Key takeaways on Mosaic Tech

- Mosaic is an FP&A platform designed for SaaS companies and small businesses.

- Mosaic focuses on visual appeal and simplicity.

- Mosaic's lengthy implementation process and lack of support for non-SaaS businesses makes it less suitable for other SMBs and enterprises.

Mosaic Tech review

Mosaic is a cloud-based FP&A solution that helps you view business operations through dashboards, reporting tools, automated data reconciliation, and forecasting.

Mosaic supports agile planning and quicker decision-making by consolidating insights across ERP, CRM, HRIS, and billing systems. It combines its software with a simple user interface, making it easier to collaborate, report, and make data-driven decisions.

Mosaic features

- Budgeting: Collects and analyzes data to help users understand their current and projected costs and revenues

- Data visualization: Offers different methods of visualizing data insights through dashboards, statistical graphs, and charts

- Version control: Regular updates so users have their most recent data

- Formulas: Budgeting formulas help estimate direct and indirect costs, operating and non-operating revenues, and more

- Custom reports: Edit and combine multiple department reports

Mosaic Analytics features

"Analytics" is one of Mosaic's main features. Their "Analysis Canvas" provides a collaborative space for teams to work on reports and surface insights. The "Metrics Catalog" allows teams to choose from various out-of-the-box reporting templates. Mosaic also automates data gathering, so finance teams don't have to manually extract insights.

Mosaic Planning features

"Planning" is the other primary feature of Mosaic's FP&A platform. Their “Financial Modeling tool” lets finance teams scale their financial planning with pre-configured components and flexible drivers. The “Collaboration platform” allows teams to set company goals and targets and get real-time updates on progress. Mosaic also provides a single financial planning platform for teams to have a unified view of the business.

Mosaic Arc AI

Mosaic Arc Ai is a chat-based assistant that helps finance teams supercharge their workflows, simplify complex tasks, and gain deeper insights.

Finance teams can automate insights and use chat-based AI prompts to identify performance drivers and generate trend reports.

Mosaic integrations

Mosaic supports ERP, CRM, HRIS, Billing, and data warehouse software integrations. Users can integrate popular platforms like BambooHR, Google Sheets, Chargebee, Xero, Salesforce, Stripe, etc.

Mosaic benefits

Based on user reviews, these are the main benefits of using Mosaic:

- Provides real-time data: Eliminates data silos and connects cross-system data to power real-time financial planning and analysis

- Easily integrates with other tools: Integrates with existing tech stack like ERP, CRM, HRIS, Data warehouse, and Billing systems

- Saves time and reduces error: Automates manual collection of data and provides a central platform for consolidating data

- Improves collaboration: Sharing and collaboration tools help users align their teams on metrics

Mosaic limitations

While some users appreciate Mosaic’s capabilities, others had challenges with the platform.

- Long implementation process: The implementation process can take several months. Some Mosaic alternatives, like Cube, have implementation times as short as two weeks.

- SaaS-focused: It's created for companies and doesn’t support non-SaaS operations.

- Challenging learning curve: Users have trouble understanding how to navigate the platform, and many spend several hours (and days) learning it.

- Difficulty integrating other tools: Data importation and integration can be time-consuming.

- Fixed metrics: Users have trouble manipulating back-end data to suit their business needs and must rely on the fixed metrics provided by Mosaic Tech’s platform.

- Data formatting: You can only export data in a few formats, which makes it harder for employees and shareholders to share and interpret data insights.

Mosaic pricing

Mosaic doesn't provide details of its pricing plans on its website or share them with other sources. However, here's a brief description of its different plans:

- Analytics: If you're a finance team looking to automate reporting and metrics, this plan offers analytics modules and automated HRIS, CRM, and ERP data connectors.

- Foundation: If you want to build strategic finance foundations, this plan includes analytics and planning modules plus data connectors.

- Growth: If you're looking to expand to advanced workflows, this plan offers analytics and planning modules, data connectors, vendor-level forecasting, metric builder, and more.

Top Mosaic competitors and alternatives

As an FP&A tool, Mosaic suits small-scale SaaS companies that aren’t looking to scale quickly. However, many companies fall outside of this group.

Does this sound like you? We’ve compiled a list of alternative software options that offer more functionalities to help you find a better fit.

1. Cube: Financial planning and analysis software

Customer review ratings: 4.6/5 on Capterra

Cube is a cloud-based FP&A platform that helps companies hit their numbers without having to sacrifice their spreadsheets. Cube helps your finance team work anywhere by natively integrating with Excel and Google Sheets. This allows you to plan, analyze, and collaborate with ultimate speed and confidence.

Many high-growth companies, like Instride and Figment, use Cube for their FP&A needs, including projects that require coordination across various teams like reporting and budgeting.

So, when comparing Mosaic vs. Cube, how do the two solutions stack up?

Cube can do almost everything Mosaic does and more.

Cube:

- Offers a true native Excel integration with all versions of Excel (no coding or formulas needed)

- Always remains reliable during sophisticated Excel calculations

- Onboards new accounts five times faster than the competition

- Uses simple formulas for creating reports

- Integrates with almost all source systems

Even more importantly, Cube was founded by a former CFO, building it with the problems and use cases of FP&A in mind from the start.

Features:

Use Cube to save time and improve your financial health with:

- Automated data consolidation: Centralize data from multiple systems into a single repository for easier collaboration.

- Shareable planning templates: Create new reports without starting from scratch, reducing time spent reinventing the wheel.

- Customizable dashboards and reports: Customize dashboards and reports to display different data types from various data sources, enabling easy presentation and understanding by teams and shareholders.

- Scenario planning and analysis: Forecast the financial impact of business decisions on revenues and expenses without committing any resources first.

- Bidirectional Excel and Google Sheets integration: Easily import and export information from and to Excel and Google.

- Integrates with everything: Integrate with popular ERPs (like NetSuite, Quickbooks Online, and Sage Intacct) and HRIS systems.

Pricing:

Mosaic Tech vs Cube

While both Cube and Mosaic Tech offer cloud-based FP&A solutions, Cube is much easier to use thanks to its native Excel and Google Sheets integration. This makes it a better fit for finance teams who prefer working in familiar spreadsheets without needing extensive training. Cube also supports faster onboarding, which is ideal for growing companies that want to make their team more productive quickly.

Book your free demo.

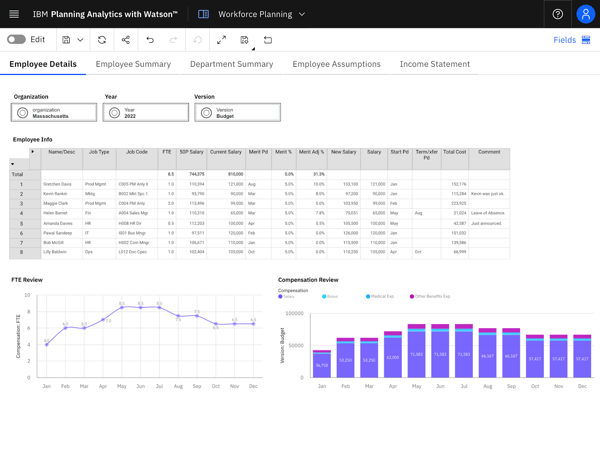

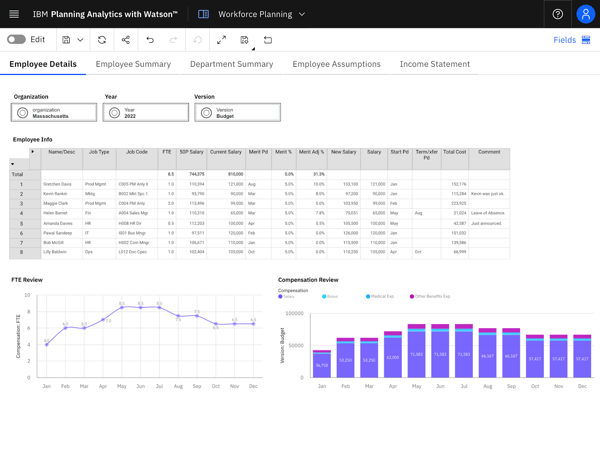

2. IBM Planning Analytics

.png?width=239&height=134&name=ibm-planning-analytics%20(1).png)

Customer review ratings: 4.3/5 on Capterra

IBM Planning Analytics is a business self-service analytics solution and a customizable modeling platform for your finance team.

With IBM Planning Analytics, you can gain automatic data insights from a custom planning workspace to improve your decision-making. The platform includes an interface for collaboration and an automated discovery feature for data analytics.

Additionally, IBM Planning Analytics offers an AI platform, IBM Analytics with Watson, which enables you to automate your planning and forecasting processes.

Features:

- Templates: Create plans, budgets, and forecasts.

- Scenario analysis: Perform what-if scenario analysis to test assumptions.

- Modeling: Build multidimensional models to analyze profitability.

- Dashboards: Communicate insights with visualizations.

- Collaboration: Collaborate and integrate plans across departments.

Pricing: IBM Planning Analytics offers customizable pricing plans according to the number of users and the type of license they need.

The prices below do not include tax:

- Essential: $825/month

- Standard: $1650/month

- Premium: Custom quote

Mosaic Tech vs IBM Planning Analytics

Both tools offer AI-powered forecasting capabilities. However, IBM Planning Analytics high cost and more advanced features may be overwhelming for smaller businesses with less technical expertise. Mosaic may be easier to implement for smaller businesses with its straightforward approach to financial modeling.

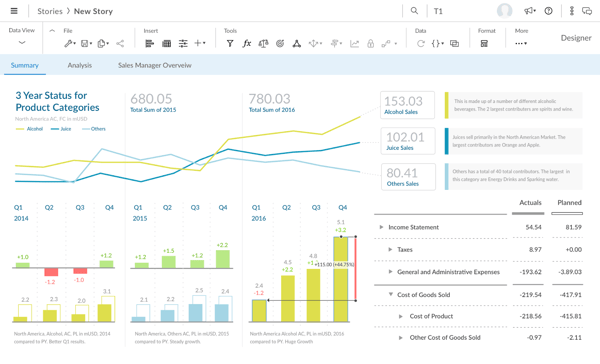

3. SAP Analytics Cloud

Customer review ratings: 4.2/5 on G2

SAP Analytics Cloud is a business intelligence solution. It provides users with business planning, predictive analytics, digital boardroom, and reporting capabilities.

With SAP Analytics Cloud, you can integrate Microsoft SQL and Salesforce into a single system. The platform offers data analytics functions, including ad hoc reports, planning and forecasting, and performance monitoring.

SAP Analytics Cloud lists technical requirements for configuring the software and offers multiple deployment methods. However, its long implementation time may not work for businesses that need software on the go.

Features:

- Big data: Search global data sets to find and discover data.

- Data governance: Connect to enterprise data governance software.

- Planning: Use data from budgeting and forecasting to help businesses plan and make decisions.

- Workflow support: Share data insights and reports within and outside the tool and through other platforms.

Pricing: SAP Analytics Cloud offers two levels of pricing and a 30-day free trial.

- Business: $384 per user/month

- Enterprise: Contact SAP Analytics Cloud for custom pricing

Mosaic Tech vs SAP Analytics Cloud

SAP Analytics Cloud offers enterprise-level features like big data analytics, enterprise data governance, and advanced reporting. However, its long implementation time and technical setup requirements may not be ideal for businesses looking for quick deployment. Mosaic might lend itself to faster implementation.

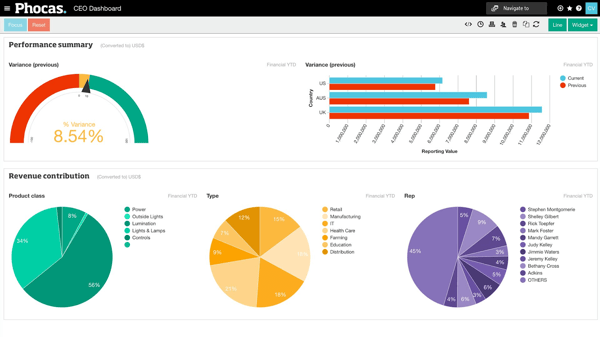

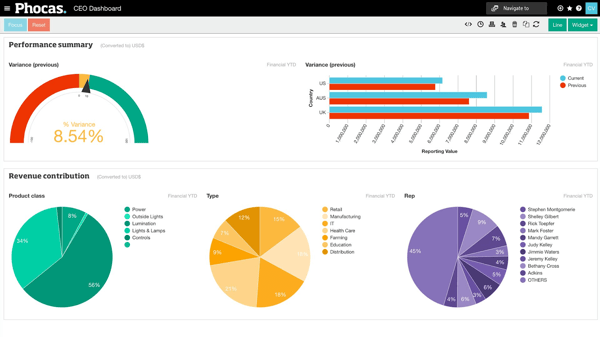

4. Phocas Software

Customer review ratings: 4.6/5 on G2

Phocas Software is BI and financial reporting software for non-technical users. Its platform provides data discovery, analytical capabilities, ad-hoc data interrogation, data consolidation, and modeling features.

It has an inbuilt CRM which serves as a single platform for interlocking CRM data with other business information. It also integrates with other ERP or CRM programs.

The platform features integrated transactional and geospatial data, which works with OpenStreetMap or Google API.

Features:

- Strategic planning: Visualize outcomes, define goals, and outline steps towards achieving them.

- Reporting: Ranges from high-level overviews to granular P&Ls.

- Dashboards: Provides charts and graphs for users to track metrics and KPIs.

Pricing: Phocas Software keeps its pricing info private, but sources say the platform is more expensive than the industry average.

Mosaic Tech vs Phocas

Phocas Software can be used by non-technical users who want business intelligence tools combined with financial reporting features. Its built-in CRM and geospatial data integrations make it useful for businesses managing complex data across multiple systems. Mosaic may be a better choice for SaaS companies that want to focus on team collaboration, rather than broader business intelligence capabilities.

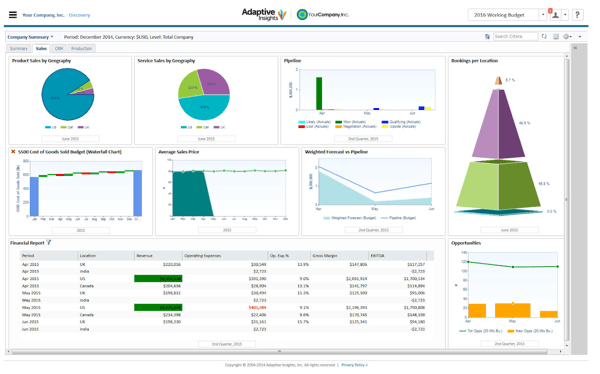

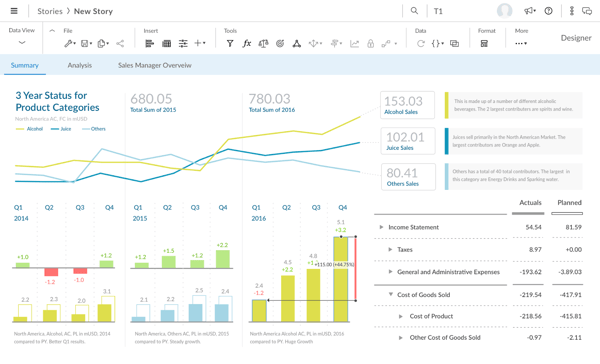

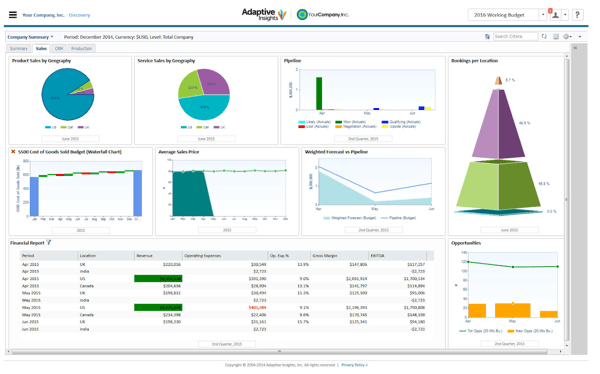

5. Workday Adaptive Planning

Customer review ratings: 4.3/5 on G2

Workday Adaptive Planning is a cloud-based software solution that offers modeling, analytics, and planning capabilities.

Their solutions help larger companies struggling with manual financial processes, data inaccessibility, data inaccuracy, limited scalability, weak data visualization, inefficient collaboration, disconnected spreadsheets, and more.

It focuses on large enterprises, midsize to large companies, and divisions of enterprises and is for companies who already use other Workday solutions.

Features:

- Forecasting: Create a recurrent planning process according to a customizable timeline.

- Idea management: Capture, organize, and evaluate ideas based on business impact.

- KPI monitoring: Assess progress on set objectives.

- Roadmapping: Develop and communicate strategy with stakeholders.

Pricing: Workday Adaptive Planning provides pricing information on its website, but various sources estimate that pricing starts at $5,900, depending on the organization's size.

Mosaic Tech vs Workday

Workday Adaptive Planning caters to larger companies or those already using other Workday solutions. Its focus on complex financial processes makes it suitable for organizations managing vast amounts of data but may feel overwhelming for smaller teams or SaaS companies. Mosaic provides a more straightforward platform for businesses that aren’t in the Workday ecosystem.

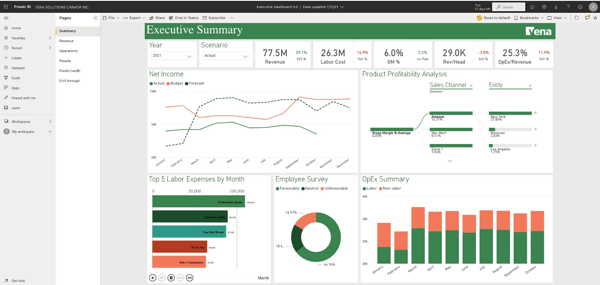

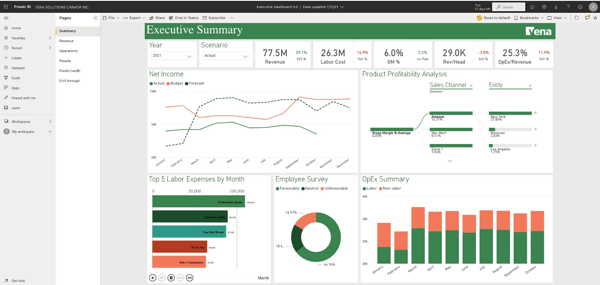

6. Vena Solutions

Customer review ratings: 4.5/5 on Gartner

Vena Solutions is a capEX and complete planning software for businesses using Excel for FP&A planning to scale.

It centralizes budgeting and workflows while leveraging Excel's format. The solution helps companies collaborate on their budgets and financial managers gain an overview of their financial operations.

Vena Solutions enables annual budgeting and ongoing business performance analysis on a monthly, quarterly, or yearly basis. It also provides reporting opportunities for variance analysis.

Features:

- Collaboration: Allows every department to import data into a single location.

- Budgeting, forecasting, and reporting: Build models and make projections using historical data.

- KPI tracking and benchmarking: Track and report KPIs and benchmarks.

- Integrations: Integrates with other business apps like Cpmview, Delaware, CIS Consulting, and more.

- Consolidation/roll-up: Consolidate numbers from multiple sources.

Pricing: Vena Solutions keeps its pricing data private, but sources say the product is more expensive than the industry average.

Mosaic Tech vs Vena

Vena Solutions is designed for businesses already comfortable working in Excel. Mosaic is for businesses who want to move onto a new spreadsheet platform. Both platforms offer real-time reporting, budgeting, and planning.

7. Anaplan

.png?width=150&height=33&name=Anaplan_logo%20(1).png)

Customer review ratings: 4.3/5 on Capterra

Anaplan is a suite of web-based planning and forecasting enterprise applications. It helps organizations make decisions by giving them real-time access to data sources.

The application offers the ability to create and manage models, share data across teams, and collaborate on projects.

Anaplan works to help businesses make decisions by evaluating options and trade-offs in the current environment in real time. Anaplan also offers signal analysis to uncover insights and adapt to changing conditions and markets.

Features:

- Data warehouse: House all data needed to create financial forecasts and maintain a single source of truth for all teams in the organization.

- Compensation plan modeling: Define the system's compensation packages and allowance plans.

- Integration: Integrate with other CRM and financial systems.

- Automation: Automate quality assurance and inspection processes for business products.

Pricing: Pricing for the Anaplan platform is not available online. The platform offers three tiers- Basic, Professional, and Enterprise.

Mosaic Tech vs Anaplan

Anaplan caters more to larger organizations with features like compensation plan modeling and a centralized data warehouse. Users may find it can handle larger datasets for enterprises. Mosaic, on the other hand, may appeal to smaller SaaS businesses looking for a simpler interface and visual planning tools.

Read more: Top Anaplan Alternatives

8. Planful

-jpeg.jpeg?width=251&height=132&name=Planful-Social-Card-dc025794d4b83bd77fe9208b65b99100%20(1)-jpeg.jpeg)

Customer review ratings: 4.2/5 on Capterra

Planful is a cloud-based financial modeling tool that provides you with data insights for agile planning and decision-making. Planful streamlines your financial organization processes, including budgeting, consolidating, and analytics.

With Planful, you can manage cash flow, annual operating planning, monthly close and consolidation, and multi-dimensional analysis. The platform also offers real-time performance analysis, reporting automation, workflow automation, and more.

Planful provides prebuilt connectors to common data sources, an open-access RESTful API, and homegrown software. You can integrate it with your accounting and finance systems, data warehouses, and business intelligence tools.

Features:

Pricing: Planful doesn't publicly share its pricing information. However, sources say it is one of the most expensive in the market.

Mosaic Tech vs Planful

Planful is better known for its GAAP-based budgeting and financial reporting, making it suitable for large enterprises with complex financial structures. However, its high price point and rigid structure can limit flexibility. Mosaic may be more appealing to smaller SaaS companies with a smaller budget.

Also read: Anaplan vs Adaptive vs Planful vs Vena vs Datarails vs Cube

9. Datarails

Customer review ratings: 4.7/5 on G2

Datarails is an AI-powered FP&A platform for businesses that want to keep their Excel financial spreadsheets and models while automating manual processes.

With Datarails, you can support data consolidation, financial reporting, scenario analysis, budgeting and forecasting, and ERP-Excel connectivity. The platform allows you to drill down into underlying business data in real time.

Datarails includes a built-in visualization tool that integrates with other business intelligence tools and data warehouses. You can automate data collection and create KPI dashboards and reports.

Features:

- Storyboards: Use generative AI visuals to gain insights, spot trends, and share presentations.

- FP&A chat tool: Get answers to critical business questions about forecasts, budgets, and variances.

- Scenario modeling: Identify key drivers and trends and prepare for best-case and worst-case scenarios ahead of time.

- Collaborative planning: Connect all teams working on budgets and forecasts and track file versioning and status for each department.

Pricing: Datarails pricing is unavailable on their website or other review websites.

Mosaic Tech vs Datarails

Datarails is designed for finance teams that want to keep using Excel while automating tasks like data consolidation and financial reporting. Both offer spreadsheets with real-time data insights and AI-powered tools. Mosaic is designed for businesses that want a browser-based platform to run financial reports.

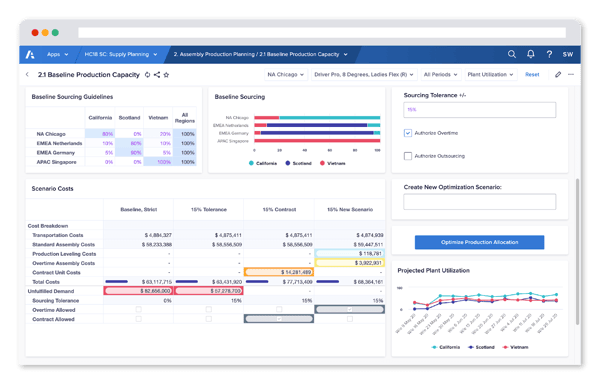

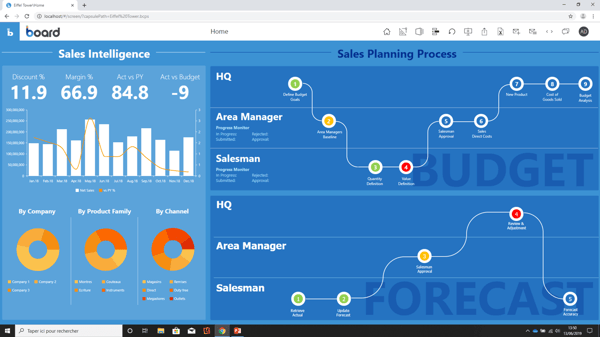

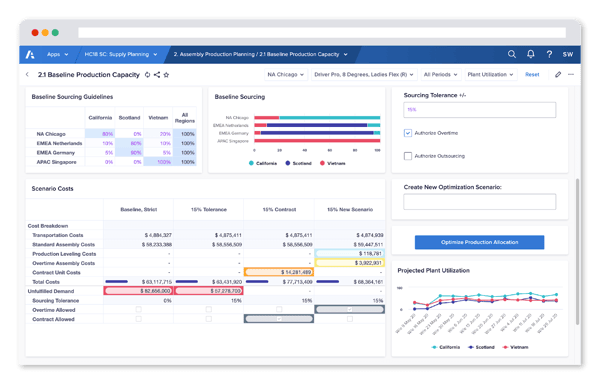

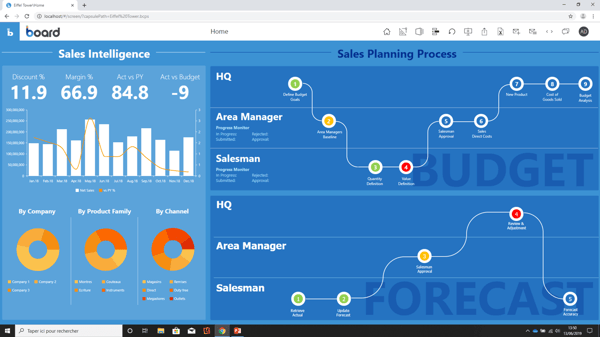

10. Board

Customer review ratings: 4.4/5 on G2

Board is a business insight software solution with predictive analytics capabilities that leverage machine learning algorithms to give users forecasts.

Board offers financial modeling tools and simulation capabilities, enabling companies to set objectives, track progress, analyze complex datasets, and draw insights.

It offers self-service planning, forecasting, and analytics that unify metrics, analytics, and reports in a single platform. Users can create custom planning and analysis applications through an open API.

Features:

- Reporting templates: Use pre-built reporting templates to organize data for payroll, manufacturing, and other company factions.

- Audit trails: Create workflows to assign tasks for audits and inspections and monitor work in progress, timelines, and approvals.

- Extended planning: Perform analysis for business plans outside of finance, including sales, marketing, and HR.

- Data mining: Mine data from databases and prepare them for analysis.

Pricing: Board doesn’t list its pricing information on its website because it depends on the size of the business, the number of user licenses, and custom needs. But, sources report that Board is less expensive than the industry average.

Mosaic Tech vs Board

Board is more for companies that need to customize more complex models and extend planning beyond finance to areas like marketing and HR. Mosaic might suit finance teams needing clear visuals for decision-making. Mosaic would not be able to support non-SaaS companies like Board can.

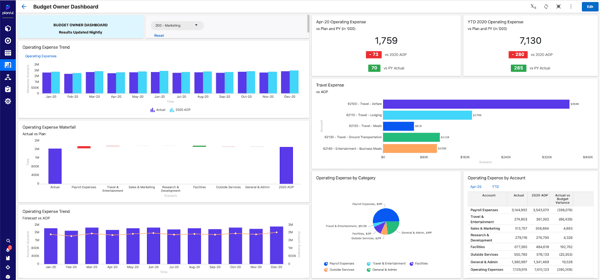

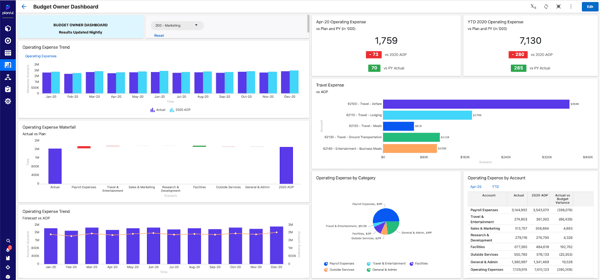

11. Centage Planning Maestro

Customer review ratings: 4/5 on Capterra

Centage Planning Maestro is cloud-based financial intelligence, planning, and analytics software.

Planning Maestro offers various features, including cash management tools, ad hoc reporting, KPI tracking, what-if scenario analysis, and data visualization capabilities.

Budget Maestro is their budgeting tool that provides basic planning capabilities to help businesses understand their spending habits and plan better for future investments.

Features:

- Cloud-based: Use a cloud-native technology platform optimized for performance and scalability.

- Modeling: Leverage pre-built modules for revenue planning, headcount modeling, and other tasks, with no proprietary scripts, formulas, links, or logic to maintain.

- Automation: Automate consolidation of multiple units, locations, and products.

- Self-service: Get full functionality with little to no IT involvement.

Pricing: Centage Planning Maestro has three pricing tiers: Standard, Professional, and Enterprise. Prices aren’t listed on their website.

Mosaic Tech vs Centage

Centage Planning Maestro suits businesses needing automation and pre-built modules to handle budgeting and forecasting. Mosaic offers more visually appealing dashboards.

12. Causal

Customer review ratings: 4.6/5 on G2

Causal is a financial planning platform that enables users to build and share financial models through dashboards and visuals. Causal handles financial statements, ARR reporting, forecasts, budgets, and scenario plans. It also integrates with QuickBooks and Xero to pull historical data for financial reports.

Features:

- Financial modeling: Create financial models with user-friendly interfaces.

- Data integration: Connect with accounting software like QuickBooks and Xero.

- Scenario analysis: Run multiple scenarios to assess potential outcomes based on financial decisions.

- Collaborative dashboards: Share dashboards with team members and stakeholders in real-time.

Pricing: Pricing is not publicly available.

Causal vs Mosaic

Both platforms might suit businesses that don’t want to rely on traditional spreadsheets. However, Casual can run ARR reporting for teams in any sector. Mosaic Tech offers financial tools tailored for SaaS companies.

13. Jirav

Customer review ratings: 4.9/5 on G2

Jirav is a cloud-based financial planning and analysis platform that can streamline budgeting, forecasting, reporting, and dashboarding processes. Jirav markets itself towards accounting firms and small to mid-sized businesses, not enterprises. It integrates accounting, workforce, and operational data to enable informed decision-making and strategic planning.

Features:

- Financial modeling: Create financial models that automatically update across the income statement, balance sheet, and cash flow statement.

- Budgeting and forecasting: Develop annual budgets and rolling forecasts with the capability to adjust for various scenarios.

- Cash flow forecasting: Gain real-time insights into cash positions and future cash flows.

- Integrations: Connect with accounting software like QuickBooks, Xero, NetSuite, and others for data synchronization.

Pricing: Jirav offers custom pricing.

Jirav vs Mosaic

Jirav is made more for businesses and accounting firms seeking an all-in-one FP&A solution. Mosaic Tech focuses on delivering real-time reporting, budgeting, and planning to SaaS companies.

14. Pigment

Customer review ratings: 4.6/5 on G2

Pigment offers an AI-augmented business planning platform for financial planning and analysis. It enables organizations to build financial plans to adapt to market changes and collaborate across departments. Businesses can extend their capabilities to sales, HR, and supply planning.

Features:

- Financial planning: Develop, approve, and adjust financial plans.

- Scenario planning: Evaluate multiple "what-if" scenarios to understand potential impacts of various financial decisions.

- Data Integration: Connect with business applications through native connectors, APIs, and scheduled imports.

- AI planning assistant: Utilize AI to augment interactions with data and the planning platform.

Pricing: Pricing is not publicly available.

Pigment vs Mosaic

Pigment is tailored for organizations seeking AI-powered insights. Its strength lies in being able to provide a unified view of the entire business, not just finance. Mosaic Tech may appeal to SaaS companies and smaller teams that prioritize simplicity.

15. Abacum

Customer review ratings: 4.8/5 on G2

Abacum offers an intelligent platform that handles FP&A processes for finance teams, CFOs, and RevOps. It sets traditional spreadsheets like Excel or Google Sheets aside and embraces shared digital dashboards. Abacum serves as a single source of truth for anyone to access.

Features:

- Intelligent forecasting: Leverage Abacum Intelligence to understand performance and create intelligent forecasts

- Data integration: Connect with over 50 integrations, including major ERP, HRIS, CRM, and BI tools

- Financial modeling: Manage what-if scenarios and analyze risks

- Board reporting: Create board presentations with financial insights

Pricing: Pricing is not publicly available.

Abacum vs Mosaic

Abacum is made for larger teams that need more extensive financial forecasting capabilities. Its intelligent forecasting tools make it suitable for organizations managing larger data sets. Mosaic Tech may not be able to keep up with the large demands of enterprises.

Choose the best Mosaic Tech alternative

Choosing the right FP&A software is essential for managing your finances and making informed decisions. While Mosaic is a popular option, it suits small, SaaS businesses best.

If you're a mid-sized or enterprise company, SMB, or a startup focused on hyper-growth, you need an alternative solution that simplifies the complexities of FP&A.

Look for software that:

- Scales easily

- Integrates with everything

- Super simple to implement

- Powerful enough to simplify your workflows but simple enough for anybody to learn

- Works for companies of all sizes

Book a free demo with Cube to see if this software meets your needs.

.png)

.png)

![15 best Mosaic Tech competitors and alternatives [2025]](https://www.cubesoftware.com/hubfs/Mosaic%20Tech%20Alternatives-1.png)

.png?width=239&height=134&name=ibm-planning-analytics%20(1).png)

-jpeg.jpeg?width=251&height=132&name=Planful-Social-Card-dc025794d4b83bd77fe9208b65b99100%20(1)-jpeg.jpeg)

.png)

![Prophix Software: Review, Alternatives & Pricing [2025]](https://www.cubesoftware.com/hubfs/Prophix%20Alternatives.png)