What are retained earnings?

Retained, reinvested, or accumulated earnings are part of any profit a company puts aside for future investment in the business. These funds accumulate year on year until they’re needed.

Think of it like a rainy day fund for a company. A business builds up cash to make investments or pay off loans, all to improve its financial position.

Kind of like how a family put might put some spare money in liquid savings accounts so they have cash on hand.

The nature of the investment can look like: buying equipment, paying off debt, or spending money on marketing campaigns to boost sales.

Retained earnings are linked to dividends. The more profit is paid to shareholders, the less retained earnings will be recorded on the balance sheet. Businesses can prioritize retained earnings when times are tough to build a safety buffer to get through the lean times.

Retained earnings definition

Retained earnings are the cumulative profits a company has earned and kept after distributing dividends to shareholders. This financial metric represents the reinvested earnings within a business, used for growth, debt reduction, or as a reserve for future use.

What are retained earnings used for?

If retained earnings are like a savings account for a business, there are a few ways the money can be spent to better improve the company’s financial health.

Here are a few common examples.

Investment

Focusing on expansion and growth takes money, so the retained earnings account can be used to fund bigger projects.

This might look like buying new tech or systems to improve workflow for a small business. A scale-up company might be looking at expanding into new locations or opening a physical location for sales.

Pay off debt

An organization might use excess profits to pay off debt, leaving the company in a stronger financial position.

For example, a company may need to refinance its existing debt to get more favorable terms. Retained earnings can help to put more capital down to reduce the loan and get those better terms.

Share buybacks

Companies that want to make the shareholders' equity more valuable can use retained earnings for share buybacks. This can be a sign the company is doing well and confident about its future profits.

Partnerships

Retained earnings can partially or fully fund any merger, acquisition, or partnership. This means the company doesn’t need to pay as much debt or rely on outside investment to finance its growth, which could dilute the existing shareholders’ ownership.

How net income and dividends affect retained earnings

While a few figures on the balance sheet can indirectly impact retained earnings, three parts of the company’s finances directly affect the figure.

Net income

Net income directly correlates with the retained earnings figure on the balance sheet. The bigger the net income figure, the more potential for retained earnings. This could look like revenue, operating costs, and depreciation as a few common examples.

If it goes up, great! But if a company isn’t doing so hot on the net income front, it can lead to negative retained earnings. This often happens over a few years but can be a warning sign to investors that a business isn’t profitable.

Dividends

Cashing out to shareholders with dividend payments is the other side regarding retained earnings.

These figures come from profit, so whatever dividends are paid will directly affect the retained earnings figure.

Common stock

Repurchasing common stock can also affect retained earnings, as share buybacks decrease the equity available to shareholders.

Shares are marked as treasury stock on the balance sheet if returned for the company to reissue. This, in turn, reduced the retained earnings figure because the ‘savings account’ money can’t be used for anything other than those shares.

Where are retained earnings recorded?

When looking to find retained earnings in a company's financial reports, you'll typically see this figure recorded in one or more financial statements.

Statement of retained earnings

A finance team produces a statement of retained earnings, also known as an equity statement, focusing solely on how a business spends or saves profits. This statement is usually produced at the end of a business’s accounting period.

A statement of retained earnings shows external stakeholders (like investors or banks) a piece of the organization’s financial performance.

Balance sheet

Retained earnings can also be added to other financial statements, like the equity section of a balance sheet.

This is because it’s a pot of money set aside for future growth that can be used to buy assets, so the equities section is the sensible place to list it.

Income statement

Smaller businesses may prefer to record their retained earnings on the income statement ))(AKA a profit and loss statement). It’s usually recorded on the bottom line of this document.

Statements of retained earnings are prepared with generally accepted accounting principles (GAAP), so accuracy is key when preparing this financial document. You can use software to help simplify and speed up the process.

Example retained earnings scenario

An AI technology company has a net income of $1.2m. The founders issue $700,000 in dividends to shareholders and keep $500,000 as retained earnings.

The AI company earned a further $1m net income the following year. The founders foresee needing to spend some money upgrading their machine learning software, so they issue $400,000 in dividends while keeping $600,000 back for retained earnings. The new total is $1.1m.

Their third year is focused on expansion. While it made $1.5m in net income, it spent $300,000 acquiring a small start-up to enhance its existing AI product capabilities using its accumulated retained earnings.

It also bought back $200,000 worth of shares while paying shareholders $250,000.

The money for the shares moves to the treasury stock section of the balance sheet, so their total retained earnings now stand at $1.85m.

Why are retained earnings important?

Retained earnings are an integral figure in a company’s financial statements. Here are some of the key reasons they’re so important:

Financial health check

Analysts, lenders, and investors use retained earnings to understand where a company’s profits are going.

Too much focus on paying dividends to shareholders with nothing in the tank for reinvesting in the company might not be the best move, depending on the industry.

Retention ratio

This ratio is based on how much profit is diverted toward retained earnings. It’s another way of giving anyone outside the company a quick snapshot of whether sensible financial decisions are being made over the years.

They might also look at the payout ratio, which is how much profit has gone to shareholders and dividends, to supplement this info.

Demonstrate profitability

A healthy retained earnings statement could attract investors and increase its valuation if a company is looking to attract new investment and wants some credibility behind its claims.

What is the retained earnings formula?

Here’s the simplest way to calculate retained earnings:

Ending retained earnings = Beginning retained earnings + net income - dividends

How to calculate retained earnings

Start with the Beginning Balance: Begin with the retained earnings figure from the end of the previous period.

Add Net Income: Incorporate the net income (or loss) earned during the current period. This is the revenue minus expenses.

Subtract Dividends: Deduct any dividends paid out to shareholders.

While this is a starting point, most retained earnings calculations will be more complicated and involve a few moving pieces.

Many finance teams use software to ensure they’re accessing the most up-to-date information.

Example retained earnings statement

Let’s see what that example would look like in the AI company’s statement of retained earnings.

We’ll pick the final year for this example.

| Retained earnings ar December 21, 20X2 |

$1,100,000 |

| Net income |

$1,500,000 |

| Dividends paid |

-$250,000 |

| Shares buyback - treasury stock |

-$200,000 |

| Company $2 acquisition |

-$300,000 |

| Retained earnings at December 31, 20X3 |

$1,850,000 |

This is a slightly more complicated retained earnings example involving the shares buyback; more advanced statements could include details about common and preferred stocks or additional paid-in capital streams.

Can retained earnings be negative, and what does that mean?

Retained earnings can indeed turn negative, and this situation is often referred to as an "accumulated deficit." Here's what it signifies:

Indication of Prolonged Losses: Negative retained earnings typically indicate that a company has been suffering losses over a period, and these losses have exceeded any profits made in the past.

Impact on Financial Health: This scenario often raises concerns about the company's long-term viability and financial health.

Dividend Distribution: When retained earnings are negative, a company usually cannot distribute dividends, as there are no profits to distribute.

Recovery Strategy: Businesses with negative retained earnings need to reassess their operations and strategies to return to profitability.

In essence, negative retained earnings serve as a red flag, signaling the need for a thorough review of business practices and strategies.

How to put together a statement of retained earnings

Working out retained earnings numbers can be summarized as follows:

Take the beginning retained earnings figure, use the formula above, and you have the ending retained earnings figure.

Let’s get into the step-by-step process.

- Look at the previous year’s statement of retained earnings. This will give you the beginning balance for this year’s calculation.

- Add net income to the beginning balance. This is the total profit after deducting expenses and taxes. Now you’ll have the combined beginning balance and net income figure.

- Minus the dividends. Any amount handed out to shareholders should be subtracted from the previous step.

- Calculate the final figure. Using the above formula, you should have the ending retained earnings balance.

- Prepare the statement. Include the accounting period and the amounts that led you to the final number.

Common errors in retained earnings reporting

Avoiding these common mistakes in calculating retained earnings is key to ensuring your financial statements are robust and reliable, rather than riddled with errors and uncertainties.

Ignoring Prior Period Adjustments: Failing to account for errors or changes from previous financial periods can lead to inaccurate retained earnings calculations.

Misunderstanding Dividend Impact: Overlooking or incorrectly recording dividends paid can distort the true picture of retained earnings.

Inaccurate Net Income Reporting: Errors in calculating net income, a key component of retained earnings, can significantly affect the end result.

Neglecting Legal Restrictions: Not considering legal or regulatory limits on retained earnings distribution can lead to compliance issues.

Conclusion

Now you know all about the statement of retained earnings.

How to prepare it, how to calculate the numbers on it, and what to look out for.

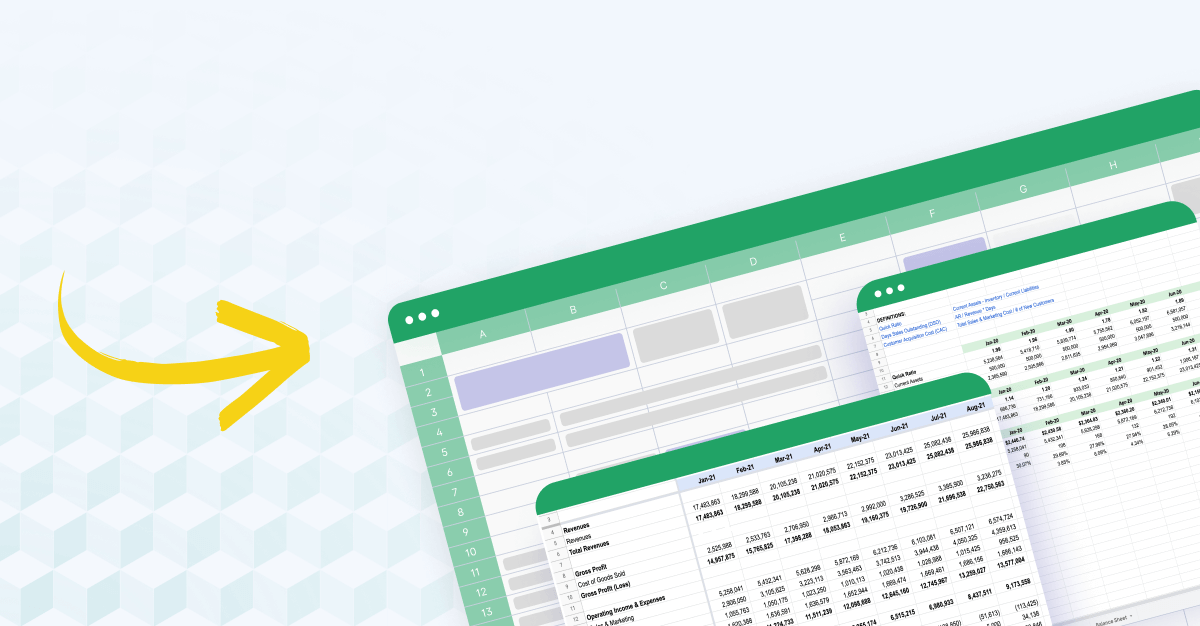

If you're doing all your reporting in Excel, you might want to check out Cube.

It integrates with all of your source data (like your ERP and banks) and lets you pull that data into Excel for easy access and manipulation.

(And it integrates with Google Sheets to make reporting to board members super simple.)

Plus a whole bunch of other good stuff.

Click the image below to request a free demo and see how Cube can enhance your workflow.

.png)