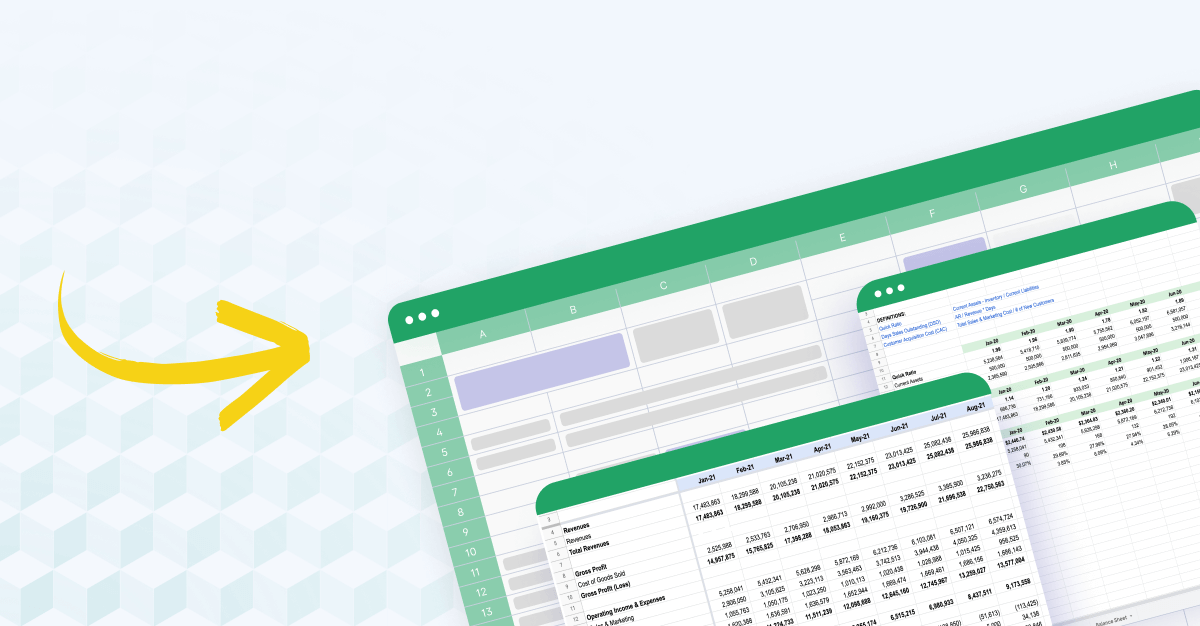

What is a pro forma financial statement?

No business can survive without planning.

As we've seen over the past few years, company leaders can expect a wrench in the works at any time—even when the economy's booming.

That's where pro forma statements come into play.

These financial modeling tools are one of the most important to help a company prepare for any kind of scenario imaginable and map out a future trajectory.

Pro forma statements are financial projections that ask and attempt to answer "what if" questions.

For example, they might ask, "what if our revenue decreases by 20%?" or "what if we acquire this other company? What will our finances look like?"

The answers—based on different sources of data like market research or historical sales information—guide internal decision-making to promote regular, sustainable growth as well as create contingency plans for worst-case or best-case scenarios.

Think of pro forma statements as a monetary crystal ball, a guiding financial forecast.

When creating pro forma statements, you can plug in different variables to see how each would affect the business as a whole—it's a bit like playing financial Mad Libs, but rather than inserting nouns or verbs, you put in changes in revenue, assets, or costs. Instead of silly sentences, you get a glimpse into your company's financial future.

Key differences between pro forma and traditional financial statements

Two types of financial statements that often draw comparisons are traditional financial statements and pro forma statements. While they both serve as valuable tools for financial analysis, they have distinct characteristics and purposes.

Traditional Financial Statements

Traditional financial statements, including the income statement, balance sheet, and cash flow statement, provide a snapshot of a company's financial performance over a specific period.

Traditional financial statements adhere to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) and are prepared based on historical transactions and events recorded in the company's accounting records.

Pro Forma Financial Statements

On the other hand, pro forma financial statements are forward-looking projections that forecast a company's financial performance under hypothetical scenarios or assumptions.

Unlike traditional financial statements, which reflect past performance, pro forma statements offer insights into potential future outcomes.

Pro forma financial statements are commonly used for strategic planning, budgeting, investment analysis, and communication with stakeholders.

While they provide valuable insights into potential future outcomes, it's essential to recognize that pro forma projections are based on assumptions and may not always reflect actual results.

Pro forma financial statements and GAAP

It's important to note that, since pro forma statements are based on hypothetical or projected data, they are not compliant with generally accepted accounting principles—GAAP statements must be based on actual financial results.

The Securities and Exchange Commission (SEC) requires that discrepancies between pro forma and GAAP-compliant financial reports be explained when released to the public.

It's also illegal to mislead potential investors with overinflated pro forma projections.

While GAAP statements are required for public companies, pro forma financials are not. However, they’re increasingly viewed as an important supplement to GAAP, providing a more accurate assessment of a company's finances for investors.

For example, GAAP statements are required to include non-recurring expenses, which might distort the firm’s true financial position. Pro forma statements, on the other hand, can ignore these expenses, along with several others required by GAAP like unusual or extraordinary expenses.

Another context you might see "pro forma" is in reference to pro forma invoices. A pro forma invoice is not a type of pro forma financial statement. Instead, it's a bill of sale that records the goods being sold and their estimated price, often used in international transactions.

Types of pro forma financial statements

There are three main types of pro forma financial statements:

- Pro forma balance sheet

- Pro forma income statement

- Pro forma cash flow statement

You'll notice these correspond to the three major financial documents. Normally, these are concerned with a company's present situation—you build on historical data to create financial statements.

Think of the pro forma statements as extensions of each, projecting into the future. They're constructed to answer specific questions relevant to one or more of the financial statements.

Pro forma balance sheet

The balance sheet, for example, considers assets and liabilities like accounts receivables, payables, and inventories. So, if you wanted to see how refinancing debt—a liability—would affect your future financial position, you'd use a pro forma balance sheet.

Pro forma balance sheets are also used to analyze the risk of hypothetical transactions. By plugging the specific transaction into the balance sheet, treasurers can see how it would affect the rest of the company and determine whether the benefits outweigh the potential risks/drawbacks.

Pro forma income statement

The income statement (also known as the profit & loss or P&L statement) mainly evaluates revenue and operating expenses, along with other metrics related to each like cost of goods sold (COGS) or net income.

What if your expenses suddenly increased by a significant margin, or revenue dropped sharply? How long would your business be able to continue operating? You'd answer these types of questions with pro forma income statements. Other use cases include budgeting and analyzing mergers and acquisitions.

Pro forma cash flow statement

Lastly, we have the cash flow statement.

Cash flow is the amount of money coming into and going out of the business at any one time—it's important to line up inflows and outflows so that you don't get caught in a situation where, for instance, you can't afford to pay back loans and payroll simultaneously.

If you're expecting a decrease in cash flow, you'd use a pro forma cash flow statement to try and estimate the effects, and make adjustments accordingly.

More than that, though, you could see how a particular event would affect your cash flow.

This is useful for seeing if a specific investment is a good idea before completing it or—if it's something that's unavoidable and will decrease cash flow—creating contingency plans to acquire financing or decrease costs in other areas.

How to create a pro forma financial statement

Since they can be built using the same template as your usual financial statements, creating pro forma statements is easy.

When preparing your statement, remember that you can remove certain lines that would be required in GAAP like non-recurring operations or discontinued operations.

Here are steps to create your pro forma statement:

- Determine its purpose: This will help you decide which type of statement(s) to use—for example, if you want to assess how a new product launch would affect the company, you'd use a pro forma income statement (the income statement includes cost of goods sold) as well as a pro forma balance sheet.

- Look at your assumptions: Continuing with the previous example of launching a new product, what is the cost of goods sold likely to be? How much revenue will the product drive? Base all these financial assumptions on data, and remember to keep them conservative—better to overestimate expenses and underestimate revenue than stretch your finances thin as a result of overly optimistic projections.

- Create your statements: You can either create these from scratch or, more simply, adjust your existing financial statements. In this case, you'd simply take your pro forma income statement, and adjust the cost of goods sold line item in line with your projection. Do the same for inventory in your balance sheet.

- Share with stakeholders: Learning how to create pro forma statements would be useless if they didn't inform your company's decision-making process—the final step. Communicate the results to stakeholders, who must then perform pro forma analysis and take action. If the market research shows that this product is not going to drive profit, for instance, shelve it, or begin finding ways to reduce costs and/or boost sales.

How to use pro forma financial statements

When based on solid data, pro forma financial statements make your business agile.

It's not hard to imagine a situation where a company is hit by drastically decreased cash flow and doesn't have the time or liquidity to make the proper adjustments—just think of March 2020.

To avoid something like this, you'd use a pro forma cash flow statement, plug in a decrease in cash flow and see how this affects your other operations.

But keep in mind pro forma statements don't only plan for the worst—you can also plan for a best-case scenario, like increased cash flow.

You'd do this by determining how that cash could be most efficiently allocated—another use case for pro forma statements. You might compare how a particular piece of equipment would boost the bottom line against a marketing campaign, for example.

Another, critical use case of pro forma financial statements is risk analysis. You might take a financial statement, and move around certain variables. This is known as sensitivity analysis, and basically shows how risky the company's current position is. This is always important to do, but especially now in the midst of economic uncertainty.

One of the most important use cases of pro forma statements is to assess the viability of a merger. For one, using a pro forma income statement you'd see what the new entity's financial situation would look like after the merger, and be able to make appropriate preparations (or, of course forget about the whole thing if the outlook is grim).

You'd also know whether specific redundancies (such as multiple accounting departments) would be needed. Keep in mind pro forma statements do not usually include one-time costs such as restructuring costs.

Pro forma statements are also used to secure financing. Investors want to see how your business will grow, and with an investment pro forma projection you can specifically show them how you will use their capital in a way that helps the company grow sustainably (and provides a high ROI for them).

Pro forma statements can help boost investor confidence by showing you can generate healthy cash flow and pay down debt. The same goes for banks—pro forma statements are often required to secure bank loans for major expansions or new businesses.

Finally, since a pro forma financial statement often projects a year or two down the line, they can also be used to determine the valuation of a company.

Limitations of pro forma financial statements

Pro forma financial statements are a useful tool, and sometimes critical (when it comes to projecting the effects of mergers or securing financing, for instance). But since they're based on assumptions, they're only as good as those assumptions.

To steer your business in as safe a manner as possible, then, your estimates should be conservative. It's also best practice to audit the data before plugging it into your pro forma statements.

In summary, use pro forma statements as an adjunct to other strategies—don't let them be the only thing that guides business decisions!

What is Pro Forma Reporting?

Pro forma reporting involves creating financial projections based on hypothetical scenarios and assumptions.

These projections serve as valuable insights into how a business might perform in the future under different conditions.

Unlike traditional financial statements, which reflect historical performance, pro forma reports look ahead, offering stakeholders a glimpse into potential outcomes.

The Process of Pro Forma Modeling

Establishing Assumptions: Pro forma modeling begins with setting assumptions about future business conditions. These assumptions encompass factors such as revenue growth rates, cost trends, capital expenditures, and financing activities. They're typically grounded in historical data, market research, and management insights.

Building Financial Statements: Leveraging the established assumptions, pro forma models project future financial statements, including income statements, balance sheets, and cash flow statements. These projections provide a holistic view of expected financial performance over a defined period.

Scenario Analysis: Pro forma modeling often entails running scenario analyses to assess the impact of different variables on financial outcomes. By exploring best-case, worst-case, and base-case scenarios, businesses can gauge the sensitivity of their projections to changes in key assumptions, thereby enhancing decision-making.

Supporting Decision Making: Pro forma reporting serves as a vital tool for decision-making processes such as budgeting, strategic planning, and investment analysis. By offering insights into potential financial outcomes, businesses can evaluate various strategies and make informed choices to drive growth and mitigate risks.

Conclusion: how to create and use pro forma financial statements

Now you know all about pro forma financial statements.

Now that you've learned all about pro forma financial statements—what they are, their significance as a powerful forecasting tool, and some best practices for using them—staying organized and making accurate predictions can still pose challenges.

That's where Cube comes in.

Cube seamlessly integrates with your ERP, HRIS, and other platforms like Salesforce, and operates natively within Excel and Google Sheets. This allows you to create scenarios and model pro forma financial statements quickly and easily.

Ready to simplify your forecasting process? Click the image below to request a free demo and see how Cube can help.

.png)