Converting foreign currencies: the basis of multi-currency reporting

Doing business internationally across multiple currencies comes with plenty of benefits: enhanced market opportunities, diversified revenue streams, and ultimately, enhanced profitability.

When it comes to reporting with foreign currencies, though, you can't report your company's financial status in US dollars, yuan, and rupees—at least not in a way that will immediately make sense to stakeholders.

That's why the most fundamental aspect of multi-currency reporting is to establish a standard reporting currency, which will appear on your consolidated financial statements.

A company's standard reporting currency is almost always their home country’s currency. This is usually its functional currency, which is used primarily in operations.

When preparing financial statements, the first thing you'll do is convert foreign currencies into your standard reporting currency.

But wait a second—isn't the exchange rate between two currencies always changing? How are you supposed to convert the foreign currency to your home currency for a specific reporting period in a way that provides an accurate picture of its value?

Let's say your reporting period is a fiscal quarter. You're based in the United States and receive a cash flow statement from a subsidiary in China that's recorded in renminbi. Thanks to normal fluctuations, the conversion rate between dollars and renminbi at the end of the quarter will be different from the exchange rate at the beginning of that quarter. So which exchange rate do you use?

There are a few different options, each applicable in different situations:

The spot rate

First we have the spot rate. This is the conversion rate that existed the day of the transaction. If your goal is to report financial results in real time, or you want a more granular view of how specific currency pair fluctuations are affecting your bottom line, you'd use this approach.

It's also best for income statements as it captures the most current exchange rate, reflecting the economic conditions during the transaction date and providing a more accurate representation of revenue and expenses

That said, the spot rate requires the most work. It's also the most volatile and may not accurately represent the rate applicable to the majority of transactions during the reporting period.

The average rate

The average rate looks at the average exchange rate of a currency across the specific reporting period.

So, if your cash flow statement covers a fiscal quarter and you’re dealing with three currencies (e.g., yen, the Hong Kong dollar, and USD), you'd determine the average exchange rate between each type and use it to make conversions between the respective currencies.

Using the average rate helps simplify the conversion process, particularly when dealing with a large volume of transactions of multiple currencies. It ensures consistency in reflecting the impact of exchange rate fluctuations on your operations. (In other words, it helps "smooth out" those fluctuations.)

The closing rate

This means using the exchange rate that exists at the end of the reporting period. This method makes the most sense for balance sheets, since their purpose is to provide a snapshot of assets and liabilities at the end of the reporting period.

When it comes to multi-currency reporting, there's no "best" method for currency conversion. It depends on what you're trying to accomplish, as well as which financial statement you’re preparing.

In fact, your company's specific accounting standards may stipulate which conversion approach you should choose (see below).

Accounting standard rates

IFRS provides detailed guidance on multi-currency reporting in IAS 21, which outlines the requirements for translating foreign currency transactions, foreign operations, and financial statements into the reporting currency.

Similarly, GAAP in the United States provides guidance through various accounting standards, including ASC 830 - Foreign Currency Matters. This standard addresses the translation of foreign currency financial statements, transactions, and hedging activities.

For shareholder equity, it's best to use the exchange rate at the date of entry. This ensures the equity section of the financial statements reflects the initial exchange rate at the time of the transaction, preserving the value of the equity components.

Make currency adjustments

So we've made the conversions, but there are other ways exchange rates affect your reports. We must also look more closely at the exchange rate fluctuations, which can impact the reported values.

How do you establish the actual values when exchange rates are constantly shifting? Addressing this is referred to as currency adjustment.

Currency adjustment addresses the potential gains or losses that arise due to changes in exchange rates. A translation gain is when a reporting currency grows in value relative to the foreign currency. On the other hand, a translation loss occurs when the reporting currency weakens, which leads to a decrease in the value of foreign currency assets or income.

By adjusting the reported values, businesses can eliminate the distortion caused by changes in currency exchange rates and provide a more precise representation of their financial results.

To establish the true values and properly account for currency adjustments, businesses may use a specific accounting method, such as the functional currency approach, depending on the applicable accounting standards and reporting requirements.

Make your financial statements clear

To make your financial reporting clear, it's importan to divide currencies into different types.

Divide financial reports into separate columns, displaying amounts in local currencies and the converted amounts in your home currency. This makes it much easier for you to manage money—and for stakeholders to understand.

For instance, if a stakeholder wants to view the impact of the yuan on the company's position, they don't have to scrounge through data.

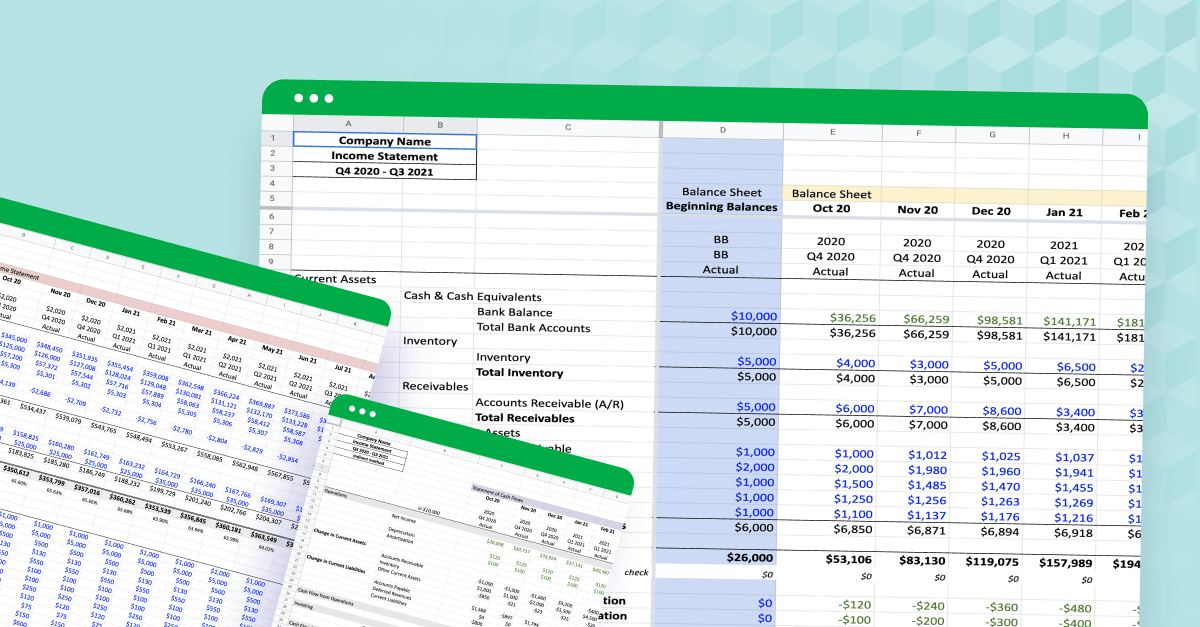

Consolidate financial statements

When businesses have subsidiaries in other countries, each subsidiary will make reports in their local currency.

This presents a problem: what if you want to create a company-wide balance sheet? Showing liabilities in yen, pound sterling, and USD will not give a clear, meaningful picture of the company's financial situation.

The first thing you'll have to do is convert foreign currencies into the home currency (let's say USD). As explained above, there are different methods available for currency conversion.

The next step is consolidating all the individual reports into one comprehensive report presented in the home currency. This is also where you'd eliminate inter-company transactions so they're not counted twice.

Consolidation ensures a comprehensive view of the organization's financial performance, regardless of the different currencies involved. Simply having a multi currency account can be hugely advantageous here. By helping to manage and track transactions across currencies, the currency conversion and consolidation processes are simplified.

Conclusion: multi-currency reporting made easy

Multi-currency reporting can seem daunting, especially when exchange rates are constantly changing. Luckily, armed with the proper knowledge and tools, multi-currency reporting can be made easy.

Want to learn how software can simplify multi-currency reporting? Request a demo today to see how Cube can help you set your company up for success in any country.

.png)