What is strategic financial management?

Strategic financial management is the practice of managing an organization’s finances to achieve long-term goals. It involves optimizing resources, monitoring key financial metrics like profitability and cash flow, and controlling assets and liabilities.

Finance leaders and senior management use strategic financial management to drive business continuity and maximize stakeholder returns.

Why is strategic financial management important?

Strategic financial management helps businesses make better decisions, allocate resources wisely, and maintain long-term stability. When finance is involved in shaping company strategy, it goes beyond balancing budgets and tracking expenses—it becomes a key part of driving growth and ensuring the company stays competitive.

When finance is a central part of strategic planning, businesses can move beyond short-term fixes and take a proactive approach to financial stability. Finance leaders can anticipate challenges, identify opportunities, and contribute to decisions that shape the company’s future.

Companies that integrate strategic financial management benefit from:

- Smarter resource allocation: Ensuring resources are spent where they have the most impact.

- Stronger decision-making: Using financial insights to guide business priorities.

- Sustainable growth: Preparing for the future while maintaining stability in changing market conditions.

When finance works as a strategic partner, businesses gain the clarity and confidence needed to adapt, grow, and succeed.

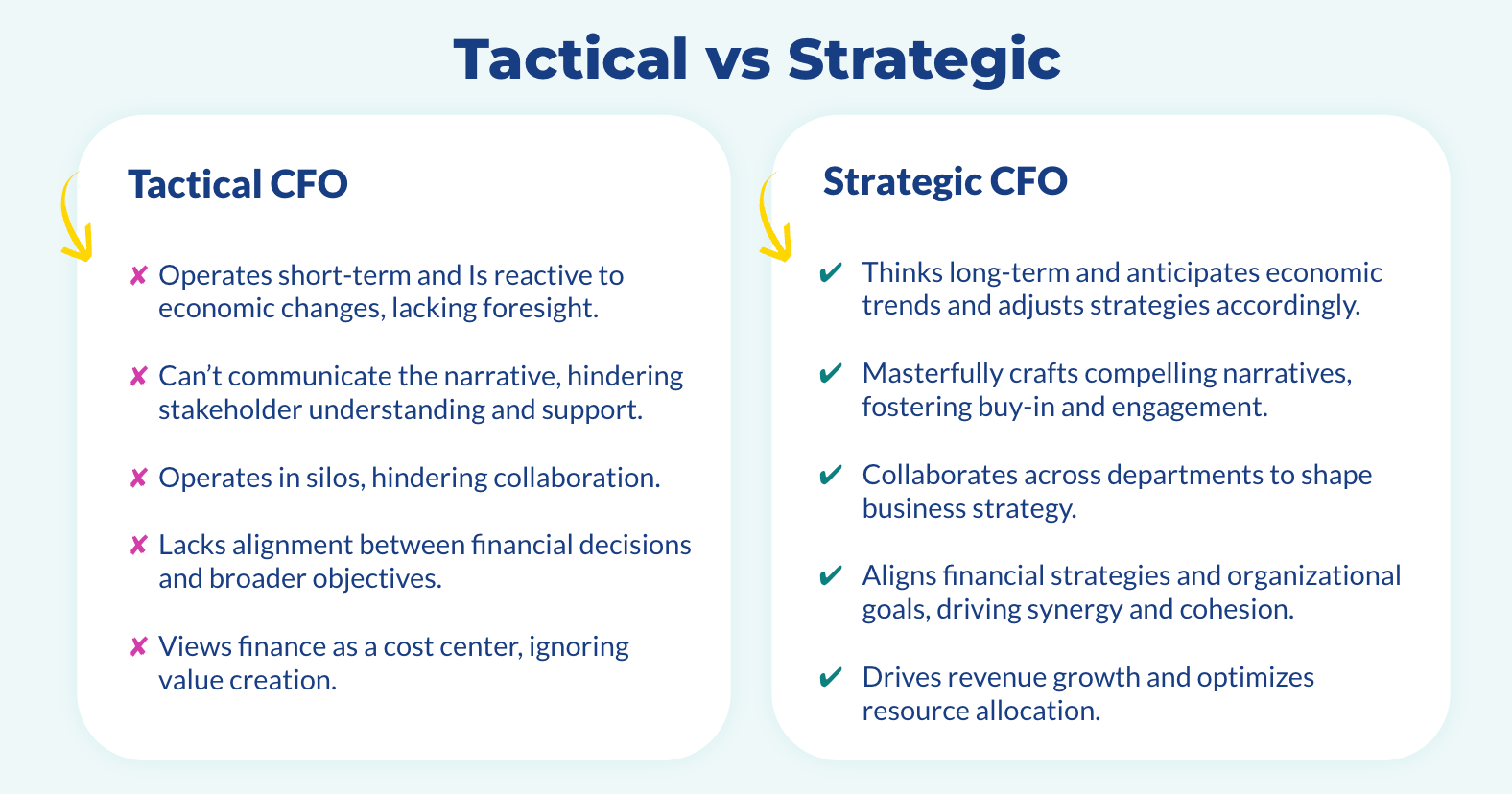

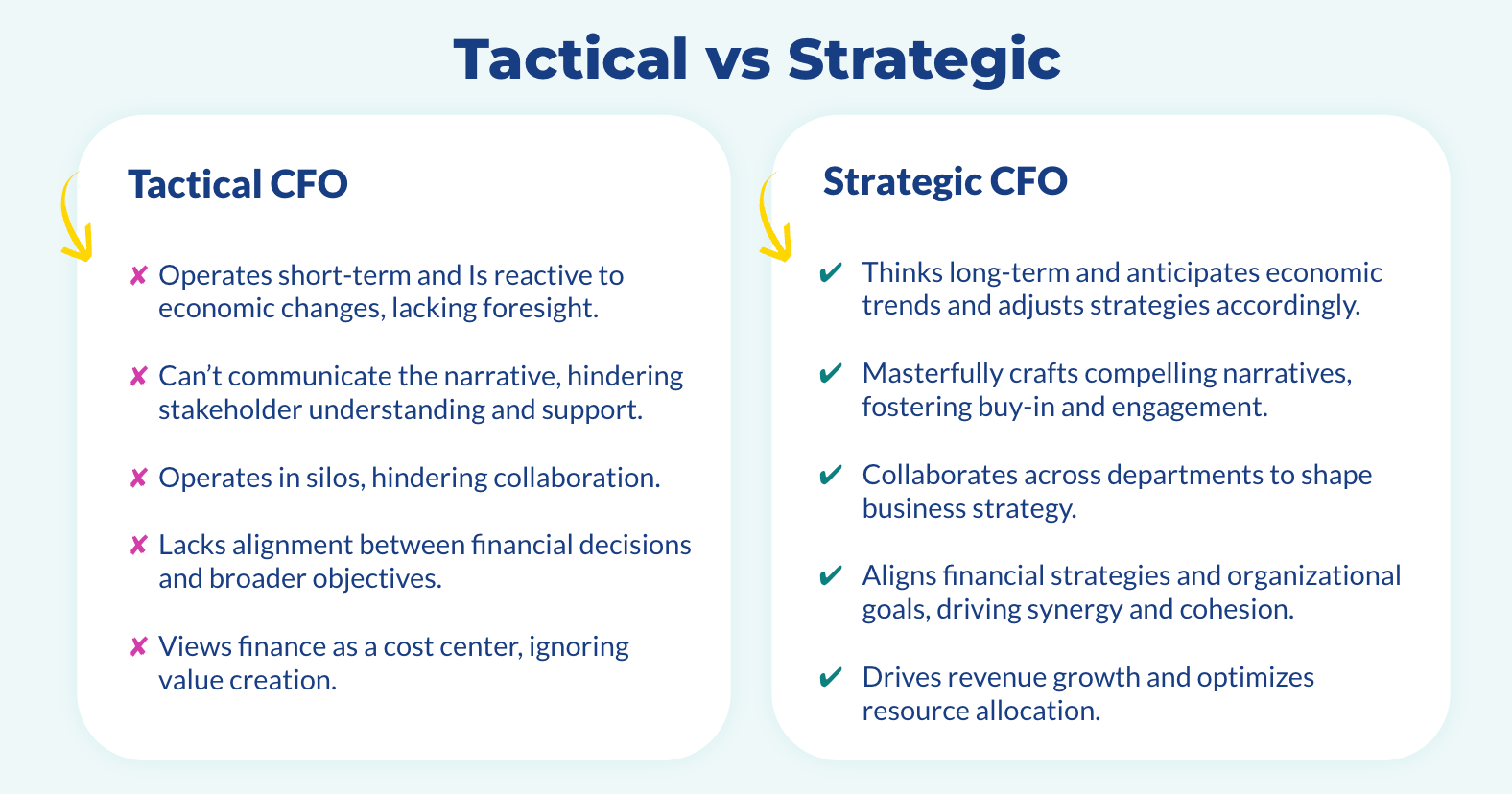

Strategic vs. tactical financial management

Strategic financial management involves organizing and managing the company’s finances with a focus on its future financial goals, such as improving business profits, return on investment (ROI), and market position.

Tactical financial management prioritizes the business's current needs and short-term goals, such as making its operations more efficient, generating more income, or improving its working capital.

Strategic financial management elements: Creating a strong financial foundation

Great finance teams aim to achieve strategic finance—where financial planning goes beyond day-to-day operations to drive long-term business success. To get there, they must establish a strong foundation built on accurate data management, in-depth reporting and analysis, proactive financial planning and modeling, and continuous performance monitoring.

This foundation ensures finance teams can maintain data integrity, generate reliable insights, and make informed, forward-looking decisions that align financial strategy with overall business goals.

1. Data management

A study by McKinsey reveals that data-driven businesses are 19 times more likely to be profitable. But you can’t make informed, high-impact decisions without accurate, complete, and reliable data. Every financial decision you make, from budgeting to forecasting, relies on the quality of your data.

Data integrity ensures business data is accurate and complete. With strong data integrity, businesses can avoid costly errors, fraud, and misinformed decisions. You can maintain data integrity by keeping proper records, conducting regular audits, and using advanced software to manage financial data.

Key data management practices you can adopt to promote data integrity include:

- Data governance: Define what financial data is critical to business operations and establish standardized processes for collecting, storing, and managing it. Clear governance ensures consistency and improves decision-making.

- Data cleansing: Regularly audit and refine financial data to remove outdated information, correct discrepancies, and eliminate duplicate entries. This prevents errors from distorting forecasts and financial reports.

- Data consolidation: Structure financial data in a way that centralizes key business drivers, making it easier to track performance, identify trends, and generate accurate reports. Integration across systems ensures a single source of truth.

2. Reporting and analysis

With effective reporting and analysis, your quality data becomes trends and insights you can use to develop a strategic plan. It helps you present your financial data in a way that’s easy to understand, allowing you to answer important questions such as:

- How much is the business making?

- What are the business expenses?

- Where can the organization cut costs to improve revenue?

This provides insights into the “why” behind business performance and “how” the organization can replicate successful strategic initiatives for future growth.

3. Planning and modeling

Planning, budgeting, and modeling are about figuring out the best ways to manage and allocate the company’s finances to achieve strategic goals. Great financial planning helps you anticipate potential issues, adapt your strategy, and stay on course to reach business objectives. Budgeting sets spending limits based on revenue forecasts, ensuring resources are allocated efficiently. For example, if a company plans to launch a new product, the budget should cover research, production, marketing, and distribution while maintaining profitability.

Financial modeling involves simulating different scenarios for plans and their financial outcomes to choose the best course of action. For example, if you’re planning to expand into a new market, a financial model will help you understand how this plan will affect your cash flow and if you’ll get the best ROI.

A robust financial planning, budgeting, and modeling process can include:

- Cash flow forecasting: Ensuring the business has enough liquidity to meet its obligations.

- Operational budgeting: Creating budgets that align with the immediate goals of the business.

- Breakeven analysis: Determining the viability of a new initiative, that is, understanding when a project will become profitable.

You can use dedicated finance software to make these processes more efficient. Explore budget and forecasting tools that allow for real-time data analysis and quicker turnaround times.

4. Performance monitoring

Strategic financial management is a process that requires you to continuously assess financial plans and strategies and make adjustments if need be. During planning, organizations typically set key performance indicators (KPIs) to track progress toward each business objective, whether it's revenue growth, gross margin, operating cash flow, or others.

Targeted monitoring allows you to pinpoint areas requiring attention and make smarter decisions faster quickly. Ensuring your financial reporting and decision-making are always aligned with these key business drivers empowers your team to focus their efforts where it counts.

The benefits of strategic financial management

Adopting strategic financial management gives your organization a long-term focus on your goals, helping you:

Create future-ready finances

Strategic financial management helps an organization build a strong financial foundation and prepare its finances for long-term success. Businesses can anticipate future financial needs, allocate money efficiently, and invest in the right growth opportunities. For example, if an organization expects a downturn in the market, it can establish a contingency fund to keep operations running smoothly during that period.

Improves risk management

Strategic financial management helps organizations anticipate and manage financial risks rather than simply reacting to them. By incorporating risk management best practices into planning, budgeting, and modeling, finance teams can identify potential challenges, assess their impact, and take steps to minimize disruptions.

A strong risk management approach includes:

- Monitoring industry and economic trends: Keeping an eye on technological advancements, regulatory changes, and shifts in consumer behavior helps businesses stay prepared.

- Developing flexible financial models: Creating models that factor in different scenarios allows organizations to test their resilience against potential risks.

- Refining budgets and forecasts: Regularly reviewing financial plans ensures that businesses can adjust to market changes and unexpected events.

- Performing sensitivity analysis: Testing how different variables affect financial outcomes helps businesses understand which factors have the most impact.

Proactively tracking risks and making adjustments based on new information strengthens a company’s ability to navigate uncertainty and achieve long-term financial stability.

Attracts more stakeholders

Organizations that earn the confidence of potential stakeholders usually have easier access to investments, capital, and better credit ratings. When you successfully manage finances, meet short- and long-term obligations, increase profitability, and drive sustainable growth, you position your company as a stable, trustworthy investment.

Beyond your financial performance, it is important to attract the right stakeholders and engage them early to build their confidence in your organization. From the outset, understand their perspectives and get their buy-in for the strategic role of finance in business development.

Enhances business performance

Investing in the right projects and managing finances efficiently leads to stronger business performance. Strategic financial management enables companies to allocate resources effectively—whether by adopting new technology, optimizing operations, or expanding product offerings—to drive revenue growth and profitability.

By continuously evaluating financial data and market conditions, businesses can stay agile, make informed decisions, and maintain a competitive edge. A well-executed financial strategy ensures the company helps you meet current objectives and scales sustainably for the future.

How to achieve strategic financial management for your business

Great strategic financial management can improve your business performance by over 25%. Here are actionable steps you can take to achieve strategic financial management for your business:

1. Build a strong financial foundation

Build a strong foundation by focusing on the essential elements that ensure stability and long-term success of the organization. This involves everything we discussed above—primarily using quality business data to make decisions—but also identifying key trends in business performance, modeling plans before implementation, and tracking performance continuously.

With this foundation, you set up the organization to handle all outcomes efficiently and take advantage of growth opportunities when they arise.

2. Streamline routine financial processes

Finance teams often spend a significant amount of time on tasks like tracking expenses, invoicing, and financial reporting, leaving little room for strategic initiatives. Simplifying and automating these routine processes allows finance professionals to focus on higher-level analysis and decision-making.

Key steps to achieve this include:

- Automating core financial processes: Implementing automation in areas like reporting and account reconciliation speeds up workflows and reduces errors.

- Optimizing financial workflows: Refining how financial data is collected, processed, and analyzed enhances efficiency.

- Focusing on strategic analysis: With time freed up, finance teams can concentrate on spotting trends, forecasting scenarios, and contributing to business growth.

By making financial operations more efficient, organizations position finance as a key strategic function rather than a purely administrative one.

3. Focus on long-term planning

Long-term financial planning helps companies navigate growth and market shifts. Finance teams help align strategic objectives, forecast future scenarios, and identify opportunities for expansion. To drive long-term success, actively shape company goals, collaborate with senior leaders, and participate in strategic planning. Use KPIs to track progress, adjust plans as needed, and ensure financial resources support business objectives.

This long-term financial planning ability showcases your expertise in not only managing the present but also anticipating and preparing for future challenges and opportunities. This forward-thinking approach is essential for navigating growth phases and market shifts.

4. Understand the nuances of market dynamics

The external business environment your organization operates in plays a huge role in strategic financial management. Understanding market trends and how they operate allows you to identify potential opportunities and risks, allocate resources effectively, and make informed decisions about the overall business direction.

You can consistently:

- Monitor industry and economic trends

- Conduct regular market research to stay up to date with industry reports, market analysis, and competitor news

- Consult industry experts and analysts to get their opinions on your financial analysis

- Integrate market insights into financial forecasts and models

- Share your market insights with senior leadership to help them understand how external factors affect the business

5. Identify and prepare for financial risks and opportunities

Risks represent threats to your long-term goals, while opportunities include potential areas of expansion, such as new market segments and untapped customer needs that can accelerate growth. Proactively identify and prepare for risks like market downturns to minimize their impact on business performance. Set up contingency plans and secure proper insurance to protect cash flow, assets, and operations from unexpected disruptions.

Ensure your financial strategy includes allocated funding for new opportunities—whether investing in emerging technologies, acquiring competitors, or expanding into high-growth markets—so you can act quickly and gain a competitive edge.

6. Implement modern financial software

Modern financial software is redefining strategic financial management by providing new tools and methodologies that significantly enhance strategic decision-making. For example, FP&A software can help automate data cleansing and validation, making it easier to maintain data integrity. You can use data analytics tools to create dynamic financial dashboards and transform business information into financial insights that inform key stakeholders' decisions.

By integrating modern financial software into core operations, finance teams can improve efficiency, enhance forecasting accuracy, and strengthen their role as strategic business partners.

7. Position finance as a strategic business partner

When organizations integrate finance strategically, finance switches from a support role to a key driver in decision-making and business strategy. To achieve this, you can:

- Regularly engage with other departments to understand their challenges and align financial strategies with their needs

- Devise clear and impactful ways to communicate financial insights to various stakeholders

- Identify and focus on key factors that drive business growth and tailor financial strategies to support these factors

The success of strategic financial management also relies on your ability to foster trust and strong relationships with business partners. Make sure to establish open lines of communication, provide data-driven recommendations, and demonstrate how finance can help achieve shared business goals.

8. Enhancing impact with accessible communication

Communication and storytelling can significantly improve the impact of strategic financial management, especially in terms of showing stakeholders the results of strategic initiatives to gain their trust, confidence, and investments.

Translate financial data into compelling narratives that connect company goals to your stakeholder's needs. Business stakeholders have varying understandings of financial data, so use different methods of communication, such as visualizations, emails, and presentations, to make performance data accessible to all stakeholders.

Financial strategizing for success

Strategic financial management isn’t just about balancing budgets—it’s about positioning your business for long-term success. By strengthening financial foundations, aligning finance with company strategy, and proactively managing risks and opportunities, organizations can drive sustainable growth and stay competitive in a rapidly evolving market.

Modern financial software plays a critical role in making strategic finance more effective. The right tools streamline processes, enhance forecasting accuracy, and empower finance teams to focus on high-value decision-making.

Want to learn how a solution like Cube can help you achieve long-term goals? Schedule a free demo today.

.png)

![Best strategic planning software for CFOs [2025 review]](https://www.cubesoftware.com/hubfs/Strategic-Planning-Software%20%281%29.webp)