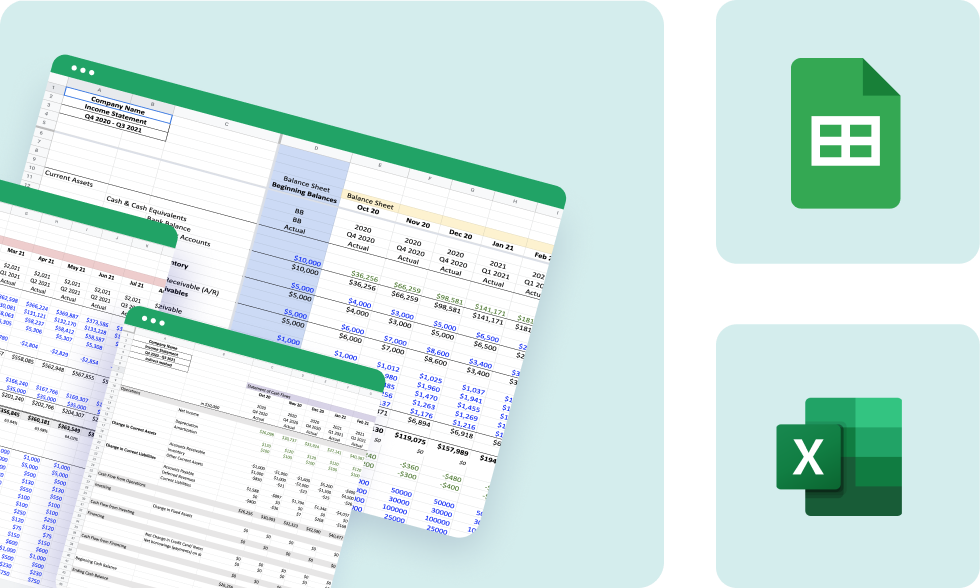

3-Statement model template for Excel: What's inside

A ready-to-use tool to simplify your financial planning process, our 3-statement model template combines your income statement, balance sheet, and cash flow statement for connected, accurate financial forecasts–without the manual headaches.

With our free template for Excel and Google Sheets, you can:

- Quickly input your financial data into pre-formatted sections.

- Automate key calculations like retained earnings, depreciation, and financing activity with built-in formulas.

- Visualize the impact of decisions with linked statements that automatically update when assumptions or projections change.

- Analyze your business’s financial health from multiple angles–profitability, liquidity, and capital needs–in one place.

Use Cube’s 3-statement model template to connect and better understand your:

Income statement

Track revenue and expenses to calculate net income and get insights into profitability.

Balance sheet

Determine what your business owes and owns to assess cash needs and financial stability.

Cash flow statement

See how money moves in and out of your business to forecast liquidity and plan financing activity.

Use the 3-statement model with Cube

This is an Excel template. You don't need to be a Cube customer to use it!

But if you are a Cube user, you can start using this template in under two minutes. Here's how.

Step 1: Open the template in Excel or Sheets.

Step 2: Customize the row and column headers to match your Cube's dimensions and filters.

Step 3: Select the range where you want to fetch your data.

Step 4: Fetch your data.

.gif?width=600&name=CreateTemplate%20(1).gif)

All About the Basic 3-Statement Model

A three-way forecast, also known as the three-statement model, uses assumptions, drivers, and information relevant to a modeler’s business to quickly produce a single consolidated forecast with projections for all three financial statements.

It links your profit & loss (income statement), balance sheet, and cash flow projections together so you can forecast your future cash position and financial health.

Because your cash flow forecast is driven by the real-time data in your balance sheet and profit and loss statements, the report has accounting integrity.

For this reason, a three-statement model is the best way to provide granular financial forecasts that explain the future perspective of your business from multiple angles (revenue growth, profitability, capital needs, cash burn).

Today, we’ll cover the essentials of the three-statement model. You’ll learn:

- How the 3-statement model works: See how linked assumptions and drivers create unified forecasts.

- Why it matters: Understand how the 3-statement model supports planning, budgeting, and long-term strategy.

- How to use it: Explore the steps to build and optimize the three-statement model for your business.

- Common use cases: From preparing for institutional investors to improving decision-making with precise insights.

As an Excel and Google Sheets template, the three-statement model is easy to manipulate and learn how to use.

What is a 3-statement model template?

A 3-statement model template is a tool that simplifies financial forecasting by combining your income statement, balance sheet, and cash flow statement into one dynamic file. Using pre-built formulas and links, it automates calculations and shows how changes in one area affect the others for a more complete view of your business’s financial health.

But this model isn’t just for finance teams–it also empowers non-financial executives. By presenting complex financial data in a clear, easy-to-follow format, leaders can better understand the numbers, ask smarter questions, and make better decisions.

It can help answer important questions about your business, like:

- What happens to cash flow if expenses increase next quarter?

- How much funding will we need to meet next year’s growth targets?

- How will investing in new equipment affect profitability and liquidity?

An easy-to-use and flexible framework for decision-making, Cube’s 3-statement model template can help you get the clarity you need to act confidently–whether you’re modeling scenarios for investors, tracking liquidity, or analyzing profitability.

Most importantly, our template is designed to help you focus on strategy instead of spending hours chasing data. And because it works in both Excel and Google Sheets, you can easily use it with your existing workflows.

What are the three financial statements?

Financial statements report on a company's financial performance over a given period. They include information about the company's historical financial data, capital expenditures, debt balances, working capital items, revenue growth, net income, expenses, cash flow, and other historical information necessary to build financial models.

Organizations use the three-statement financial reporting framework. This consists of three pro forma documents prepared using all available financial data. In the case of publicly traded companies, financial statements are subject to periodic review and audit to ensure accuracy for shareholders.

The three financial statements are the company's income statement, the balance sheet, and the cash flow statement (sometimes called the statement of cash flows).

Let’s go into more detail on each component of the 3-statement financial model.

Income statement

The income statement is the most important of the three financial statements. The income statement reports all business operations for the period in review. It gives the reader a summary of all cash (revenue) coming into the business and the cash spent to earn that revenue. It shows whether the business can profit and how much it could be.

Read the income statement from top to bottom. It starts with the total revenues earned over the period. Below it shows the expenses:

- Direct: Costs that can be tied to a product or project. This is reflected in the Cost of Goods Sold (COGS). These costs are then taken out of revenue to show a gross profit.

- Indirect: Overhead costs that can’t be tied to a specific project but contribute to generating revenue. These include wages, administrative costs, R&D, asset depreciation, and loan amortization.

The income statement also shows operating and non-operating expenses like interest expenses, as calculated by the debt schedule.

After deducting total expenses and tax, you’re left with net earnings.

Balance sheet

The balance sheet shows how much cash (or cash equivalents) is needed to support sales and profits shown on the income statement.

The balance sheet shows what the company “owns and owes,” meaning all the assets, liabilities, and shareholder equity reported for a specific period. It can be used to calculate the rate of return on investment and examine the company’s capital structure.

Some sample balance sheet items are the company's long-term debt, the accounts payable, wages payable, the average balance of debt outstanding, cash, accounts receivable, and long-term assets like PP&E (property, plant, and equipment).

The balance sheet also contains information about shareholders' equity. Sometimes, this information may be broken out into separate reports.

Cash flow statement

The cash flow statement reports all the movement of cash (and cash equivalents) into and out of the company. This statement shows the organization's cash management and its operations' health. It also reveals the company’s liquidity—the funds it has to run the daily operations and pay off liabilities.

The statement of cash flows will also show free cash flow, or how much cash a company has after paying the costs to keep the business running (operating expenses and capital expenditures).

Why is the 3-statement financial model important?

Financial reporting provides your stakeholders with needed information to evaluate the company’s financial health. It also empowers decision-making by providing easy access to the most valuable data in easy-to-read reports.

The financial statements provide information for several internal and external purposes:

- Financial ratios: The figures in your financial statements will provide the data necessary to calculate numerous financial ratios.

- Forecasting: Accurate financial statements are used in financial forecasting and financial modeling, using the historical data contained in previous statements to act as a source of truth for making future assumptions and predictions.

- Scenario planning: Financial data from the cash flow statement is used to create scenarios for better decision-making. The information on revenue growth, expenses, and cash flow can be used to adjust product pricing, overhead costs, and other variables to improve financial performance.

- Investor relations: Financial statements are often the basis for decision-making on questions of credit and investment. By showing strong financials, your company will have access to lines of credit. It will be easier to attract interest from investors. In publicly traded companies, financial statements are required to show shareholders the financial position of the company.

A solid understanding of financial modeling (like the three-statement financial model) in Excel is essential for people who work in investment banking.

How to build a 3-statement model

Finance builds the three statements in a specific order because pieces of data on one statement carry over to lines in the other two. Here’s how it works:

1. Input historical data into a spreadsheet

The process begins by gathering historical financial data–including revenue, expenses, assets, liabilities, and cash flow from past periods–organizing it and entering it into a spreadsheet. This step forms the model's foundation and provides a baseline for identifying trends and building realistic projections.

Best practices include:

- Use data sources that cover all accounts to prevent gaps.

- Structure data chronologically to align with reporting intervals.

- Maintain consistent formatting for units, labels, and values.

- Verify that historical net income matches retained earnings on the prior balance sheet and that cash balances align with past and current cash flow statements.

- Cross-check key accounts like payables, receivables, and inventory for consistency.

Approaching this step with precision and attention to detail can help minimize errors that could cascade through the model. Starting with clean, consistent data will help prevent errors as the model takes shape.

2. Set the assumptions for forecasting

Assumptions are the foundation of any financial model. They’re the key drivers like revenue growth rates, profit margins, and planned capital expenditures that let finance teams project future performance and test different scenarios. These inputs are important because they shape every calculation across the income statement, balance sheet, and cash flow statement.

Best practices include:

- Determine which metrics are most relevant.

- Create a dedicated assumptions section in the spreadsheet to keep inputs centralized and easy to update.

- Label each assumption clearly with corresponding units.

- Base assumptions on historical trends, market research, and internal goals.

- Link assumptions to other parts of the model using formulas to see the immediate impact on forecasts when assumptions are adjusted.

Thoughtfully defined assumptions make it easier to answer questions like, “What happens to cash flow if expenses grow faster than revenue?” or “How much investment is needed to achieve the company’s goals?” Creating a flexible and actionable model that adapts to changing assumptions will be key for forecasting and decision-making.

3. Forecast the income statement

The income statement is the starting point for every 3-statement model and lays the groundwork for linking all three financial statements. Based on the assumptions set earlier, calculate projected revenue, gross profit, operating income, and net income.

Here’s how to forecast the income statement:

- Revenue: Apply growth rates from the assumptions section to historical revenue figures to calculate projected revenue.

- Gross profit: Subtract projected COGS from revenue. Use historical data or benchmarks to estimate COGS as a percentage of revenue.

- Operating income: Subtract operating expenses, including salaries, rent, and marketing, from gross profit to calculate operating income.

- Taxes and interest: Apply the tax rate and include interest expenses to arrive at net income.

Remember, each figure builds on the last and connects to the other statements. Specifically, net income flows into retained earnings on the balance sheet and serves as the starting point for operating cash flow on the cash flow statement. Accurate forecasting at this stage is especially important for consistency.

4. Forecast capital expenditures and assets

Next comes forecasting capital expenditures (CapEx). These expenditures represent long-term investments in assets like property, equipment, or technology upgrades and must be integrated into the 3-statement model to reflect their impact on cash flow, depreciation, and financial position.

Best practices include:

- Estimate CapEx needs based on historical trends, planned projects, and growth goals.

- Calculate depreciation schedules by assigning rates based on asset type and lifespan.

- Adjust the balance sheet by adding CapEx to property, plant, and equipment (PP&E) under assets and reducing it annually by the calculated depreciation amount. Depreciation also reduces net income, flowing into retained earnings.

- Update the cash flow statement by recording CapEx as a cash outflow in the investing activities section.

Projecting CapEx and assets accurately can help cultivate a better understanding of the long-term impact of investments on cash flow and financial health. Make sure to regularly review forecasts to account for new projects or changes in strategy.

5. Forecast financing activities

Accounting for financing activities like taking out loans, repeating debt, or issuing equity is the next step. Every financing decision impacts all three financial statements in unique ways, so planning for changes in financial structure is essential.

Best practices include:

- Determine the amount, timing, and terms of new loans or debt repayments.

- For new loans, add the amount to liabilities on the balance sheet. Deduct repayment amounts from liabilities.

- Record interest expenses on the income statement under financing costs.

- Reflect cash inflows from new loans and outflows for repayments in the financing section of the cash flow statement.

- If issuing new shares or repurchasing equity, update the equity section of the balance sheet to reflect these transactions and include any cash inflows from share issuances or outflows for buybacks in the financing section of the cash flow statement.

Keep in mind that financing activities typically incur costs like interest or dividends:

- Interest payments reduce net income on the income statement and flow into operating cash flow adjustments.

- Dividend payments reduce retained earnings on the balance sheet and appear as outflows in the financing section of the cash flow statement.

6. Finish the income statement

Once all revenue, expense, and financing details are entered, the focus shifts from forecasting to finalizing the income statement. Using actual data to complete gross profit, operating income, and net income helps ensure the income statement is calculated accurately and connected to the balance sheet and cash flow statement.

Here’s how to calculate the final income statement:

- Gross profit: Using actual revenue and COGS projections, compute gross profit by subtracting direct costs from revenue.

- Operating income: Use finalized gross profit and subtract operating expenses such as salaries, utilities, and other indirect costs.

- Net income: Apply finalized tax rates and interest expenses to the pre-tax income figure.

Here, net income is the ultimate measure of profitability for the period and connects to the other statements:

- Balance sheet: Net income flows directly into retained earnings, adjusting the company’s equity.

- Cash flow statement: Net income is also the starting point for operating activities. Non-cash items (like depreciation and amortization) are added back during this process to reflect the cash flow.

7. Finish the balance sheet

With the income statement finalized, it’s time to update the balance sheet to complete the second piece of the 3-statement model. That means consolidating the results from prior calculations to reflect changes in assets, liabilities, and equity for the reporting period.

Best practices include:

- Use net income from the income statement to adjust retained earnings–the portion of net income not distributed as dividends, which increases the equity section of the balance sheet.

- Account for CapEx added during the period and subtract depreciation from the PP&E balance and total assets to reflect asset value over time.

- Reconcile current assets and liabilities by updating accounts receivable, accounts payable, and inventory figures.

- Verify that the cash balance on the balance sheet matches the closing balance on the cash flow statement.

The balance sheet must “balance”—total assets should equal liabilities plus equity. If it doesn’t, you’ll need to track down errors. Double-check that changes in PP&E, retained earnings, and working capital align with figures on the income statement and cash flow statement.

8. Finish the cash flow statement

The cash flow statement is the final piece of the 3-statement model, connecting data from the income statement. Here, using actual results from the reporting period (rather than projections) to complete the calculations helps show how cash actually moves through the business.

Best practices include:

- Pull net income from the income statement as the starting point for the operating cash flow statement. It represents profitability before non-cash adjustments and changes in working capital.

- Add back non-cash expenses (like depreciation and amortization), which reduce net income but don’t impact cash flow.

- Account for changes in working capital using data from the balance sheet to reflect increases or decreases in accounts receivable, inventory, and accounts payable.

- Reflect cash inflows and outflows related to CapEx or other investments.

- Add data from the financing section of the balance sheet, including loan repayments, new borrowings, or equity transactions.

- Calculate the net change in cash for the period by adding cash flows from operating, investing, and financing activities.

- Calculate the closing cash balance by adding the net change to the opening cash balance from the prior period’s balance sheet.

Make sure the closing cash balance reconciles with the ending cash line on the balance sheet to avoid errors.

9. Link the three statements

Linking the income statement, balance sheet, and cash flow statement is the final step in building a 3-statement model. Creating these connections ensures that changes in one statement dynamically impact the others for a clearer and more accurate picture of financial performance.

Key connections to keep in mind:

- Net income links the income statement to the balance sheet and cash flow statement.

- Depreciation connects the income statement, balance sheet, and cash flow statement.

- Working capital changes connect the balance sheet and cash flow statement.

- CapEx links the balance sheet and cash flow statement.

- Financing activities link the cash flow statement and balance sheet.

- Closing cash balance ties the cash flow statement to the balance sheet.

Creating these links in a spreadsheet will require attention to detail and a solid understanding of financial relationships. Formulas can help automate connections—for example, by referencing net income from the income statement directly on the balance sheet. Make sure figures match across statements to avoid errors and test formulas and links regularly to confirm that changes in one statement update the others correctly.

10. Model and review

Once all three financial statements are linked and the 3-statement model is complete, shift focus to reviewing and refining the model to make sure it’s accurate, dynamic, and useful for decision-making.

Best practices include:

- Adjust key assumptions to test their impact on the model and analyze how changes cascade across each statement.

- Validate key relationships to confirm that net income, depreciation, working capital changes, and CapEx entries are consistently represented across statements.

- Audit key formulas to make sure they reference the correct cells and produce logical results.

- Check for formula errors to identify broken links, circular references, or incomplete formulas.

- Confirm the model can adapt to changing inputs without breaking.

A solid review process produces a clear, accurate view of the model’s performance and adaptability. Testing scenarios and double-checking links between statements help identify inconsistencies, refine assumptions, and make adjustments. With the 3-statement model as a reliable decision-making tool, organizations can get actionable insights into multiple financial scenarios for better planning and risk management.

How Cube makes it easier

With Cube’s 3-statement model template, you can skip the complexity of building a model from scratch. Pre-built formulas and automated links between statements eliminate the need for tedious manual work.

Simply input your historical data and assumptions, and Cube does the heavy lifting–calculating projections, linking statements, and generating actionable insights in real time.

Focus on analyzing results and making data-driven decisions–instead of spending hours troubleshooting formulas or linking spreadsheets–with Cube.

How to format and structure a 3-statement model

Proper formatting and structure are essential for building a 3-statement model that’s functional and easy to understand. Here are some tips for formatting and structuring your model:

Use consistent color coding

Color coding is a simple yet powerful way to organize your model. It visually separates inputs, formulas, and links, making it easier to follow and audit.

Use consistent data formatting

Formatting inconsistencies can cause confusion and make your model harder to use. Keep a uniform approach to data presentation across all three statements.

- Use the same unit scale throughout (e.g., thousands or millions) and clearly indicate the unit at the top of each worksheet.

- Stick to one decimal place for most numbers, two for per-share data, and three for share counts.

- Align text and numbers consistently (e.g., align numbers to the right and text to the left).

Avoid partial inputs

Never mix hard-coded numbers and cell references in the same formula. For example, instead of writing =A1 1.1 (where 1.1 is hard-coded), reference another cell for the growth rate, like =A1 B1, and input 1.1 into B1.

Partial inputs make your model harder to audit because the hard-coded number isn’t visible in the formula bar. Use dedicated input cells to make sure assumptions are easy to locate and update.

Standardize column widths and headers

Consistency in layout makes your model more professional and easier to read. Use uniform column widths across all three statements. For instance, if column A is 15 characters wide in the income statement, keep it the same width in the balance sheet and cash flow statement.

Label headers clearly and consistently. For example, use “Revenue” across all worksheets rather than alternating between “Sales” and “Revenue.”

Keep your model audit-friendly

When your model is easy to follow, it’s easier to check for errors and confirm accuracy. Separate inputs, calculations, and outputs into distinct sections or worksheets. That way, reviewers know where to look for each type of data.

Add comments or notes for complex formulas. For example, if a formula includes multiple adjustments, briefly explain its purpose. Include a summary section that pulls key metrics, like net income, cash flow, and ending balance sheet figures, into one place for quick review.

How are the three statements connected?

Each financial statement is linked together with data from one report supporting the data on the other two. Income statement line items that link to the balance sheet and cash flow statement include:

- Net income: The bottom calculation from the income statement appears on the balance sheet and cash flow statement.

- Depreciation: Added back into the cash flow statement.

- Capital expenditure: deducted from the cash flow statement, which determines the amount for PP&E on the balance sheet.

- Financing: Feature on the balance sheet. Cash from financing also appears on the balance sheet.

- Cash balance: Closing cash balance from the previous period, added to the current period cash from operating activities, investing, and financing, becomes the closing cash balance on the balance sheet.

3-statement model application examples

These industry-specific examples illustrate the adaptability and precision achievable through a customized three-statement model. Whether in tech, healthcare, or other sectors, this approach proves instrumental in navigating the unique landscapes of varied industries.

Real estate: Customize the three-statement model for the real estate sector, accounting for property acquisition costs, rental income streams, and the impact of market fluctuations on property values.

Manufacturing: Fine-tune the three-statement model for manufacturing, addressing inventory turnover, production cycles, and specific metrics like cost of goods sold (COGS).

Software development: Tailor the three-statement model for software companies, considering recurring revenue, R&D expenses, and agile financial planning in the fast-paced tech industry.

Healthcare: Tailor the model to healthcare complexities, considering regulatory nuances, varying patient volumes, and significant investments in medical infrastructure.

Download your free 3-statement model Excel template

Ready to simplify your financial forecasting? Our free 3-statement model template for Excel and Google Sheets gives you everything you need to build dynamic, accurate financial models—all in one place.

- Save time: Pre-built formulas and automated links eliminate manual calculations and reduce errors.

- Get clarity: Forecast your income statement, balance sheet, and cash flow statement side by side to see how decisions impact your business.

- Run scenarios: Adjust assumptions like revenue growth, capital expenditures, or financing activities to explore potential outcomes.

- Make informed decisions: With linked statements, you’ll have a clear view of profitability, liquidity, and capital needs, so you can plan with confidence.

Enter your business email to download the template and take the first step toward better, faster financial forecasting.

3-statement model FAQs

How long should a 3-statement model take?

Building a 3-statement model from scratch can take several hours to days, depending on the complexity of the business and the data available. Adding time to the process are factors like reconciling historical data, creating formulas, and linking statements. A pre-built template like Cube’s can help significantly reduce this time by automating calculations and connections across all three statements.

What is the difference between DCF and the 3-statement model?

A DCF (Discounted Cash Flow) model is a valuation method using future cash flows to estimate a company’s present value. It relies on outputs from the 3-statement model—specifically cash flow projections—but focuses on calculating intrinsic value.

The 3-statement model, on the other hand, is designed for financial forecasting and decision-making. It provides the detailed inputs (like revenue growth and CapEx) needed for a DCF, which makes the two models complementary.

What is the 3-way forecast model?

Another term for the 3-statement model, the 3-way forecast model is a tool for projecting a company’s future financial performance by linking the income statement, balance sheet, and cash flow statement into a single framework so businesses can forecast metrics like cash burn, profitability, and liquidity under different scenarios.

How do the three statements interact?

The income statement, balance sheet, and cash flow statements are interconnected in the following ways:

- Net income flows from the income statement to retained earnings on the balance sheet and serves as the starting point for operating cash flow.

- Depreciation reduces net income on the income statement but appears as a non-cash expense in operating cash flow and decreases PP&E on the balance sheet.

- Changes in working capital (e.g., accounts receivable or payable) affect both the cash flow statement and balance sheet.

Creating links between these figures helps make sure that changes in one area of the business are reflected across all three statements for a more dynamic and accurate financial model.

What is periodicity in a 3-statement model?

Periodicity refers to the time intervals covered by a financial statement. A 3-statement model typically operates on monthly, quarterly, or annual periods. Consistent periodicity helps make sure figures like revenue, expenses, and cash flow are comparable and that they align across the income statement, balance sheet, and cash flow statement.

How do you prepare the 3-statement model?

Prepare the trial balance: A trial balance account lists all the ending balances in your general ledger accounts. This is an internal report used to start the reporting process. After the trial balance is calculated, accounting makes adjustments to account for differences due to accruals.

Make adjusting entries: Once your trial balance is complete and accurate, the accounting team will make adjusting entries to bring balances up to date. For instance, if you owe paychecks to employees but they haven’t been paid out yet, an adjustment debiting your wage expense and crediting your wages payable will bring that account into balance.

Adjust the trial balance: As with the unadjusted trial balance, list the accounts and their ending balances. This time, the balances will reflect the adjustments made in the previous step. Entering the adjusted trial balance ensures that the figures appearing in your financial reports are accurate.

From this point, you can compile the financial statements with certainty that your adjusted balances on the income statement are accurate. It’s important to ensure accuracy with these early steps since errors in the income statement will flow through to the other two statements.

.png)

.png)