How are AI tools changing finance?

AI tools are changing finance by heavily reducing the amount of manual calculations needed to generate and analyze important financial reports. AI makes a significant impact by:

- Automating tedious tasks: AI handles repetitive tasks like data entry, consolidation, and report generation.

- Generating insights: AI can analyze vast amounts of data quickly, identifying trends and patterns that would be difficult for humans to detect.

- Detecting errors: AI tools can detect unusual patterns or errors in financial data, which can give a false representation of the current finances.

- Predicting financial scenarios: AI enables more sophisticated analytics for financial forecasting of future trends based on complicated predictive algorithms.

Benefits of using AI in finance

AI offers several tangible benefits in finance, such as:

- Increased efficiency: The automation of repetitive tasks allows financial professionals to focus on higher-value activities like analysis and strategic planning.

- Higher accuracy: By reducing human error, AI ensures more precise data processing and financial analysis. This leads to more reliable financial reports and reduces the risk of costly mistakes.

- Cost savings: AI reduces the need for manual labor, leading to substantial cost savings on payroll. Additionally, AI’s ability to detect anomalies and errors early can prevent financial losses.

- Improved risk management: AI tools can analyze risk factors more comprehensively than traditional methods. This helps in identifying potential risks early and developing strategies to mitigate them.

- Enhanced fraud detection: AI can detect unusual patterns and behaviors in financial data that may indicate fraud. By identifying these anomalies early, AI helps prevent fraudulent activities to ensure financial security.

Best finance AI tools

Whether you're in financial planning, reporting, or managing accounts payable, the right AI tools can significantly improve your efficiency and decision-making. Let’s look at the best AI tools available for the finance industry today.

1. Cube

.png?width=276&height=82&name=horiz-wordmark-ultramarine%20(2).png)

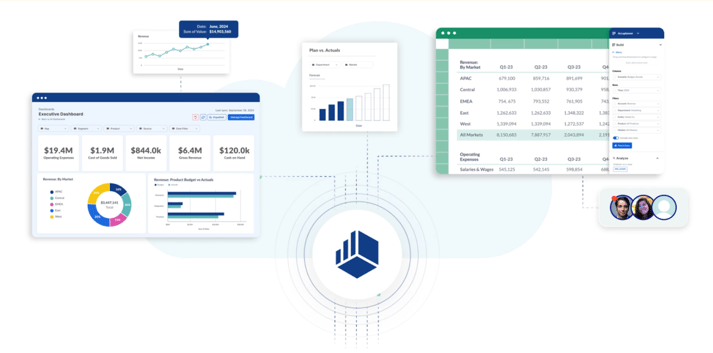

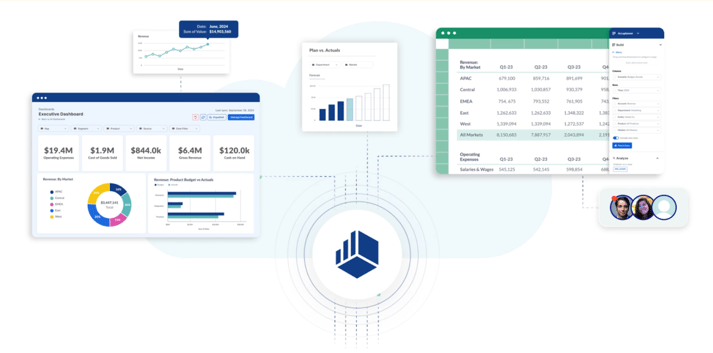

Best for: FP&A, planning and modeling, reporting and analytics

Cube is the best FP&A software tool that streamlines financial planning, reporting, and analysis processes for businesses. This AI tool eliminates the inefficiencies and complexities often associated with traditional FP&A tools. The platform allows users to connect their existing enterprise resource planning (ERP), human resource information system (HRIS), and customer relationship management (CRM) systems directly to Excel and Google Sheets, providing a single source of truth for all financial data.

Cube tops the list due to its flexible and frictionless integration with existing spreadsheets, user-friendly report generation, and finance-first design. It’s even been recognized for its ease of administration, excellent customer support, and high user adoption rates by customers.

Features:

- Connects with existing ERP, HRIS, and CRM systems

- Uses advanced analytics for scenario modeling and planning

- Generates real-time static reports for budgets and headcount

- Facilitates collaboration in Excel, Google Sheets, or directly in Cube

- Centralizes data from multiple sources

- Features a user-friendly dashboard creator and report builder

- Analyzes data for budgetary discrepancies

Best for: Bookkeeping

Booke.ai is an AI-powered bookkeeping tool designed to automate bookkeeping tasks for businesses and accounting firms. It integrates with accounting software like QuickBooks Online and Xero. Booke.ai can run 24/7, automating categorization and reconciliation without human intervention.

Features:

- Uses AI to categorize transactions and extract data from invoices, bills, and receipts

- Syncs data with QuickBooks Online and Xero

- Continuously monitors for inconsistencies in financial records

- Generates and shares financial reports with one click

- Provides a single portal to connect accountants and business owners

Pricing:

- Data Entry Automation Hub: $20/mo per business

- Robotic AI Bookkeeper: $50/mo per business

3. ChatGPT

Best for: Content generation

ChatGPT, developed by OpenAI, is a conversational AI tool designed to generate human-like text based on the input it receives. For financial professionals, it can be used for tasks like customer support, content creation, and educational assistance. However, OpenAI does note that ChatGPT can give false information, so users should always fact-check important information.

Features:

- Engages in conversations based on the context of the text input

- Assists with writing, brainstorming ideas, and generating content like emails, articles, and social media posts

- Helps in writing, debugging, and learning new programming languages and APIs

- Can be integrated into applications and workflows through APIs

Pricing:

- Free

- Plus: $20/mo

- Team: $30/mo per user

- Enterprise: Pricing is not publicly available.

4. Datarails

Best for: FP&A

Datarails is another FP&A platform designed specifically for Excel users. It enables finance teams to automate data consolidation, reporting, and planning. Datarails can also integrate with existing accounting software, ERPs, and CRMs.

Features:

- Consolidates data from various sources into one place

- Automates tasks like preparing profit and loss statements, balance sheets, and cash flow statements

- Uses scenario modeling to evaluate how different changes in financials can affect business outcomes

- Integrates with ERP, CRM, and HRIS

Pricing: Datarails pricing is not publicly available.

5. Domo

Best for: Intelligent insights and data visualization

Domo is a cloud-based platform designed to help businesses have a better visual representation of their data. By integrating with existing cloud and legacy systems, the platform allows users to access data analytics, dashboards, and AI-driven insights.

From preparation to forecasting to automation, Domo.AI guides you through your data analysis with natural-language conversation, contextualized insights, visualizations, and security and governance.

Features:

- Connects over 1,000 data sources, including cloud services and on-premise systems

- Provides customizable dashboards that enable real-time data visualization

- Uses AI for predictive analytics, augmented analytics, and data modeling

- Allows for the creation of low-code and pro-code apps to automate business processes and insights

Pricing: Domo offers four plans, but pricing details are not publicly available.

6. Vena Insights

Best for: FP&A, data visualization

Vena Insights is an FP&A platform that integrates with Microsoft Excel and Power BI. It’s designed to assist with financial and operational planning processes for businesses. Vena Insights provides real-time data for AI-powered reporting and analysis, enabling finance teams to make informed decisions.

Features:

- Provides instant access to all Vena data for AI-powered reporting and analysis

- Uses Microsoft’s AI and machine learning technology to enhance data analysis capabilities

- Offers predictive analytics to improve forecast accuracy

- Allows users to generate and compare different business scenarios

- Natively integrates with Microsoft 365

Pricing: Vena pricing is not publicly available.

7. Trullion

Best for: Lease accounting, auditing

Trullion is an AI-powered accounting software platform designed to automate financial workflows for CFOs, accountants, and auditors. It leverages AI to handle processes like lease accounting, audits, and revenue recognition. Users can use this platform to maintain compliance with regulatory standards.

Features:

- Extracts lease contracts using AI, automates lease accounting workflows, and ensures ongoing compliance

- Automates audit workflows and provides audit-ready outputs

- Streamlines the revenue recognition process, ensuring compliance with ASC 606 and IFRS 15

- Uses AI and computer vision to convert unstructured data from documents into structured formats

- Automates manual reconciliation tasks using rules-based logic

Pricing: Trullion pricing is not publicly available.

Best for: Accounts payable, invoice processing

Vic.ai is an AI-powered autonomous finance platform designed to eliminate manual tasks and improve accuracy in the accounts payable (AP) processes. It offers workflows for invoice processing and bill pay and can connect with any ERP system.

Features:

- Automates the entire invoice processing workflow

- Automates vendor payments, surfaces early payment discounts and reduces fraud risk

- Automatically routes invoices for approval and processes payments when confidence levels are met

- Extracts data from various formats like PDFs and emails, converting unstructured data into structured formats

- Provides real-time insights and analytics on invoice processing data

- Integrates with all major ERP systems

Pricing: Pricing is not publicly available.

9. Workiva

Best for: Financial reporting, compliance

Workiva is a cloud-based platform designed to handle complex reporting and compliance tasks. It provides tools for financial reporting, environmental, social, and governance (ESG) reporting, and regulatory compliance. Workiva’s generative AI capabilities help finance teams streamline their reporting and assurance.

Features:

- Drafts documents and gets a head start on filling in specific information

- Rewrites, summarizes, shortens, or expands current content

- Helps brainstorm, research topics, or anticipate questions from leaders, the board, analysts, or investors

- Streamlines ESG data collection, management, and reporting to meet stakeholder demands for transparency

- Connects and aggregates data from multiple sources including ERP, CRM, and HRIS systems

Pricing: Workiva pricing is not publicly available.

10. Planful Predict

Best for: Financial planning, budgeting, forecasting

Planful Predict is a suite of AI-powered tools designed to assist FP&A by providing intelligent insights and automation capabilities. It leverages machine learning to improve the efficiency of budgeting, forecasting, and financial reporting processes. Planful Predict can check for errors and identify patterns to assist in financial decision-making.

Features:

- Identifies and flags risks, errors, and outliers in data

- Analyzes historical data to generate predictive forecasts for planning and budgeting

- Continuously reviews data for potential errors before reports are published

- Integrates with ERP, CRM, and HRIS systems to consolidate data from various sources

- Facilitates real-time collaboration through features like Dynamic Commentary

Pricing: Pricing is not publicly available.

11. Stampli

Best for: Accounts payable automation, invoice management

Stampli is an AI-powered AP automation software that centralizes and streamlines the entire accounts payable process. It’s designed to integrate with existing ERP systems, allowing businesses to automate AP without disrupting their current workflows.

They feature Billy the Bot, an AI bot that adapts to your unique AP processes and automates manual tasks to eliminate manual ERP work.

Features:

- Automates invoice capture, coding, and approvals using AI

- Features Billy the Bot, an AI bot that learns your AP processes to assist with tasks like fraud detection and duplicate payment prevention

- Centralizes communication and documentation around invoices

- Integrates with over 70 ERP systems

- Supports various vendor payment methods like ACH, checks, and credit cards

- Provides detailed tracking and reporting of the entire invoice lifecycle

Pricing: Stampli pricing is not publicly available.

12. Nanonets

Best for: Accounts payable automation, invoice processing

Nanonets is an AI-powered platform that specializes in transforming unstructured data from documents, emails, and other sources into actionable insights. The platform is used for automating accounts payable, supply chain processes, and invoice processing.

Features:

- Uses AI to extract meaningful information from documents, emails, and databases, reducing manual data entry

- Streamlines AP processes by automating invoice capture, approval workflows, and payment processing

- Automates the supply chain process with order processing, inventory management, and demand forecasting

- Automates the capture, categorization, and approval of invoices

- Allows users to create custom AI workflows to automate specific business processes using natural language commands

- Integrates with popular ERP systems

Pricing:

- Starter: Pay as you go (First 500 pages free, then $0.3/page)

- Pro: $999/month/workflow (10,000 pages, then $0.1/page)

- Enterprise: Pricing not publicly available

13. Sage Intacct

Best for: Financial management, ERP, reporting

Sage Intacct is a cloud-based financial management platform designed to help businesses streamline their accounting processes and enhance financial visibility. Sage AI automates routine tasks like invoice processing as well as provides a dynamic, real-time view of business performance.

Features:

- Connects with multiple data sources including ERP, CRM, and HRIS systems to provide a unified financial management platform

- Generative AI business assistant provides a view of your business performance and turns data into actionable insights

- Supports financial processes like multi-entity consolidation, currency conversions, and local tax reporting

- Automates workflows for accounts payable, accounts receivable, and fixed asset management

Pricing: Sage Intacct pricing is not publicly available.

14. NetSuite Text Enhance

Best for: Content creation, business communication, financial summaries

NetSuite Text Enhance is a generative AI-powered feature integrated into the NetSuite ERP platform. It’s designed to assist with creating and refining business content using company-specific data to produce contextual and personalized text. This tool can be used for drafting item descriptions, sales communications, purchase orders, job listings, and more.

Features:

- Uses generative AI to create content based on the specific context and data from NetSuite

- Enhances existing text by correcting grammar, rephrasing for style and tone, and making content more concise or detailed as needed

- Automates the generation of business documents

- Fully embedded within the NetSuite ERP, allowing use across modules like sales, HR, and finance

- Enables multiple users to work on documents simultaneously

Pricing: NetSuite pricing is not publicly available.

Incorporate AI tools into your financial processes

Now that you know the capabilities of AI tools in finance, you're ready to incorporate them into your financial processes. This means you can automate tedious tasks, generate insightful analytics, and improve accuracy for your business.

For those looking for a powerful FP&A tool, consider Cube. Cube allows you to work directly within Excel and Google Sheets for budget forecasting and planning to make proactive decisions. Request a free demo to learn how Cube can work for you.

.png)

.png?width=276&height=82&name=horiz-wordmark-ultramarine%20(2).png)