What's Inside

An operating budget template helps you create a budget that you can use to compare expenditures (like COGS, or cost of goods sold) with revenue or other income sources in order to determine an operation's viability.

An operating budget estimates every line item on an income statement. Sales, materials, labor, overhead (COGS), and SG&A (selling, general, and administrative) costs. The end result is a pro forma (expected) income statement.

This template includes different methodologies to plan your data. When planning future resource needs, it’s important to think about how costs move with revenues, and what costs are relatively fixed (rent, utilities) and which ones are more variable (personnel-related, which grow with headcount).

Variable costs include, among other things:

- Cost of goods sold,

- Direct selling costs,

- Sales commissions,

- Payment processing fees,

- Freight,

- Certain aspects of marketing,

- Direct labor

Fixed costs typically don't vary with changes in revenue and are mostly constant, at least within the time frame of the operating budget.

Examples of fixed costs include:

- Rent,

- Head office,

- Insurance,

- Telecommunication,

- Management salaries & benefits,

- Utilities

You will want to consider all variable and fixed costs by department for each period. Using previous year trends and future revenue projects will help determine expected costs.

The result of collecting this information from your department leads is an accurate, timely view of what resources you need to achieve your goals and how much they will cost.

Use with Cube

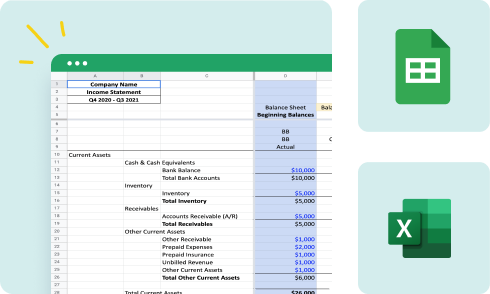

This is an Excel template. You don't need to be a Cube customer to use it!

But if you are a Cube user, you can start using this template in under two minutes. Here's how.

Step 1: Open the template in Excel or Sheets.

Step 2: Customize the row and column headers to match your Cube's dimensions and filters.

Step 3: Select the range where you want to fetch your data.

Step 4: Fetch your data.

.gif?width=600&name=CreateTemplate%20(1).gif)

Why operating expense planning matters

In the ever-changing landscape of economic uncertainties and market fluctuations, Operating Expense Planning becomes the bedrock for a stable financial foundation.

Organizations proactively fortify themselves through meticulous forecasting and scenario planning, ensuring a secure and steadfast financial future.

This empowers decision-makers by providing comprehensive, data-driven insights into financial performance. Armed with a clearer understanding of operating expenses, organizations can make informed decisions, enhance efficiency, and strategically allocate resources, paving the way for sustainable growth.

Overcoming challenges in managing operating expenses

Manual Operations: Streamlining with Automation

Implement automation for efficient and accurate manual budgeting and expense tracking, saving valuable time in routine financial processes.

Data Silos: Achieving Clarity Through Integration

Invest in integrated systems to dismantle data silos and gain a comprehensive financial view. Foster cross-departmental collaboration for seamless information flow and insights.

Economic Uncertainties: Building Resilience

Utilize scenario planning for sudden market shifts and economic uncertainties. Establish flexible budgeting and forecasting models to adapt strategies in response to changing economic conditions.

Technology Gaps: Embracing Modern Financial Tools

Upgrade legacy systems for cloud-based solutions and advanced analytics. Prioritize ongoing training to ensure FP&A teams adeptly utilize the full potential of modern financial technologies.

Forecasting future resource needs

Anticipating the future requirements of resources involves a strategic and systematic approach. Here's a step-by-step guide to help you navigate this process effectively:

Collect Historical Data:Gather data on past resource usage, expenditures, and performance. This historical data forms the foundation for future projections.

Identify Key Variables:Determine the key variables that impact resource needs, such as sales volume, production levels, or service demand.

Analyze Trends: Conduct a thorough analysis of historical trends to identify patterns and fluctuations in resource usage. Look for seasonal variations and any factors influencing changes.

Align with Revenue Projections: Align your resource forecasting with revenue projections. Understanding how resource needs correlate with expected revenue helps ensure realistic and achievable plans.

Consider External Factors: Take into account external factors like market trends, economic conditions, and industry developments that might influence resource requirements.

Engage Cross-Functional Teams: Collaborate with departmental heads and teams to gather insights into specific resource needs. Their input provides a more comprehensive view and ensures a well-rounded forecasting process.

Scenario Planning: Develop scenarios based on different assumptions or potential changes in the business environment. This prepares your organization to adapt to varying conditions.

Additional resources

Whether you aim to refine your proficiency, optimize procedures, or embrace industry best practices, these guides are designed to enhance and improve your operating expense planning.

- Building a foolproof operating budget

- 9 variable expenses examples you should know

- What’s the difference between a plan, a budget, and a forecast?

- Expense management software: how to control costs and boost profit margins

Grab your free operating expense planning template for Excel

Our free operating expense planning template is designed to help you organize and analyze your financial data.

Enter your business email to the right and download the template to get started immediately.

.png)