Key Takeaways

- Financial analytics uses statistical analysis to gain insights and make decisions about a business's financial performance.

- Financial analytic skills include financial modeling, data visualization, analysis and reporting, and budgeting and forecasting.

- Financial analytics tools can improve a company's collaboration, efficiency, and decision-making processes.

Financial analysis software skills to know

Financial analysis software is designed to help businesses and financial professionals collect, analyze, and interpret financial data. Here are the key functions and benefits it provides:

- Data analysis and visualization: Sift through large amounts of data to identify trends and present insights in easy-to-understand formats, like graphs and charts.

- Financial modeling: Facilitate the creation of financial models that predict future financial performance based on various scenarios.

- Budgeting and forecasting: Create accurate budgets and forecasts, ensuring that companies allocate resources effectively.

- Accounting and financial reporting: Streamline the accounting process and generate precise financial reports.

- Risk management: Identify, assess, and prioritize risks, and implement strategies to mitigate them.

- Compliance and regulations: Ensure that financial activities comply with relevant laws and standards.

- Project management: Manage financial aspects of projects, including costs, resources, and timelines.

Benefits of financial analysis software

These are some of the many benefits of using financial analysis software:

Centralize financial management

Financial analysis software centralizes financial management by consolidating diverse financial processes and data into a unified platform. It aggregates data from multiple sources, such as accounting systems, ERP systems, spreadsheets, and databases, creating a single source of truth for financial information.

This centralization facilitates comprehensive and consistent financial reporting, as the software generates consolidated reports that incorporate data from various departments and business units, offering a holistic view of the company's financial health.

Identify trends

Centralizing data allows financial analysts to view all relevant financial information in one place, facilitating more accurate and holistic trend analysis.

The software employs advanced analytical tools and statistical algorithms to sift through the data, identifying patterns and trends that might not be immediately apparent. It presents this data in an easily understandable format, using charts, graphs, and tables. This visualization capability enables analysts to quickly spot trends, such as revenue growth, expense patterns, and changes in profit margins, and to understand the underlying factors driving these trends.

Manage risk

The software uses advanced analytics and predictive modeling to identify potential risks. It analyzes historical data and current financial trends to forecast future performance and detect early warning signs of financial instability.

Through scenario planning and what-if analysis, businesses can simulate different financial situations and assess the impact of various risk factors, such as market fluctuations, operational disruptions, or regulatory changes. This proactive approach enables companies to develop contingency plans and strategies to mitigate identified risks.

Report in real time

Financial analysis software enables instant access to up-to-date financial information. With real-time data integration, financial reports reflect the most current information, eliminating the delays and inaccuracies associated with manual data entry.

The software's advanced analytics capabilities process this data continuously, updating financial metrics and key performance indicators (KPIs) in real time.

Moreover, financial analysis software automates the generation of financial reports, reducing the time and effort required to produce them manually. Reports can be scheduled to run automatically or generated on demand, ensuring that stakeholders always have access to the latest financial insights.

Improve accuracy and precision

Financial analysis software improves accuracy and precision in financial operations by automating data collection, processing, and reporting. By integrating with various financial systems and consolidating data into a single platform, the software eliminates the errors associated with manual data entry and disparate data sources. This centralization ensures that all financial information is consistent and up-to-date, providing a reliable foundation for analysis.

Advanced algorithms and analytical tools within the software further enhance accuracy by performing complex calculations and financial modeling with high precision. These tools can identify patterns, trends, and anomalies in the data that might be missed by manual analysis.

Optimize operations for scalability

Financial analysis software helps businesses optimize operations for scalability by streamlining financial processes, enhancing data management, and providing actionable insights. By integrating with existing financial systems and consolidating data into a unified platform, the software ensures seamless access to accurate and up-to-date financial information. This centralization eliminates data silos and enhances collaboration across departments, fostering a more efficient and cohesive operational environment.

The software automates routine financial tasks such as data entry, reconciliation, and report generation. This automation reduces the burden on financial teams, allowing them to focus on strategic activities rather than time-consuming manual processes. As a result, businesses can scale their operations without a corresponding increase in administrative overhead.

Key features of financial analysis software

Financial analysis software offers a comprehensive suite of features designed to enhance the efficiency, accuracy, and strategic value of financial management. These key features empower finance teams to make informed decisions, streamline operations, and drive business growth.

Multi-scenario modeling

Multi-scenario modeling enables businesses to evaluate the potential impact of various financial decisions and market conditions. Companies can assess risks, forecast outcomes, and develop contingency plans by creating and analyzing multiple financial scenarios.

This feature is crucial for strategic planning, as it allows organizations to visualize how different variables—such as changes in revenue, costs, or market conditions—affect their financial performance. As a result, businesses can make more informed decisions and prepare for a range of potential futures.

Budgeting

The budgeting feature helps businesses create, manage, and track budgets with precision. Financial analysis software streamlines the budgeting process by automating data collection, validation, and aggregation from various departments and sources. This ensures that budgets are comprehensive, accurate, and up-to-date.

Additionally, the software allows for real-time budget monitoring, enabling businesses to compare actual performance against budgeted figures. This continuous oversight helps identify variances early, allowing for timely adjustments to keep financial goals on track.

Forecasting and planning

Forecasting and planning tools allow businesses to predict future financial performance based on historical data, current trends, and projected market conditions.

These tools use advanced algorithms and predictive analytics to generate accurate financial forecasts, helping companies plan for future growth, manage cash flow, and allocate resources efficiently. By incorporating various factors and assumptions, forecasting tools enable finance teams to create detailed financial plans that support long-term strategic objectives.

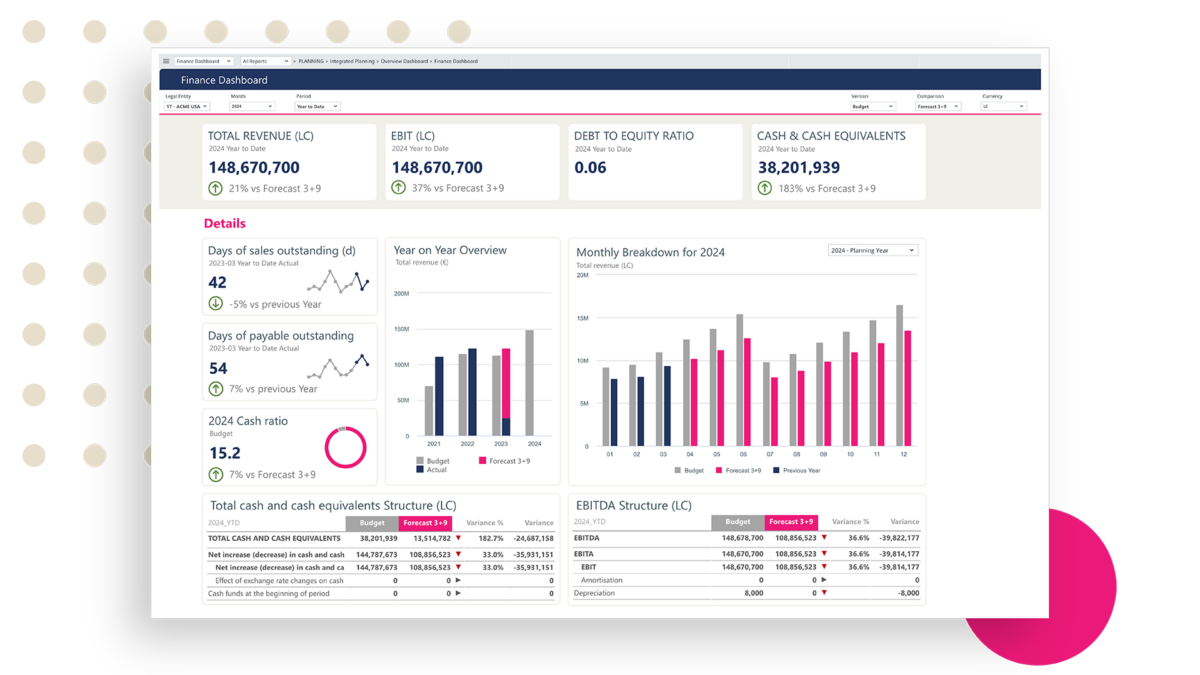

Customizable dashboards

Customizable dashboards offer visual representations of key financial data and metrics, tailored to the needs of different users. These dashboards provide at-a-glance insights into financial performance, with interactive charts, graphs, and tables that can be adjusted to display specific information.

Users customize their dashboards to highlight the most relevant data, making it easier to track key performance indicators (KPIs), monitor trends, and identify areas that require attention. The ability to visualize data in a clear and intuitive manner enhances decision-making and communication across the organization.

Real-time reporting and analytics

Real-time reporting and analytics enable businesses to access and analyze financial data as it is updated. This feature eliminates the delays associated with traditional reporting methods, providing instant insights into financial performance.

Real-time analytics tools process and present data continuously, allowing finance teams to monitor key metrics, identify trends, and respond swiftly to emerging issues. This immediate access to accurate information supports proactive decision-making and enhances the overall agility of the organization.

Integration capabilities

Integration capabilities allow financial analysis software to connect seamlessly with other business tools and systems, such as ERP, CRM, and HR platforms. This integration ensures that all relevant financial data is captured and consolidated in one place, providing a comprehensive view of the organization’s financial health.

By integrating with other systems, the software eliminates data silos, reduces manual data entry, and enhances data accuracy. This interconnected approach supports more efficient financial processes and enables better-informed decision-making across the business.

Top financial analysis software tools

This section will review the top financial analytics software tools on the market.

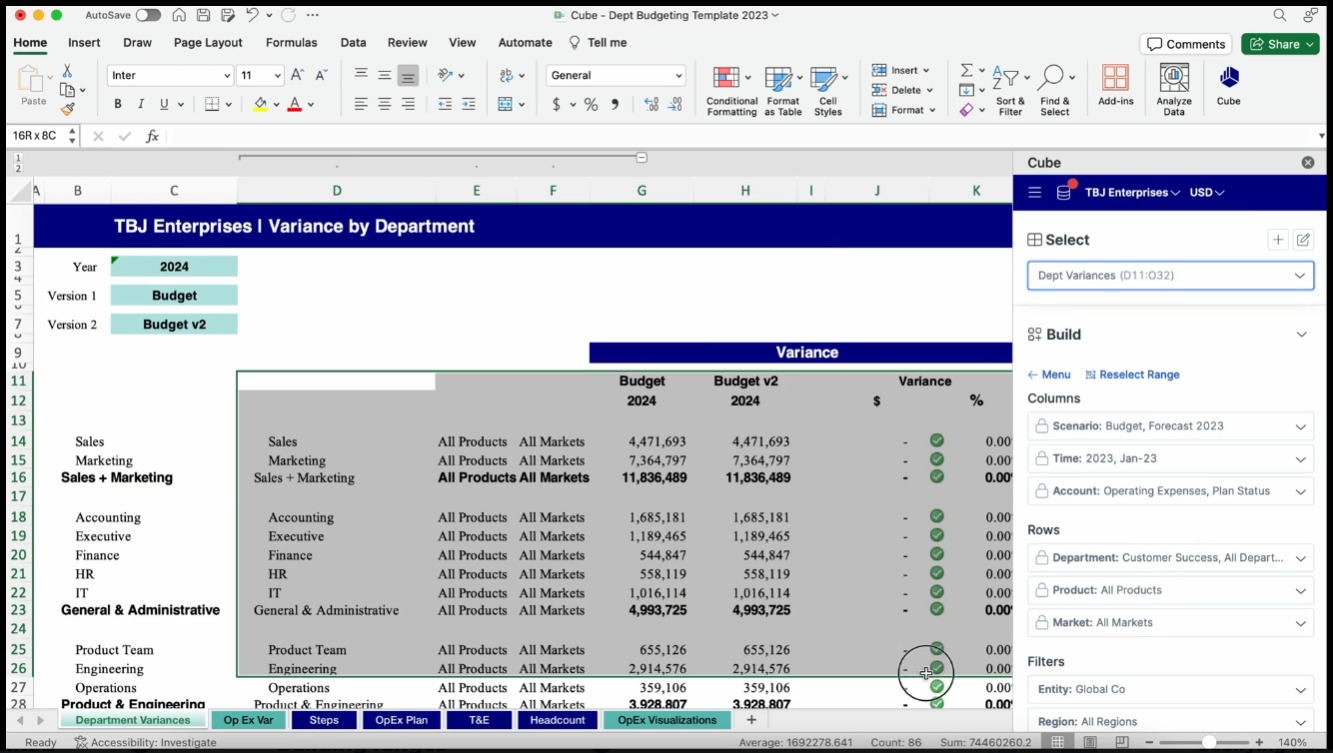

1. Cube

Cube is a comprehensive FP&A solution for businesses looking to improve efficiency and accuracy in their accounting operations, financial forecasting, and budgeting.

It's a spreadsheet-native platform that helps finance teams make smarter business decisions by automating laborious manual processes while reducing errors.

With Cube, tedious FP&A and accounting tasks (like financial consolidation) are automated so finance teams can focus on strategy, planning, and corporate performance.

Financial experts can work within the familiar spreadsheet environment while enjoying all the benefits of a modern FP&A tool.

Features:

- Easy collaboration allows multiple users to access and work on the same financial data, facilitating collaboration and decision-making.

- Budget control allows for the setting of custom budgets for different departments or projects and track actual financial performance.

- Custom templates quickly generate financial reports and analytics.

- Visualize data in a clear and easy-to-understand format, represented as charts and graphs that are easily exported and shared with others.

- Scenario planning aids in planning and modeling by allowing for the creation and analysis of different scenarios to determine their potential impact on the business's financial performance.

- Role-based permissions grant access to data with custom permission levels for users based on their roles within the organization.

Pricing:

Pricing for Cube varies depending on the selected plan. The Cube Go plan starts at $1,500/month, Cube Pro is $2,800/month, and the Enterprise plan is available at custom pricing.

Ready to get started? Try Cube today.

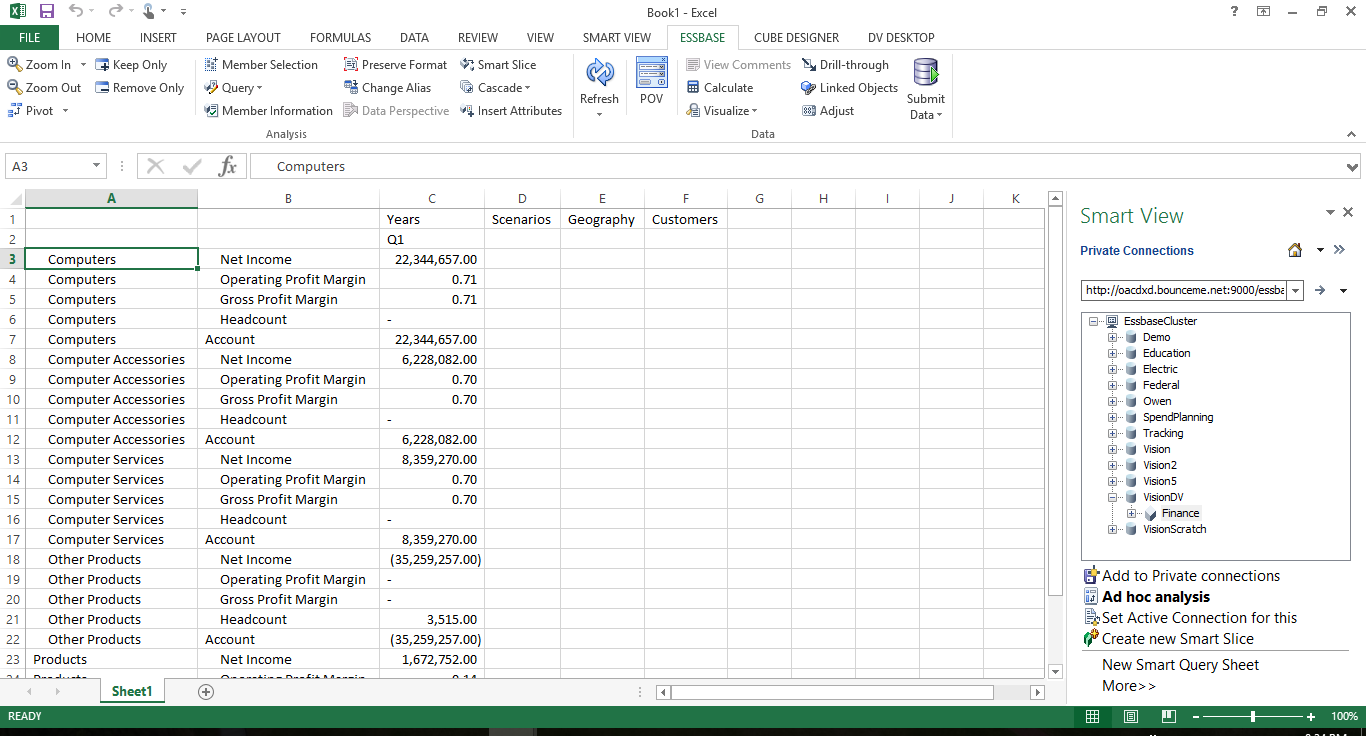

2. Oracle Essbase

.jpeg?width=150&height=75&name=oracle-hyperion-essbase%20(1).jpeg)

Oracle Essbase is a database management system for online analytical processing (OLAP) and business intelligence (BI) applications. It's designed to provide analysis of large, complex data

The tool integrates with other Oracle BI tools, such as Oracle BI Enterprise Edition. Oracle Essbase also includes a query and reporting tool called Smart View, which allows users to create and share reports, pivot tables, and charts.

Features

- Real-time data analysis provides timely insights.

- Data aggregation and consolidation come from multiple sources.

- Integrates with the most commonly used office software globally, Microsoft Office.

- Automated data loading and extraction save time and reduce manual effort.

Pricing:

Oracle Essbase’s price is based on the custom needs of the user, and requires potential clients to reach out for a quote.

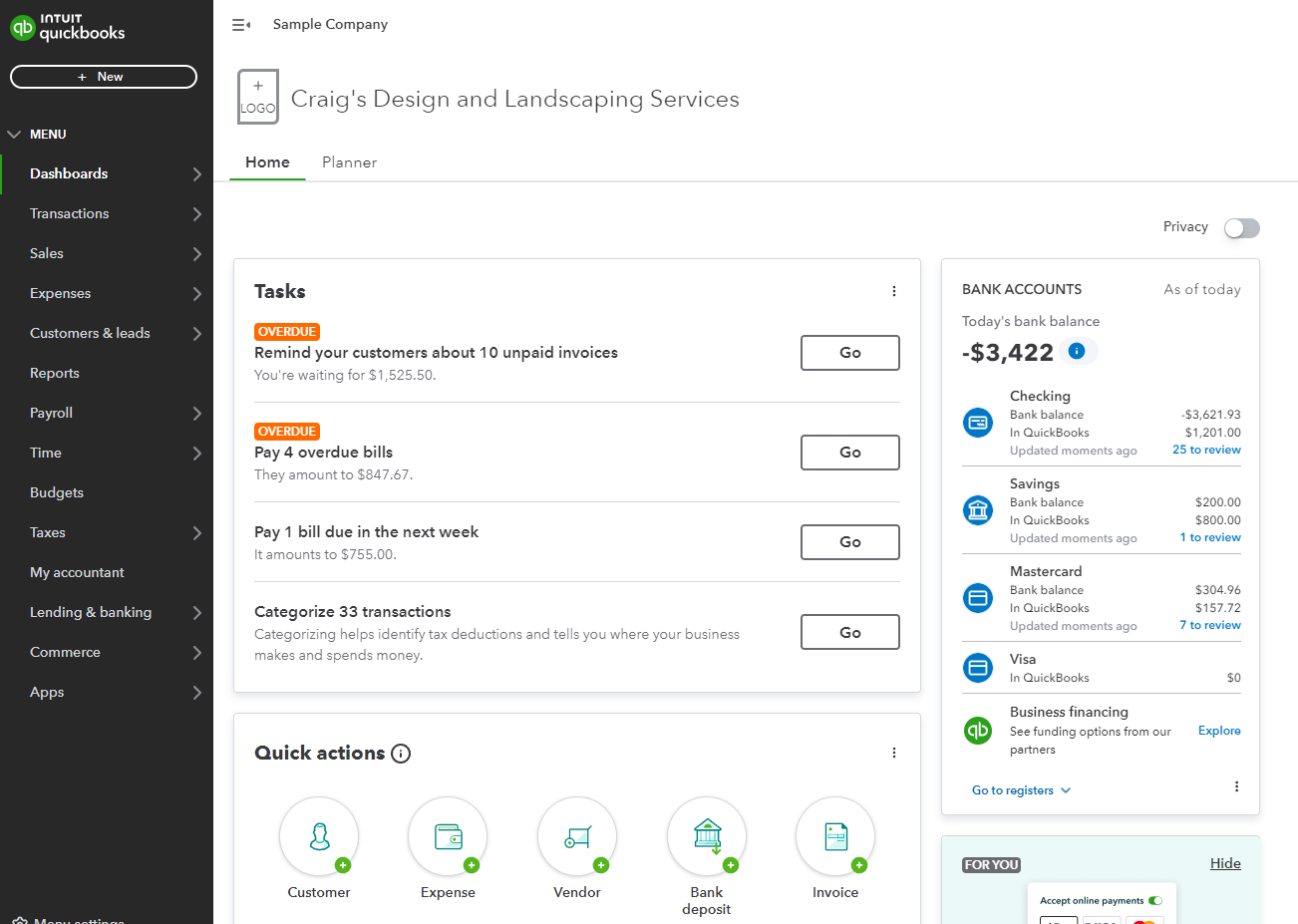

3. QuickBooks

Intuit’s QuickBooks is an accounting software developed and marketed by Intuit.

It’s designed for small and medium-sized businesses and offers invoicing, expense tracking, financial reporting, and more to help businesses manage their finances.

As accounting software, QuickBooks can work as a cash planning tool in a pinch.

QuickBooks is available in different versions including QuickBooks Online and QuickBooks Desktop. It can also be integrated with other software and services, such as payment processors and e-commerce platforms.

Features:

- Track project expenses and billable hours accurately, facilitating project management.

- Monitor finances in real-time and monitor cash flow.

- The general ledger records and categorizes financial transactions.

Pricing:

QuickBooks has various pricing tiers, including Self-employed at $30/month and Advanced at $200/month, with additional options for QuickBooks Desktop and enterprise solutions.

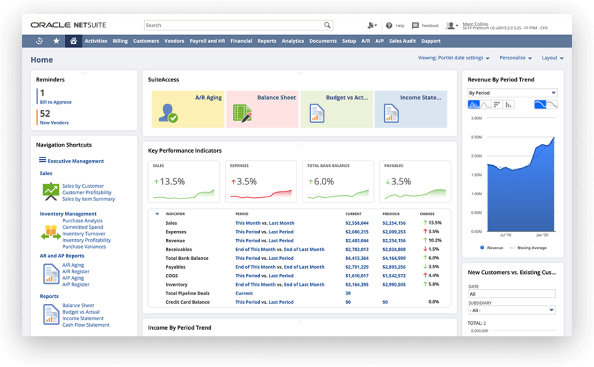

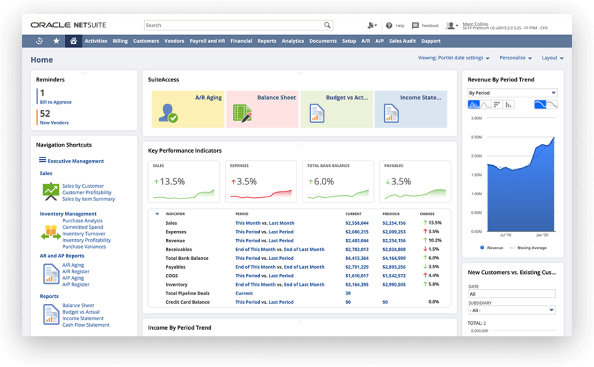

4. NetSuite

NetSuite is a cloud-based enterprise resource planning (ERP) software for financial management, customer relationship management (CRM), inventory management, ecommerce, and more.

Also, NetSuite enables users to see real-time business insights at the click of a button and uses business intelligence to help with forecasting and scenario planning.

Features:

- Supply chain management and manufacturing capabilities optimize operations and reduce costs.

- Human resources and payroll features help ensure compliance and efficiency.

- Business intelligence and reporting provide tools for generating reports and analyzing data.

- Inventory and order management capabilities facilitate accurate inventory levels easing order fulfillment.

Pricing:

Although NetSuite doesn’t list its pricing, sources say that users pay an annual licensing fee (calculated individually), a one-time implementation cost ranging from $25-100,000, plus additional costs for customizations, integrations, and training.

Read the review: NetSuite vs. QuickBooks

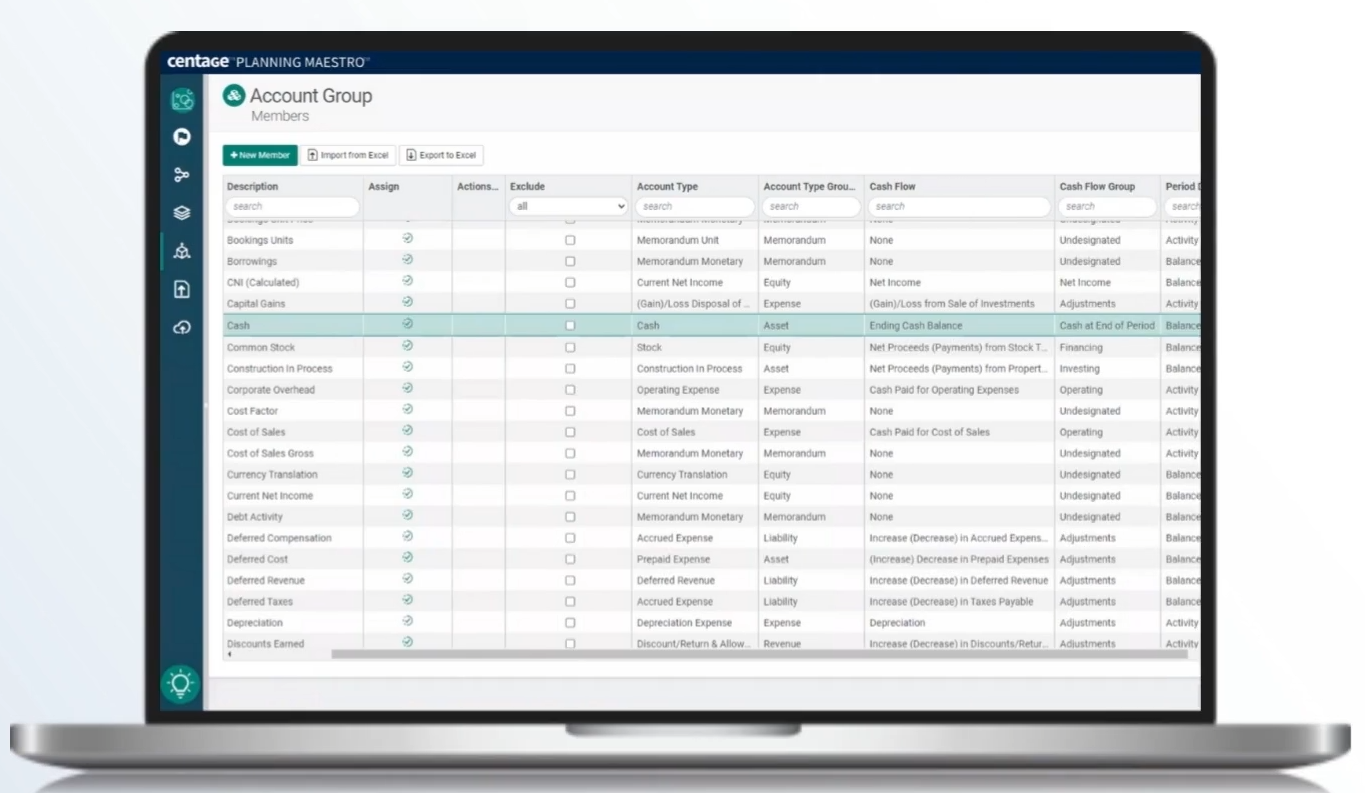

5. Centage Planning Maestro

.png?width=150&height=83&name=centage-vector-logo-2021%20(1).png)

Centage Planning Maestro is a software product developed by Centage Corporation. Centage Planning Maestro is a budgeting and forecasting software designed for businesses to create and manage financial plans.

Financial managers can use Centage to synchronize their balance sheets and cash flow statements, drill down into data, and enforce their chart of accounts.

Features:

- What if/scenario analysis capabilities enable users to explore various scenarios to anticipate potential outcomes.

- Centralized database ensures data integrity and consistency across all financial operations.

- Visual reports and web-based dashboards for comprehensive data visualization and intuitive insights.

Pricing:

Centage offers a standard, professional, and enterprise plan, but requires potential users to request a quote for more details.

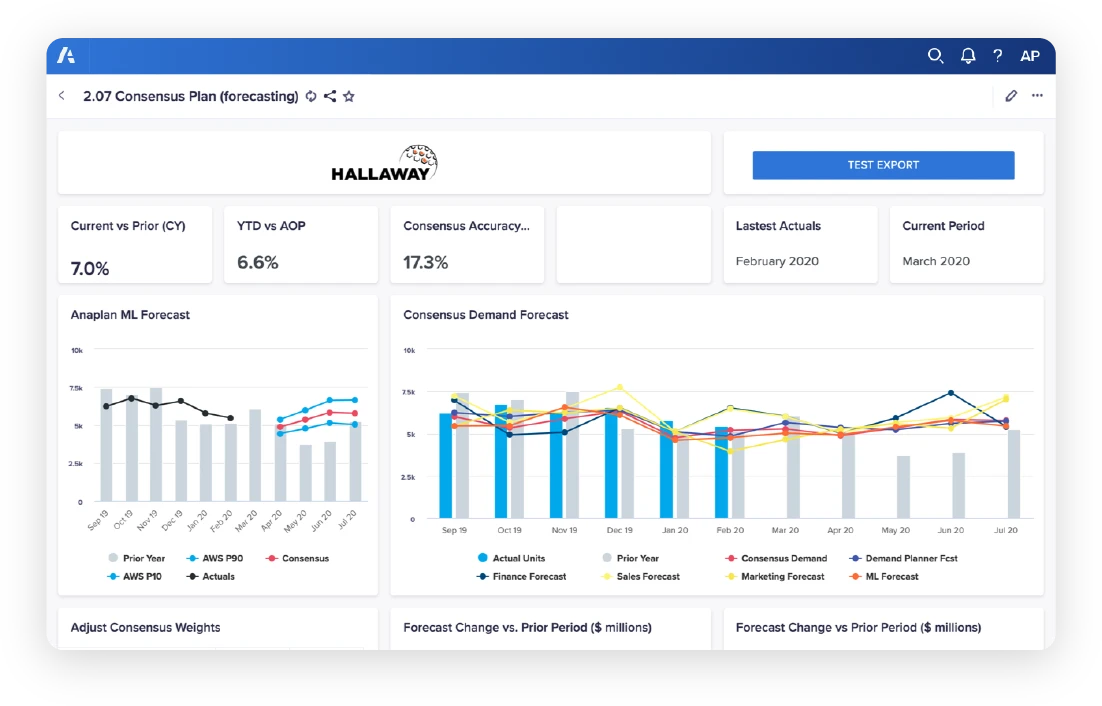

6. Anaplan

.png?width=150&height=33&name=Anaplan_logo%20(1).png)

Anaplan is an enterprise-grade planning platform that enables companies to connect, model, and optimize their business processes. It’s designed for finance teams and business users who need to build robust models for embedding comprehensive financial, sales, HR, and supply chain plans.

The solution includes an application platform that enables organizations to create or modify financial planning, and Anaplan utilizes its proprietary Hyperblock technology and enables businesses to build what-if scenarios.

Features:

- Modeling capabilities allow users to create intricate business models with tailored specifications.

- Data management tools ensure data accuracy, integrity, and accessibility.

- Collaboration capabilities include real-time sharing and editing of planning models.

Pricing:

According to various sources, pricing estimates range from $30,000–$50,000 or higher depending on the scope and scale of the project.

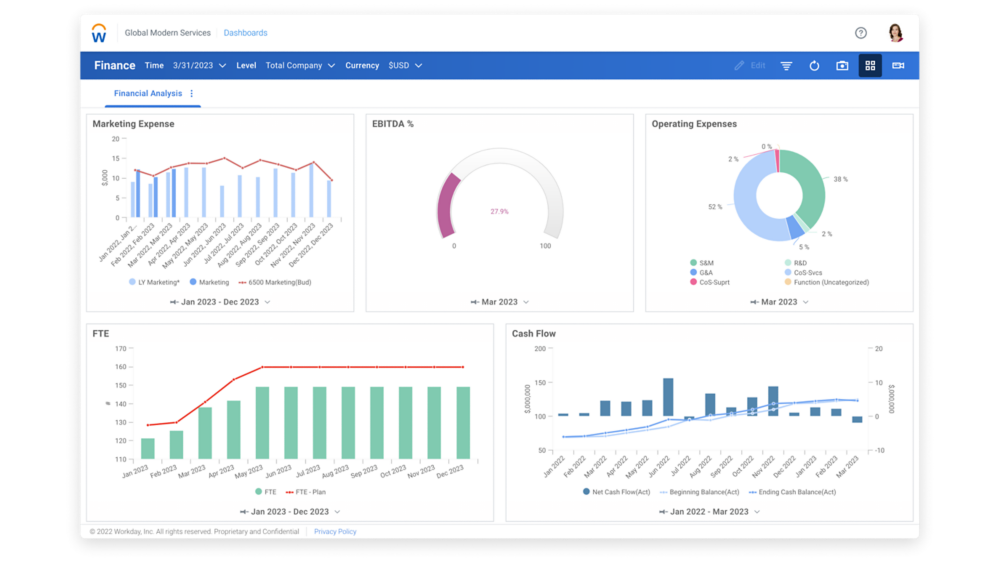

7. Workday Adaptive Planning

Workday Adaptive Planning is a financial planning and analytics tool for budgeting, planning, and reporting. The software automates and streamlines financial processes, allowing for real-time collaboration and reporting.

It integrates with other systems such as ERP, Salesforce automation (SFA), customer relationship management (CRM), and more. Workday Adaptive Planning is best suited for companies who already use other Workday solutions.

Features:

- Membership and event management features aim to facilitate efficient resource allocation and planning.

- Data integration capabilities help organizations consolidate data from various sources.

- KPI monitoring in real-time provides insights into business performance and trends.

- Roadmapping and idea management tools allow organizations to plan and execute strategic initiatives effectively.

Pricing:

Workday Adaptive Planning does not provide pricing information on its website, and requires potential users to contact them for a quote.

Read the full review: Anaplan vs Adaptive vs Planful vs Vena vs Datarails vs Cube.

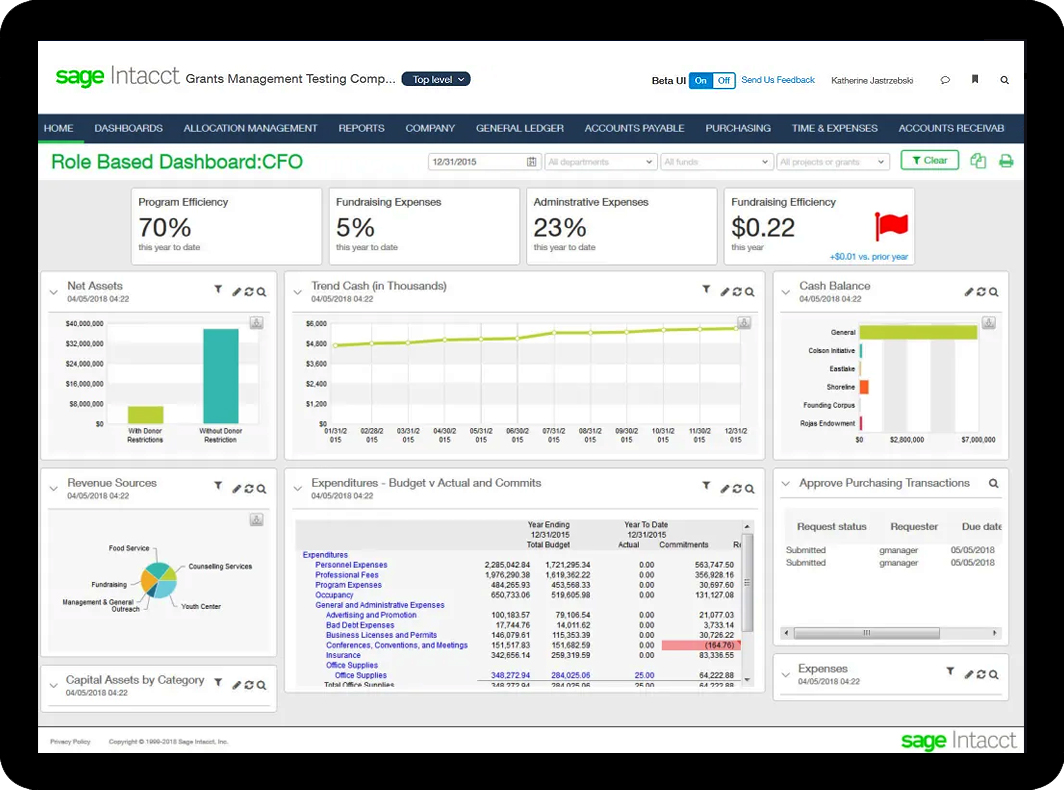

8. Sage Intacct

Sage Intacct is a financial management and accounting software that caters to small to midsize businesses. The platform streamlines core accounting tasks including accounts receivable and payable, budgeting, financial reporting, and cash flow forecasting.

Sage Intacct offers reporting capabilities that enable users to access real-time insights into their financial health and user-defined dashboards that enable users to gain visibility into their business.

Features:

- Vendor management features help streamline procurement processes.

- Invoice customization allows the tailoring of invoices to their specific needs and branding.

- Reporting and analytics capabilities enable users to generate customized reports and analyze financial data.

- Streamlined collaboration among team members through document sharing, and communication tools.

Pricing:

Online sources note that prices start at $10,320/year, and range up to $35,000/year.

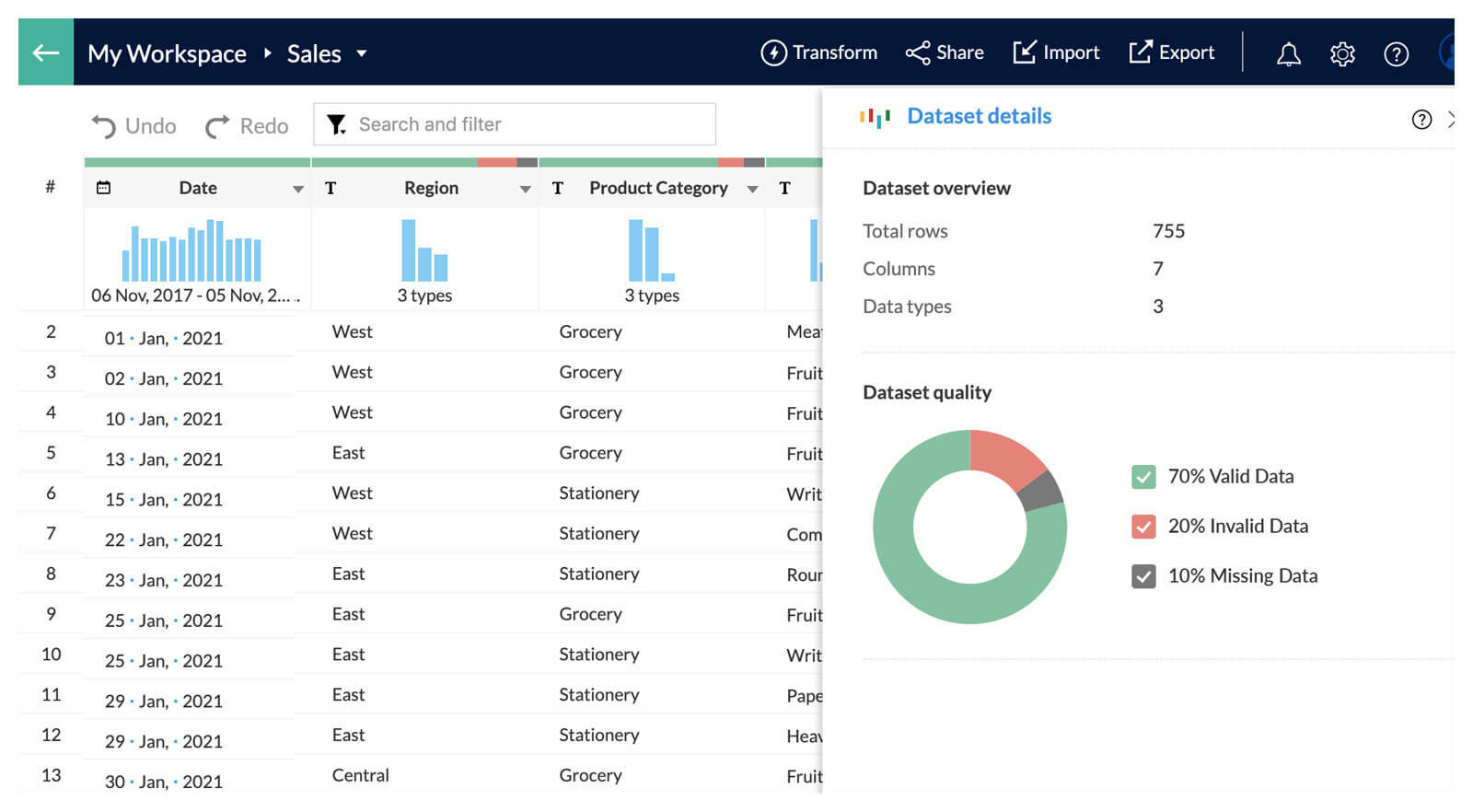

9. Zoho Analytics

Zoho Analytics allows businesses to collect, store, and analyze data, create and share reports, and perform complex data analysis.

It integrates with other Zoho products and third-party applications and includes data visualization tools and real-time collaboration.

It also offers a self-service option so users can create reports and dashboards without coding.

Features:

- Data import and integration from various sources ensure a unified view of business data.

- Data preparation tools cleanse, transform, and enrich data for analysis.

- Advanced analytics, including predictive analytics and statistical modeling, extract insights from data.

Pricing

- Basic: $24/month

- Standard: $48/month

- Premium: $115/month

- Entreprise: $455/month

- Custom pricing available by quote

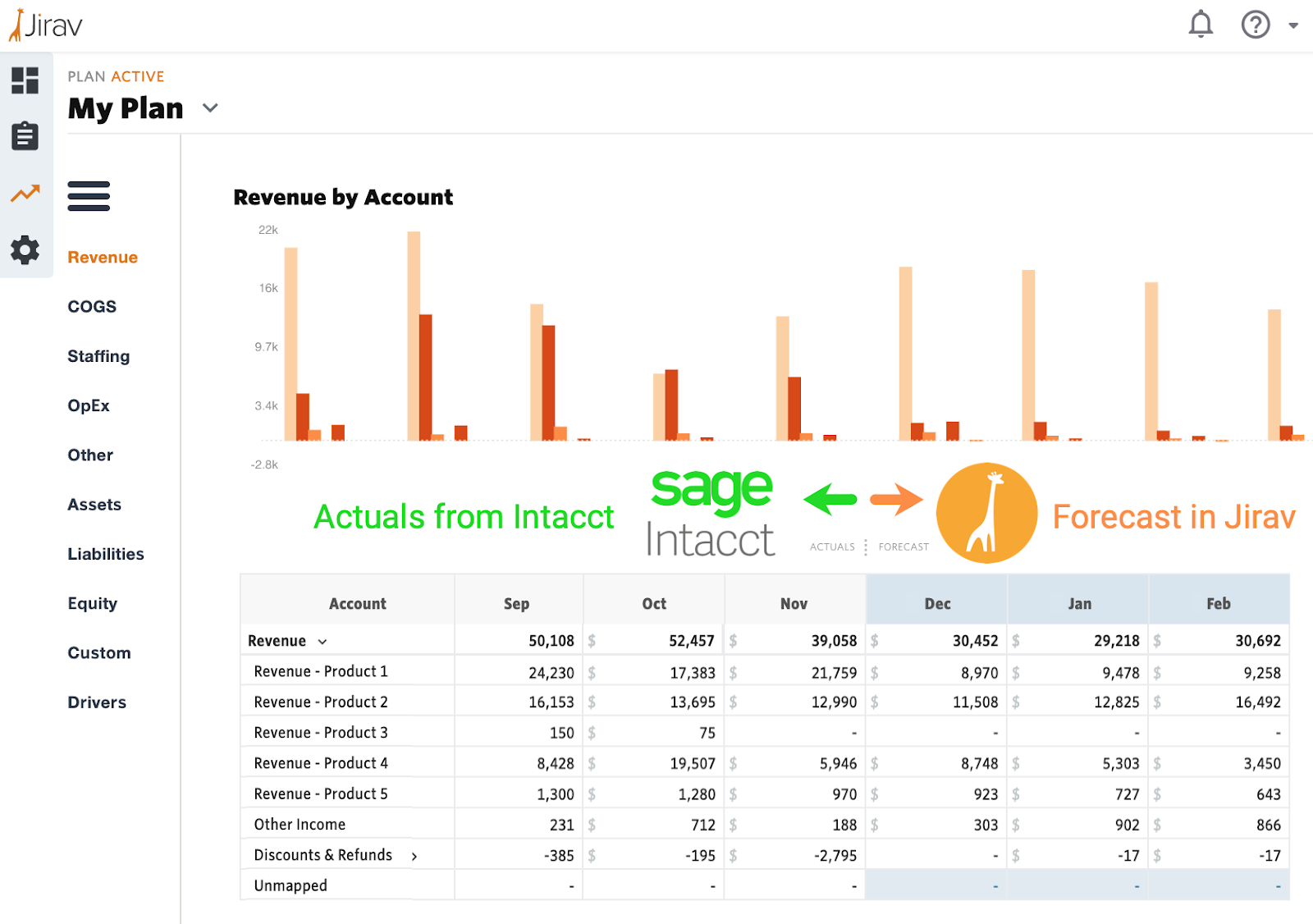

10. Jirav

Jirav is a financial analytics software offering budgeting, forecasting, reporting, and dashboarding.

The Jirav platform provides financial insights to support strategic decision-making and reduces manual planning thanks to its integration options.

Features

- Driver-based planning enables users to align financial forecasts with key operational drivers.

- Profit/loss statements provide visibility into revenue, expenses, and profitability metrics.

- General ledger capabilities track and manage financial transactions.

- Custom dashboards allow tailoring to users’ specific needs, consolidating relevant financial metrics and KPIs for monitoring and analysis.

Pricing:

Pricing for Jirav starts at $20,000/year and the next level requires custom pricing.

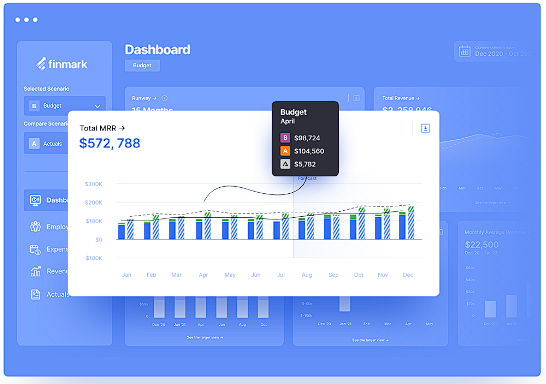

11. Finmark

Finmark is a strategic finance platform for financial analytics.

It automates data, analyzes business performance, and provides insights to support decision-making.

Finmark allows users to test assumptions with scenario planning, access insight into runway and burn rate metrics, and share financial models with team members and investors. It’s geared toward SMB and accounting professionals. It’s geared toward SMB and accounting professionals.

Features

- Real-time data analysis brings marketing, sales, and financial data together.

- Scenario planning allows testing of various financial scenarios.

- Centralized budgeting allows users to bring expenses, analysis, and budget forecasting to one location.

- Automated hiring planning forecasts future staffing needs.

Pricing:

Finmark’s pricing starts from $50.00/month, and increases based on your company’s annual revenue.

12. Jedox

Jedox is designed to help organizations accelerate their financial planning and analysis activities. The software leverages artificial intelligence and machine learning to provide data cleaning, forecasting, and smart commentaries. It also integrates with familiar tools such as Excel, Qlik, Power BI, and Tableau.

Features:

- Automated data handling automates the export, preparation, and consolidation of financial and non-financial data.

- Fast and detailed analysis provides opportunities to identify correlations and discrepancies in the data.

- Pre-built models and accelerators streamline financial planning and analysis processes.

- Rolling forecasts allow users to stay updated with the latest financial trends and respond quickly to changes.

- Visualizations of analyses and reports aim to allow organizational members to understand and utilize financial insights.

Pricing:

Jedox offers three pricing tiers, Business, Professional, and Performance. All plans require price quotes.

13. Spotlight Reporting

Spotlight Reporting is a comprehensive financial reporting, forecasting, and consolidation software designed to enhance decision-making for businesses and streamline advisory services for accounting firms.

By presenting data in a visually engaging format, Spotlight Reporting aims to allow users to uncover valuable insights and make informed strategic decisions. The platform integrates with accounting systems like Xero and MYOB.

Features:

- Multi-entity consolidation allows consolidation from up to 500 entities, with multiple currencies, and performs eliminations to aggregate and benchmark performance across networks and industry verticals.

- High-level dashboards give overviews of key business metrics using drag-and-drop dashboard creation.

- KPI reporting tracks both financial and non-financial KPIs with a wide selection of displays and charts.

- Client-specific reporting generates tailored reports and forecasts.

- Flexible forecasting rules utilize three-way cash flow forecasting with customizable rules and outputs suitable for banks and boards.

Pricing:

Pricing starts at $295/month for a basic plan and ranges up to Enterprise options, which require custom pricing.

More financial analysis software

Need more specific software options? Check out these categories.

Financial analytics tools for small business

- Cube

- Zoho

- Jirav

- Finmark

- Vena Solutions

Financial analytics software for banks

These software solutions are designed to handle the complex financial analysis requirements of banks.

- Cube

- QuickBooks

- NetSuite

- Oracle Essbase

Financial analytics platforms for investors

- Cube

- Anaplan

- Centage Planning Maestro

- Sage Intacct

Choose the best financial analysis software

Selecting the best tool for financial analytics is crucial for optimizing your FP&A processes. Each tool mentioned in this article offers unique features and capabilities designed to enhance data analysis, financial modeling, budgeting, forecasting, and reporting. By understanding your specific needs and the strengths of each software, you can choose the one that best fits your business requirements.

Whether you're a small business looking for cost-effective solutions, or a larger organization needing advanced capabilities there is a suitable financial analysis software for every business.

Book a demo today to see how Cube can help your business.

.png)

![13+ best financial analysis software for FP&A teams [2024]](https://www.cubesoftware.com/hubfs/Financial%20Analysis%20Software%20Featured%20Image.png)

.jpeg?width=150&height=75&name=oracle-hyperion-essbase%20(1).jpeg)

.png?width=150&height=83&name=centage-vector-logo-2021%20(1).png)

![The 11+ best Oracle Essbase alternatives [updated for 2024]](https://www.cubesoftware.com/hubfs/oracle%20essbase%20featured%20image-1.png)