What is budget software for nonprofits?

Budget software for nonprofits provides organizations with the tools to manage financial planning, monitor expenses, and generate reports while maintaining compliance with grant restrictions and donor requirements. Nonprofit budgeting software offers automation, real-time financial insights, and integration with existing accounting systems to improve efficiency and accuracy.

These tools are especially valuable for board meetings, grant reporting, and donor transparency. For example, if a board member asks about the current budget status for a specific program, budget software provides real-time figures, spending trends, and remaining balances. Similarly, if a donor wants a breakdown of how their contributions are being used, budgeting tools generate detailed reports to enhance trust in the organization’s financial stewardship.

The right budget software saves time, increases financial accuracy, and empowers nonprofits to focus on their mission rather than administrative tasks.

Features to look for in nonprofit budgeting software

Nonprofit budgeting requires tracking restricted and unrestricted funds, grant compliance, and adherence to financial best practices. Here are key features to look for in budget software:

Budgeting and planning

Nonprofits need flexible budgeting tools to adjust to fluctuating funding, program needs, and economic conditions. Budget software should support:

- Annual budgeting: Track financial goals and allocate resources with real-time visibility.

- Fund reallocation: Shift resources between programs to meet urgent needs while maintaining financial stability.

- Real-time spending insights: Monitor program budgets to identify underutilized funds or potential overspending.

Quick adjustments enabled by budgeting software ensure that programs remain operational and impactful, even when circumstances change. Accounting for historical data and spending patterns while budgeting allows nonprofits to identify trends and make better predictions about future funding and resource needs.

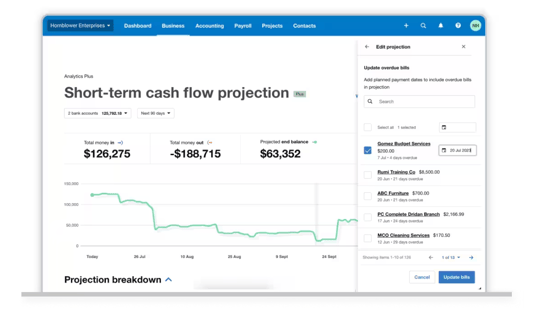

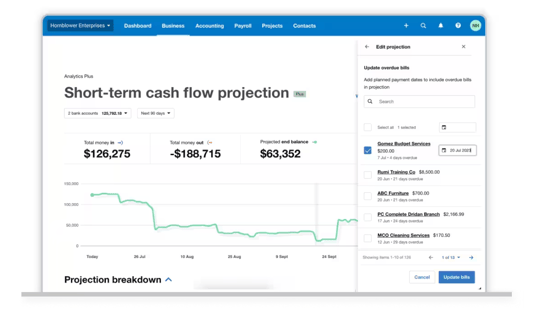

Forecasting and modeling

Financial projections become more manageable and actionable when nonprofits can model different scenarios in real time. With forecasting tools, organizations can simulate various "what-if" scenarios and understand their potential impact.

For example, nonprofits can quickly evaluate how a 10% drop in donations might affect program delivery, assessing which services could be scaled back or restructured without compromising the core mission. If a major grant falls through, the right budget software can help identify alternative funding sources or areas where expenses can be trimmed to maintain financial stability.

Accurate projections also support strategic financial planning—nonprofits can use scenario modeling to evaluate the feasibility of expanding programs, hiring additional staff, or investing in new initiatives. Strategic financial planning highlights the implications of decisions in advance so nonprofits can:

- Align financial plans with strategic business goals: Teams can develop comprehensive, forward-looking financial plans, expanding from managing current finances to shaping the business's financial trajectory.

- Guide the business through growth phases and other economic changes: Long-term financial planning demonstrates a team’s ability to envision and plan for the future so they (and the business) can stay on course.

- Support strategic initiatives: Effective long-term planning requires a deep understanding of strategic objectives, as well as the ability to forecast future financial scenarios, identify potential growth areas, plan for investments, and anticipate issues.

Real-time projections facilitate better communication with stakeholders. Board members, funders, and donors appreciate clear, data-driven insights into how the organization plans to navigate financial uncertainties.

A nonprofit budgeting software with forecasting capabilities helps organizations remain proactive, resilient, and mission-focused, regardless of changes in their funding landscape.

Analytics and reporting

Effective decision-making and stakeholder communication depend on access to clear, accurate, and actionable data. Budget software's analytics and reporting features provide nonprofits with the tools to deliver this transparency and demonstrate the organization’s financial health and program impact.

Here are some key analytics and reporting features to look for in budget software:

- Visual dashboards for real-time insights: Interactive dashboards can provide an at-a-glance view of key financial metrics and program performance. These visual tools break down complex data into easily digestible charts, graphs, and summaries, helping board members, donors, and staff understand how funds are being used.

- Automated reporting: Instead of manually compiling data from various sources, nonprofits can leverage automated reporting features to generate accurate and up-to-date reports in minutes. This reduces the administrative burden so your staff can focus on mission-critical activities.

- Customizable reports: Budget software also allows nonprofits to generate tailored reports based on the specific needs of their audience. For example, a detailed financial report for the board might include cash flow, fund balances, and grant utilization, while a donor report might focus on how contributions supported specific programs or achieved measurable impact.

- Trend analysis and forecasting: Analytics features allow nonprofits to identify trends in revenue, expenses, and program outcomes over time. These insights support better financial planning, help anticipate future challenges, and enable data-driven decision-making to improve program effectiveness.

Integration capabilities

Integration capabilities are a cornerstone of modern budgeting software, providing nonprofits with the ability to connect their financial systems. By integrating budgeting software with accounting platforms, donor management systems, and other essential tools, nonprofits can streamline operations, reduce administrative burdens, and improve data accuracy. Integration also enables nonprofits to work seamlessly within familiar tools, such as Excel or Google spreadsheets, while connecting to platforms like QuickBooks, Salesforce, and fundraising software.

Effective integration allows data to flow automatically between systems, ensuring that information such as revenue, expenses, and donor contributions is updated in real-time across all platforms. It can also consolidate financial data from multiple sources into a single dashboard, providing a comprehensive view of the organization’s financial health.

Look for software that integrates with grant management software, fund accounting tools, and other existing organizational tech to ensure effective implementation.

Fund accounting

Nonprofits often manage a mix of restricted and unrestricted funds, each with distinct purposes and limitations. Establishing clear boundaries between these money pools is essential for effective financial management. Nonprofits should prioritize tools that help them:

- Track expenses and funding sources: Many funding sources, such as grants or donor-restricted gifts, come with strict usage guidelines. Budgeting and planning tools that allow for clear expense tracking and financial organization can help ensure compliance with these guidelines. This reduces the risk of penalties, legal issues, or loss of future funding.

- Simplified reporting for stakeholders: Budgeting software with strong reporting capabilities makes it easier to generate customized reports that detail how restricted and unrestricted funds have been utilized. Whether reporting to donors, board members, or auditors, nonprofits need tools that can pull data from various financial systems, such as ERPs and CRMs, to generate detailed, tailored reports that separate different fund types and present financial data in clear, accessible formats.

- Real-time visibility into fund balances: Nonprofits benefit from tools that provide real-time access to up-to-date financial data. The ability to consolidate and analyze data quickly allows organizations to monitor the balances of restricted and unrestricted funds separately, track progress toward spending goals, and make necessary adjustments to stay aligned with financial plans.

- Improved financial planning and decision-making: Software that supports financial planning and analysis (FP&A) can help establish clear fund boundaries and ensure accurate tracking, supporting informed decisions about resource allocation, program expansion, and long-term financial planning. Look for tools with budgeting, forecasting, and scenario modeling capabilities that enable nonprofits to create strategic financial plans and track fund performance over time.

If a nonprofit organization requires specialized fund accounting features—such as transaction compliance tracking and donor-restricted fund management—a dedicated fund accounting tool may be necessary. However, many budgeting and planning platforms integrate with existing accounting systems, including spreadsheets, making it easier to track expenses and funding sources while maintaining familiar workflows. Choosing a solution that supports these capabilities ensures proper allocation and alignment with donor and grantor guidelines.

The best budget software for nonprofits

Your team deserves budget software that works for them—not the other way around. Here are this year's most effective budget software options for nonprofits, ranked by feature depth, user satisfaction, and ROI.

1. Cube

Cube is a cloud-based, spreadsheet-native financial planning and analysis (FP&A) platform that empowers nonprofits to streamline financial management while maintaining their focus on impact. By automating reporting and reducing errors, Cube eliminates manual processes and improves efficiency, freeing up valuable time for mission-critical tasks. Its real-time data capabilities provide nonprofits with up-to-date financial insights, enabling informed decisions about funding, grants, and resource allocation.

With enterprise-grade tools integrated directly into familiar spreadsheet environments, Cube minimizes learning curves and simplifies adoption. Its seamless system connectivity allows organizations to easily integrate donor management systems, grant tracking tools, and other essential software in just minutes. Backed by an award-winning support team with deep expertise in nonprofit FP&A, Cube offers the guidance and technology needed to navigate the unique financial challenges of the sector.

Key features:

- Advanced planning and modeling: Fast-track your planning cycle with annual budgets, multi-scenario planning, break-even analysis, and more.

- Reporting and analytics: Automate compliance reporting, variance analysis, sensitivity analysis, and more.

- Automated data consolidation: Connect data from numerous sources automatically.

- Seamless integrations: Integrate with spreadsheets (Google and Excel), accounting & finance software, HR systems, ATS, billing & operations software, sales & marketing software, and business intelligence tools.

- Customizable dashboards: Build and share reusable templates and dashboards with your team.

- Multi-currency support: Evaluate your financials in all your reporting currencies.

- Centralized formulas and KPIs: Store and manage all your calculations in a central source of truth.

- Strategic finance support: Support the business in making strategic data-driven decisions with impact analysis, streamlined financial modeling, market trend analysis, strategic initiative evaluation, and more.

Pros:

- Intuitive and familiar: Cube integrates seamlessly with existing spreadsheet platforms like Excel and Google Sheets, minimizing the learning curve and accelerating tasks such as grant reporting, donor tracking, and program budgeting.

- Expert support: Cube offers access to a team of finance professionals experienced in addressing the unique needs of nonprofits, including managing restricted funds, tracking in-kind donations, and preparing for audits or grant applications.

- Quick, detailed analysis: Cube allows nonprofits to collect, validate, and analyze financial data efficiently, aiding in identifying funding gaps, tracking program expenses, and making data-driven decisions with reduced manual effort.

Cons:

- Cube is not for individual business owners.

- Cube is not a dedicated fund accounting tool.

- Cube doesn't sell to companies outside of the United States and Canada at this time.

Pricing: Plans start at $2,000/month with a 10% discount for nonprofit entities.

Use Cube to confidently plan, analyze, and collaborate so every dollar is maximized for impact.

2. Aplos

Aplos is a cloud-based software designed for nonprofits and churches, offering tools like fund accounting, donor management, and financial reporting to streamline operations. Its integrated features simplify tracking donations, managing events, and creating real-time reports.

Key features:

- Donation categorization: Categorize donations by purpose and donor.

- Custom reports: Build financial reports for specific projects, campaigns, or departments.

- Fund accounting: Track grants and other funding for simpler financial reporting on restricted gifts.

- Custom account chart: Build a flexible account chart and use tags to track funds and manage fundraising campaigns.

Pros:

- Aplos provides easy implementation and integration with platforms commonly used by nonprofits.

- Aplos' support staff is helpful and responsive.

- Donation categorization features help nonprofits track and manage specific donations and their purposes.

Cons:

- The chat system eliminates screen sharing for collaborative problem-solving.

- Aplos can be expensive for some nonprofits.

- The platform provides limited tagging for reports.

[Pros and cons sourced from G2 customer reviews.]

Pricing:

- Lite: $59/month

- Core: $99/month

- Advanced: Custom pricing

3. Blackbaud

Blackbaud is a cloud computing provider dedicated to empowering social impact organizations, including nonprofits, educational institutions, and healthcare entities. Their suite of software solutions encompasses fundraising, financial management, CRM, and analytics.

Key features:

- Multi-program fund tracking: Track and manage multiple grants and restricted funds with ease, ensuring accurate allocation across programs.

- Grant compliance monitoring: Monitor grant requirements and reporting standards to ensure compliance and accountability.

- Advanced financial reporting: Generate customized reports and dashboards for clear financial insights and informed decision-making.

- Full nonprofit management suite: Access tools for fundraising, CRM, financial management, and analytics in one platform.

Pros:

- Blackbaud easily integrates with other software often used by nonprofit organizations.

- Customization is simple for users to implement.

- Grant compliance monitoring supports nonprofit compliance and accountability to donors.

Cons:

- The platform's customer service can be slow.

- There is a learning curve for non-technical users.

[Pros and cons sourced from G2 customer reviews.]

Pricing: Pricing is not available publicly.

4. Budgyt

Budgyt is a cloud-based financial budgeting tool designed to replace traditional spreadsheets. It offers tailored solutions for small to medium-sized businesses, nonprofits, and larger enterprises with complex needs, such as cost allocation.

The platform streamlines financial workflows by enabling finance teams to automate manual processes, providing real-time data consolidation and dashboard navigation.

Budgyt helps users simplify cash flow forecasting and profit-and-loss budgeting by reducing the reliance on complex formulas. It also automates business formula auditing, boosting accuracy and saving time.

Key features:

- Custom APIs: Import data from other software systems via APIs to enable data integration and automation.

- Multi P&L budgeting: Consolidate profit-and-loss budgets across departments, sub-departments, or entities within a hyperlink-enabled platform for organized analysis.

- Data visualization: Use custom dashboards to view and interpret data through interactive visual presentations.

Pros:

- It's easy to review and report on financial statements for donors and track budget use.

- There are a multitude of customization options for forecasting.

Cons:

- Budgyt's complexity presents a steep learning curve.

- The platform requires manual import of payroll and accounting data.

[Pros and cons sourced from G2 customer reviews.]

Pricing: Budgyt offers discounts for nonprofit organizations. Monthly plan prices not available on Budgyt’s site.

5. FreshBooks

FreshBooks is a cloud-based accounting and budgeting software designed for small organizations and service-oriented companies.

It includes tools for managing invoices, tracking expenses, and monitoring budgets through an intuitive interface that promotes financial organization. The platform also integrates with various business tools, enabling easier data management without advanced accounting expertise.

Key features:

- Time tracking: Record billable hours directly within the platform for accurate billing.

- Expense management: Track and categorize both regular and one-time expenses for improved visibility into financial activity.

- Invoicing: Manage payments efficiently with customizable templates and automated reminders.

- Project management: Track project budgets, task assignments, and deadline management.

- Reporting and analytics: Gain visibility into profit and loss statements, tax summaries, expense tracking, and other financial insights.

Pros:

- The platform is easy to set up and use.

- It offers simple analytic tools for donor and grant reporting.

Cons:

- Customization options are limited.

- The platform can be expensive for some nonprofits.

[Pros and cons sourced from G2 customer reviews.]

Pricing:

- Plus: $33/month

- Premium: $60/month

- Select: Custom pricing

6. Nonprofit+

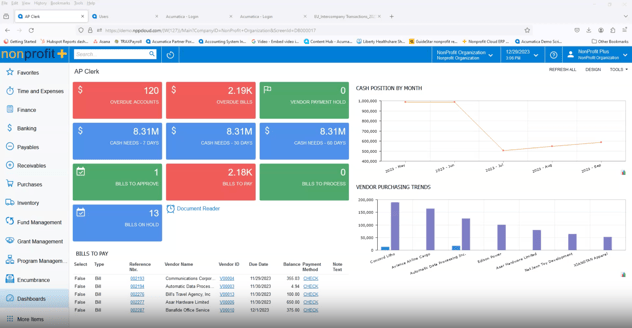

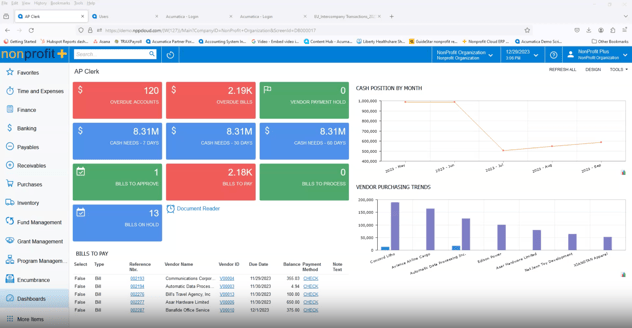

NonProfit+ is a cloud-based enterprise resource planning (ERP) solution tailored for nonprofit organizations. Built on the Acumatica framework, it offers features such as fund accounting, grant management, donor tracking, and encumbrance accounting to streamline financial and operational processes.

Key features:

- Automated fund separation: Automatically segregate restricted and unrestricted funds to ensure compliance and accurate financial reporting.

- Grant expense tracking: Monitor and categorize grant-related expenses.

- FASB-compliant reports: Generate financial statements that comply with Financial Accounting Standards Board (FASB) regulations.

- Budget forecasting: Project future financial needs easily.

Pros:

- Auditing is an especially easy task for users to complete.

- Modules and suites for fund and grant accounting are included.

- Automated fund separation streamlines nonprofit funding and reporting workflows.

Cons:

- The platform is difficult to operate without proper training.

- Customers note high costs.

- Users have experienced performance issues when handling large datasets.

[Pros and cons sourced from G2 customer reviews.]

Pricing: Costs are unavailable on Nonprofit+’s site.

7. QuickBooks

QuickBooks is budgeting and accounting software designed to help nonprofits and small to mid-sized organizations manage their finances effectively. It offers features such as budgeting, expense tracking, invoicing, and reporting.

With integration capabilities and a scalable structure, QuickBooks supports a variety of organizational needs, from routine financial management to detailed financial oversight. The platform also provides customization options to meet the unique requirements of different nonprofit sectors.

Key features:

- Automated expense categorization: Automatically classify expenses based on past transactions.

- Online payment processing: Clients or donors can make secure online payments, streamlining cash flow management.

- Standard financial reports: Take advantage of ready-to-use reports like profit and loss statements, balance sheets, and cash flow summaries for clear financial insights.

- Multi-currency transactions: Oversee global transactions and donations.

Pros:

- Collaborative tools simplify coordination for small or large nonprofit teams.

- Report customization options allow easy adaptation for various donors.

Cons:

- There is a steep learning curve for new users.

- The software takes up a lot of storage space.

- The platform doesn’t always integrate with bank feeds correctly.

[Pros and cons sourced from G2 customer reviews.]

Pricing:

- Simple start: $35/month

- Essentials: $65/month

- Plus: $99/month

- Advanced: $235/month

Learn more about how QuickBooks stacks up against NetSuite in NetSuite vs. QuickBooks: how do they measure up?

8. Sage Intacct

Sage Intacct is a cloud-based financial software that allows users to create dashboards in minutes. Its general ledger includes eight dimensions, offering detailed context for transactions, budgets, and operations.

The platform provides real-time visibility into financial data for budgeting and forecasting, along with multi-entity functionality to support planning across various departments.

Sage Intacct also offers API access for building custom solutions and supports integration with native business tools to streamline operations.

Key features:

- Accounts payable and receivable: Automate the management of payables and receivables to streamline cash flow.

- Dashboard and reporting: Get real-time financial insights to support data-driven decision-making.

- Payroll: Integrate payroll, HR, and accounting.

Pros:

- The platform integrates with FP&A software, like Cube.

- Payroll, HR, and accounting integrations streamline processes so nonprofit teams can focus on mission-critical tasks.

- Users can access easy customization options.

Cons:

- Customer service can be inconsistent.

- The software can be difficult for users to learn.

[Pros and cons sourced from G2 customer reviews.]

Pricing: Organizations must request pricing information.

9. Springly

Springly is an all-in-one, cloud-based software solution designed to streamline nonprofit management. It integrates tools for membership management, accounting, fundraising, and communication, allowing organizations to handle daily operations from a single platform.

Key features:

- Real-time budget monitoring: Track income and expenses live for accurate budget oversight.

- Automated donation receipts: Automatically send tax-compliant donation receipts.

- Member database and communications: Manage member info and streamline email communications.

- Event registration and ticketing: Simplify online registration and ticket sales.

Pros:

- Springly simplifies nonprofit operations with tools like automated donation receipts, event registration, and ticketing, allowing teams to focus on strategic initiatives.

- The platform is easy to navigate, making it accessible for nonprofit professionals without extensive training.

- Automated donation receipts help nonprofits streamline routine tasks while ensuring compliance with financial regulations.

Cons:

- Springly’s budgeting features are basic and may not meet the needs of nonprofits requiring advanced financial planning tools.

- The platform offers limited customization options, which may not be sufficient for organizations with specific or complex requirements.

[Pros and cons sourced from G2 customer reviews.]

Pricing:

- Liberty: $0/month

- Serenity: $79/month

- Professional: $149/month

- Network management: Custom pricing

10. Xero

Xero provides straightforward accounting software that connects with banks for AI-driven reconciliation. It offers cloud-based accounting, enabling businesses to centralize their financial management and maintain paperless records.

The platform allows users to handle their accounting needs from a single, user-friendly interface, reducing time spent on routine tasks. Xero is ideal for small organizations and nonprofits looking for cost-effective solutions and collaborative tools for budgeting and forecasting.

Key features:

- Payment processing: Accept online payments through a variety of payment methods.

- Expense claims: Track and manage spending with an easy expense claim submission process.

- Account reconciliation: Compare financial records to ensure accuracy and consistency.

Pros:

- Xero provides easy-to-use invoice templates, streamlining the billing and donation process for nonprofits.

- A variety of accepted payment methods enhance the donor experience by making contributions more convenient.

Cons:

- Xero does not integrate with all bank types, which may create challenges for some nonprofits.

- The platform has undergone repeated price hikes, potentially impacting budget-conscious organizations.

[Pros and cons sourced from G2 customer reviews.]

Pricing:

- Early: $20/month

- Growing: $47/month

- Established: $80/month

11. Wave Accounting

Wave is a cloud-based accounting software tailored for small businesses and freelancers. It offers features such as invoicing, expense tracking, and receipt scanning, all accessible through a user-friendly interface. With integrated financial tools, Wave simplifies bookkeeping and provides real-time insights into business finances. Additionally, it supports online payment processing, enabling businesses to receive payments directly through invoices.

Key features:

- Income and expense tracking: Monitor all business income and expenses to keep finances organized and up to date.

- Donation receipt generation: Automatically create and send receipts for donations, ensuring accurate records and compliance.

- Financial statements: Generate key financial reports like profit and loss statements and balance sheets for a clear overview of performance.

- Bank reconciliation: Match transactions with bank records to ensure accuracy and identify discrepancies quickly.

Pros:

- Wave offers a user-friendly and visually appealing interface, making navigation simple.

- The platform is intuitive, reducing onboarding time and allowing nonprofit teams to focus on mission-critical work quickly.

- Streamlines record-keeping and ensures compliance with financial regulations.

Cons:

- Response times can be delayed, which may be frustrating for users needing urgent support.

- The platform lacks extensive third-party integrations, which may limit its flexibility for nonprofits using multiple software tools.

[Pros and cons sourced from G2 customer reviews.]

Pricing:

- Starter: $0/month

- Pro: $16/month

How to choose the right budget software for your nonprofit

The financial success of your nonprofit hinges on finding budget software that perfectly fits your unique needs. To make the right choice, consider these key factors:

1. Assess your organization's needs

Map out your nonprofit's specific financial workflows before evaluating software options. Which funds need tracking? How many grants require monitoring? What reports do your board and donors expect? Create a checklist of must-have features based on your daily operations.

Consider how your nonprofit approaches financial planning through top-down or bottom-up budgeting. A small nonprofit managing a single grant needs different capabilities than a multi-program organization juggling restricted funds across multiple projects.

2. Determine your budget

Know your software spending limits upfront. Beyond the monthly subscription cost, factor in implementation fees, training expenses, and any per-user charges. A $500/month plan can quickly become $1000/month with add-ons and growing user counts.

Compare pricing models across vendors—some charge by user count while others charge by transaction volume or feature access. And don’t forget to look for nonprofit discounts, which can reduce costs by 25% to 50%.

3. Prioritize ease of use and implementation speed

Your budget software should work for everyone—from tech-savvy accountants to volunteer treasurers—and, if it includes donor-facing capabilities, it should be just as user-friendly for them. Clean interfaces with clear labels and logical workflows reduce training time, prevent costly mistakes, and ensure a seamless experience for all users.

Fast implementation is also crucial since it allows your team to stay focused on your mission rather than getting bogged down in software setup. Look for vendors that provide quick-start guides, video tutorials, and responsive support teams to simplify the onboarding process. The easier it is for your team—and your donors—to adopt the software, the faster you’ll achieve improved financial oversight, streamlined donations, and accurate reporting.

Choose the best budget software to support your nonprofit fundraising goals

Effective nonprofit budgeting requires tools that offer multi-scenario planning, monthly forecasting, and real-time reporting. These tools help you follow budgeting best practices and stay financially agile while focusing on your mission.

Cube meets you where you’re already working—your spreadsheets. From cash flow and risk management to program budgeting and fundraising planning, the platform provides the flexibility your nonprofit needs to plan, model, and report with ease.

Ready to see how Cube streamlines nonprofit budgeting? Get a free, customized demo to learn more.

.png)

.png)

![11 of the best budget software for nonprofits [2025]](https://www.cubesoftware.com/hubfs/Blog%20image%20%2885%29.png)

![The 5 best mid-market planning tools for business [updated for 2024]](https://www.cubesoftware.com/hubfs/Mid-Marketing%20Planning%20Tools%20%281%29.png)