What to look for in revenue forecasting software

Revenue forecasting software is a tool designed to help businesses predict future sales and income over a specific period. It leverages historical data, sales trends, and market analysis to provide an estimate of the revenue a company can expect to generate.

Choosing the right revenue forecasting software is key for effective financial planning, achieving precise forecasts, and gaining insights into future revenues. The question is: what does the right software look like?

The best revenue forecasting software should offer:

- Integration capabilities: Seamless integration with ERP, CRM, and other financial systems makes data collection easier, reduces mistakes, and saves time.

- Data analytics and reporting: Deep analytics help understand financial health better, while customizable reports keep everyone updated with the latest insights.

- Accuracy and reliability: High-quality forecasts are essential for planning. The best tools provide reliable forecasts that you can trust.

- Scalability: Your forecasting tool should grow with your business, handling more data and complexity as needed.

- User-friendly interface: An easy-to-use interface means your team can get the most out of the software without extensive training.

- Customization options: Being able to tailor the software to fit your business improves the accuracy and relevance of forecasts.

- Collaboration tools: Features that facilitate teamwork ensure that everyone is on the same page, enhancing strategic alignment.

- Compliance and security: Ensuring your data is safe and regulatory requirements are met is crucial for your company's integrity.

- Scenario planning and simulation: The ability to test different forecasting scenarios helps prepare for various market conditions and their effects on sales.

Focusing on these features will help you select a software that not only meets your current needs but also supports your company's growth and strategic goals.

Top 10 revenue forecasting software options for FP&A teams

1. Cube

.png?width=366&height=106&name=blue-cube-logo%20(1).png)

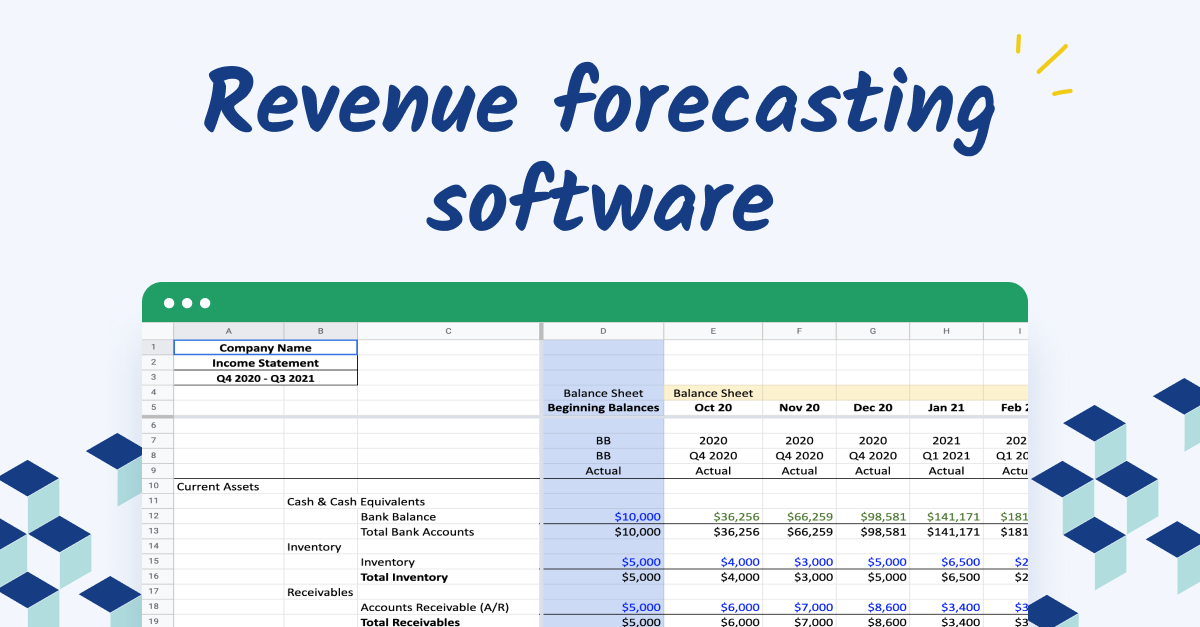

Cube is the first spreadsheet-native FP&A software that empowers finance and sales teams to drive better planning and performance without changing how they work. Cube eliminates manual work and provides real-time insights so organizations can strategize (and forecast sales) with speed and agility.

Cube allows users to work within their favored environment: the spreadsheet. This gives users all of the benefits of a robust FP&A tool, like scenario analysis, data consolidation, and custom reporting–all within Excel or Google sheets.

In addition to forecasting support, Cube automates all other time-consuming FP&A tasks including budgeting, reporting, planning, and management. Cube is the perfect choice for mid-market companies that want a quick implementation time and scalable, enterprise-grade technology.

Features:

- Automated data consolidation: Cube consolidates data from multiple sources in one place and provides a single version of the truth.

- Sharable planning templates: Share customizable, best-practice templates

- Customizable dashboards and reports: Create and share custom dashboards and reports from reusable templates to flexible ad-hoc reporting.

- Scenario planning and analysis: Model how changes to key assumptions affect overall outputs.

- Bidirectional Excel and Google Sheets integration

- Centralized formulas and KPI: Calculate and store your calculations in a central location and manage from a single source of truth.

Pros:

- Intuitive spreadsheet-native platform (bidirectional Excel and Google Sheets integration).

- Sophisticated automation reduces manual errors.

- Exceptional customer support ensures a smooth transition.

- Quick setup, with most customers onboarded within two weeks.

Cons:

Primarily for finance professionals, presenting a learning curve for new FP&A teams.

Pricing:

Starts at $1,250/month for lean teams, scaling to meet organizational growth needs.

2. Anaplan

Anaplan offers a comprehensive cloud-based scenario planning and forecasting platform, connecting data across the enterprise for faster, more informed decision-making. It's well-suited for large enterprises undergoing digital transformation.

Key features:

- Real-time scenario planning and predictive forecasting.

- Comprehensive integrations, including Salesforce.

- In-memory processing and customizable workflows.

- A secure, cloud-enabled platform for decentralized teams.

Pros:

- Supports complex, multi-scenario modeling.

- Customizable and secure, with cloud access from anywhere.

Cons:

Steep learning curve and the potential need for consultants.

Pricing:

Entry-level pricing from $30,000/year, with total costs varying based on complexity and consulting needs.

3. OnPlan

OnPlan streamlines budgeting, forecasting, and financial planning with an FP&A platform that integrates easily with Excel and Google Sheets. Tailored for small to mid-market companies, it automates planning processes and enhances collaborative efforts.

Key features:

- Facilitates sales, profit, and cash flow forecasting with financial analytics.

- Custom templates and dashboards enhance financial visibility.

- Integrates with systems like Salesforce and QuickBooks for comprehensive data management.

Pros:

- Customized financial modeling with enhanced dashboards for better decision-making.

- Aims to reduce spreadsheet errors, boosting financial accuracy.

Cons:

- Implementation can be lengthy, with some users noting slow data processing.

- Limited reporting templates and a notable learning curve.

Pricing:

Contact OnPlan directly for pricing details, as information is not publicly listed.

4. Adaptive Insights (now part of Workday)

Adaptive Insights revolutionizes financial planning with a cloud-based solution that streamlines large enterprises' budgeting, modeling, and forecasting. It eliminates manual spreadsheet dependencies, offering real-time consolidation and analysis.

Key features:

- Scalable financial planning and real-time consolidation for enterprise-wide strategy.

- Industry-specific templates and analytics for precise financial management.

- Scenario analysis tools for dynamic forecasting and decision-making.

Pros:

- Comprehensive planning across the financial, workforce, and sales domains.

- Facilitates collaboration and modernizes financial processes company-wide.

Cons:

May overwhelm smaller FP&A teams with its enterprise focus.

Pricing:

Available in standard and enterprise tiers, tailored to organization size and needs; contact for specifics.

5. Vena

Vena Solutions extends Excel's capabilities with cloud-based FP&A tools, streamlining budgeting, forecasting, and financial reporting. It combines Excel's familiarity with advanced features like drill-down analysis and comprehensive integrations, catering to SMBs and mid-market companies.

Key features:

- Direct Excel integration, maintaining a familiar UI for users.

- Supports budgeting, forecasting, financial close, and consolidation.

- Broad integration range with systems like NetSuite and Salesforce.

- Preconfigured templates and reports for quick setup and insights.

Pros:

- Minimizes learning curve by leveraging Excel.

- Adaptable to specific organizational needs with customizable support.

Cons:

- Potential for lengthy implementation and reliance on Vena's team for maintenance.

- Professional services may lead to additional, unforeseen costs.

Pricing:

Pricing is based on per-seat and service-tier models; specific details require direct contact with Vena.

6. Pipedrive

With its intuitive pipeline management tool, Pipedrive enhances sales management for small to medium-sized businesses. Designed for activity-based selling, it visualizes sales stages, optimizes activities, and ensures no deal is overlooked.

Key features:

- Customizable sales pipeline visualization.

- Integrated email with activity and goal tracking.

- Automation of repetitive tasks to boost productivity.

- Mobile app for managing sales on the go.

Pros:

- Intuitive interface encourages quick adoption.

- Focus on prioritizing sales activities that directly impact closing deals.

Cons:

- Reporting features may be too basic for some users.

- May not suit larger organizations with complex sales needs.

Pricing:

Pipedrive offers multiple tiers, starting from a basic plan for essential CRM functionalities and scaling with more advanced features for larger teams. Pricing is per user per month.

7. Salesforce

With its cloud-based solutions and extensive customization, Salesforce delivers a scalable CRM platform, enhancing customer management, sales, and marketing for all business sizes.

Key features:

- Comprehensive customer and contact management.

- Customizable sales pipelines and marketing tools.

- Wide-ranging app integrations.

- Advanced analytics for informed decision-making.

Pros:

- Flexible to meet diverse business needs.

- Strong support and community resources.

Cons:

- Steep learning curve for new users.

- Premium pricing for full features.

Pricing:

Multiple tiers based on functionality and user count, per-user, per-month basis.

8. Prophix

Prophix simplifies strategic financial planning tools for budgeting, forecasting, and real-time reporting to enhance organizational financial performance. It's best suited for organizations looking for a robust FP&A solution to streamline complex financial tasks.

Key features:

- Financial modeling and scenario planning for future performance forecasting.

- Data visualization tools for insightful financial presentations.

- Seamless ERP and CRM system integration.

- Real-time reporting and dashboards for financial monitoring.

Pros:

- Supports detailed financial analysis and decision-making.

- Aids in visualizing potential financial scenarios.

Cons:

- Report customization and data processing may be challenging.

- Integrations and technical knowledge requirements can be complex.

Pricing:

Contact Prophix for pricing, which is tailored to organizational needs and industry standards.

9. IBM Planning Analytics

IBM Planning Analytics offers in-depth business planning, turning complex data into actionable insights. It also supports detailed scenario analysis, available on-premises or cloud, including AWS.

Key features:

- Real-time, fine-grain data analysis down to SKU level.

- Direct in-platform reporting; no need for external tools.

- Pre-built planning apps; Excel interface with added control.

- Intuitive web interface for advanced data visualization.

Pros:

- AI capabilities boost accurate sales forecasting.

- Flexible deployment fits various IT setups.

Cons:

- May require training due to complexity.

- Resource-intensive setup and integration.

Pricing:

Customized based on needs; contact IBM for details.

10. Oracle NetSuite

NetSuite streamlines business operations with integrated ERP, CRM, and eCommerce cloud applications, boosting efficiency with real-time insights. It's best suited for mid-sized to enterprise companies needing a comprehensive, all-in-one business management solution.

Key features:

- Unified ERP system for financial, inventory, and supply chain management.

- CRM for managing all customer interactions.

- Real-time analytics and reporting across business functions.

Pros:

- Enhances decision-making with a unified data source.

- Customizable and integrates well with other platforms like Cube.

Cons:

- May be costly for smaller businesses.

- Reporting can be complex without training.

Pricing:

Custom pricing starts at $999/month licensing fee plus $99/month per user.

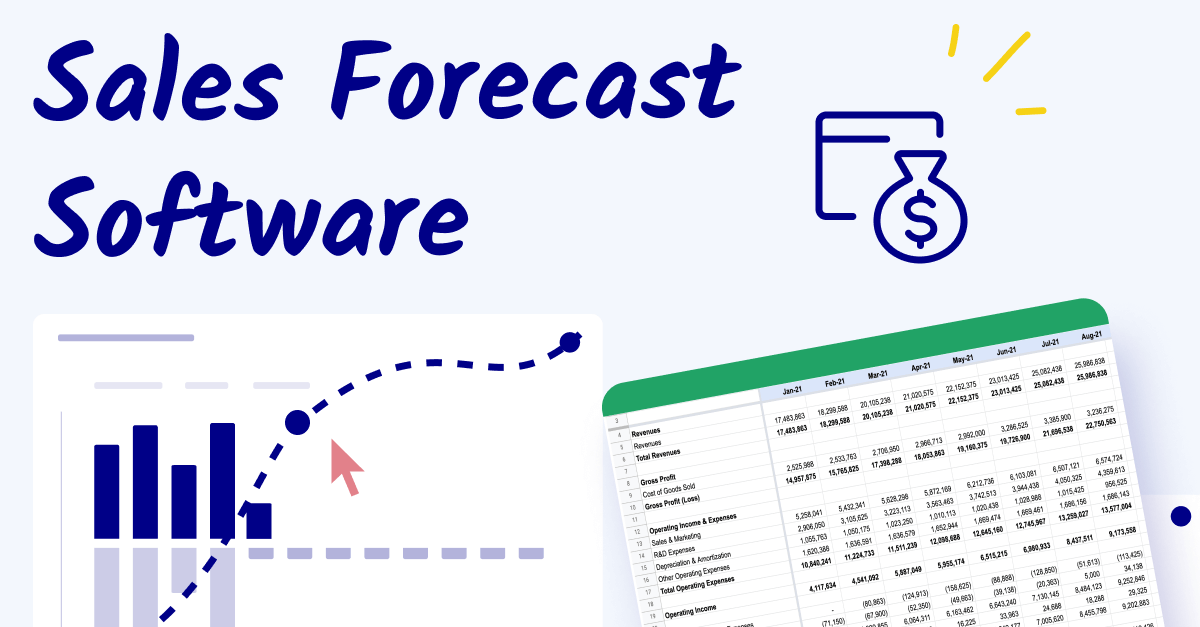

Implementing a sales forecasting tool: best practices

Incorporating new sales forecasting tools into your business's financial framework is a strategic move that demands careful execution. Following these best practices can help simplify the integration of revenue forecasting software, ensuring it becomes a cornerstone of your financial analysis and planning:

- Conduct a thorough needs assessment: It's critical to start with a detailed evaluation of your forecasting needs. Determine if your focus is more on immediate sales forecasting or broader revenue predictions. This clarity will help you select sales forecasting software that aligns perfectly with your business's requirements.

- Opt for software with robust integration capabilities: Choosing forecasting software that seamlessly meshes with your existing ERP and CRM systems is essential. Such integration is crucial for enabling sales teams and sales managers to access historical data and analyze sales pipeline trends effectively, thereby refining the precision of your sales forecasts.

- Ensure comprehensive training and support: Smooth adoption of new sales forecasting tools by your team hinges on providing in-depth training and support. This approach guarantees that both sales reps and financial analysts can confidently navigate and fully exploit the software's capabilities.

- Implement stringent data governance policies: The foundation of accurate sales forecasts lies in the integrity and reliability of your sales data. Establish rigorous data governance protocols to ensure your sales forecasts are always grounded in the most current and accurate data.

- Engage in continuous monitoring and evaluation: To optimize the utility of your revenue forecasting software, it's vital to regularly assess its performance. This continual scrutiny allows sales managers to swiftly identify areas needing refinement, ensuring that your sales forecasting methods remain agile and responsive to market trends.

Conclusion: choosing the right fit

Embracing advanced sales forecasting software is no longer optional in the modern business landscape; it's imperative for staying competitive. By implementing the above best practices, FP&A leaders can leverage revenue forecasting software to achieve more precise sales forecasts and make informed decisions.

Want to learn how Cube can elevate your revenue forecasting? Request a free demo today.

.png)

.png?width=366&height=106&name=blue-cube-logo%20(1).png)

![The 9+ Best OnPlan Alternatives and Competitors [for 2024]](https://www.cubesoftware.com/hubfs/OnPlan%20Alternatives%20ft%20image.png)

![Workday Adaptive Planning: Complete review & top alternatives [2024]](https://www.cubesoftware.com/hubfs/Workday-Adaptive-Planning-Review%20%281%29.webp)