Key takeaways

- The LTV/CAC ratio helps you measure your return on Sales and Marketing spend

- CAC stands for customer acquisition cost, which is the amount you spend (on average) to acquire new customers

- LTV stands for customer lifetime value, which is the amount of revenue you expect the average customer to generate for you over their time as a customer

- The ideal LTV/CAC ratio for early-stage (high-growth) companies is 3:1

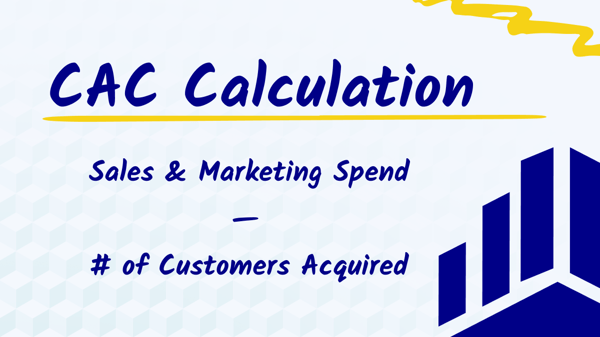

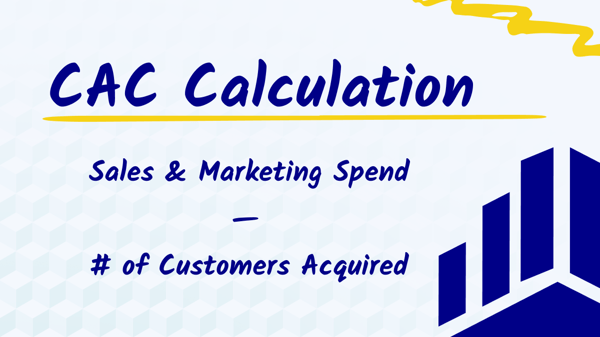

What is customer acquisition cost (CAC)?

CAC stands for customer acquisition cost.

It means exactly what it says: how much must we spend (in sales & marketing dollars) to acquire a customer?

To calculate this, divide the total marketing and sales expenses by the number of new customers acquired for a given period.

CAC = (Sales & Marketing Spend) / # of New Customers Acquired

Now, at this point, you might be wondering:

- Aren't there different kinds of customers?

- Aren't some customers more expensive to acquire?

- What is our existing customer retention like?

And you're not wrong—there are different kinds of customers. And some customers are more expensive to acquire.

This is when cohort analysis becomes handy because you can get specific about metrics like CAC for a targeted subset of customers.

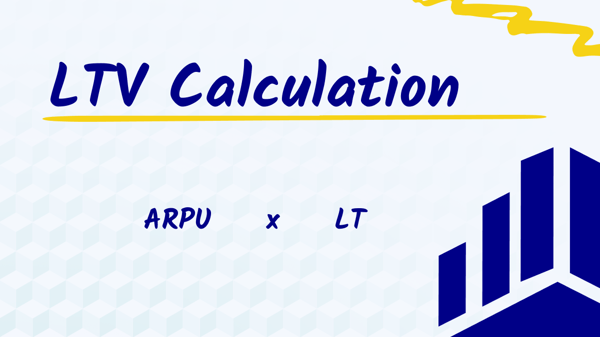

What is customer lifetime value (LTV)?

LTV stands for Lifetime Value. It's the amount of revenue you expect the average customer to generate during their time as a customer.

There is no universally agreed way to calculate lifetime value. However, unless you have a specific reason for using a different formula, we like to keep it simple:

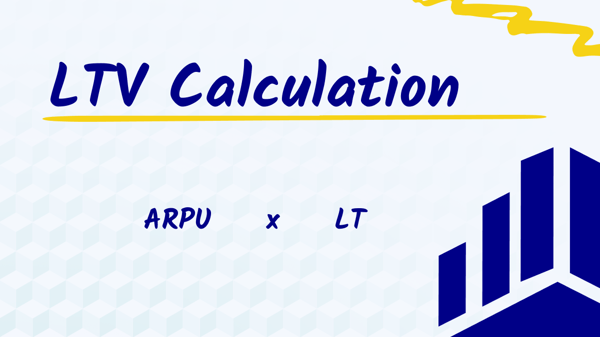

Your LTV is made up of your average revenue per user (ARPU) and your customer's lifetime (LT).

It looks like this:

LTV = ARPU * LT

...now, if you're thinking that looks suspiciously simple, it's because it is.

We have to calculate ARPU and customer lifetime first.

Let's get started on those.

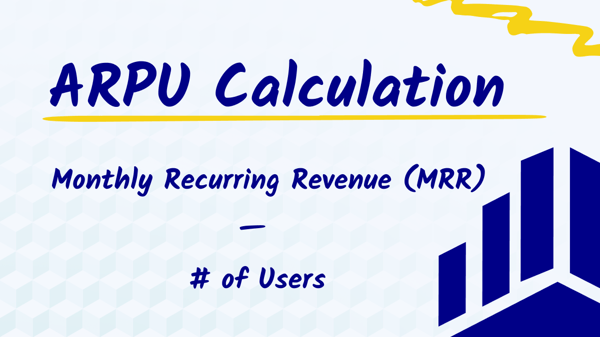

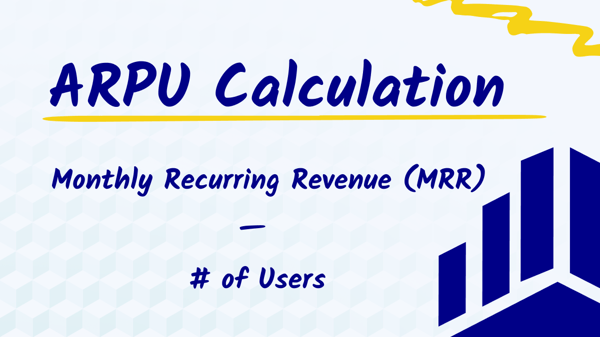

Calculating average revenue per user (ARPU)

Average Revenue Per User, like LTV, doesn't have an official calculation.

But it does have a generally accepted one, which is monthly recurring revenue divided by your number of users.

ARPU = MRR / # of Users

This should be a pretty easy calculation to make.

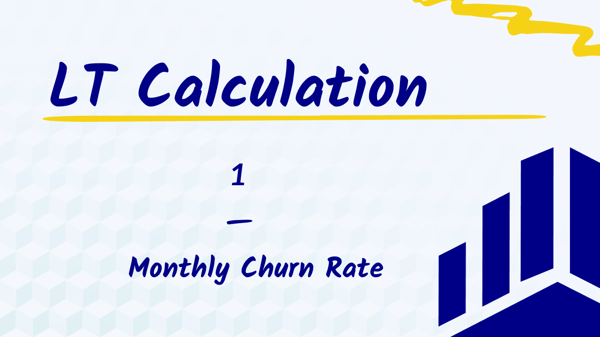

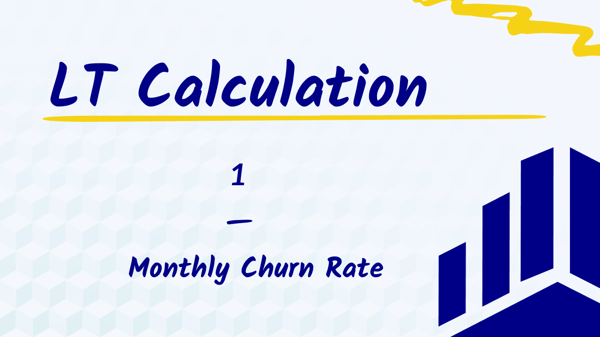

Customer lifetime (LT)

Customer lifetime (LT) is when you expect a customer to stay with you.

It makes sense that, to calculate lifetime value, you must first know the customer's lifetime.

But this might feel like a strange calculation, especially if you're working with a newer company—how can you know your customer lifetime without years of historical data insight into retention rates?

Fortunately, there's a simple approximation you can make if you know your churn rate.

Customer Lifetime = 1 / Monthly Churn Rate

(You can use monthly or annual churn; just make sure the rest of your calculations also use the time period you picked.)

For example, if you see 0.5% churn each month, your LT = 1/0.005 = 200 months = 16 years and 8 months = 16.67 years.

Since we're using monthly metrics like MRR and monthly churn rate in this post, we also want to keep Customer Lifetime in months.

You can use ARR, average annual recurring revenue, or yearly churn rate, but that's not recommended unless you know your business model converts a few high-value customers in long sales cycles.

Calculating LTV

Now that you have your Average Revenue Per User (ARPU) and your Customer Lifetime (LT), you can calculate your Customer Lifetime Value (LTV or CLTV).

To calculate LTV, just multiply the two numbers together.

LTV = ARPU * LT

So if your average revenue per user is $100 (per month) and your expected customer lifetime is 200 months, then 100 * 200 = $20,000.

Again, it's important to keep your time segments consistent. Don't calculate LT in years and ARPU in months!

What is the LTV/CAC ratio?

The LTV to CAC ratio is the money you spend to acquire customers to the revenue you get from those customers.

In other words, it's a financial ratio that measures the ROI on your sales and marketing spend.

The ideal ratio for early-stage (high-growth) companies is 3:1.

In other words, those companies will ideally calculate LTV that's 3x their CAC.

How do you calculate the LTV/CAC ratio?

Once you have your LTV and CAC, calculating the LTV to CAC ratio is as easy as dividing LTV by CAC.

Like this:

LTV/CAC ratio = LTV ÷ CAC

Another way to gut-check this metric: LTV should be 3x higher than CAC.

Why is the LTV/CAC ratio important to track?

At a very high level, the LTV/CAC ratio tells you how sustainable your business model is.

When you analyze it a little more closely, it can tell you a few other things:

Who are your quality customers?

Especially when you calculate this ratio during cohort analysis, the LTV/CAC ratio tells you who your most profitable customers are.

Once you know this, you can focus more of your marketing spend on acquiring them.

How much should you spend on acquiring customers?

The LTV/CAC ratio for your entire consumer base indicates your "average" customer.

This means that when you dig deeper into the data and look at individual cohorts, you have a benchmark to determine whether or not you're spending too much on acquiring certain types of customers.

Ratio guidelines

You're probably missing out on business if your ratio is above 3:1 (say, a higher ratio like 5:1). This means you have the funds to expand your sales & marketing team and go after some tougher-to-acquire customers.

If your LTV/CAC ratio is below 3:1 (say, a low ratio like 2:1 or 1:1), then you're spending too much on sales and marketing or need to increase the LTV of your existing customers.

LTV/CAC ratio by cohort

The real power of the LTV/CAC ratio is when you segment it by cohort.

This metric tells you if your company is headed in the right direction. It tells you about the "average customer."

This is helpful information, but it's not specific enough unless all your customers are the same. (Which they probably aren't.)

If you're familiar with the Pareto principle, sometimes called the 80/20 rule, you know that a subset of your paying customers is responsible for most of your total sales or revenue.

Calculating your LTV/CAC ratio by cohort helps you identify exactly who those customers are.

In other words, this kind of individualized segmentation can uncover incredible insights about who your most profitable customers are.

...and about how you should consider targeting your marketing campaigns going forward.

What is the industry standard LTV to CAC ratio?

The ideal LTV/CAC ratio is 3:1, which means you make 3x of what you spend to acquire a customer.

However, your LTV/CAC ratio should be between 3-5 if you're scaling a SaaS business.

So the gold standard of 3:1 is a minimum in some cases.

.webp?width=600&height=314&name=LTV_CAC-Ratio-Calculation%20(1).webp)

If you're trending below that, we've provided some suggestions to get back on track in the next section.

External factors impacting LTV/CAC

While internal factors play a significant role in shaping the LTV/CAC ratio, businesses must also pay close attention to external forces that can influence its dynamics.

Economic Conditions: Economic fluctuations can directly affect consumer behavior and purchasing power, thereby influencing the LTV/CAC ratio. During economic downturns, customers may become more price-sensitive, leading to longer payback periods and lower customer lifetime values.

Regulatory Changes: Regulatory changes, ranging from data privacy regulations to industry-specific compliance requirements, can impact customer acquisition strategies and operational costs. Non-compliance or failure to adapt to regulatory changes can lead to reputational damage and financial penalties,

Industry Trends: Emerging industry trends can create both challenges and opportunities for businesses aiming to improve their LTV/CAC ratio. Rapid technological advancements, shifting consumer preferences, and disruptive innovations can alter market dynamics and competitive landscapes.

Competitive Pressures: Intense competition within industries can drive up customer acquisition costs and exert downward pressure on customer lifetime values. Competitors vying for market share may engage in aggressive pricing strategies or launch innovative marketing campaigns, necessitating strategic differentiation and value proposition alignment.

How to improve your LTV/CAC ratio

If your ratio is low, it's either because your CAC is too high or your LTV is too low.

Here are some strategies to improve each:

How to reduce customer acquisition cost (CAC)

Focus on more efficient channels: Content marketing, ad retargeting, and email marketing are all cheaper (and more efficient) marketing channels than going entirely outbound or running ads to a cold audience.

Go after different customers: Not all customers cost the same to acquire. Study the market: is there any low-hanging fruit you haven't gone after? Could you be using better prospecting tools? Are you underspending when it comes to specific personas?

Increase your conversion rates: When your conversion rates are better, your CAC decreases because more customers will convert for the same amount of spend. Invest in user research and copywriting to improve your conversions.

Simplify your sales cycle: Longer sales cycles tend to be more expensive. How can you shorten or speed up your sales cycle?

How to increase customer lifetime value (LTV)

Since churn directly affects LTV, anything you do to reduce your revenue churn will also positively affect your LTV.

Said differently, anything you can do to increase your customer lifetime (LT) will also increase your LTV.

Likewise, increasing your average revenue per user (ARPU) also increases LTV. So there's a lot to work with!

Experiment with pricing to increase ARPU: Raising your prices for new customers, assuming you don't also increase your churn rate, will lead to a higher LTV. This is worth experimenting with!

Improve your customer success experience to reduce churn: Many companies churn because of a frustrating customer success experience. When you invest in customer retention, you keep customers around longer, thus increasing their average lifetime value.

Offer expansions to increase ARPU: Up-sells, cross-sells, and expansions are all powerful ways to increase your ARPU, increasing LTV.

Limitations and pitfalls of the LTV/CAC ratio

Like every metric, the LTV/CAC ratio is only a single piece of the story. Here are some of the things to keep in mind as you calculate and interpret your numbers:

Not accounting for all marketing and sales expenses when calculating CAC

Paid advertisements are the most obvious costs when calculating CAC. But they're far from the only cost.

You also need to consider the costs of your marketing efficiency (or lack thereof) including:

- Creative (design, copywriting, content marketing, and so on)

- Acquisition-related employee salaries

- Software (such as website hosting costs)

- Lead scoring and strategy

Among other costs.

Misrepresenting your CAC inflates your LTV/CAC ratio and paints a much rosier picture than reality.

The LTV/CAC ratio differs by cohort

We've said this many times, but it's worth repeating:

Since not all customers are created equal, their ratios will differ.

Assuming their ratios are similar is a huge mistake.

For example, if a small subset of customers is wildly profitable but your largest customer base only has a LTV/CAC ratio is only 1:2, you'll invite slow growth that you could have avoided.

An investor’s perspective of the LTV/CAC ratio

Investors consider the LTV/CAC ratio crucial when evaluating a company's sustainability and growth prospects. This metric provides valuable insights into how efficiently a company is acquiring and retaining customers over the long term.

Transparent communication regarding customer acquisition strategies and efficiency is paramount for investors. They seek alignment between a company's strategic approach, execution in customer acquisition and retention, and the resulting financial performance.

A high LTV/CAC ratio indicates that a company is effectively leveraging its resources to acquire customers who will generate significant value over their lifetime, suggesting strong growth potential.

Conversely, a low ratio may suggest inefficiencies in customer acquisition or retention strategies, which could raise concerns about the company's ability to sustain growth over time.

Therefore, it's essential for businesses to not only focus on optimizing the LTV/CAC ratio but also to communicate transparently about their efforts, challenges, and strategies for improving customer acquisition efficiency.

Conclusion: all about the LTV/CAC ratio

Now you know how to calculate and interpret the LTV/CAC ratio.

You also know how to use it to make aggressive, strategic recommendations to bolster your company's future growth.

Now I want to turn it over to you: what will you focus on this year? Lowering your CAC? Or raising your LTV?

Share this on LinkedIn and tag Cube to keep the conversation going.

.png)

.webp?width=600&height=314&name=LTV_CAC-Ratio-Calculation%20(1).webp)