Key takeaways on financial close software

- Financial close software significantly reduces the time required to close the books and meet tight reporting deadlines.

- It can integrate data from multiple sources into a single platform to minimize human errors and give stakeholders access to reliable financial information.

- Custom workflows and task management features make it easier to manage inputs, approvals, and adjustments across departments during the close process.

- Many financial close solutions are suitable for small and large businesses.

Best financial close software at a glance

- Cube

- BlackLine

- FloQast

- LucaNet

- Redwood Software

- Datarails

- Workiva

- Adra by Trintech

- Vena Solutions

- Board

- JustPerform

- OneStream

- Prophix

- Planful

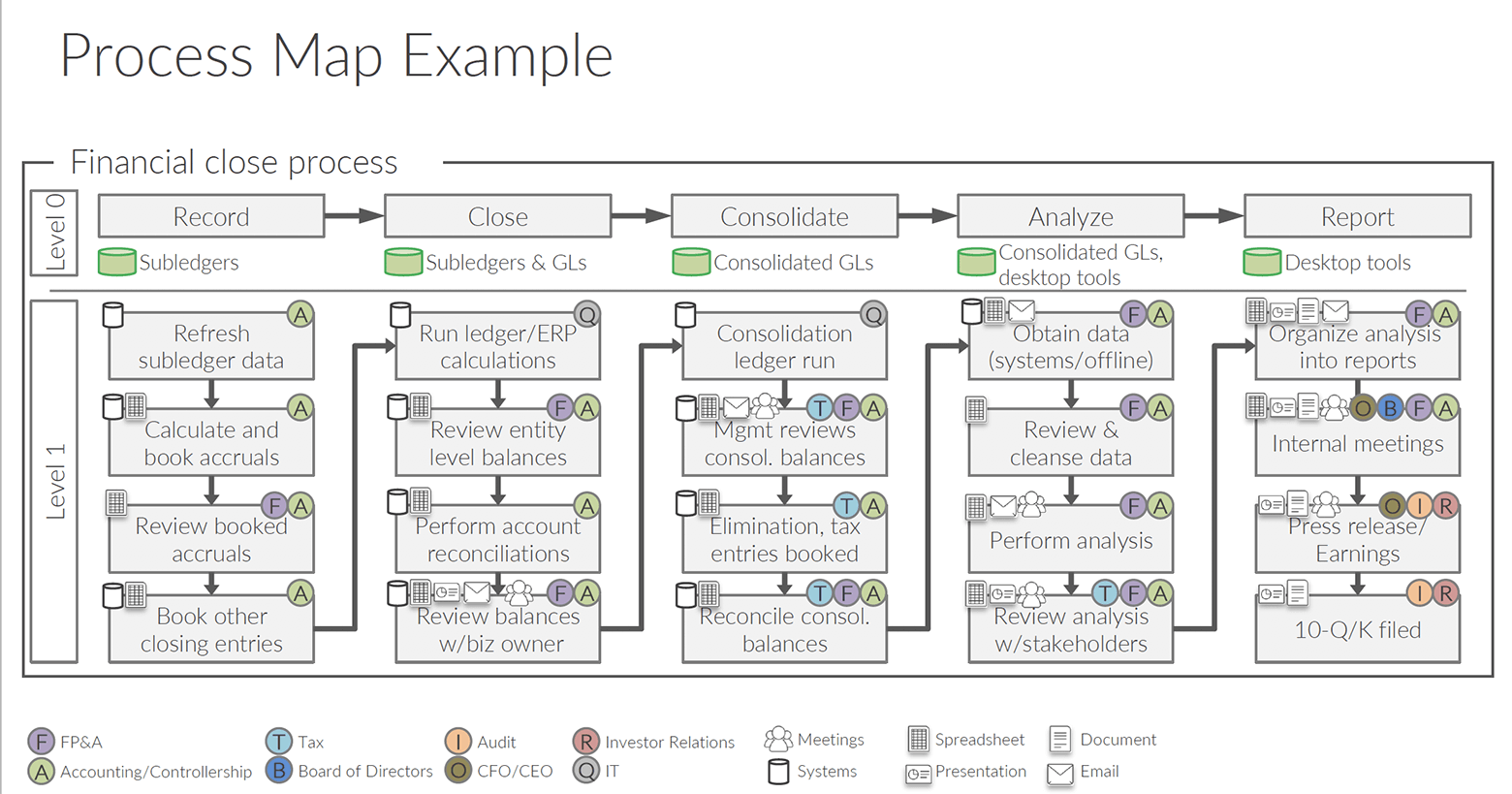

What is financial close software?

Financial close software brings together your company’s financial data into a central location, allowing you to close the books at month-end in an efficient and organized way.

You can automate many manual processes using financial close software, create a streamlined invoice reconciliation system, and speed up your time to close with confidence.

What is financial close and consolidation?

Financial close and consolidation is the process by which financial teams zero out account balances—reconcile revenues and expenses—and update the retained earnings account in the general ledger (GL) to match the end-of-period balance.

Financial consolidation refers to the process of combining and simplifying those accounts in the general ledger. Financial close refers to zeroing out and balancing accounts.

Standard practice at the end of the financial close process is to generate reports like updated versions of the three financial statements: the income statements, the balance sheets, and the statement of cash flows.

A quick refresher: The financial close process

Also called the month-end close process, accounting and finance teams are responsible for "closing the books" at the end of every reporting period, usually the end of the month. This eats up a sizable chunk of their working hours for many teams.

We made a month-end close checklist for you to keep track of all the closing tasks, but here's a quick refresher of what goes into the financial close process:

Cash review

Cash review is pretty self-explanatory: it's when you review the discrepancies between your ledge and the bank statements. This is also called cash account reconciliation. You'll also review your petty cash during this time.

Account reconciliation (AP and AR)

Your account reconciliation process includes your accounts payable (AP) and your accounts receivable (AR). This step requires resolving any outstanding, missing, or incorrect payments or receipts.

This can be one of the most time-consuming steps in the entire close process because the finance team needs to review receipts, bank accounts, and account balances by hand.

Fixed asset review

Here you check up on fixed asset costs or depreciation.

This kind of asset accounting helps you accurately track your assets in your current financial systems. It also helps you forecast when you might need to replace those assets.

Accruals and fluxes

An accrual represents money that has been earned but not yet paid. Many finance teams use a double-entry accounting process to track their accruals; that is, they recognize the revenue in the period where it's earned, even if money doesn't actually change hands during that same period.

Recording accruals early in the process helps finance teams complete their financial statements on time. Flux is how finance teams measure variances in accounts period over period.

Revenue recognition and preliminary accounting/compliance reviews

It's good to check in on compliance every month. Staying on top of your ASC 606 compliance and other business processes is one of the best ways to minimize risk and avoid accruing project debt that you'll need to pay off in the future.

Financial data and statement creation

Now that you've finished your closing tasks, it's time to create your financial statements. Financial close processes have evolved as CFOs seek to become more strategic partners to CEOs and the rest of executive leadership. So, in the name of enterprise risk management, the number of standard financial statements they create at the end of each reporting period has also increased.

Here's a bare minimum for reporting:

- Income statement

- Balance sheet

- Cash flow statement

- Plant throughput

- Labor hours/product produced

- Downtime

- Capacity percent

- Average cost

- 12-month trailing gross margin analysis

- Delivery targets (on-time delivery)

- Inventory turnover

- Days sales outstanding (DSO)

- Days payable outstanding (DPO)

- Working capital analysis

- Debt to EBITDA ratio

The mix of KPIs, metrics, and financial ratios you include varies depending on your industry. For example, many SaaS companies want to monitor their magic number but don't have a physical inventory to track.

Financial close software benefits

Obviously, the most significant benefit of financial close management software, also called accounting close software, is that it speeds up your entire closing process.

A few other benefits of using accounting close software include:

- Greater accuracy (and peace of mind) with your entire financial close process

- Financial close automation, or being able to set specific processes on autopilot

- Less human error

- Custom workflows to match the nuances of your particular process

- Better collaboration across the accounting team

- Data centralization to create a single source of truth for the company

- Enhanced visibility with tools to track reconciled and unreconciled accounts or drill down to transaction-level details

- Real-time financial insights that allow leaders to make quicker, better-informed decisions

- Support for complex processes like inter-company eliminations, partial ownership reporting, and multi-currency transactions

Improving your financial close capabilities, reducing manual work, and finding more routes for process improvement are just a few of the other benefits of using financial close automation software.

Best financial close software

The right financial close software will help your team streamline the close process, reduce errors, and improve collaboration. Let’s explore the best platforms on the market today.

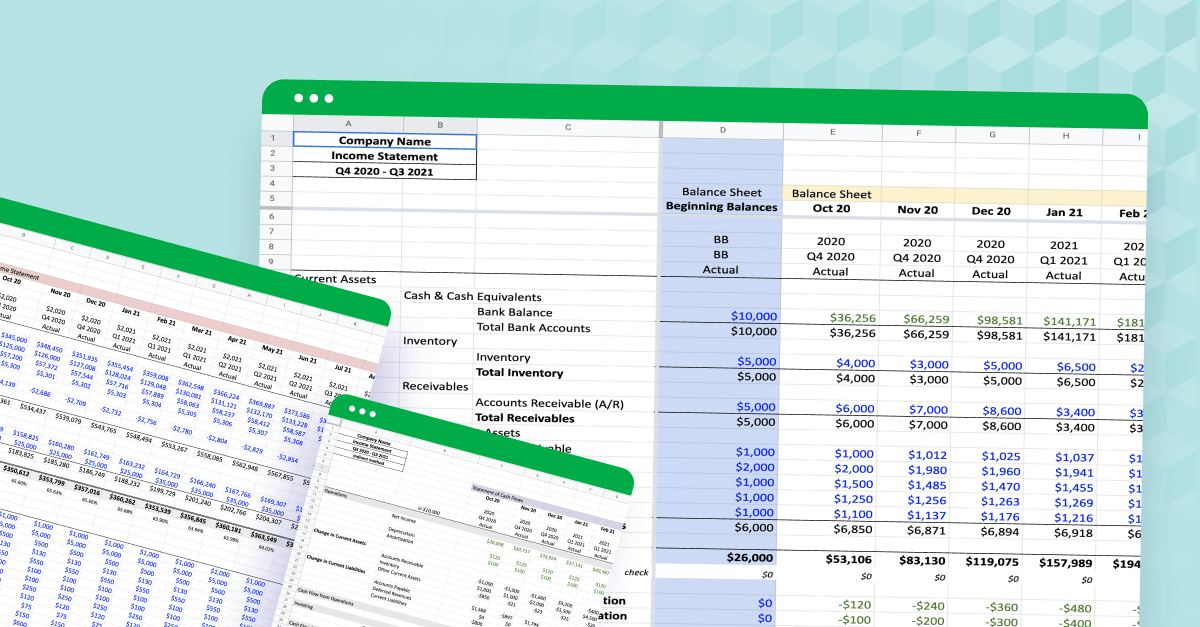

1. Cube

.png?width=366&height=106&name=blue-cube-logo%20(1).png)

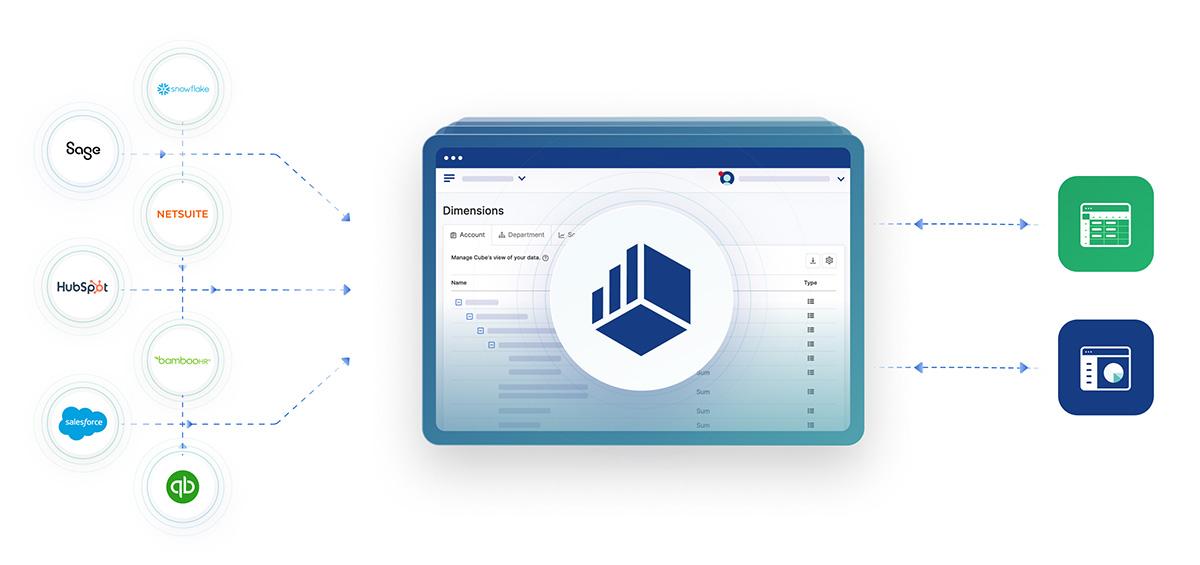

Cube believes that finance and accounting professionals should work in their favored environment—the spreadsheet. Cube users enjoy all the power of a robust, AI-powered FP&A tool—including automated scenario analysis, data consolidation, multi-currency support, dynamic user controls, robust source system integrations, and custom reporting—with the ease and familiarity of Excel or Google Sheets.

Cube lets finance teams quickly and accurately automate financial close and consolidation processes. It integrates with other financial systems, including accounting software like NetSuite, QuickBooks, and Sage Intacct.

Best for: Cube helps FP&A teams at companies of all sizes successfully drive faster and more accurate month-end closes while allowing them to continue performing tasks in the spreadsheets they love.

Features to improve the financial close process

- AI capabilities: Automate data consolidation, anomaly detection, and predictive insights. Cube identifies discrepancies in financial data to help your team meet month-end deadlines.

- Data consolidation: Unite your source data and financial information and automate your reporting process with high accuracy and confidence. Cube integrates with your existing software and gives you the speed and flexibility of a cloud-based platform.

- Spreadsheet-native: Cube unites the power of a dynamic financial close platform with the familiarity of a spreadsheet, including powerful integrations to accelerate the reporting process without learning a new system.

- Audit trail: Dynamic audit trails let you quickly dig into the transactions and cell-level data.

- Scenario analysis: Iterating data to surface new insights is easy with customizable analysis and dashboards.

- Data management: Cube allows you to import, consolidate, and validate data from multiple systems to create a single source of truth for all your financials.

- Report distribution: Create, approve, and distribute financial packages to all internal and external stakeholders.

Pros:

- The spreadsheet-native platform allows your teams to work where they are most comfortable and productive.

- Easy implementation process and easy access to a world-class customer support team.

- Sophisticated automation tools make manual processes and error-prone data entry a thing of the past.

- Eliminating busy work and manual entry saves money and lets your teams focus on creating value.

- Extensive reporting functions allow you to parse and analyze data and scenarios without requiring extensive code. Reporting and visualizations are available at a glance.

Cons:

Pricing: Cube pricing is customized to fit your needs, starting at $2,000/mo.

Schedule a demo to learn more

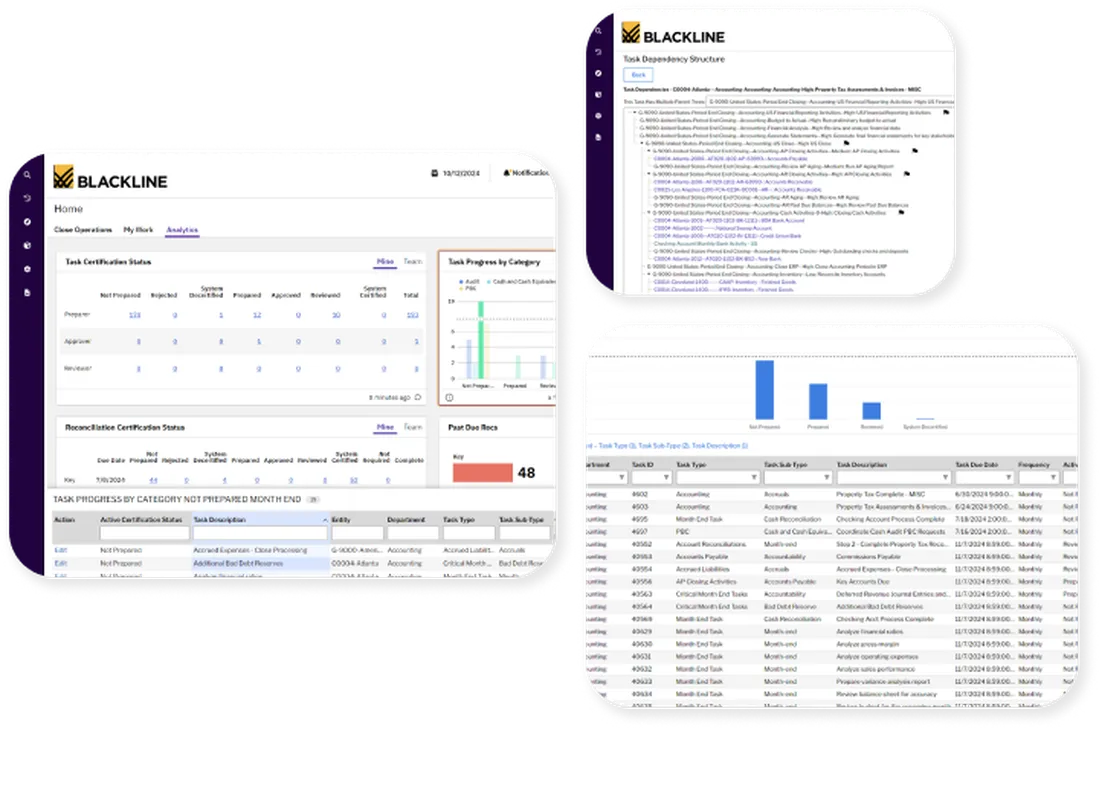

2. BlackLine

.png?width=421&height=124&name=BlackLine_Logo%20(1).png)

BlackLine helps finance and accounting teams manage their financial close processes through automated workflows and streamlined financial reporting options. The software integrates with multiple ERP and CRM data sources to unite data into a single source of truth.

For: Serves a variety of segments, focusing primarily on enterprise-sized companies.

Features:

- Smart Close (for SAP): Limit manual touchpoints and enable exception-based close management.

- Dynamic user management: Facilitate auditor reviews with trails that documents data imports, journal postings, and user access.

- Task management: Track and manage tasks from a cloud-based command center.

- Transaction matching: Ingest data from multiple systems such as ERPs, banks, payroll providers, revenue, lease accounting, and procurement.

Pros:

- Incorporates AI to automate financial close processes

- Allows finance teams to access info from anywhere in the world

Cons:

- Lacks strong support for other GL/ERP applications that aren’t SAP

- Users report the most recent version is hard to navigate

- Reconciling in Excel won't provide the same level of insights as using Blackline natively

Pricing: Blackline doesn’t share pricing information through its website.

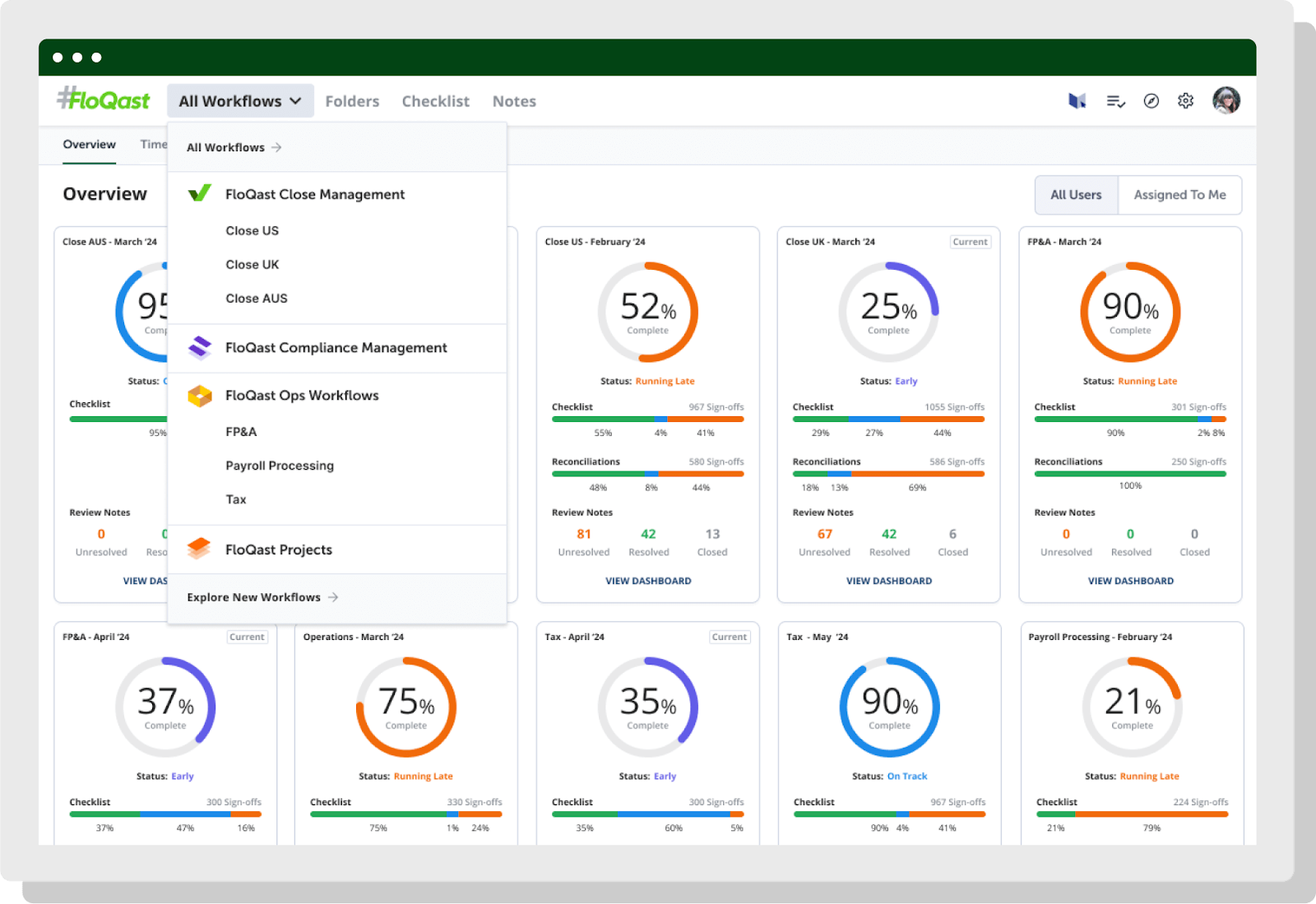

3. FloQast

FloQast is financial close automation software that offers robust integrations with other finance tools or accounting software and high-confidence reporting and approval.

For: Clients of all sizes, mainly in the mid-market.

Features:

- Data consolidation and management: Gather financial data from different sources—like accounting systems, spreadsheets, or sub-ledgers—and organize it in one place for easy access and accuracy.

- Financial reporting and distribution: Create financial reports like income statements and balance sheets to share with stakeholders.

- Journal entry adjustments: Make updates or corrections to financial records to keep data accurate.

- Audit trail: Track every change made to financial records.

Pros:

- Centralizes review controls for journal entries and reconciliations.

- Gives alerts when numbers are out of balance after you have reconciled.

Cons:

- Users report there’s a high learning curve which adds time to the implementation process.

- Size and grouping limitations make this platform easy to outgrow for companies who need more powerful automation features.

Pricing: Pricing information for FloQast is not provided on their website.

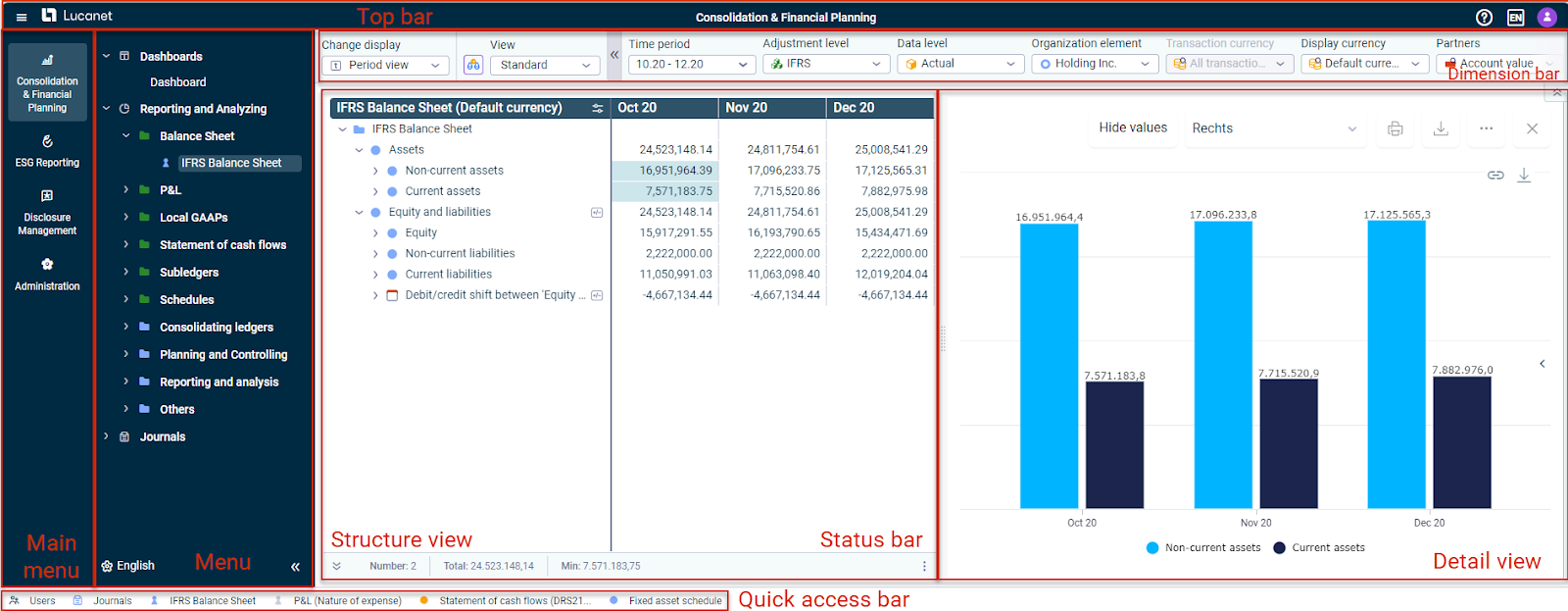

4. LucaNet

LucaNet is an all-in-one FPM solution that focuses on providing process automation and professional consulting services as an integrated solution. Finance industry professionals developed it.

For: Serves mostly small business and mid-market clients.

Features:

- Data visualization: Turn financial data into visuals to spot trends and insights.

- Customizable reporting: Build reports tailored to your business needs by selecting specific metrics and formats.

- Real-time data access: View up-to-date financial information without waiting for manual updates or batch processing.

- Versioning support: Find and recover previous versions of financial reports

Pros:

- Offers Excel integration to pull financial data

- Provides a user-friendly interface

Cons:

- Users report the reporting, visualization, and chart creation capabilities are limited.

- Some reports are rigid, limiting flexibility for those seeking to customize their close documents.

Pricing: LucaNet does not disclose pricing on its website.

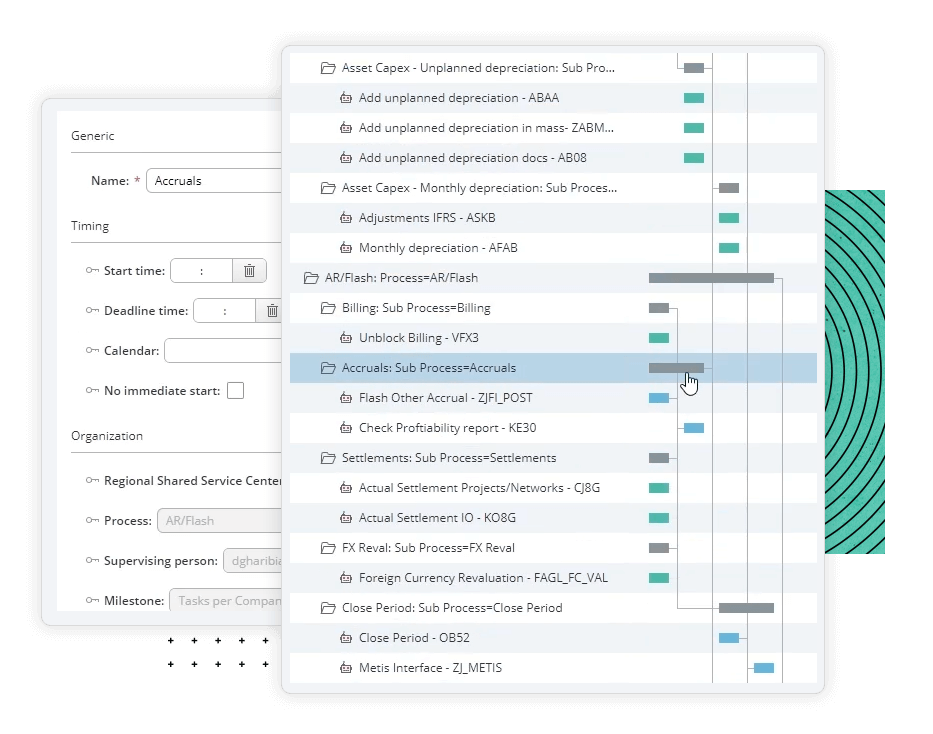

5. Redwood Software

Redwood Software is a large supplier of one-stop cloud solutions for IT, Finance, and business processes. They provide solutions for enterprise customers such as robotic process automation (RPA), financial close automation, and low-code tools for various industries.

For: Has a strong client base of enterprise customers.

Features:

- Workload management: Organize and assign tasks to team members

- Financial data management: Collect, store, and organize financial information securely.

- AI-enabled automation: Automate repetitive tasks and detect data outliers.

Pros:

- Can handle very large data sets

- Offers 24/7 customer support

Cons:

- The vast offerings might present a large learning curve for smaller finance teams

- Not beginner-friendly

Pricing: Redwood doesn't disclose pricing.

6. Datarails

Financial planning and analysis (FP&A) platform Datarails automates reporting and planning, saving time on manual processes. Though Datarails is not spreadsheet-native, it does offer integrations for Windows-based spreadsheet users.

For: Focused on serving the small to medium business (SMB) segment.

Features:

- Excel-based functionality: Work within Excel spreadsheets with financial planning and analysis tools.

- Visualization tools: Create charts, graphs, and dashboards to present financial data.

- Scenario modeling: Test different financial scenarios to see potential outcomes.

- KPI tracking: Measure key performance indicators against business goals.

Pros:

- Allows teams to work with Excel spreadsheets

- Offers customizable financial close formulas

Cons:

- Users report updates can be inconsistent and buggy, slowing down teams

- Users find that mapping change processes can be time-consuming

Pricing: Datarails provides custom quotes for its services.

Check out our full review of Datarails.

7. Workiva

Workiva offers a financial platform that’s “open, intelligent, and intuitive” to help professionals do their most complex work without manual processes or system-hopping. It centralizes data and integrates sources so “you can work better in the cloud.”

The company enables Environmental, Social, and Governance (ESG) reporting to help clients demonstrate a corporate commitment to this emerging investment metric.

For: Has a strong following in the mid-market and enterprise sectors.

Features:

- Audit support: Provide clear records and trails to verify financial accuracy.

- Custom financial close documentation: Tailor documents to your specific close processes.

- Custom reporting: Design reports that highlight the exact metrics and formats your business needs for decision-making.

Pros:

- Enables teams to ensure documents are SEC compliant.

- Allows users to export filings as Word and PDF documents.

Cons:

- Users report this platform is on the pricier side of the spectrum.

- Does not provide all of the native Excel features when working within an Excel spreadsheet

Pricing: Pricing for Workiva services is not disclosed on the website.

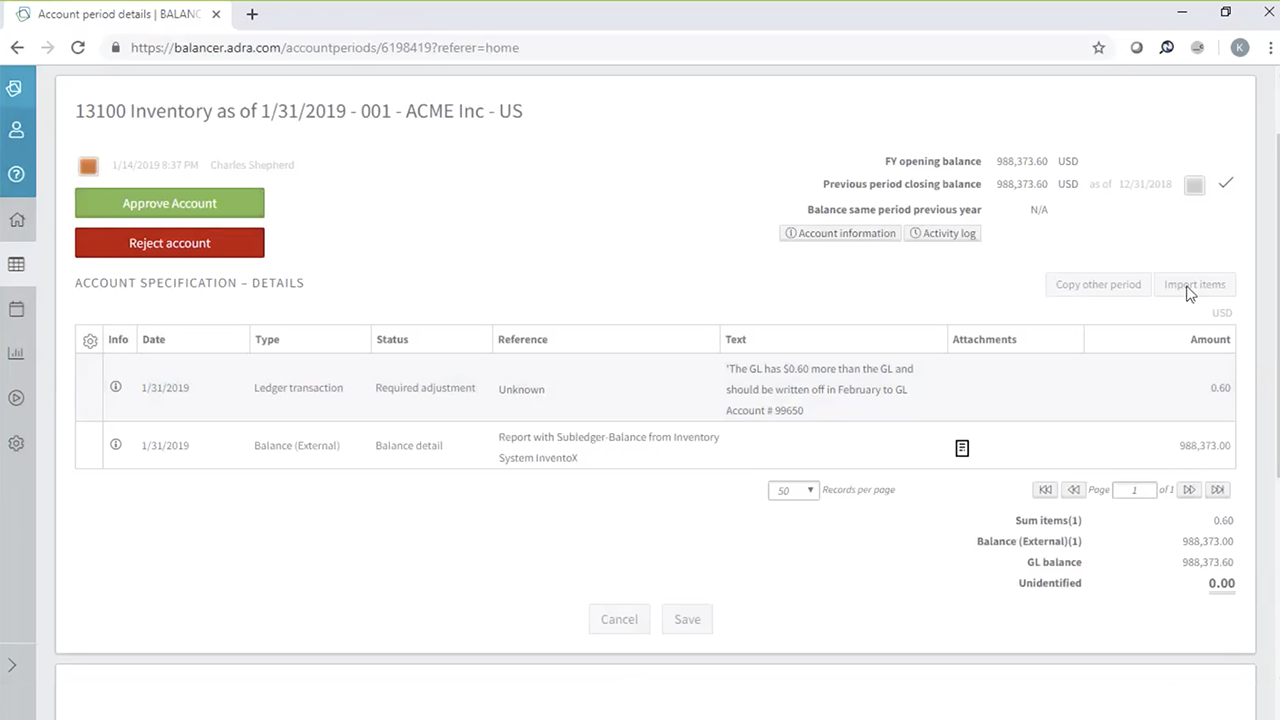

8. Adra by Trintech

Adra by Trintech delivers simplicity to the financial close process with a cloud-based solution that improves the speed and accuracy of reporting. The company offers data continuity solutions through automated transaction matching, account reconciliation, task management, and real-time reporting.

For: Focuses on serving mid-market clients.

Features:

- Financial audit support: Prepare financial records for audits and ensure compliance with legal and regulatory standards.

- Financial close management: Adra Task Manager provides centralized checklists and documents for visibility and control of the financial close process.

- Report distribution: Share finalized financial reports with relevant stakeholders or team members.

Pros:

- Offers an intuitive platform

- Automates workflows to minimize manual workload

Cons:

- Limited help tools to utilize and maximize the potential of the application

- Users report it slows down heavily when importing large amounts of data

Pricing: Adra by Trintech doesn't provide pricing information online.

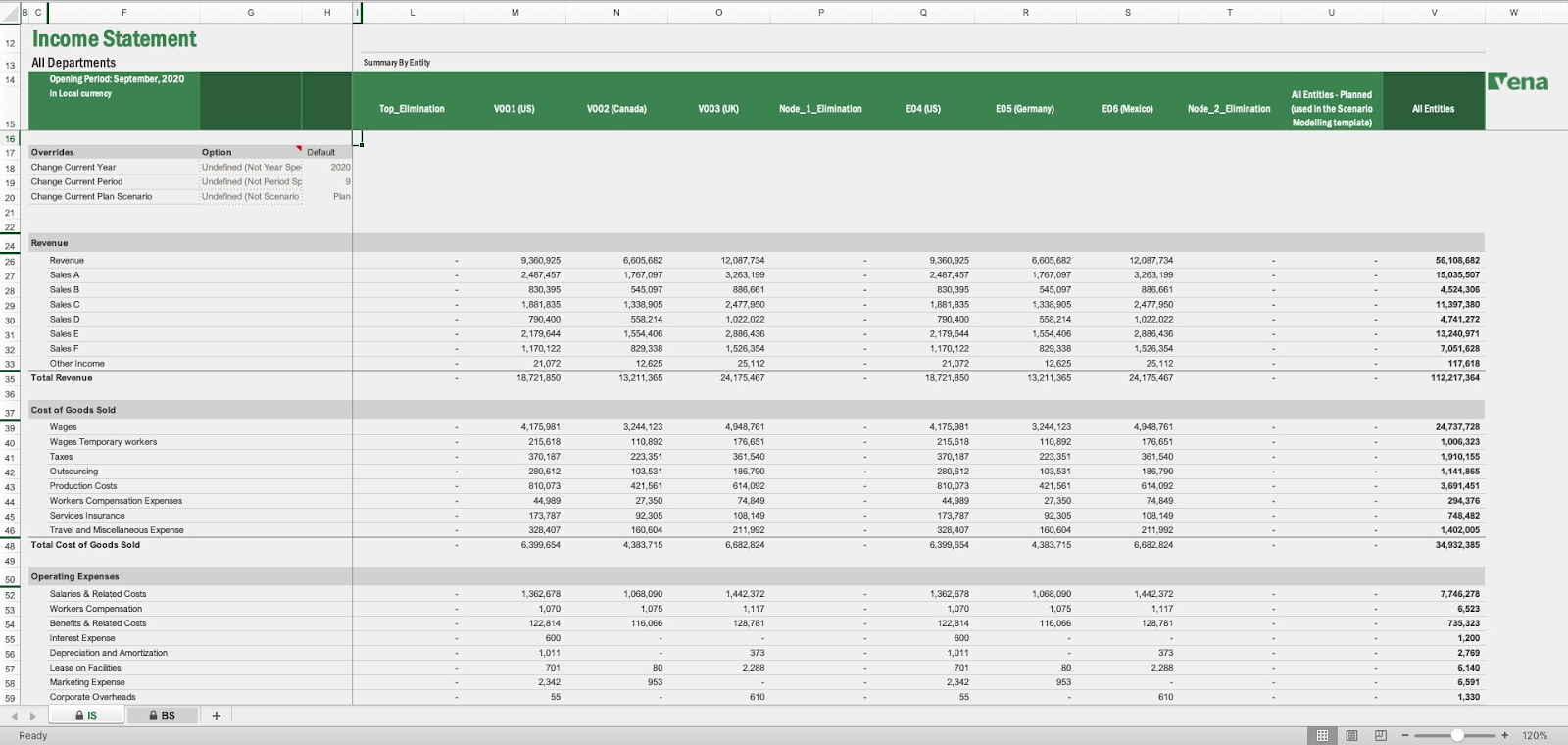

9. Vena Solutions

Vena Solutions is a complete planning platform that offers users a spreadsheet-native planning tool to empower growth. The Vena platform stands out as an Excel-based tool built specifically for Microsoft 365, with added business intelligence tools designed specifically for the platform.

For: Serves customers in all segments, mainly from the mid-market sector.

Features:

- Custom data import: Import financial data from various sources and formats.

- Versioning control: Track changes to reports or models, save previous versions, and compare updates.

- Data visualization: Convert numerical data into visuals to make insights more accessible.

- Journal entry adjustment: Edit financial records to fix errors or reclassify transactions.

Pros:

- Offers an Excel spreadsheet native interface

- Responsive customer support team

Cons:

- Presents a steep learning curve with the advanced report-building process

- Users report Vena as a very costly platform, even for enterprises.

Pricing: Vena does not offer pricing information on its website.

10. Board

Board offers a self-service approach to reporting and analysis. The platform features time-saving automation solutions with an easy-to-use interface. The platform's automation capabilities allow users to investigate, create, and audit financial reports quickly and easily.

For: Serves clients across the small business, mid-market, and enterprise segments.

Features:

- Trial balances: Ensure total debits equal the total credits by listing the closing balances of all accounts.

- Custom and template reporting: Build your own reports or use pre-built templates to generate financial insights.

- Predictive analytics: Use AI to anticipate trends and identify risks.

- Integration support: Connect with existing systems, like ERP or accounting software.

Pros:

- Provides responsive customer support

- Enables predictive analytics on top of financial close capabilities

Cons:

- Users report it is not beginner-friendly.

- The cost of licenses can be high for smaller finance teams.

Pricing: Pricing information is not provided on the Board website.

11. JustPerform

JustPerform is a cloud-based financial performance management platform that helps businesses streamline financial close processes. It enables finance teams to manage tasks like consolidation, reporting, and disclosure management. JustPerform is an IFRS/Multi-GAAP compliant app, meaning the outputs comply with financial reporting standards in the United States and most countries.

For: Businesses of all sizes who need support with financial performance management

Features:

- Automated consolidation: Merge financial data from multiple entities, with compliance to IFRS and Multi-GAAP standards.

- Self-service reporting: Enable users to generate audit-friendly reports without extensive IT involvement.

- Disclosure management: Streamline the preparation of financial disclosures by reducing the time and effort required to compile notes to accounts.

Pros:

- Allows finance teams to run reports with minimal IT support

- Comes with built-in reporting and input template packs

Cons:

- Users report the training materials and product documentation are not fully refined.

- The learning curve can be steep for newer finance teams.

Pricing: Pricing is not publicly available

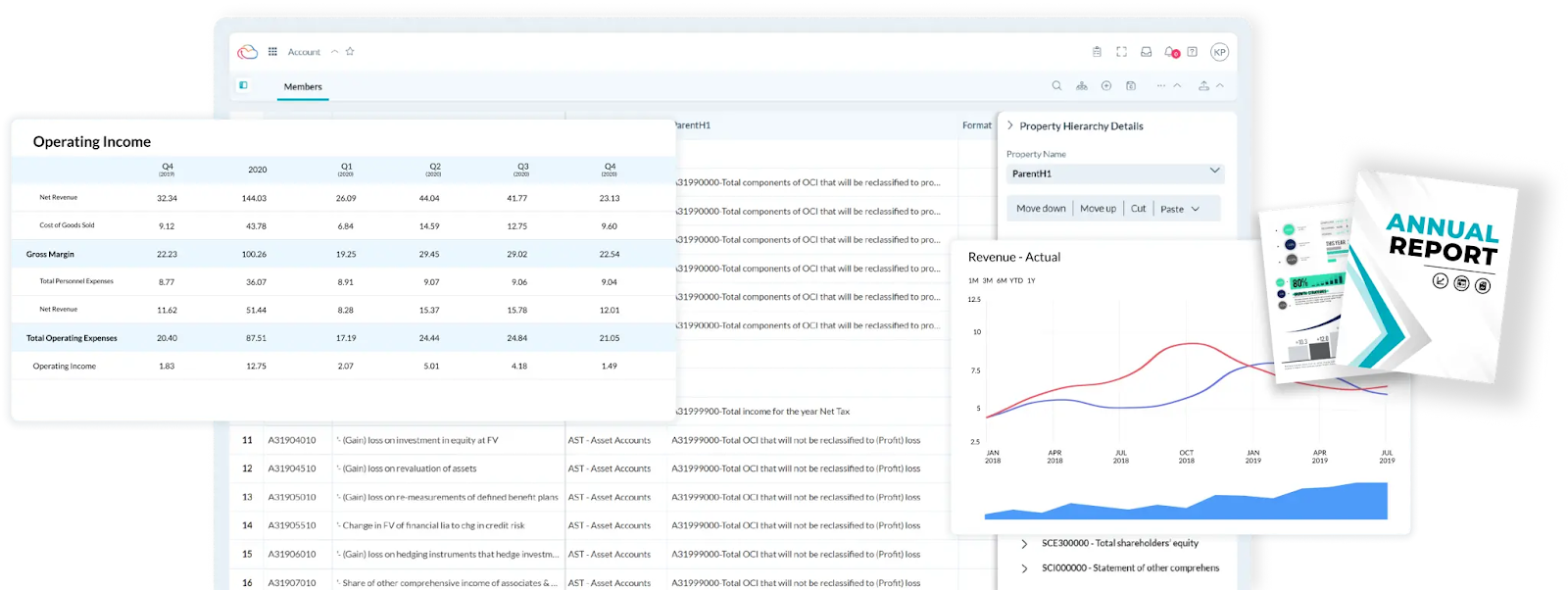

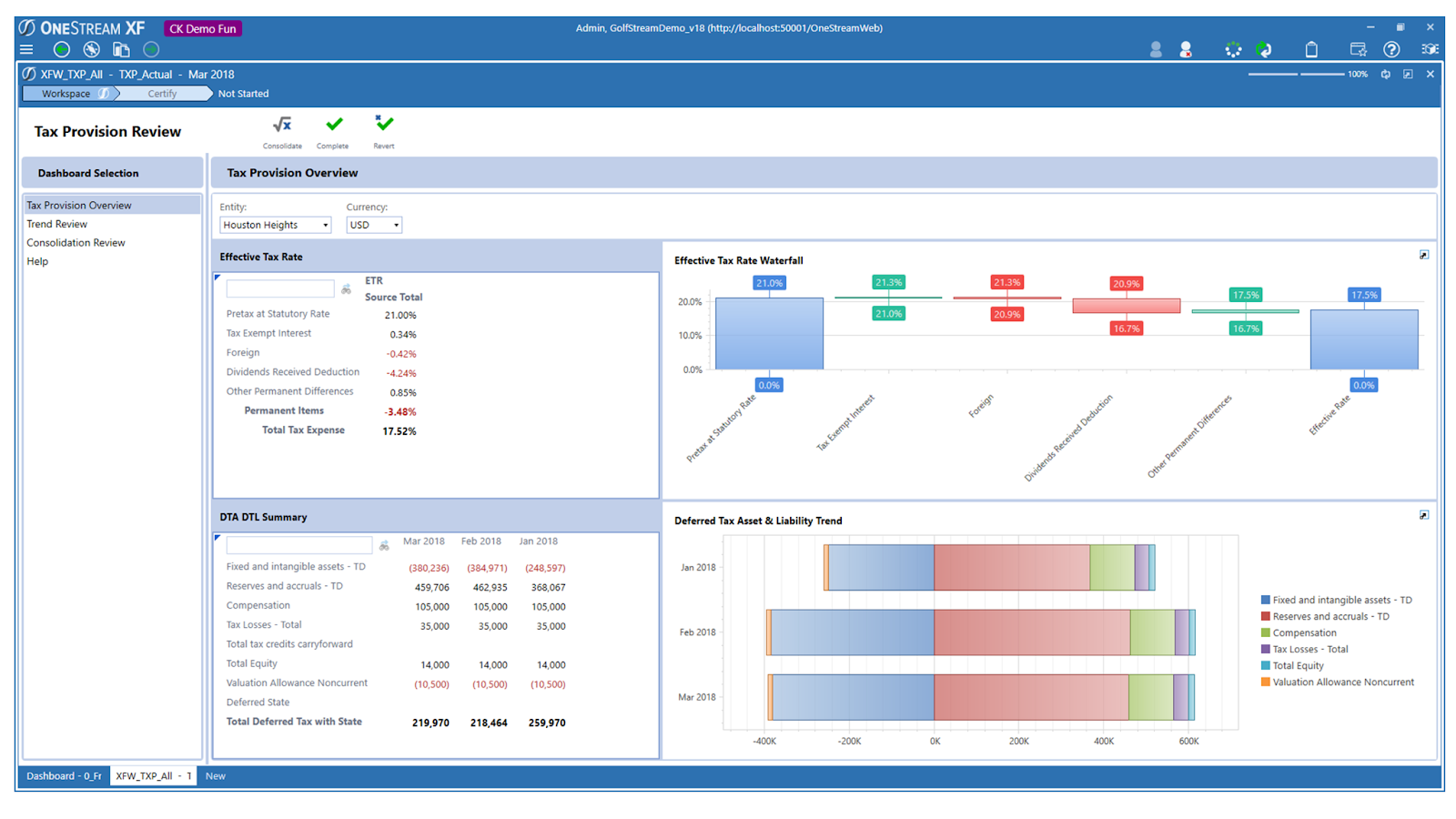

12. OneStream

OneStream is a unified corporate performance management (CPM) platform that can streamline financial close, consolidation, and reporting processes for large enterprises. It replaces multiple legacy systems and spreadsheets with a single, integrated solution. OneStream caters to teams who need AI to manage larger financial datasets.

For: Serves enterprises in all sectors.

Features:

- Financial consolidation and reporting: Use AI to automate the consolidation of financial data.

- Account reconciliation: Enhance risk management by linking reported balances to reconciled accounts

- Transaction matching: Accelerate the close process by loading and reconciling transactional data, identifying errors, and supporting auto-matching from different sources.

Pros:

- Provides a responsive implementation team

- Centralizes financial close tasks in one application

Cons:

- Can present a learning curve for teams transitioning from traditional spreadsheet platforms

- High cost and customization may be too much for smaller teams

Pricing: Pricing is not publicly available.

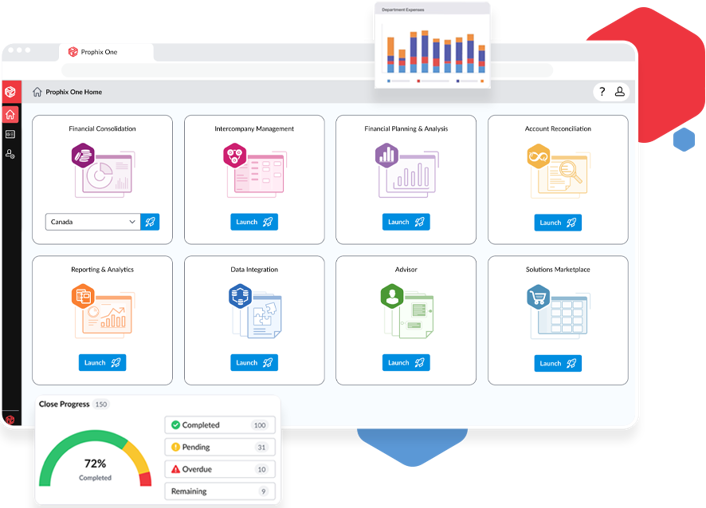

13. Prophix

Prophix is a financial performance management platform that offers tools to handle the financial close process. It can automate tasks like account reconciliation, intercompany eliminations, currency translations, and reporting. Users can access a library of ready-to-use and configurable audit report templates to stay ahead of financial audits.

For: Businesses of all sizes in all sectors.

Features:

- Financial consolidation: Automate the consolidation of financial data with multi-currency translations and intercompany eliminations.

- Data integration and validation: Automate imports, data integrations, and custom validation rules to consolidate financial information.

- Customizable workflows: Tailor workflows for internal or external audit processes.

- Audit trail and compliance: Maintain detailed records of all financial transactions and adjustments.

Pros:

- Features a user-friendly interface

- Centralizes all data, not just financial

Cons:

- Users report ad-hoc flexibility for end users working with data in templates is limited

- The limited filters in reports can be an issue for larger enterprises with extensive needs

Pricing: Pricing is not publicly available

Read more about the best Prophix alternatives.

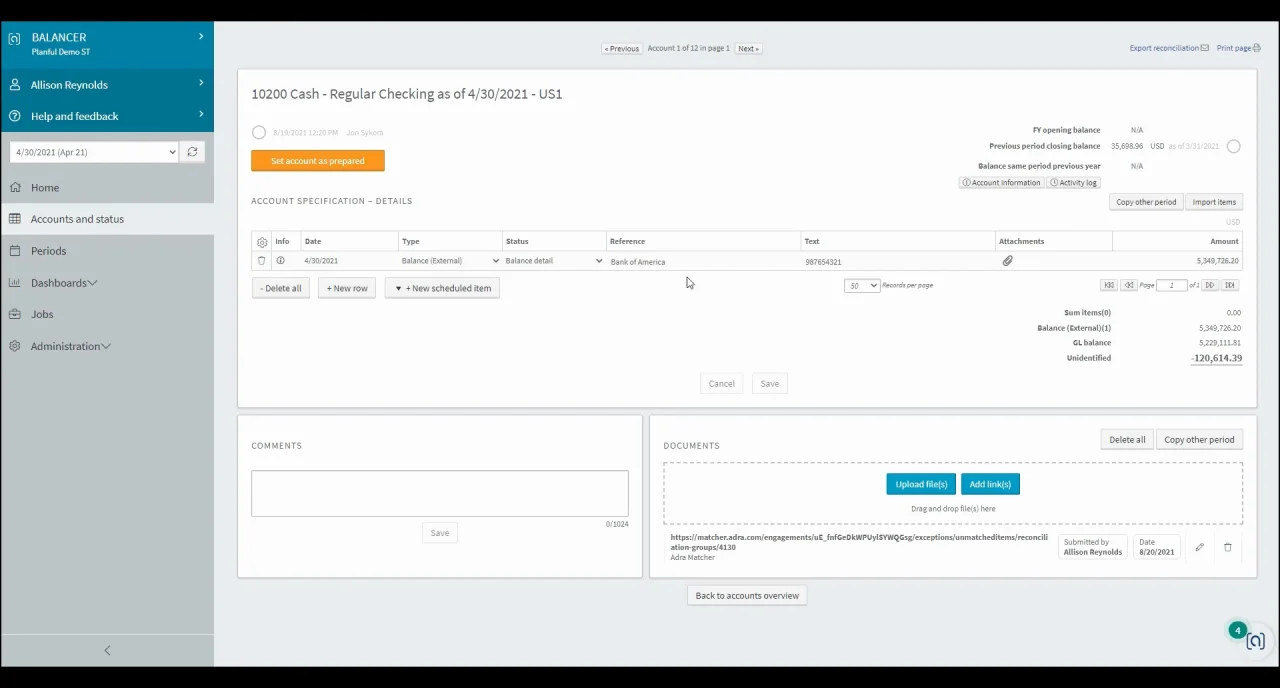

14. Planful

Planful is a financial performance management platform that offers financial close management and account reconciliation. Finance teams can use it to standardize account reconciliation and month end close processing. It can also automatically detect anomalies in data using AI.

For: Businesses of all sizes in all sectors.

Features:

- AI-powered account reconciliation: Match and validate financial data automatically

- End-to-end task management: Track and manage all financial close tasks in one platform.

- Automated month-end close: Close books with automated journal entries and consolidations

Pros:

- Uses AI to automate financial close tasks

- Provides responsive customer support

Cons:

- May have a steep learning curve for teams who are used to working in Excel

- Users say formatting can be a huge pain on reports.

Pricing: Pricing is not publicly available

Choose the best financial close software

Now you know about the industry's top financial close software, you’re ready to make an informed choice for your finance team. Choosing the right platform will help you minimize financial reporting errors, detect anomalies early, and streamline your month-end processes.

If you're looking for a tool that:

- Works with the spreadsheets that you're already using

- Makes it easy to collaborate and share across the team or departments

- Also makes the rest of your accounting and FP&A work easier

... then Cube might be a fit for you. The best way to learn about Cube is to see it in action—Schedule a demo to see exactly how Cube can help you.

.png)

![14+ best financial close software tools [2025 review]](https://www.cubesoftware.com/hubfs/Financial-Close-Software%20%281%29.webp)

.png?width=366&height=106&name=blue-cube-logo%20(1).png)

.png?width=421&height=124&name=BlackLine_Logo%20(1).png)

![14+ of the best financial consolidation tools [2025]](https://www.cubesoftware.com/hubfs/Blog%20image%20%2891%29.png)