue). Your organization can also model certain variables/scenarios, such as market conditions, business acquisitions, and cost trends, to predict their impact on the business's financial status and effectively plan for opportunities and unforeseen events.

Financial planning

Financial planning features allow businesses to develop a strategy based on predetermined financial parameters, such as cash flows and profit and loss. Using business data already available within the software, you can analyze past performance, assess the business's current financial situation, and plan what financial goals to achieve and how to achieve them.

Financial statement and reporting

Financial statement and reporting features use ledger consolidation to aggregate financial data from ledgers and accounts into one financial statement. These features are great for businesses with multiple units.

FP&A software tracks revenue, expenses, assets, and liabilities, ensuring that all transactions are accurately classified into their transaction class. With readily available financial statements, you can see how each business unit performs and the overall financial position.

Accounting and tax management

Business financial software has tools for automating and managing an organization’s accounting procedures end-to-end. It covers basic administrative accounting processes such as recording transactions in general ledgers, payroll, bank reconciliation, generating tax forms for filing taxes, etc.

Financial software also offers tax management features that enable you to store business taxation settings for consistent tax and VAT collection. It also helps to track liabilities, file tax returns, and manage tax payments.

Payroll and invoicing

The payroll functionality of financial software automates the calculation, processing, and distribution of pay to employees so you don’t spend hours calculating taxes, scheduling deposits, or writing checks. Invoicing capabilities mean businesses can automate and generate customized invoices for recurring transactions like subscriptions to services and contracts.

Expense tracking

As your organization grows, so will all business-related expenses. An expense tracking feature lets you record expense reports and have a complete view of how financial resources are spent. The feature also helps FP&A teams analyze business spending patterns in-depth to discover unnecessary spending and cost-saving opportunities.

Best finance software for businesses

Staying on top of finances is necessary for businesses of all sizes, whether it’s through tracking expenses, forecasting growth, or closing the books at the end of the month.

Thankfully, modern finance software tools can automate tedious processes like reconciling accounts or generating reports to give your team more time to focus on strategic decisions. But with so many options to choose from, how do you know which platform is the right fit for your business?

Let’s look into the best finance software available so you can make an informed decision for your finance team.

1. Cube

What it is: FP&A software for financial planning and analysis

Best for: Finance teams who need a spreadsheet-native tool for faster planning and smarter decision-making

Cube is the first spreadsheet-native FP&A platform that helps you plan for the unexpected and stay ahead of changes. The cloud-based FP&A software platform helps finance teams work anywhere, integrating natively with both Excel and Google Sheets so you can plan, analyze, and collaborate with the ultimate speed and confidence.

Cube uses powerful AI to automate data consolidation, detect anomalies, and surface predictive insights so teams can make smarter, faster financial decisions. Many companies (like Edge Fitness Club, BlueWind, and Smart City) use Cube for most if not all of their company's financial operations.

Cube offers faster time to value, with most companies finishing onboarding within two weeks, and maintains competitive pricing.

%20(1)%20(1).png?width=600&name=Big%20image_Howcubeworks_V2%20(4)%20(1)%20(1).png)

Key features:

- AI capabilities: Automate anomaly detection and predictive modeling to identify risks and opportunities for growth with ease.

- Automated data consolidation: Connect data from numerous sources for automated rollups and drilldowns.

- Multi-scenario analysis: Model how changes to key assumptions affect overall outputs seamlessly.

- Endless integrations: Find integrations for spreadsheets (Google and Excel), accounting and finance, HR, ATS, billing and operations, sales and marketing, and business intelligence software.

- Customizable dashboards: Build and share customizable dashboards that are guaranteed to impress stakeholders.

- Native Excel and Google Sheets integration: Work where you want, as Cube is compatible and bi-directional with any spreadsheet.

- Multi-currency support: Evaluate your financials in both your local and reporting currencies.

- User-based controls: Ensure that the right data goes to the right people at the right time with user controls, validations, and an audit trail.

- Centralized formulas and KPIs: Store all your calculations in a central location and manage from a single source of truth.

- Drilldown and audit trail: Get straight to the transactions and history behind a single cell of data in just one click.

➡️ See more of Cube’s financial software features here.

Pros:

- Automate and analyze important data with powerful reporting and KPIs.

- Streamline manual data, reduce errors, and improve collaboration so you can make smarter business decisions in a fraction of the time.

- Collaborate easily with industry-leading FP&A experts and an award-winning support team.

Cons:

- Cube works best for midmarket and enterprise companies—it’s not a personal finance app.

Pricing: Cube offers custom pricing starting at $2,000/mo.

2. Anaplan

What it is: Strategic planning software for financial modeling and operations planning

Best for: Large enterprises who need tools for predictive insights and scenario modeling

Anaplan is a cloud-based financial modeling and planning software that helps businesses model transactions, commissions, and established relationships between different data sets. It connects strategy to outcomes and drives accountability so all business units can maximize their contribution to overall results.

Key features:

- Predictive insights: Connect internal and external market data to uncover actionable planning insights.

- Planning and modeling: Model potential outcomes using real-time operation metrics and multi-dimensional scenarios.

- Financial management: Unite business finance and corporate teams on a single platform for aligned, data-driven decision-making.

[Source]

Pros:

- Integrates with other business platforms like Microsoft 365 and Google Sheets

- Flexible and scalable

- Capable of handling real-time calculations on large data sets

Cons:

- High costs for data storage

- Improvements needed for user management

- Limited front-end dashboard functionality

Pricing: Pricing is not publicly available.

3. Workday Adaptive Planning

What it is: Finance software for budgeting, forecasting, and reporting

Best for: Enterprises who need collaborative tools for modeling and data analysis

Workday Adaptive Planning is a type of finance software that offers businesses a more personalized and collaborative approach to budgeting, forecasting, and reporting. It uses machine learning to conduct goal setting and what-if analysis.

Key features:

- Advanced analytics: Make data-driven decisions with access to formatted and ad hoc reporting on metrics, scenarios, etc.

- AI and machine learning: Use embedded artificial intelligence and machine learning tools to build strategic plans.

- Reporting: Monitor organizational health and keep track of KPIs.

[Source]

Pros:

- Allows monitoring of staff time management

- Integrates with banking software

- User-friendly interface

Cons:

- Changes are not auto-saved, making it easy to lose progress

- Expensive for small businesses

- Steep learning curve

Pricing: Pricing is not available on their website.

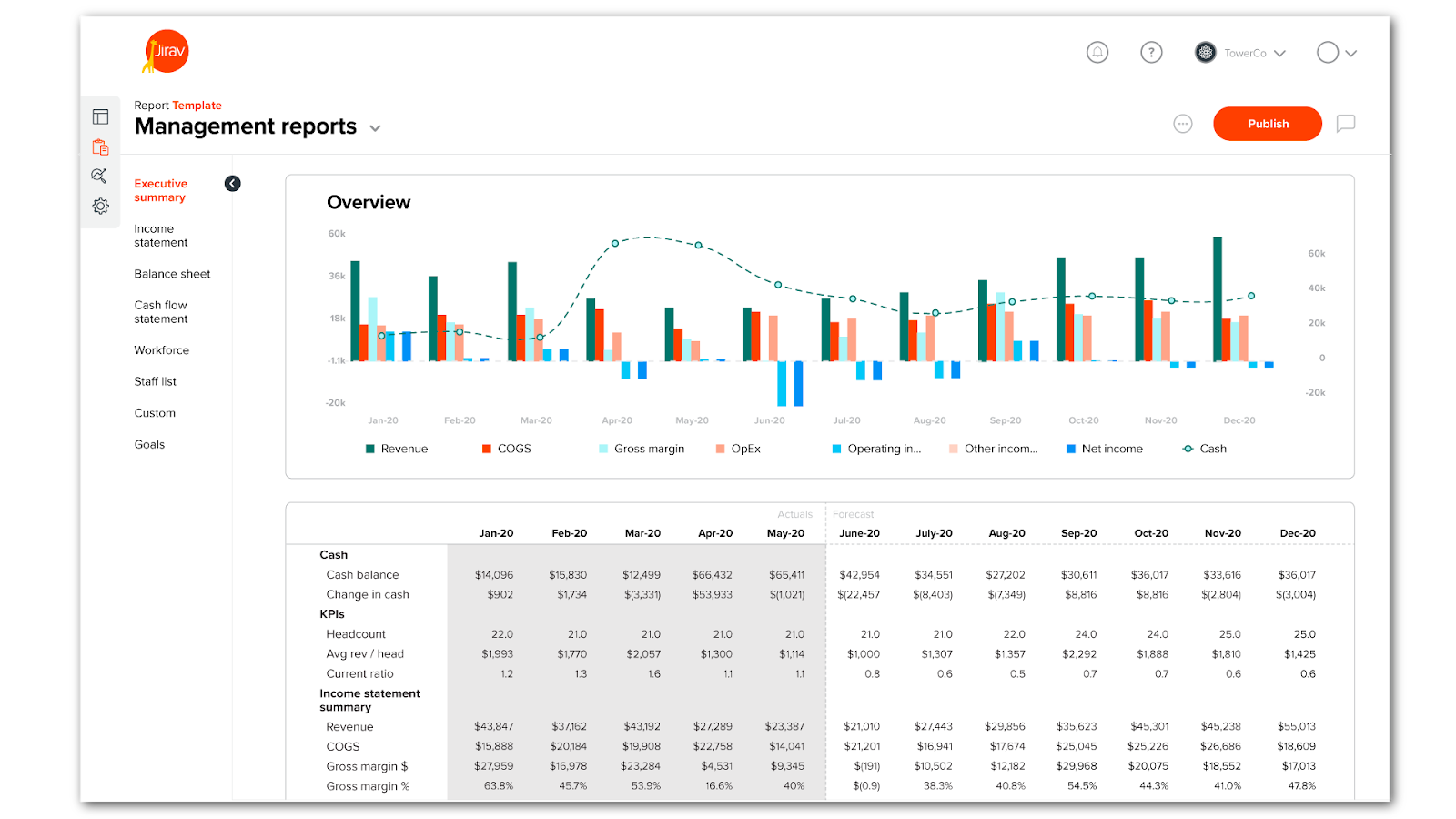

4. Jirav

What it is: Forecasting software for financial modeling

Best for: Accounting firms and VC-funded businesses who need driver-based financial models

Jirav offers forecasting, reporting, and analysis tools that give you a clear picture of your financial health. It helps you budget and forecast with a driver-based financial model that consolidates accounting, workforce, and operational data.

Users can share plans, reports, and dashboards with select editors and an unlimited number of read-only users to streamline collaboration and feedback.

Key features:

- Cash flow management: Monitor cash flow forecasts and build what-if scenarios for cash impacts.

- Automated report packages: Automate the delivery of monthly financial reports to clients.

- Quickbooks, ADP, and other integrations: Connect other enterprise systems to access deeper insights.

[Source]

Pros:

- Lets users create customized reports

- Assigns users an accounting professional when integrating Jirav

- Responsive customer support

Cons:

- Has a high learning curve

- Users may need to hire a Jirav expert during the integration process

- Cannot fully export Excel versions of financial models

Pricing:

- Industry Safari: $20,000+

- Strategy Safari: Custom pricing

5. Vena Solutions

What it is: Cloud-based financial planning software for reporting and forecasting

Best for: SMBs and mid-market companies who need financial planning capabilities

Vena is a cloud-based financial planning and analysis solution that brings cross-functional teams into a scalable and flexible single source of truth. Users can control data access and drill down into the history of a spreadsheet, so you know who has been in your templates and where your numbers are coming from.

Key features:

- Financial and business-wide reporting: Create monthly management reports based on business KPIs.

- Capital expense and revenue planning: Use pre-configured logic to calculate amortization and depreciation of assets.

- Incentive compensation management: Automate compensation calculations and build reports for payroll.

[Source]

Pros:

- User-friendly interface

- Allows users to import spreadsheets from other platforms

- Offers visualizations and dashboards for identifying trends

Cons:

- Lacks robust data operations and computing efficiency

- Vena’s Excel add-in modeling tool does not work for Apple users

- Not suitable for users who aren’t proficient in Excel

Pricing: Pricing is not available on their website

6. Sage Intacct

What it is: Accounting software for budgeting, payroll, and cash flow management

Best for: Small businesses and self-employed professionals who need cloud-based accounting tools

Sage Intacct is a cloud-based accounting software solution that allows users to budget, plan, and adapt to ever-changing conditions. The subscription service offers financial consolidation, revenue recognition, project accounting, and employee management features like syncing employee data and running payroll.

Key features:

- Order management: Streamline complex quote to cash processes.

- Cash management: Improve cash visibility and cash flow management process.

- Accounting collaboration support: Bring teams on a single platform to resolve issues and align team members on business goals.

[Source]

Pros:

- Provides an overview of business performance through the dashboard

- Customizable report generation

- Cloud-based platform

Cons:

- Inadequate reporting functionality

- Steep learning curve

- Delayed payment processing since users cannot download same-day bank transactions

Pricing: Pricing is not available on their website

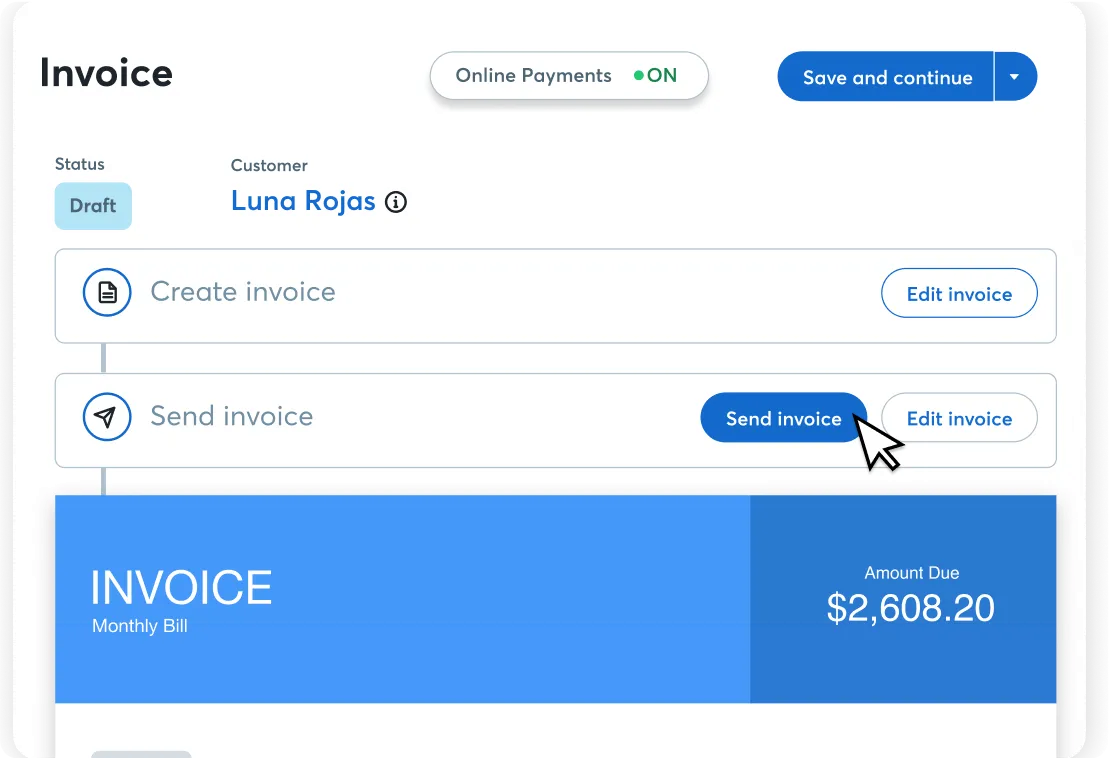

7. FreshBooks

What it is: Accounting software for invoicing, expense tracking, and payments

Best for: Freelancers and small business owners looking for affordable financial tools

FreshBooks is accounting software designed for business owners and accountants. It provides customized invoices for your products or services and automates other financial tasks.

Key features:

- Double-entry accounting: Maintain a customizable chart of accounts that is regulation-compliant.

- Invoicing: Use an invoice generator to create and customize invoices.

- Payments: Enables customers to pay directly to FreshBooks to improve cash flow management.

[Source]

Pros:

- Allows users to track time for projects

- Supports tracking of clients and project progress

- Affordable for small business owners

Cons:

- iOS version of the app has limited functionality

- No customer service accessibility

- Lacks robust integrations with payment services

Pricing:

- Lite: $19/month

- Plus: $33/month

- Premium: $60/month

- Enterprise plan: Custom pricing

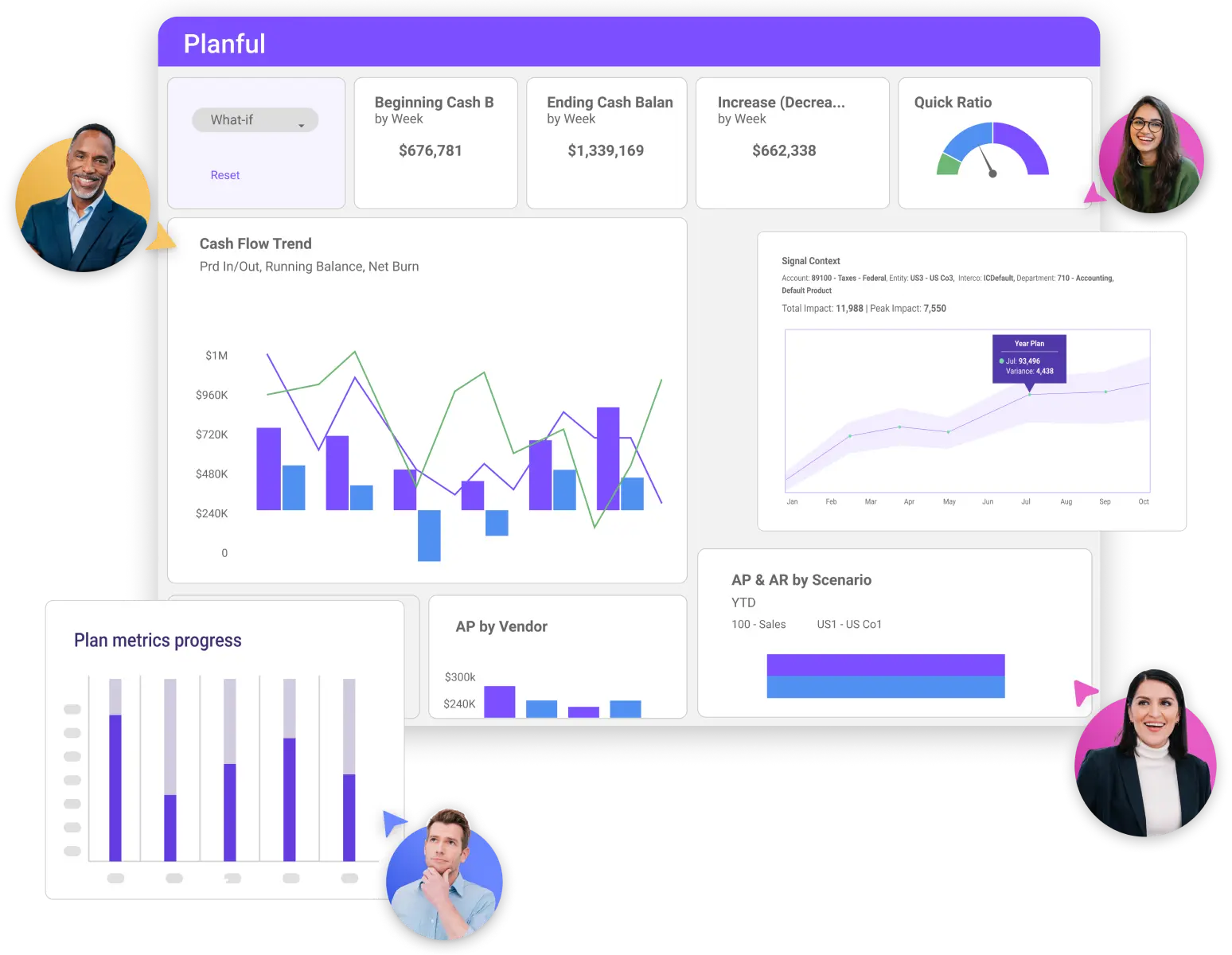

8. Planful

What it is: FP&A software for budgeting, forecasting, and reporting automation

Best for: Finance teams who need to deliver real-time insights and automate financial processes

Planful is a cloud-based financial planning and analysis software that enables businesses to automate their budgeting, forecasting, and reporting processes. It provides users with real-time insights into their financial data so they can deliver plans, reports, and insights.

Best for: Larger companies with extensive FP&A teams

Key features:

- Multi-layer security: Protect business data with enterprise-wide security certificates and maintenance.

- AI-driven anomaly protection: Identify and understand business patterns using AI and machine learning (ML).

- Annual operating plan: Create collaborative annual operational plans based on KPIs and metrics.

[Source]

Pros:

- Customizable dimensions for measuring business performance

- Automated FP&A reporting

- Consolidated financial statements

Cons:

- Formatting reports is cumbersome

- Reporting tool has a high learning curve

- Lacks a sandbox environment for testing

Pricing: Pricing is not available on their website

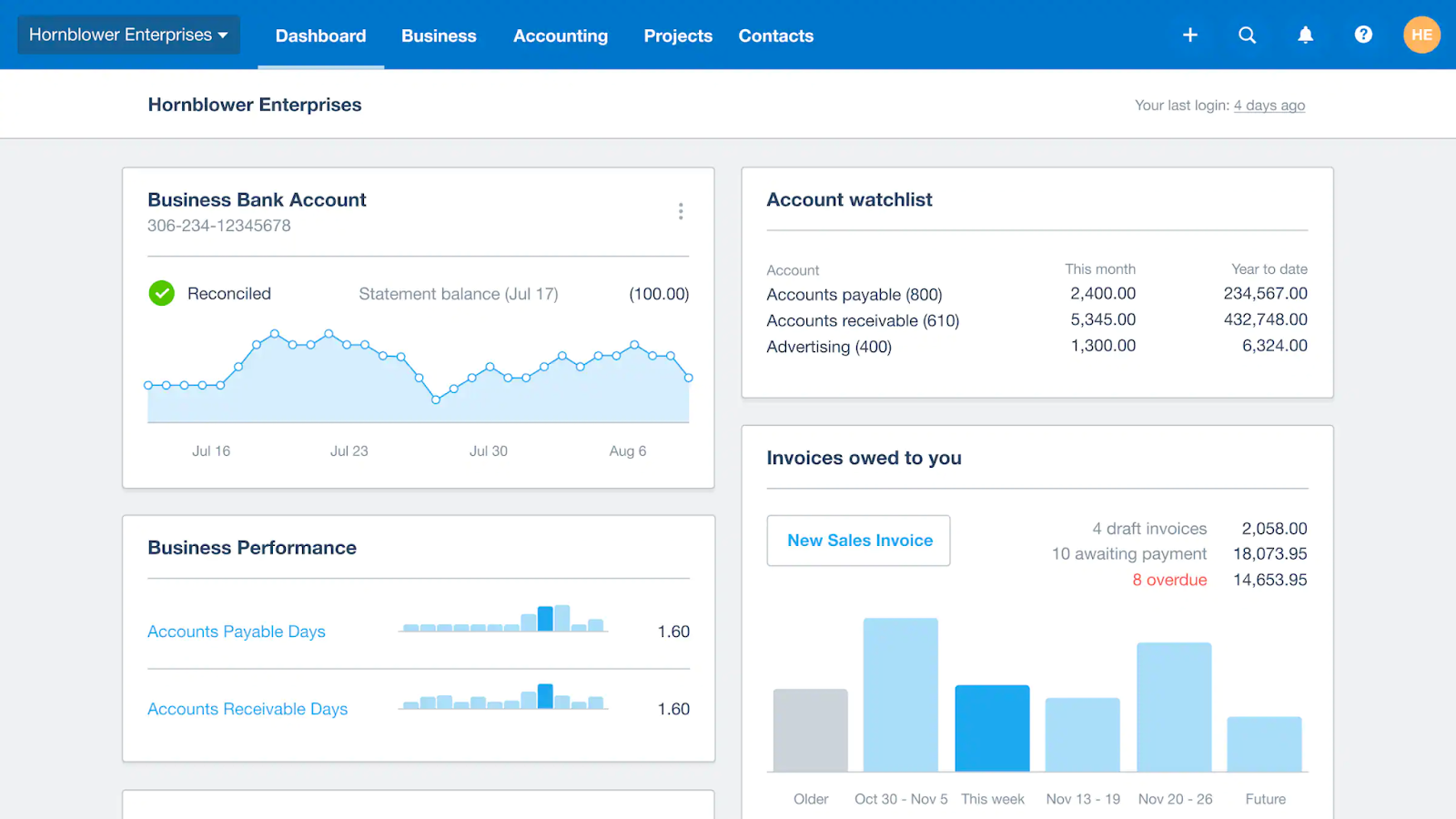

9. Xero

What it is: Accounting software for tracking finances and managing invoices

Best for: Small businesses, accountants, and bookkeepers who need tools for everyday financial management

Xero is an accounting software option for everyday businesses that allows users to work smarter with intuitive invoicing software. It allows you to send online invoices from the desktop or app as soon as the job is done.

The software tracks your finances with accounting reports and allows you to collaborate with your advisor online in real time. It can also track costs and profitability with its project tracker software.

Key features:

- Bank connections: Set up bank feeds and integrate banking data into Xero for automatic processing.

- Automatic data capture: Automatically store copies of documents and key data into Xero.

- Multi-currency accounting: Carry out transactions in up to 160 currencies.

[Source]

Pros:

- Supports sync with banking apps

- Easier learning curve

- Enterprise level security

Cons:

- Poor customer support

- Does not allow users to track employee activity

- Limited reporting tool functionality

Pricing:

- Early: $20/month

- Growing: $47/month

- Established: $80/month

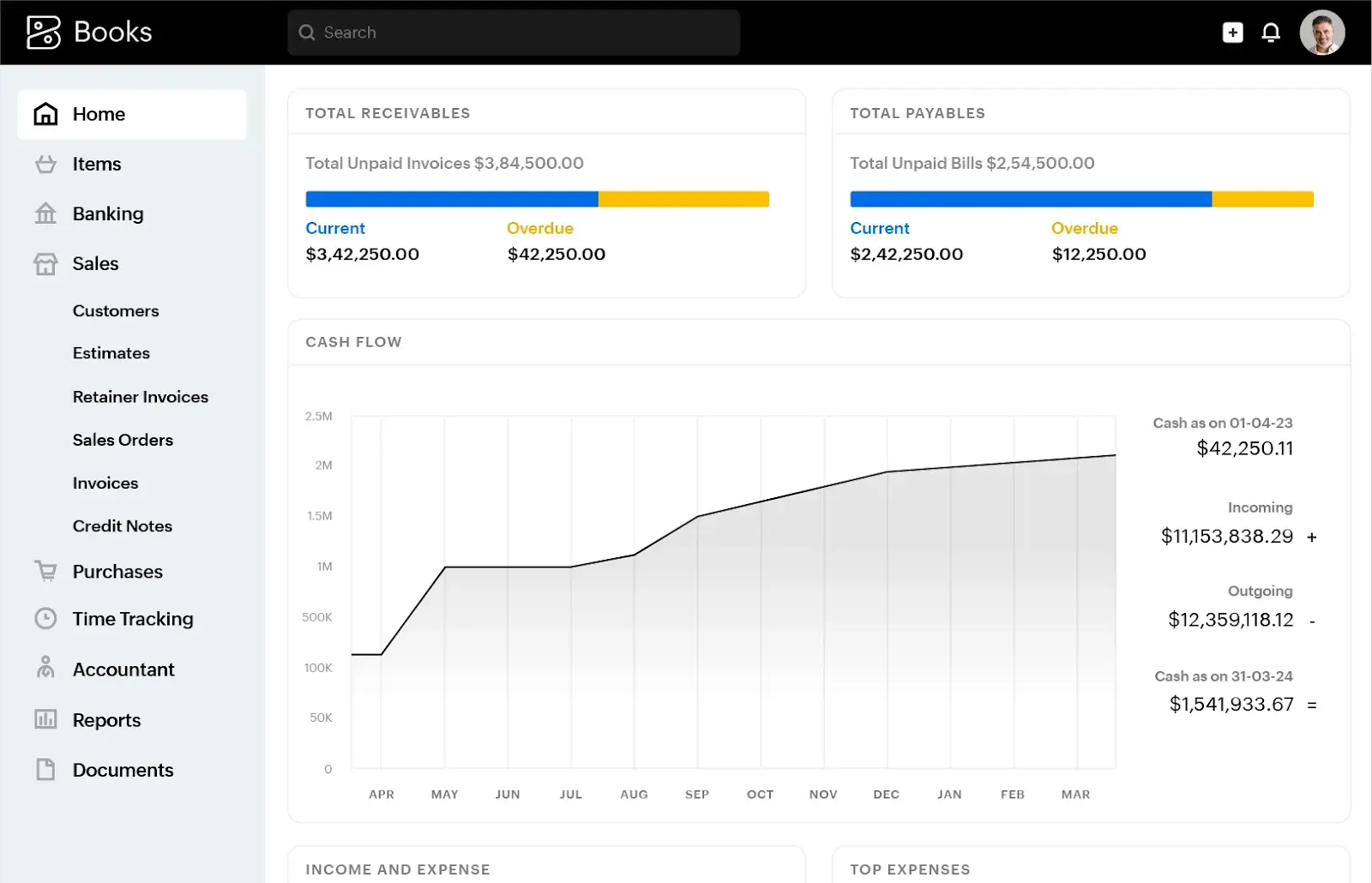

10. Zoho Books

What it is: Accounting software for managing finances and automating workflows

Best for: Businesses that need straightforward tools for expense tracking and invoicing

Zoho Books is an online accounting software for managing your finances, automating business workflows, and facilitating collective work across departments. It lets you track your income and expenses, create invoices and estimates, and manage projects from negotiating deals to raising sales orders and invoicing.

Zoho Books enables role-based access so you can add your colleagues and collaborate effectively. You can also share quotes with clients and start a discussion to speed up estimate approvals.

Key features:

- Inventory management: Track inventory, maintain stock, and fulfill orders.

- Expense reporting: Use built-in customizable reports and advanced analytics to monitor spending.

- Tax compliance: Generate sales tax and 1099 reports.

[Source]

Pros:

- Supports multi-currency accounting

- Automates accounting tasks

- Integrates with payment platforms

Cons:

- Poor data management

- Not ideal for businesses that require high-level customization

- Limited reporting capabilities

Pricing:

- Free: $0

- Standard: $20/month

- Professional: $50/month

- Premium: $70/month

- Elite: $150/month

- Ultimate: $275/month

11. Wave

What it is: Web-based bookkeeping software for managing income and expenses

Best for: Small businesses and freelancers who need simple accounting tools

Wave is a web-based software that provides small business owners with simple bookkeeping and payment solutions. It offers accounting, invoicing, receipt scanning, and the ability to track your spending and create a budget.

The software helps you manage income and expenses with payroll, payments, and invoicing features like recurring billing and automatic payments.

Key features:

- Mobile receipts: Capture, store, and back up receipts.

- Invoicing: Send invoices, set payment reminders, and recurring billing for repeat clients.

- Payments: Enable customers to pay conveniently and receive payment in 1-2 business days.

[Source]

Pros:

- Users do not need an accounting background to use this tool

- Allows users to set automatic reminders for payments

- Lets users duplicate past invoices

Cons:

- Few insightful stats on the dashboard

- Does not give users access to customer support on the free version

- High cost of filing taxes

Pricing:

- Starter plan: $0

- Pro plan: $16/month

12. QuickBooks

What it is: Accounting software for creating reports and managing cash flow

Best for: Small businesses and freelancers who want cloud-based tools for financial tracking and invoicing

QuickBooks is an accounting software that small businesses and freelancers use to create reports, collaborate, and build better business insights. The software is easy to use and has features that help users manage their finances and transaction information. It enables you to track expenses and cash flow, customize invoices, and run reports and receipts in one place.

QuickBooks is accessible on any device such as your Mac, PC, tablet, or phone, since all data is stored in the cloud.

Key features:

- Free support: Access free user support for accountants.

- Secure cloud storage: Keep business data in the cloud and access it in real-time on any device.

- Integration with Cube: Integrate Cube financial software to optimize workflows.

[Source]

Pros:

- Useful for businesses that send invoices for every sale

- Allows multiple users to access the platform from different locations

- Integrates with payroll modules

Cons:

- Contains many bugs

- Has a clunky user interface (UI)

- Online version is not suitable for large businesses

Pricing:

- Simple Start: $35/month

- Essentials: $65/month

- Plus: $99/month

- Advanced: $235/month

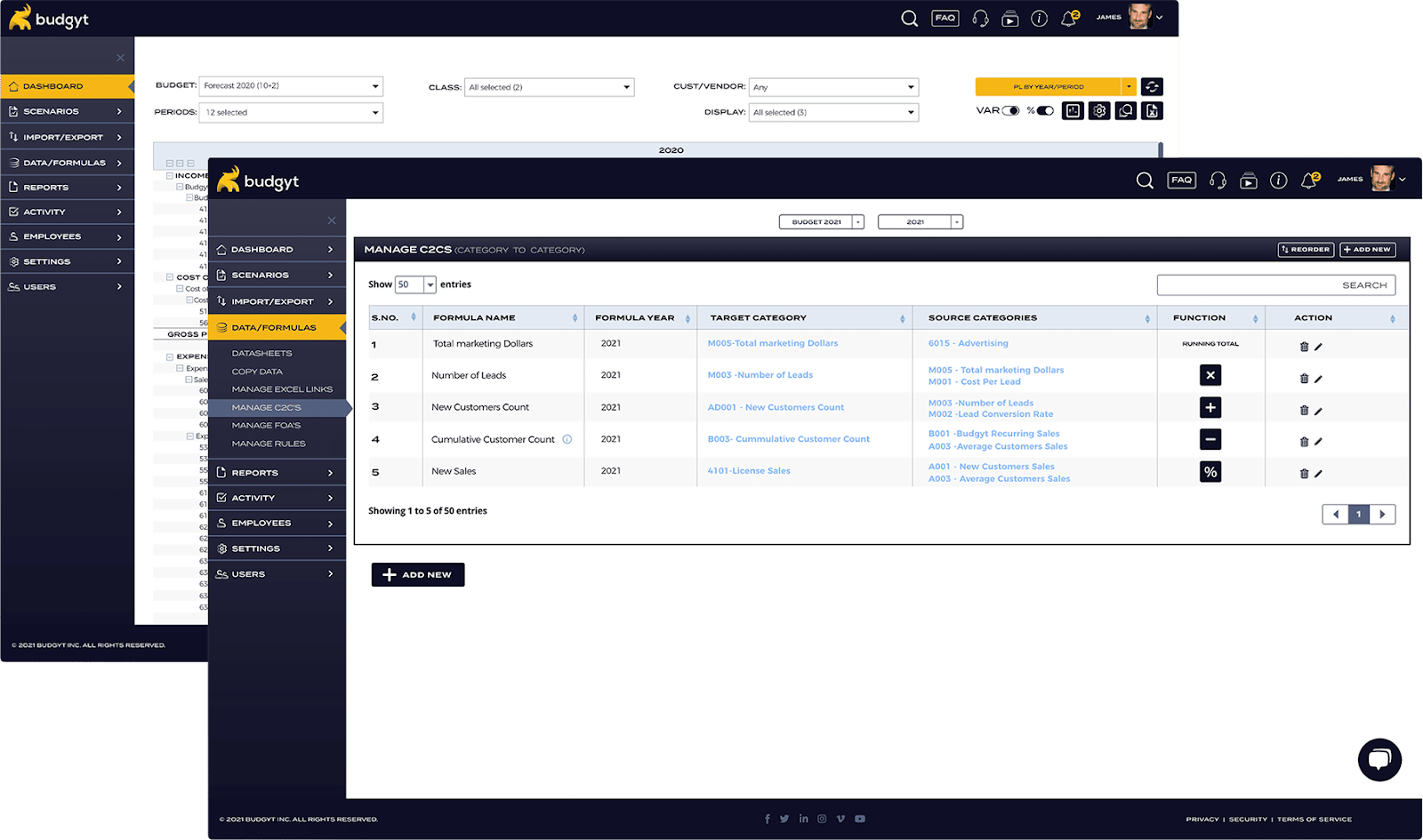

13. Budgyt

What it is: Finance software for budgeting and expense management

Best for: SMBs and nonprofits looking to simplify financial planning and cost allocation

Budgyt is a business finance platform that allows users to track their income and expenses, create budgets, and manage their finances. It provides financial plans and results from rolling forecasts to adapt to dynamic business conditions. The platform offers free collaborative budgeting for your team on a shared network and minimizes risks and errors by eliminating manual processes using its hyperlinking and dimensions features.

Key features:

- Reforecasting: Replace annual planning cycles with rolling forecasts for agility.

- Dashboards: View budgets like P&L by Cost Center, P&L by Period, and Budget Comparison.

- Integrations: Connect with platforms such as Lawson and SAP through a CSV import of your General Ledger.

[Source]

Pros:

- Provides training videos for onboarding users

- Enables users to consolidate multiple entities' financial reports

- Supports multiple currency accounting

Cons:

- Does not have robust APIs for integration

- Users have to import data into the platform

- Poor exchange rate management for multi-currency accounting

Pricing: Pricing is not available on their website

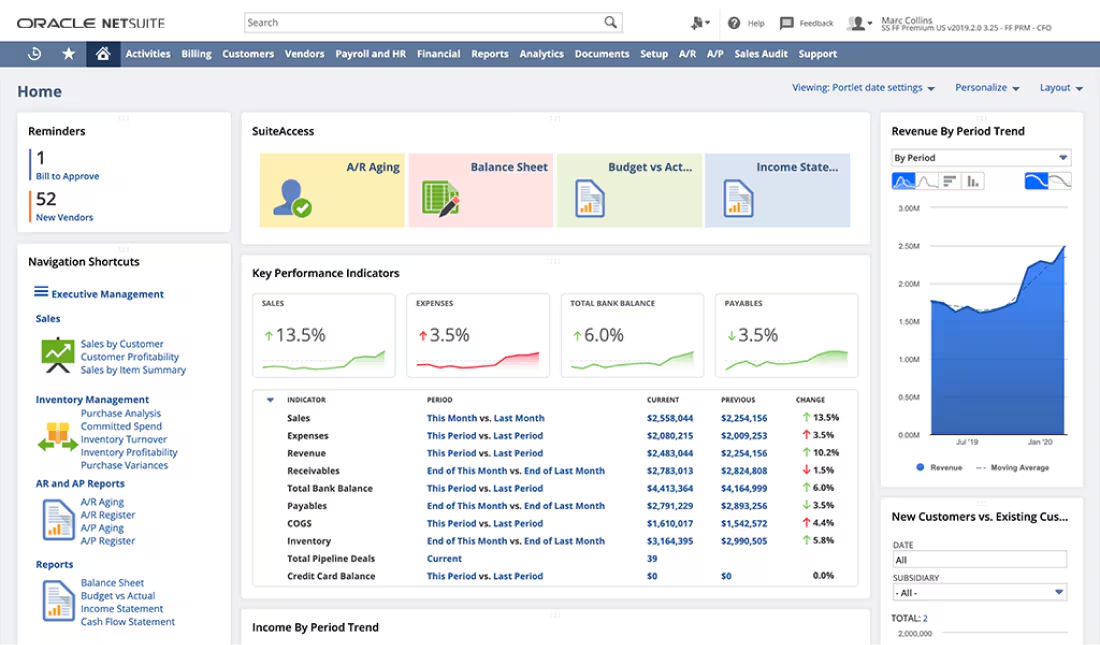

14. Oracle NetSuite

What it is: Business management software for accounting, inventory, and e-commerce

Best for: Companies already using NetSuite seeking an integrated solution for planning and financial management

Oracle NetSuite is finance software for small businesses. The software includes modules for accounting, inventory management, customer relationship management (CRM), investment portfolio, and e-commerce. It automates planning and budgeting processes to create budgets, forecasts, and reports through a single, centralized platform.

Key features:

- Subscription billing: Manage recurring subscriptions with automatic renewals.

- Financial consolidation: Centralize the visibility of accounting processes, data, and reporting across all business units.

- Microsoft Office and Cube integration: Leverage the Microsoft Office and Cube integration to streamline financial insights.

Pros:

- Can be used on any device

- Integrates with bank feeds and payment platforms

- Has customizable dashboards

Cons:

- Takes time to pull large amounts of data and reports

- Users pay for additional support and training

- Does not accommodate existing workflows

Pricing: Pricing is not available on their website

See how Quickbooks compares to Netsuite: NetSuite vs. Quickbooks

15. Centage

What it is: Financial planning and analysis software for budgeting and forecasting

Best for: Organizations in industries like healthcare or insurance needing industry-specific tools for financial intelligence

Centage is a cloud-native planning and analytics platform that delivers sophisticated financial intelligence. The solution helps finance professionals to automate budgeting, forecasting, and reporting processes while providing the flexibility to quickly adapt to changing business conditions.

Best for: Businesses with industry-specific needs such as architecture, healthcare, or insurance.

Key features:

- Driver-based budgets: Automate manual budget creation processes and build budget models.

- Consolidated reporting: Aggregate multiple business entity reports to prevent misstated or duplicated financial data.

- Financial performance dashboards: Analyze financial performance using web-based dashboards.

[Source]

Pros:

- Integrates with business accounting packages

- Strong customer service and training staff

- Robust reporting capability

Cons:

- Does not allow users to delete multiple budget lines

- Processes data slowly at times

- Duplicates records when there are mass updates

Pricing: Pricing is not available on their website

16. Sage 50 Cloud

What it is: Accounting software for expense management and inventory tracking

Best for: Smaller businesses needing simple tools for cash flow and order management

Sage 50 Cloud is a finance software that offers a variety of features, including invoicing, tracking inventory, and managing expenses. It provides the reliability of desktop accounting software and the flexibility of the cloud to manage the incoming and outgoing cash flow.

Users can also manage payments or connect to bank feeds to eliminate manual data entry and simplify payment acceptances with automatic reconciliation. Its features help track purchase orders, debts, late payments, and expenses.

Key features:

- Inventory tracking: Know what's in stock, what's on order, and the movement of inventory.

- Cash flow management: Oversee cash flow, income, expenses, and payments.

- Intelligence reporting: Get meaningful insights from simple reports.

- Job cost management: Control the cost of a job through unique records, phases, and cost codes

[Source]

Pros:

- Easy to navigate

- Allows users to transfer cost codes to their CRM

- Supports real-time inventory tracking

Cons:

- Importing data is complicated

- Not fully cloud-based and connection to a server tends to be slow

- Not suitable for growing or large businesses

Pricing:

- Pro Accounting: Starts at $61.92 /mo

- Premium Accounting: Starts at $103.92/mo

- Quantum Accounting: Starts at $177.17/mo

What to consider when deciding between financial management tools for your business

Every financial management tool promises it can save time, reduce errors, and help your business scale efficiently. That’s why it’s important to evaluate which specific features and capabilities your business needs the most.

Consider the following key factors as you make your decision:

- Your budget: Decide how much you’re willing to invest. Basic tools may suit small businesses, but it’s smart to factor in potential growth. Choosing a scalable platform now can save you from upgrading to a new one later.

- Security: The security of your financial data is no joking matter. Look for tools with strong security features like user-based permissions and access controls so only the right people can access key data.

- Scalability: Your financial tool should grow with your business. Choose software that won’t hold you back if your team expands or you start working across multiple entities or currencies.

- Cloud vs. on-premise: If you need access to your financial records from anywhere in the world, a cloud-based tool can give you that freedom. On-premise tools may lack the accessibility that modern businesses often need.

- Automation and efficiency: Look for tools that automate key parts of your workflows like creating visuals of key data or detecting anomalies in financial summaries so your team can focus on more strategic work. Consult with your team to figure out whether they need to automate repetitive tasks like reconciliations or approvals to save time and reduce errors.

Select the best finance software for your business

The right financial software can translate to easier reporting and KPIs, more accurate forecasting and budgeting, faster close and consolidation cycles, and collaborative teamwork for more control and fewer mistakes. Which finance software you should choose depends on a number of factors, including size, industry, and the goals you hope to achieve. The information provided in this blog is a great starting point to help set you on the right path.

If you’re still unsure which type of software is right for you, let’s chat.

Request a free Cube demo today to find out how FP&A software can take your finance function to the next level.

.png)

.png)

%20(1)%20(1).png?width=600&name=Big%20image_Howcubeworks_V2%20(4)%20(1)%20(1).png)