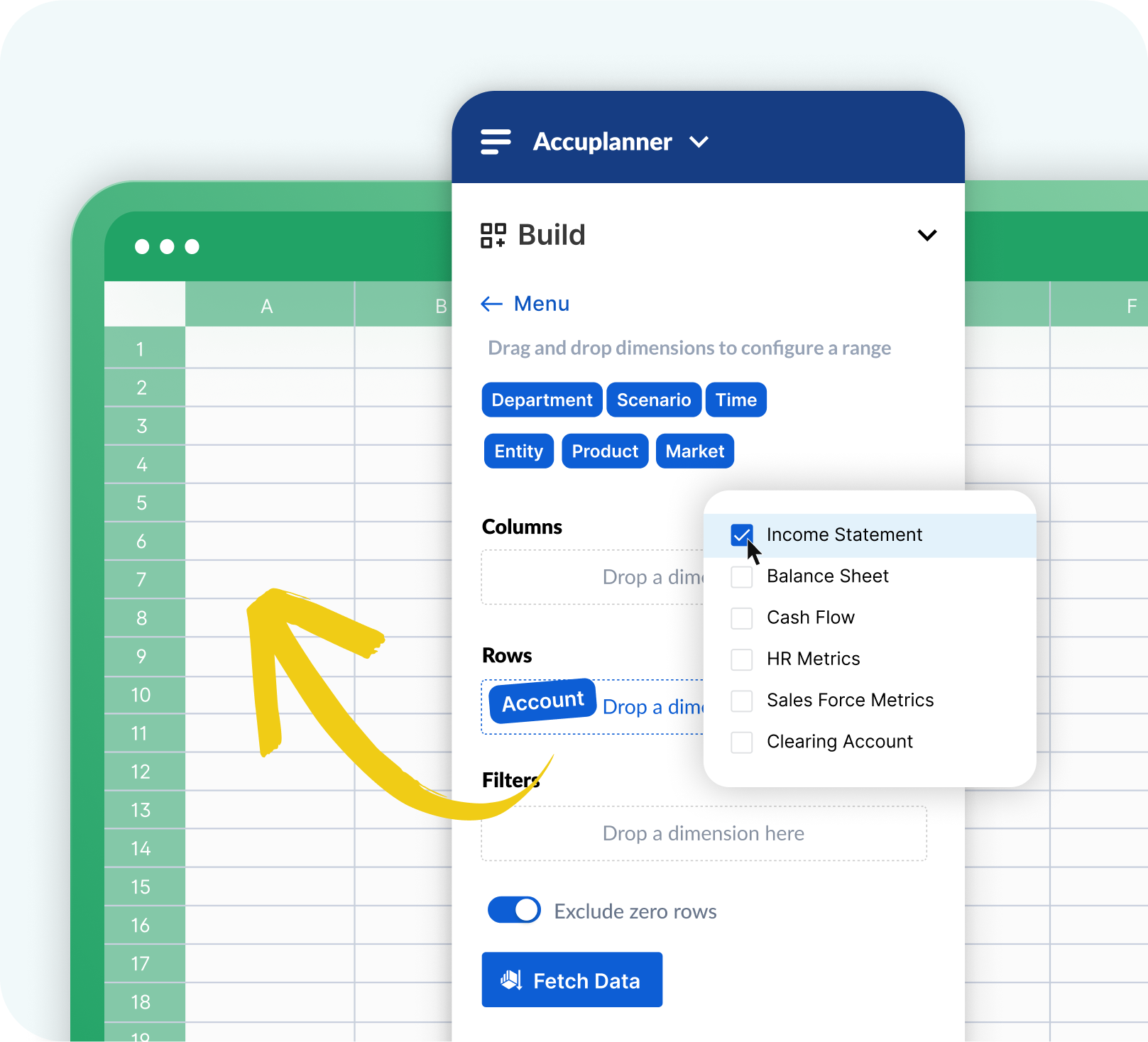

Ad-hoc analysis

Drag-and-drop simplicity, powerful results

Proactively drive strategy with ad hoc analysis that's as easy as creating a pivot table. With just a few clicks, slice, dice, and drill down to analyze real-time performance data directly within your spreadsheets.

.png)

.png)

.png)

.png)