Understanding the manufacturing industry from an FP&A perspective

Financial Planning & Analysis (FP&A for manufacturers) involves planning your company's financial future, analyzing how you're performing financially, and using this information to make better business decisions. For manufacturers, manufacturing financial planning and analysis helps manage costs, streamline operations, predict demand, and ensure your money is used wisely to support production and growth.

In job-based manufacturing, products are made to order, which requires precise budgeting for specific projects. Batch production involves producing large quantities of the same item, necessitating efficient management of inventory costs and production schedules. Continuous production, operating non-stop, demands relentless attention to operational costs and efficiency.

Financially, the manufacturing industry is marked by significant investments in machinery and technology, sensitivity to economic cycles that affect demand, and long periods required to develop and produce products. These factors make careful planning essential to ensure that resources are used effectively and that the company can adapt to changes in demand without jeopardizing its financial health.

For FP&A professionals in manufacturing, understanding these environments and characteristics is essential. This knowledge allows them to tailor financial strategies that not only tackle immediate financial needs but also align with broader business objectives, ensuring sustained operational success.

Why FP&A Matters for Manufacturers

Manufacturing involves many moving parts, from buying raw materials to producing goods, distributing them, and selling them. Effective FP&A in manufacturing provides manufacturers with:

- Clear Financial Picture: Understand your revenues, expenses, profits, and cash flow.

- Better Decision-Making: Make informed choices about investments, expansion, and cost-cutting.

- Risk Management: Spot potential financial risks and find ways to handle them.

- Operational Efficiency: Streamline processes to cut costs and boost productivity.

- Goal Alignment: Ensure your financial strategies support your long-term business goals.

Core components of effective FP&A in manufacturing

Effective FP&A in manufacturing hinges on four key components that ensure the financial health and strategic alignment of the business.

Budgeting

Accurate budgeting is fundamental in manufacturing due to its cyclical production schedules and significant capital expenditures. To manage this, FP&A professionals must employ techniques that accommodate the timing of cash flows, plan for large purchases of equipment, and allocate funds for upcoming production cycles. This might involve setting aside reserves during peak production periods to cover slower times or unexpected expenses.

Forecasting

In a sector known for market volatility, having reliable forecasting tools is essential. FP&A teams should use a combination of historical data and market trends to predict future conditions. Implementing rolling forecasts can also provide flexibility, allowing the company to adjust its financial strategy as new information becomes available and market conditions evolve.

Reporting

Effective reporting in manufacturing FP&A should focus on clarity and relevance, providing stakeholders with insights that are directly actionable and support strategic decision-making. Reports should highlight key financial metrics and trends, outline potential risks, and measure progress against strategic goals. Regular updates are crucial to keep everyone informed and prepared to act quickly when necessary.

Variance analysis

This is a critical tool for tracking actual financial performance against the budgeted figures. By regularly conducting variance analysis, FP&A professionals can identify where the business is deviating from its financial plan, understand why these deviations are occurring, and adjust operations accordingly. This process helps in fine-tuning budgeting and forecasting models over time, ensuring they remain accurate and effective.

By mastering these components, FP&A leaders in manufacturing can ensure their financial strategies are not only reactive to immediate needs but also proactive in fostering long-term growth and stability.

FP&A in manufacturing: leveraging the right technology

In manufacturing FP&A, leveraging technology is not just about keeping up with trends—it’s about gaining a strategic edge through improved accuracy, efficiency, and foresight in financial planning.

ERP systems

Enterprise Resource Planning (ERP) systems are crucial for streamlining financial data gathering in manufacturing. These systems integrate all facets of an operation, including inventory, procurement, production, and finance, providing a holistic view of the company’s financial health. This integration helps FP&A professionals quickly access accurate data, reducing the time spent on compiling information from disparate sources and increasing the time available for analysis and strategic decision-making.

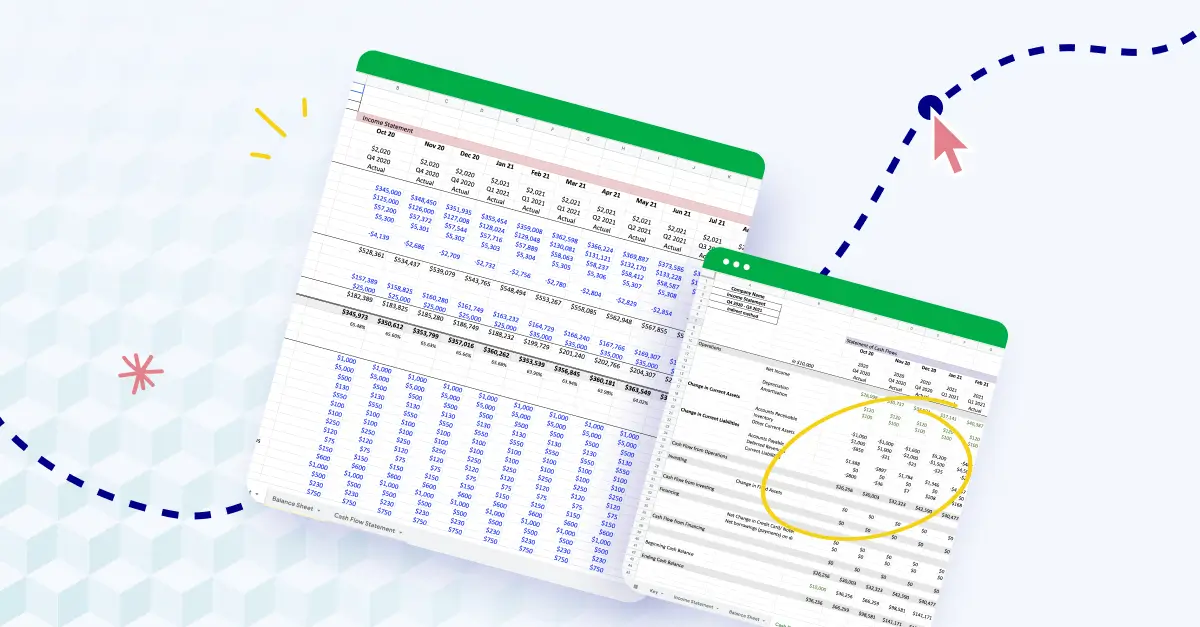

FP&A software

Manufacturing-specific FP&A software offers tools tailored to the unique needs of the industry. These tools can handle the complexities of manufacturing finance, such as managing the costs of raw materials, production processes, and distribution. Specialized software provides more nuanced insights into cost behaviors and profitability, enabling more precise budgeting and more strategic resource allocation.

Advanced analytics and AI

The use of advanced analytics and artificial intelligence (AI) in manufacturing FP&A can significantly enhance the accuracy of forecasts and the effectiveness of scenario planning. AI algorithms can process large volumes of data to identify patterns that might not be evident through traditional analysis. This capability allows for more accurate predictions of market demand, supply chain disruptions, or production bottlenecks. Additionally, scenario planning can be enriched with AI by simulating various market conditions and their potential impacts on financial performance, helping leaders make informed, data-driven decisions.

By embracing these technological tools, FP&A teams in manufacturing can not only streamline their operations but also anticipate future challenges and opportunities, leading to better-prepared, more competitive businesses.

Top FP&A best practices for manufacturers

Implementing these best financial planning practices for manufacturers can significantly enhance how you manage your finances and drive your manufacturing business forward. Each practice is designed to address specific aspects of financial management, ensuring a holistic approach to FP&A that supports both immediate operational needs and long-term strategic goals.

1. Connect Financial Data with Operations

Linking financial and operational information is essential for accurate and effective financial planning. Ensuring that your financial planning is based on real-time data from your production systems, supply chains, and other operational areas means that your financial forecasts manufacturing accurately reflect actual business activities. This integration provides a more precise picture of your financial health, enabling you to respond swiftly to operational changes and make informed decisions that drive overall business performance.

2. Make Accurate Predictions and Plans

Accurate forecasting and planning are the cornerstones of effective FP&A. By utilizing past sales data, market trends, and basic analytics, you can forecast future demand with greater precision. This foresight allows you to align your production schedules and inventory levels with anticipated customer demand, minimizing excess inventory and reducing the risk of stockouts. Additionally, creating detailed budgets that encompass all aspects of your manufacturing operations—including materials, labor, overhead, and equipment investments—ensures that your financial plans are comprehensive and adaptable to changing market conditions. Regularly updating these forecasts and budgets with input from various departments enhances their accuracy and relevance.

3. Compare Plans with Actual Results

Tracking performance by comparing your actual financial results against your budgets and forecasts is crucial for maintaining financial control. This comparison helps you identify areas where you are on track and areas that require adjustments. By examining differences in material, labor, and overhead costs, as well as comparing projected sales with actual sales, you can pinpoint specific factors that are affecting your financial performance. Monitoring operational metrics such as production rates and defect rates further provides insights into your efficiency. Taking proactive steps to address negative variances and reinforcing strategies that yield positive results ensures continuous improvement and financial stability.

4. Plan for Different Scenarios

Preparing for the unexpected by planning for different scenarios is a vital FP&A practice. Developing financial plans based on various potential future events—such as market fluctuations, changes in production capacity, or shifts in costs—ensures that your business is ready to handle any situation. By creating best-case, worst-case, and most-likely scenarios, you can assess how each situation impacts your profits and cash flow. This preparedness allows you to develop backup plans and respond effectively to challenges, enhancing your strategic flexibility and risk management capabilities.

5. Use Technology and Automation

Investing in the right technology and automation tools can significantly enhance your FP&A capabilities. Utilizing FP&A software for manufacturing companies that offers features like real-time data analysis, automated reporting, and basic predictive analytics can streamline your financial processes. Tools such as Microsoft Power BI, Tableau, or specialized manufacturing FP&A solutions can handle large volumes of data efficiently, reducing manual errors and speeding up financial reporting. Automating routine tasks like data entry and report generation frees up your team to focus on more strategic activities, while simple AI tools can uncover deeper insights and trends that inform better decision-making.

6. Work Together Across Departments

Collaboration across departments is essential for creating accurate and realistic financial plans. Encouraging your FP&A team to work closely with other departments such as production, sales, procurement, and HR ensures that your financial plans are aligned with what’s happening in each area of your business. Regular meetings, open communication, and involving key personnel from different departments in budgeting and forecasting processes foster a collaborative environment. This integrated approach leads to financial plans that are more accurate and reflective of the operational realities, enhancing the alignment between financial goals and business strategies.

7. Keep Improving and Training Your Team

Continuous improvement and training are critical for maintaining an effective FP&A function. Providing ongoing training for your FP&A team ensures that they stay updated with the latest financial practices and tools. Regularly reviewing and refining your manufacturing financial planning processes helps in making them more efficient and accurate. Encouraging professional certifications, seeking feedback to identify and address process issues, and staying abreast of new technologies enable your team to perform at their best. This commitment to development not only enhances the capabilities of your FP&A team but also ensures that your financial planning remains robust and responsive to evolving business needs.

8. Set and Track Key Performance Indicators (KPIs)

Identifying and monitoring the right Key Performance Indicators (KPIs) is essential for understanding your financial and operational performance. Selecting KPIs for manufacturers that align with your business objectives provides valuable insights into various aspects of your operations. Important KPIs include Gross Margin, which measures the difference between revenue and the cost of goods sold; Operating Expense Ratio, which assesses efficiency in managing operating expenses; Inventory Turnover, indicating how quickly inventory is sold and replaced; Cash Conversion Cycle, which tracks the time it takes to turn inventory into cash from sales; and Return on Assets (ROA), measuring profitability relative to total assets. Aligning these KPIs with your business goals, using dashboards for real-time tracking, and regularly reviewing and updating them ensures that you stay focused on what matters most for your financial success.

9. Manage Your Cash Flow Well

Effective cash flow management is vital for ensuring that your business has enough liquidity to cover expenses and invest in growth. Planning your cash flow involves accurately predicting cash inflows and outflows to maintain sufficient funds. This is particularly important in manufacturing, where operations can require significant upfront investments. Strategies such as closely monitoring accounts receivable and payable, optimizing inventory levels to free up cash, and implementing efficient billing and collection processes help maintain a healthy cash flow. Proper cash flow management enhances your ability to meet financial obligations, invest in growth opportunities, and reduce reliance on external financing.

10. Control and Reduce Costs

Managing and reducing costs throughout your manufacturing process is essential for increasing profitability. By identifying areas where costs can be controlled, you can optimize both fixed and variable expenses. Regular cost reviews help uncover inefficiencies, while lean manufacturing techniques reduce waste and enhance productivity. Negotiating better deals with suppliers can lower material costs, and activity-based costing allows for more accurate allocation of costs. Additionally, investing in energy-efficient technologies can reduce utility bills, and streamlining operations can minimize labor costs without compromising quality. These cost control measures contribute to a more efficient and profitable manufacturing operation.

11. Align Financial Plans with Business Goals

Ensuring that your financial plans support your overall business strategy is crucial for achieving long-term success. Aligning your financial strategies with your business goals involves translating strategic objectives into actionable financial plans. This ensures that resources are directed toward initiatives that drive growth and competitive advantage. Understanding your company's strategic objectives allows you to develop financial plans that support these goals, while continuous monitoring and adjustment of financial plans ensure they remain aligned as your strategy evolves. This alignment leads to more effective use of resources, better chances of achieving strategic goals, and increased focus and coherence across the organization.

How to Implement FP&A Best Practices Step-by-Step

Adopting FP&A best practices involves a clear, structured approach to ensure successful implementation. The following steps provide a roadmap to integrate these practices into your manufacturing business effectively:

- Assess Your Current FP&A Processes: Begin by reviewing your existing FP&A practices for manufacturers. Identify what’s working well and what needs improvement to understand where to focus your efforts.

- Define Clear Objectives: Establish specific goals for your financial planning and analysis manufacturing function that align with your overall business objectives. Clear objectives provide direction and measurable targets for your FP&A activities.

- Invest in Technology: Select and implement the right manufacturing FP&A software and tools that fit your business needs. Ensure these tools integrate smoothly with your existing systems to enhance data accuracy and accessibility.

- Improve Data Management: Enhance how you collect, store, and analyze data to ensure it is accurate and easily accessible. Effective data management supports reliable financial forecasting and analysis.

- Build a Skilled FP&A Team: Hire or train team members with the necessary skills and knowledge to perform their roles effectively. Encourage continuous learning and professional development to keep your team adept at handling evolving financial challenges.

- Promote Collaboration Across Departments: Foster regular communication and teamwork between FP&A and other departments. Collaboration ensures that financial plans are aligned with operational realities and strategic initiatives.

- Set Up Strong Reporting Systems: Create standardized reporting formats and utilize dashboards for real-time monitoring of financial data. Strong reporting systems provide timely and accurate insights into your financial performance.

- Monitor and Adjust: Regularly review how your FP&A function is performing against your goals. Make necessary changes to improve processes and strategies, ensuring your FP&A remains effective and responsive to your business needs.

Common Challenges and Solutions

Implementing FP&A best practices can come with challenges, but with the right strategies, these obstacles can be effectively managed:

-

Resistance to Change: Change can be met with resistance, but clearly communicating the benefits of improving FP&A can help. Involving employees in the change process fosters buy-in and support, making the transition smoother.

-

Data Silos: Data silos can hinder effective financial planning. Encouraging data sharing across departments and using centralized data management systems can break down these silos, ensuring that all relevant information is accessible for comprehensive FP&A.

-

Limited Resources: Limited resources can constrain FP&A initiatives. Prioritizing initiatives based on their impact and utilizing scalable FP&A tools for manufacturers that can grow with your business helps maximize the effectiveness of available resources.

-

Technological Barriers: Adopting new technologies can be challenging. Providing training ensures that your team can effectively use new tools, while choosing user-friendly manufacturing financial planning software facilitates easier adoption and integration.

Conclusion

In the fast-paced manufacturing industry, strong Financial Planning & Analysis is essential for overcoming challenges and seizing opportunities. By connecting financial data with operations, improving forecasting accuracy, leveraging technology, fostering teamwork, and aligning financial strategies with your business goals, you can achieve financial excellence and strategic flexibility. Embracing these manufacturing FP&A best practices not only strengthens your financial performance but also empowers your manufacturing business to innovate, optimize operations, and grow sustainably in a competitive market.

Want to learn how Cube can help you on this journey? Request a free demo today.

.png)