Key Takeaways

- A cash flow statement is one of the three financial statements. It summarizes the cash flowing into and out of your business.

- There are two methods for building cash flow statements: direct and indirect.

- While one form of cash flow reporting is more common, both methods have advantages.

- Although both cash flow reporting methods meet Generally Accepted Accounting Practices (GAAP) and International Financial Reporting Standards (IFRS), the guidelines encourage the direct method.

- Direct and indirect cash flow methods use different techniques to report operating cash—the cash generated from your primary source of revenue. Investment cash and financing cash are handled the same way in both methods.

What is a cash flow statement?

A cash flow statement is one of three documents that make up a company's complete financial statements.

These documents present a detailed narrative of the company's cash position, assets, and financial health when presented alongside the income and balance sheet statements.

The cash flow statement reports on the movement of cash from all sources into and out of the business.

The cash flow statement provides a detailed account of the three sources of cash flow:

- Operating: This is revenue and expenses generated from your primary line of business.

- Financing: Revenue earned and cash spent on financing activities, including stocks, bonds, and dividend payments to investors.

- Investment: Cash spent on the business for long-term items such as supplies, equipment, and fixed assets.

Both the direct and indirect cash flow methods tell the same story about how cash moves through your business but do so from a different starting perspective.

-jpg.jpeg)

A sample cash flow budget. Image source: Iowa State University

Now let's take a closer look at each method.

What is the direct cash flow method?

The direct cash flow method looks at a simplified version of how cash comes into and out of your business. It presents cash movement along actual items that change the flow of cash, such as:

- Cash from customers

- Interest and dividends received

- Salaries

- Vendor payments

- Interest payments

- Income taxes

To build a direct cash flow statement:

- Start by stating cash flow from revenue.

- Subtract any cash payments for expenses. This number is your pre-tax income.

- Subtract the cash payments made for income taxes. The rest is your net cash flow from operating activities.

-jpeg.jpeg)

Image source: Kusuma, Hadri. (2014). The information content of the cash flow statement: an empirical investigation. International Journal of Business Administration. 5. 10.5430/ijba.v5n4p90.

What are the advantages and disadvantages of direct cash flow statements?

A direct cash flow statement is a simple representation of cash movement. The layout of the direct cash flow method makes it easy for the reader to understand how cash comes into and out of the business.

…So, what's the catch?

Direct cash flow reporting takes a long time to prepare because most businesses work on an accrual basis.

In the accruals basis of accounting, revenue, and expenses get recorded when incurred—not when the money is collected or paid out. This delay makes it challenging to collect and report data using the direct cash flow method.

That's why most businesses use the indirect method. Because the information they need to create reports is readily available in the general ledger.

Direct method example

Below is a quick example of how the direct method might look:

| Cash receipts from customers |

$2,000,000 |

| Wages and salaries |

($600,000) |

| Cash paid to vendors |

($400,000) |

| Interest income |

$10,000 |

| Income before taxes |

$750,000 |

| Interest paid |

($7000) |

| Income taxes paid |

($253,000) |

| Net cash from operating activities |

$1,500,000 |

To simplify this example, we've rolled up expenses and incomes from several categories.

If you're a Cube user, you can reduce the "messiness" of direct method reporting by using the drilldown and rollup features. So it comes down to preference.

What is the indirect cash flow method?

On the other side of the coin, we have the indirect cash flow method.

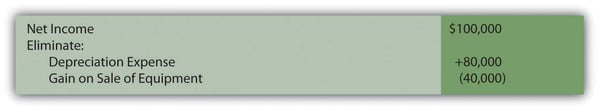

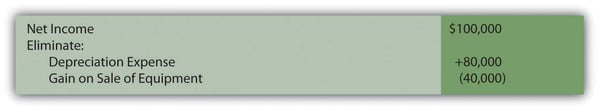

In the indirect method, reporting starts by stating net profit or loss (pulled from the income statement) and works backward, adjusting the amounts of non-cash revenue and expense items.

To build an indirect cash flow report:

- Start with your net income.

- Build non-cash expenses back in. These are items such as depreciation and amortization.

- Subtract out gains or losses from the sale of long-term assets. You do this because long-term assets appear under the "investing" portion of cash flows.

- To adjust for current assets and liabilities, subtract accruals from operating activities.

After these non-cash adjustments, the remaining number is your cash generated through operations.

Important: No matter your method, you should arrive at the same operating cash amount.

What are the advantages and disadvantages of indirect cash flow?

The indirect cash flow method makes reporting cash movements in and out of the business easier for accruals basis accounting.

It's faster and better aligned with the way this accounting method works. Accountants overwhelmingly prefer it for reporting cash movement.

The drawback here is the opposite of the direct reporting method. It's harder for outside readers to understand how cash moves in and out of the business. This means investors and lenders don't prefer the indirect method: it gives them less applicable information.

Indirect method example

Accrual method accounting recognizes revenue when earned, not when cash is received. If you're reporting month-on-month, a $30,000 sale closing at the end of the month but not getting paid out until the following month can complicate your reporting.

You recognize the revenue, but you don't yet have the cash.

The indirect method provides an out. You debit accounts receivable and credit sales revenue at the time of sale.

An example of bookkeeping with the indirect method. Source: University of Minnesota.

So while cash hasn't yet changed hands, you've recognized it will. Since crediting revenue imbalances the equation, you have to debit accounts receivable.

The balance sheet might include an "Increase in Accounts Receivable (30000)" in this scenario.

Direct vs. indirect method. How to choose a reporting method

To decide on the best reporting method for your needs, consider a few questions:

What's your desired reporting workflow? Suppose you're a smaller business simply looking for clarity in your financials. In that case, the direct cash flow method is better. The indirect method is better if you're looking for comparison data.

Who are you creating reports for? If you're reporting to internal stakeholders, you should use whichever method is easier to produce and for your audience to read. You should use the direct method if you're reporting to investors, banks, or prospective buyers.

How detailed do you need to be? Depending on the depth of reporting you're looking for, you may want to commit the work to a direct reporting method. While compiling takes longer, the direct method gives a more transparent view of your cash inflows and outflows.

Once you've considered what you're trying to do with your cash flow statement, one method will make more sense.

Conclusion: direct vs. indirect method of cash flow

Now you know how to decide between the direct vs. indirect method of cash flow.

In short, the direct method is helpful when you need to make it easy for other people—like investors and stakeholders—to understand your cash flow. But it's harder for you as the finance person to create.

On the other hand, the indirect method is much easier for the finance team to create but harder for outside readers to interpret. It might be a better option for leaner teams who don't have the time or resources to follow the direct method.

If you want to get started with your direct or indirect cash flow statements, grab our free 3-statement model Excel or Google Sheets template.

.png)

-jpg.jpeg)

-jpeg.jpeg)