What is strategic finance?

Strategic finance is the process of unifying and translating data from all teams in a business into actionable insights that would help with the growth of a business and increases profitability in the long run.

Strategic finance team members collect real-time data from different teams and software businesses run to make those strategic financial decisions needed to drive growth.

They typically spend less time on traditional accounting tasks such as closing books and focus more on achieving long-term financial goals by making data-driven financial decisions.

That said, it’s important to note that many will pass strategic finance as one of the many ‘hip-rebranding’ of FP&A since both terms are used interchangeably and the job descriptions tend to look the same.

Source: Reddit

However, that’s not the case, as strategic finance is a practice that evolved due to the limitation of FP&A.

The differences between strategic finance and FP&A

Simply put, strategic finance focuses more on helping businesses to achieve long-term growth goals with the help of data-driven financial decisions. In contrast, FP&A focuses on maintaining the financial health of a business.

To help you better understand, we've summarized the differences here:

| In terms of... |

Strategic Finance |

FP&A |

| Job function |

Integrating financial planning and strategy into the decision-making process of a company |

Developing financial plans and forecasts to support the decision-making process of a company |

| Main focus |

Aligning financial goals with the overall strategy of the organization

|

Short-term financial planning and forecasting

|

| Role of financial analysis |

Using financial analysis to understand the financial implications of different decisions and options, and to identify opportunities and risks

|

Using financial analysis to support the development of financial plans and forecasts

|

| How it works |

Setting financial goals and developing plans to achieve those goals through the effective allocation of resources

|

Developing financial plans and forecasts to support the decision-making process of a company

|

| Risk management |

Constantly evaluating potential financial risks and implementing strategies to mitigate or manage those risks

|

May not consider potential financial risks as much as strategic finance

|

| Standardizing the finance function |

Involves standardizing the finance function, following generally accepted accounting principles (GAAP) and Financial Accounting Standards Board (FASB) principles

|

Involves following generally accepted accounting principles (GAAP) and Financial Accounting Standards Board (FASB) principles but may not involve standardizing the finance function as much as strategic finance

|

Now let’s dig deeper into the limitations of FP&A that paved the way for the rise of the strategic finance function.

The limitations of FP&A

The traditional financial planning and analysis (FP&A) function has long been focused on providing historical data, budgeting, and forecasting to support a company's decision-making process.

However, as the business landscape has evolved, it has become clear that there are limitations to traditional FP&A that prevent it from fully addressing the strategic needs of an organization.

“Financial planning and reporting is a mission-critical function, but it is also highly manual, time-consuming, and seldom right. - Christina Ross, Founder of Cube

One of the main limitations of traditional FP&A is its focus on short-term, reactive decision-making.

It primarily focuses on providing data and analysis to support decisions that have already been made, rather than providing the insights and foresight needed to make strategic decisions that’ll help navigate the future.

Financial data, not strategy

Another limitation of traditional FP&A is that it is primarily focused on financial data, rather than on the broader strategic context of the organization. This can make it difficult for FP&A to provide the insights needed to address the non-financial risks and opportunities that impact a company's long-term success.

The rise of the strategic finance function is driven by the need to overcome these limitations and provide a more holistic, forward-looking perspective on a company's financial performance.

This includes answering questions such as:

- How can we align our financial goals with our overall strategic objectives?

- What are the key drivers of our financial performance, and how can we leverage them to achieve our goals?

- How can we use financial data to identify and mitigate non-financial risks and opportunities?

- How can we use financial modeling to support scenario planning and strategic decision-making?

The strategic finance function is designed to provide the insights and foresight needed to address these types of questions and support the strategic decision-making process of an organization

Strategic finance overcomes these limitations by:

- Automating traditional accounting tasks

- Bringing together siloed data from different teams and software

- Making assumptions and devising strategies from real-time data

- Using financial modeling, scenario planning, and real-time data analysis to make more informed decisions

...and a lot more.

What is the scope of strategic finance?

The scope of strategic finance refers to the specific aspects of financial management that are focused on aligning financial decisions with the overall strategy and goals of the organization.

This includes:

...but sometimes, it also goes beyond that to include assessing the financial impact of strategic decisions, such as:

- Mergers and acquisitions

- Capital investments

- New product development

- Standardization of the financial function

What is the ultimate objective of strategic finance?

The ultimate objective of strategic finance is to ensure businesses can make better-informed financial decisions that support their overall long-term growth and success.

Now you might want to know what strategic finance does.

What does strategic finance do?

The strategic finance function’s scope includes developing plans to meet a business's financial goals. The plans made can be either short-term or long-term.

Short-term planning

Short-term planning is often made to ensure businesses can meet their short-term obligations.

This would be only possible if cash inflows and outflows are managed by forecasting and budgeting for near-term financial performance.

Ideally, the goal here is to ensure there are no short-term shortages or surpluses of cash.

Let’s see how short-term planning done right can help with growth.

Assume that a rising media website in your niche is coming up for a sale, and it would be beneficial to acquire it. Then with proper planning, your business will have enough cash to acquire the website and use it to propel your growth.

Long-term planning

Meanwhile, long-term planning is made to help businesses to make informed investment decisions that support their long-term growth and success.

This might involve evaluating the potential financial impact of investment options such as capital expenditures, mergers, acquisitions, or even new product development.

Here’s how it works:

Strategic finance professionals use financial analysis and forecasting to evaluate the return on investment and the potential risks associated with different investments to decide which projects to pursue and which to avoid.

They'll implement strategies to mitigate or capitalize on those risks and opportunities identified earlier.

Strategic budgeting

Strategic budgeting involves setting financial goals and developing plans to achieve those goals through the effective allocation of resources.

Strategic budgeting involves creating a long-term financial plan that aligns with the overall goals and objectives of the company.

Strategic budgeting helps in corporate development by providing the company with a clear financial plan that allows for better decision-making, forecasting, and management of resources.

This enables businesses to invest in areas that will drive growth and profitability, identify areas that need improvement, and make necessary adjustments.

It also helps align the company's financial goals with the overall business strategy, thus enabling the company to achieve its long-term objectives.

Reporting and preparing financial statements

Reporting and preparing financial statements is another important part of strategic finance, as it helps to provide transparency and accountability while allowing stakeholders to track the financial performance of a business.

This can include preparing financial statements such as the balance sheet, income statement, and statement of cash flows, as well as supporting schedules and notes.

These financial statements are also helpful for tracking financial performance over time and identifying trends and patterns that may indicate potential issues or opportunities.

By regularly reviewing and analyzing financial statements, strategic finance professionals can identify areas of strength and weakness, and make recommendations for improvement.

Additionally, variance reporting compares the actual results with the budgeted or forecasted results.

The variances are analyzed to identify the reasons for the differences so that corrective action can be taken.

Risk management and risk assessment

Strategic finance includes identifying and evaluating potential financial risks that could impact the performance of a business.

This can include risks such as changes in market conditions, regulatory environments, or the supply chain.

By identifying these risks, strategic finance can help businesses to develop strategies to mitigate or manage those risks and protect their financial performance.

Standardizing the finance function

The strategic finance function ensures that the business adheres to Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) principles. This ensures that financial statements are accurate and consistent with industry standards.

By following these principles, strategic finance professionals can effectively communicate financial information to stakeholders and make informed decisions.

It also helps them by identifying any discrepancies or errors in the financial statements so that they could take corrective action to rectify them.

Who does strategic finance report to?

The strategic finance function reports to the Chief Financial Officer (CFO) or the Head of Finance.

The CFO is usually responsible for developing and implementing the organization's financial strategies and ensuring its financial goals align with its overall strategy.

The strategic finance function also reports to the executive management team, including the CEO, COO, and other leadership team members.

This is because strategic finance is closely tied to the overall strategy and direction of the organization, and the executive management team is responsible for setting the overall strategy and direction of the organization.

Strategic finance may also report to the board of directors.

This is because the board oversees the organization's financial performance and ensures that the available financial resources are used effectively and efficiently.

What is strategic financial management?

Strategic financial management organizes financials to ensure the entire business achieves its financial goals.

It also uses a mix of technology and techniques to create a strategic plan to ensure businesses can achieve their financial goals.

In short, strategic financial management ensures that the strategy developed is implemented without a hitch and that the resources needed are adequately allocated.

What are the benefits of strategic financial management?

If executed perfectly, strategic financial management can provide multiple benefits.

1. Better decision-making

Constantly analyzing financial data and forecasting future financial performance enables businesses to make more informed decisions about their investments, operations, and other business activities.

This also helps businesses identify new opportunities and avoid potential risks earlier, leading to increased profitability and financial stability.

2. Increased profitability

A company can increase its profitability and financial stability by managing costs and maximizing revenue.

This can be achieved through various strategies, such as cost-cutting measures, pricing changes, and marketing initiatives.

3. Improved investor relations

Strategic financial management allows transparent and accurate financial information to be provided to investors.

This way, a company can build trust and confidence with its investors.

4. Better risk management

Strategic financial management requires companies to identify and analyze any potential risks frequently.

This way, a company can develop strategies to mitigate or avoid those risks. This protects the company's financial health in the long run and ensures its success.

What are the differences between strategic financial management vs. tactical financial management?

Both are essential aspects of financial management, but they have different goals and focus on different time frames.

Strategic financial management

Strategic financial management analyzes the company's overall financial situation and external market conditions to make informed decisions about investments, operations, and other business activities to help the company achieve its long-term financial objectives.

This financial management approach will focus on the company's next 3-5 years.

Tactical financial management

Tactical financial management, on the other hand, is the process of implementing and executing the plans and goals developed through strategic financial management.

It involves managing the day-to-day financial operations of a company, such as budgeting, forecasting, and controlling costs.

The main focus of tactical financial management is to ensure that the company has the resources needed to implement its plans and reach its goals.

This type of financial management is focused on the next 1 to 2 years.

Level of involvement

Another difference is the level of involvement.

Strategic financial management is typically the responsibility of top-level management, such as the CEO and CFO.

In contrast, tactical financial management is typically the responsibility of middle-level managers, such as department heads and financial managers.

In other words:

- Strategic financial management concerns "what" the company should do

- Tactical financial management concerns "how" the company should do it

| In terms of... |

Strategic financial management |

Tactical financial management |

| Goals |

Ensure that the company achieves its long-term financial objectives |

Ensure that the company has the resources needed to implement its plans and reach its goals |

| Function |

Analyzing the company's overall financial situation and external market conditions and making decisions about investments, operations, and other business activities that will help the company achieve its long-term objective |

Implementing and executing the plans and goals developed through strategic financial management. |

| Roles involved |

Top-level executives like the CEO and CFO |

Middle-level managers like department heads and financial managers |

| Time frame |

Long-term; typically focus on the next 3-5 years |

Immediately, usually in the next 1-2 years |

Why having a strategic finance function is mission-critical?

We’re sure by now you might realize that...

Traditional FP&A is broken.

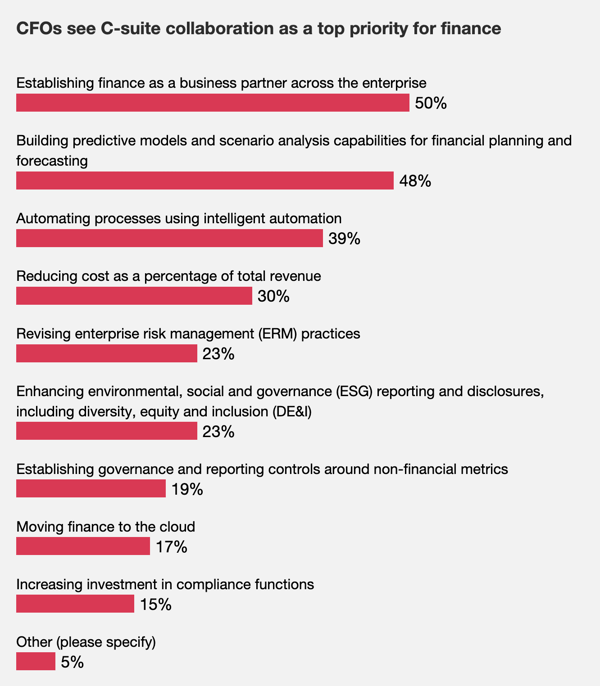

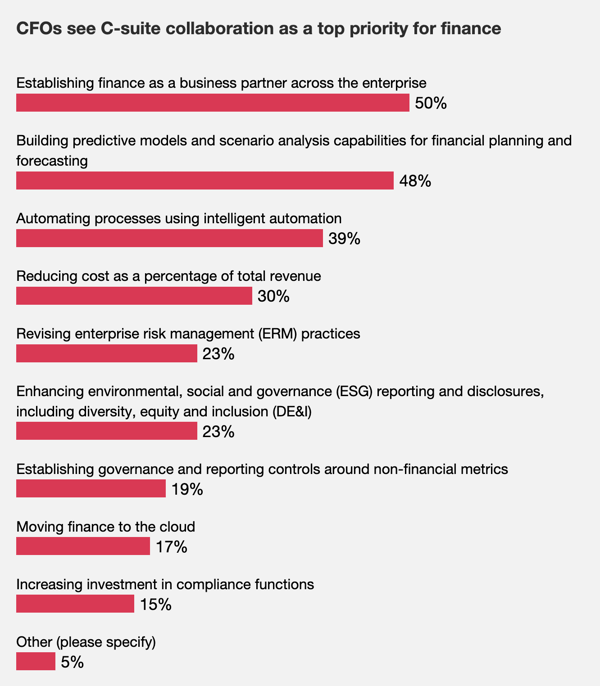

That is why more and more CFOs are embracing strategic finance; 50% believe establishing finance and the CEO as business partners is necessary to tackle more challenging issues.

Source: McKinsey’s Pulse Survey -Executive views 2022

Truth be told, with more unexpected and volatile changes, businesses need more than a finance team that works on a set of past data trying to predict and overcome challenges usually formed in a short time frame.

This is where the strategic finance function plays an important role.

Instead of working on a set of past data, the strategic finance function works closely with every team in a company to identify any potential opportunities or risks that need to be taken care of.

This way, businesses are better prepared to face any challenges in the future and won't be stumped by avoidable, crippling growth issues (like cash shortages).

Is it time to switch to strategic finance? Watch out for these 3 red flags!

1. Your existing processes are not working anymore.

Maybe you failed to reconcile your accounts on time.

Or maybe you're taking too long to pull together "a few KPIs".

You can’t focus on increasing your profitability if all your time is tied-up with financial and accounting tasks that can and should be automated.

2. Your data is siloed and archaic.

As a finance team member, you find it hard to make a detailed analysis to map out a strategy that could help your organization reduce operating expenses or increase ROI from its investments.

Not to mention, all you have access to is data gathered last quarter and you find it hard to collect relevant data from different teams in your organization.

3. Your team and tech stack are not ready for more financial complexity.

You need to invest in a strategic finance function if your team and tech stacks can’t handle the influx of data more than usual due to increased sales.

So if you ever find yourself checking off the red flags mentioned above...

...then it’s high time you switch to strategic finance.

Now that you have decided to switch to strategic finance, let’s move on to the next step.

How to build a winning strategic finance function from day 1

Building a strategic finance team from scratch requires careful planning and execution. So, let’s start with the planning — here’s what to do before building a strategic finance function:

Build an internal process that supports your strategic finance function team

Building a winning strategic finance function requires more than just assembling a team of talented individuals. It also requires solid internal processes, technology, and a strong talent foundation.

When it comes to internal processes, it's crucial to establish a clear structure and framework for the strategic finance function team.

Here’s what a good internal process that maximizes the ROI of forming a strategic finance function within an organization will look like.

-

The roles and responsibilities of the strategic finance team members are pre-determined. This includes who will be responsible for forecasting, budgeting, financial analysis, and strategic planning.

-

Clear lines of communication and decision-making within the team are established. This includes regular meetings, such as weekly or monthly check-ins, to ensure everyone is on the same page and to address any issues that may arise.

-

Developing a budgeting and forecasting process aligned with the organization's overall strategy. This should include adjustments and regular reviews of actual results versus budget & forecast as needed.

-

A financial reporting system that is transparent, accurate, and timely is implemented. This should include regular financial statements, such as the income statement, balance sheet, cash flow statement, and ad-hoc reports as needed.

-

Investing in technology and tools that will support the strategic finance function team. This includes financial planning and analysis software like Cube, budgeting and forecasting tools, and data visualization tools.

-

Continuously train and develop the skills of the strategic finance team members to ensure they have the necessary knowledge and expertise to support the organization's financial strategy.

-

Regularly review and assess the effectiveness of the internal processes and make any necessary changes to optimize the performance of the strategic finance function.

But, just planning doesn’t give you a full picture of how it works in practice–and how we execute that strategy. Execution is the key.

So let’s take a look under the hood.

As Steven Eklund from McKinsey notes,

"For financial planning and analysis organizations seeking next-level status, it will be critical to make internal changes in three areas: processes, technology, and talent."

This means building internal processes that support the strategic finance function team and investing in the right technology and talent to drive these processes forward is essential.

That brings us to the next question:

What should you look for when hiring for your strategic finance team?

It’s important to ensure you have the right talent on your finance teams.

This means identifying and hiring individuals with the necessary skills, knowledge, and experience to support the strategic finance function.

It also means providing opportunities for professional development and training to help team members stay current with the latest best practices and trends in the field.

Here are some skills and traits you need to look for when hiring for the strategic finance function.

1. Experience automating processes

As the business landscape becomes increasingly complex, it's crucial to have team members comfortable working with technology and automation.

Look for individuals with experience automating financial processes, such as budgeting, forecasting, and reporting.

2. Good storyteller

Strategic finance is all about providing insights and foresight to support decision-making. Look for individuals who can take complex data and turn it into clear, concise, and compelling stories that leadership can easily understand.

3. The ability to work autonomously

Strategic finance team members need to be able to work independently, taking ownership of their work and making decisions.

Look for self-motivated, proactive individuals who can work effectively in a fast-paced environment.

4. Effective communication with leadership

Strategic finance team members need to communicate effectively with leadership, both verbally and in writing.

Look for individuals who are comfortable presenting to large groups, can explain complex financial concepts in simple terms, and can build relationships with stakeholders.

What should you look for when choosing the tech stack for your strategic finance team?

Once you have the right talent, it's important to ensure that your strategic finance team has the right technology to support their work.

Here are a few key things to look for when choosing the tech stack for your strategic finance team:

1. Automation and integration

Look for financial planning and analysis (FP&A) software that can automate key financial processes, such as budgeting, forecasting, and reporting.

Additionally, look for a platform that can integrate with other systems, such as your accounting software, to ensure that data is accurate and up-to-date.

2. Advanced analytics and data visualization

Strategic finance is about providing insights and foresight, so look for a platform with advanced analytics and data visualization capabilities.

This will allow your team to better understand and communicate the data, which is critical for strategic decisions.

3. Scalability

As your strategic finance team grows and your organization's needs evolve, choosing a platform that can scale with your organization is essential.

Look for a platform that can handle large amounts of data and be configured to meet your specific needs.

4. Security

With sensitive financial data at stake, choosing a platform with robust security features is essential.

This includes data encryption, access controls, and disaster recovery capabilities.

In other words, building a winning strategic finance function requires not only assembling a talented team but also having a clear internal process, investing in the right technology, and having the right talent to support the function.

By following these steps, organizations can set themselves up for success from day one.

If you ever need more guidance in setting up a strategic finance function to help you achieve your organization’s finance goal, join our slack group Strategic Finance Pros.

Conclusion: all about strategic finance and FP&A

The traditional financial planning and analysis (FP&A) function has limitations that can prevent it from fully addressing the strategic needs of an organization.

The rise of the strategic finance function aims to overcome these limitations by providing a more holistic, forward-looking perspective on a company's financial performance.

...does that mean FP&A is dead?

No. Of course not. But it needs to evolve.

And an FP&A tool like Cube can provide you with the necessary support for that metamorphosis.

Click the banner below to get a quick, free demo of Cube and learn all about hot it can help you save time with your day-to-day financial and/or accounting processes and also become a better partner to your company's strategic leadership.

.png)