Understanding revenue run rate

Revenue run rate is a financial metric that uses current revenue data to predict future financial performance. It's calculated by annualizing the revenue from a specific period—typically a month or a quarter—to estimate the total revenue if current business conditions continue for a full year. For example, if a company earned $50,000 in revenue in one month, the annual run rate would be $600,000.

It's important to distinguish run rate from gross profit or net income metrics. While these other figures provide insight into a company's financial health, they use historical data rather than projected future performance.

Run rate is a valuable tool for measuring financial performance. It focuses exclusively on incoming cash flow, providing a clear view of the cash entering a business. This makes it invaluable for assessing liquidity and operational efficiency.

Run rate analysis also allows businesses to make informed decisions about growth strategies using current revenue data to predict future performance. A steadily increasing monthly run rate indicates market opportunities, while a declining rate prompts re-evaluation. The simplicity and forward-looking nature of the revenue run rate formula make it an effective tool for financial planning and decision-making.

What are the limitations of revenue run rate calculations?

It’s important to remember that the run rate metric assumes steady-state conditions. Sudden market changes or seasonal fluctuations can significantly impact its accuracy. Therefore, while it's a useful calculation for any finance leader’s toolbox, it should always be used alongside other metrics to ensure a balanced and comprehensive financial analysis.

Calculating revenue run rate: the methodology

To calculate revenue run rate, you'll need to gather the total revenue from a specific period and then multiply it to reflect the estimated revenue for a year. For instance, if you base the run rate on a month of revenue data, multiply this value by 12. If you’re calculating based on a quarter, take the sum of three months and multiply by four. This will estimate the annual revenue, assuming current business conditions continue at established levels.

For example, let's say that in Q1 of this year, your company earned $100,000 in revenue. The calculation of the run rate would be:

$100,000 (quarterly revenue) x 4 = $400,000 (annual revenue)

If your company continues earning at the same pace with no changes to variables or economic conditions, you should expect $400,000 in revenue within the next 12-month period.

When to use revenue run rate

Run rate is a useful calculation for many financial situations. Consider adding a revenue run rate formula to your analysis in some of the following scenarios:

Startup evaluation

Run rate is particularly useful for startups that don't have long-term data. It helps founders and finance leaders estimate future financial performance from short-term revenues, attracting early investors by showcasing the growth potential of the venture.

Assessing business changes in established companies

Established businesses can use revenue run rate to assess the impact of new product launches, creation of new departments or teams, or market expansion. Analyzing run rate for new lines or departments aids in predicting their growth contribution and deciding on long-term investments.

Real-time operational monitoring

Run rate serves as an excellent tool for monitoring operational efficiency in real-time. Comparing run rates across business units or products helps identify high-performing areas and those needing improvement.

Corporate budgeting insight

Incorporating run rate in corporate budgeting cycles provides insights into the feasibility of growth targets. A significant difference between projected revenues and current performance may signal the need for strategy changes or resource reallocation.

Investor communication

Run rate is crucial for communicating a company's financial health to external stakeholders, especially investors. It helps them evaluate the company's investment worthiness based on projected revenues or earnings, giving a glimpse of current performance and potential returns.

Strategic operations insight

Run rate offers valuable strategic insights into which operational aspects contribute most to revenue. This information can guide resource allocation decisions, enhancing efficiency and profitability. For instance, prioritizing resources for a product line with a high run rate can boost overall output.

Analyzing and interpreting run rate results

Although a simple run rate calculation offers a reliable glimpse at future revenue performance, analysts can fine-tune the results by adding additional refinements to the raw revenue run rate formula. Consider adjusting for common business factors when analyzing run rate and profitability:

Understand the context

Look at the broader business landscape to understand the context of run rate calculations. This includes understanding market trends, economic conditions, and company-specific factors that could influence revenue. Use reasonable assumptions about the broader economic context to refine the narrative behind the run rate metric.

Adjust for seasonality

It's crucial to consider the seasonality factor in your run rate calculations. Some businesses experience significant fluctuations during the year due to variations in consumer behavior. For instance, a retail business may see an increase in sales during the holiday season that doesn't reflect its financial performance throughout the year. To adjust for this, you can calculate a separate run rate for each season or remove seasonal sales periods from your calculation entirely.

Account for outlier events

If your business experiences unexpected one-time events such as sudden global instability, a major marketing campaign, or a sudden market shift that could significantly impact your revenue. These events can cause an unusual spike or drop in your revenue, thus affecting the accuracy of your run rate calculation. Identify and isolate these one-off events when calculating your run rate to mitigate this effect. This way, you'll ensure these anomalies don't distort your financial projections.

Adding context to run rate calculations provides more accurate and meaningful insights into the business's future revenue potential. This approach allows finance teams to make well-informed predictions and achieve better financial planning.

What factors affect revenue run rate calculations?

Run rate calculations work best within predictable business cycles. Changes in commodities costs, seasonal use, and product offerings can limit the accuracy of the run rate calculation. Here are some common conditions that affect run rate:

Seasonality

Businesses that experience seasonal fluctuations in sales, such as retail businesses during the holiday season or ice cream shops during summer, may find their run rate skewed. The annualized revenue calculated based on peak seasons will likely overestimate the expected annual revenue run rate.

Change in subscription model

Run rate calculations and annual recurring revenue may be significantly affected if a subscription-based pricing structure changes mid-year—such as monthly subscription pricing, moving to usage-based or credit-based pricing, changes to annual discount percentages, or fluctuations in service tiers.

One-off sales or large contracts

Revenue spikes due to one-off sales, launches, events, or outlier contract values (so-called “big fish” deals) can distort the run rate. This inflated revenue isn't likely consistent throughout the year and could contribute to overestimated annual revenue run rate and earnings projections.

Pricing volatility

Sudden changes in market conditions, including economic downturns or upturns, can influence inventory, materials, and labor costs, affecting revenues and distorting the run rate. Examining revenue data in light of price changes may alleviate issues with run rate calculations.

New product launches or discontinuations

New products or discontinuation of existing ones could lead to unusual spikes or drops in revenue, skewing the run rate.

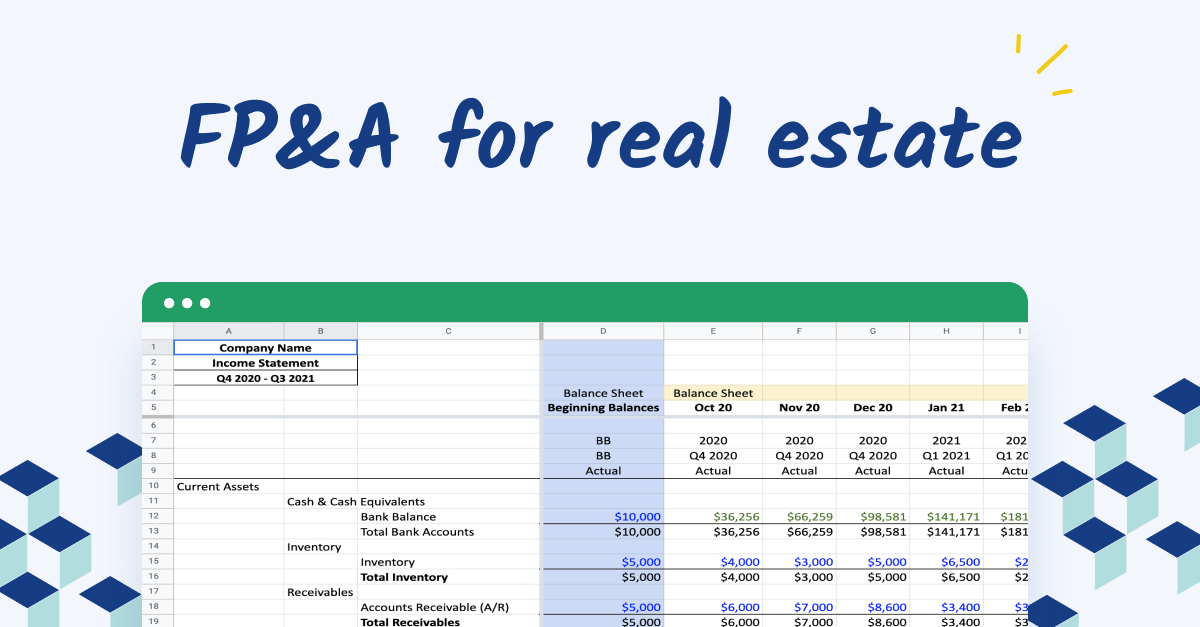

Integrating revenue run rate into financial planning

As part of a broader financial planning and analysis (FP&A) process, run rate results serve as a basis for setting realistic and achievable revenue targets for the upcoming fiscal year or quarter. Businesses can adjust their spending habits by comparing past performance with future revenue projections.

Run rate insights are valuable for considering key strategic moves such as mergers, acquisitions, or market expansions. These decisions require a deep understanding of potential revenue growth and profitability, which run rates can provide.

Run rates also inform risk management practices. It provides a basis for analyzing fluctuations in your revenue stream from market volatility or operational issues. Using run rate metrics regularly and examining them against other financial indicators helps organizations identify potential risks early and implement necessary corrective actions.

Best practices for better run rate calculation

Proper use of run rate calculations makes for better predictions—and better outcomes—regarding revenue and profitability. Use these best practices to ensure accuracy and confidence in your analyses:

- Update calculations regularly: The accuracy of revenue run rate calculations heavily depends on the most recent data. Therefore, it's critical to regularly update these figures as new sales and financial information becomes available.

- Extrapolate from a sufficient time frame: When calculating your run rate, ensure that you use a time frame that accurately reflects your business operations. A too short or volatile period may give misleading results.

- Combine with other financial metrics: While the run rate is a useful tool, it should not be considered in isolation. Using it with other financial metrics such as gross margin, net profit, and EBITDA is beneficial to provide a more comprehensive view of your company's performance.

- Consider current market trends: Many businesses experience seasonal fluctuations or are influenced by market trends. These factors should be incorporated into the run rate calculation to avoid skewed projections.

- Review against business objectives: Analysis using any tool or metric should always consider the company’s overall objectives and strategic finance goals. It's vital to regularly review these goals as they can change over time, affecting the relevance and application of your calculated run rates.

Common pitfalls in run rate calculation

When using run rate as part of financial analysis, be aware of these common mistakes and contextual clues:

- Misinterpreting the run rate as a forecast: One of the most common misconceptions about the run rate is its use as a direct forecasting tool. While it provides valuable insight into current performance, it does not account for seasonal variations or future business changes. Using run rate as a guide is important, but it should not be the sole basis for future revenue projections.

- Ignoring seasonal fluctuations: Businesses with significant seasonal fluctuations can make inaccurate revenue predictions if they solely rely on run rates. It's crucial to consider these shifts when utilizing this metric.

- Overlooking business growth/decline: Run rates are typically calculated based on current revenue data, which may not accurately reflect significant growth or decline periods. This oversight can result in skewed projections and poor strategic decisions.

Conclusion: unlock the power of your revenue data

Like all metrics, run rates give leaders a window into the company's financial health. When applied correctly, these metrics can help light the way forward by creating a reliable baseline understanding of current performance.

FP&A software helps analysts and finance professionals get those insights faster, whether they need a simple run rate calculation or want to create complex scenario planning. Cube helps businesses unlock the power of their revenue data, providing planning and analysis tools in an easy-to-use platform.

Want to get more from your calculations and analysis? Try Cube today.

.png)