Understanding capitalization tables

A cap table, or capitalization table, is a simple but vital document that lays out who owns what in your company. It lists the different types of shares—like common stock, preferred stock, and employee options—and shows the percentage of ownership each person or group holds.

This information is important because it directly influences decisions about the company’s future. For example, if you’re thinking about offering more shares to investors, you need to know how that will affect the ownership stakes already in place.

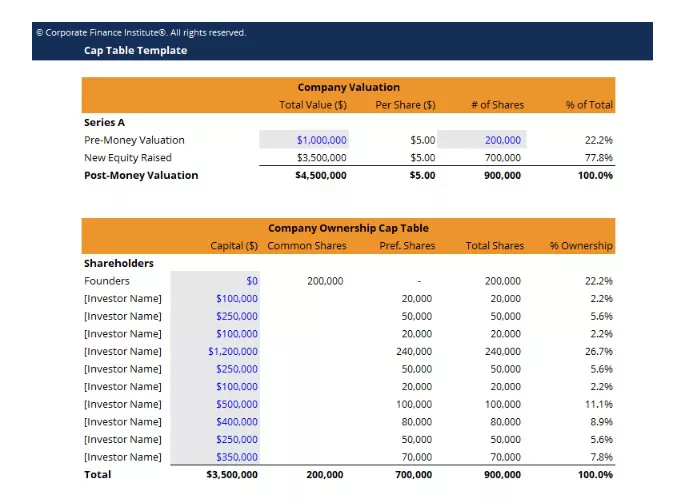

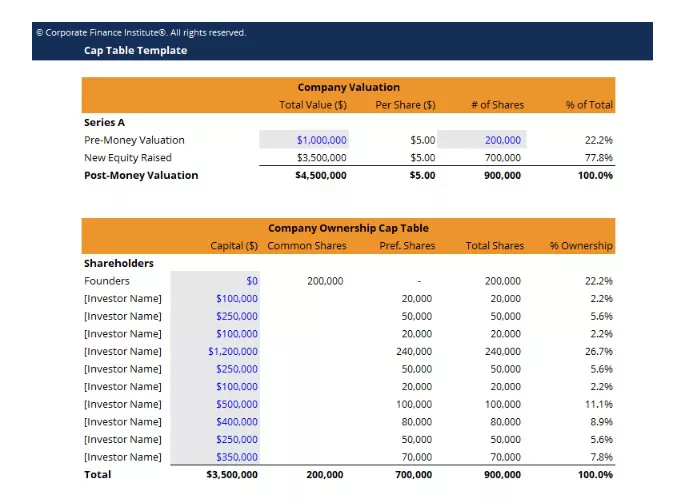

Here's an example of what a cap table may look like:

Source: Corporate Finance Institute (CFI)

Cap tables play a key role in shaping your company’s financial strategy. When you’re planning to raise money, the cap table helps you see how new investments might change who controls what. This can prevent unexpected power shifts that could complicate decision-making.

Similarly, if your company is considering a merger or acquisition, understanding the cap table helps clarify how much each stakeholder will receive. Knowing this ahead of time can prevent disputes and ensure everyone involved is clear on the financial outcomes.

Diving deeper: What does cap table management involve?

Understanding a cap table is just the start. Managing it properly is where the ongoing work comes in. Cap table management is more than just listing who owns what—it involves actively handling your company’s equity in a way that supports strategic goals and ensures everything stays accurate.

Here’s a closer look at what cap table management entails.

Keeping track of ownership changes

As your company grows, ownership will naturally shift. New funding rounds bring in new investors, employees exercise their stock options, and shares might get transferred or bought back. Cap table management is about recording these changes accurately and in real time.

This is crucial because any change in ownership affects the overall structure, which can influence control and decision-making within the company. Keeping the cap table up-to-date ensures that you always have a clear and accurate picture of who owns what, which is essential for making informed decisions.

Handling different types of equity

As companies evolve, they often deal with various types of equity. You might have common stock, preferred stock, convertible notes, or employee stock options. Each type of equity has different rules and impacts on ownership and dilution.

Managing these different equity types within your cap table is important because it ensures that everyone’s ownership stakes are accurately represented, especially during key events like fundraising or exits. Understanding these differences and reflecting them correctly in the cap table helps maintain fairness and clarity in your company’s equity distribution.

Ensuring accuracy and compliance

Accuracy is critical in cap table management, not just for internal records but also to meet legal and regulatory requirements. If your cap table contains errors, it can lead to significant problems, such as legal disputes or incorrect regulatory filings.

Regular audits of the cap table help catch mistakes early and ensure that all data matches legal documents like stock certificates or board resolutions. Keeping everything accurate and compliant helps prevent costly errors and ensures that your company’s equity is managed according to best practices.

Supporting strategic decisions

Cap table management isn’t just about keeping records—it’s about using those records to guide important decisions. Whether you’re planning to issue new shares, preparing for an acquisition, or designing employee compensation plans, the cap table provides the data you need.

Managing your cap table effectively ensures that this data is reliable and up-to-date, which helps you make decisions that support your company’s long-term success.

Tools for simplifying cap table management

Managing a cap table doesn’t have to be a headache. With the right tools, finance leaders can streamline the process, reduce errors, and gain better insights into their company’s equity structure. Let's take a look at some essential tools that can make cap table management much easier and more efficient.

Cap table management software solutions

Cap table software helps you organize and manage all aspects of your cap table, from tracking ownership to managing equity plans. These tools automate much of the manual work involved in cap table management, reducing the risk of errors and saving time. For finance leaders, this means more accurate data and less time spent on administrative tasks, allowing for a greater focus on strategic decision-making.

A few of the top cap table management tools include:

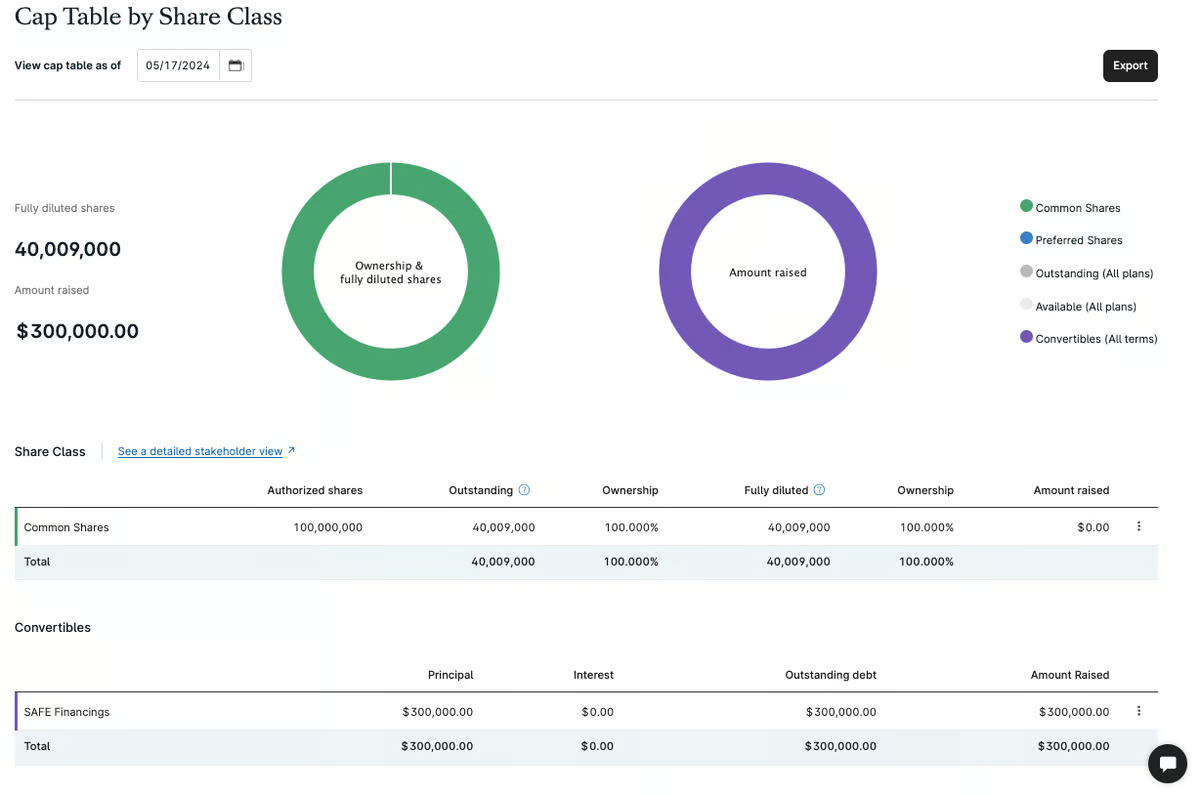

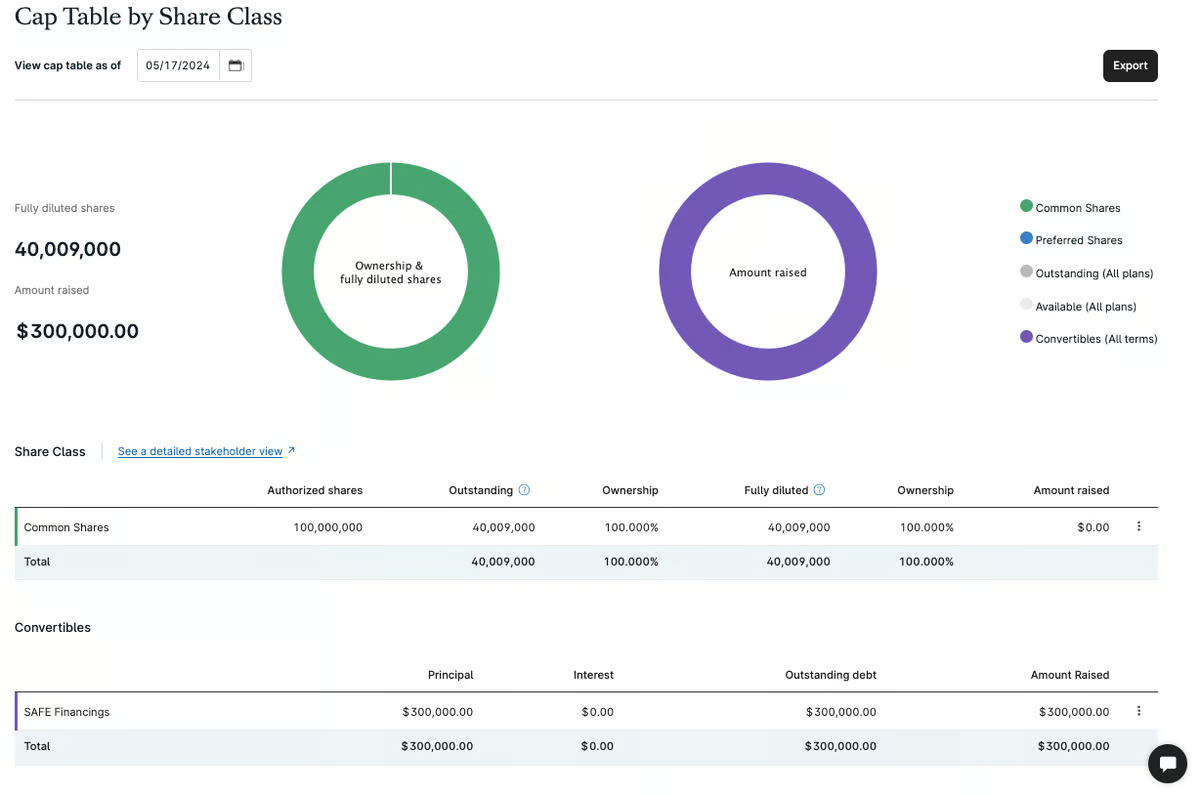

Carta

Source: G2

Carta is an equity management platform designed to help companies manage their equity and cap table data. It’s ideal if your primary focus is on tracking ownership, handling employee stock options, and ensuring compliance with equity-related regulations.

Carta can be valuable for finance and legal teams, as it simplifies complex tasks like equity management, fundraising, and investor relations, making it easier to maintain accurate records and make informed decisions about the company’s financial future.

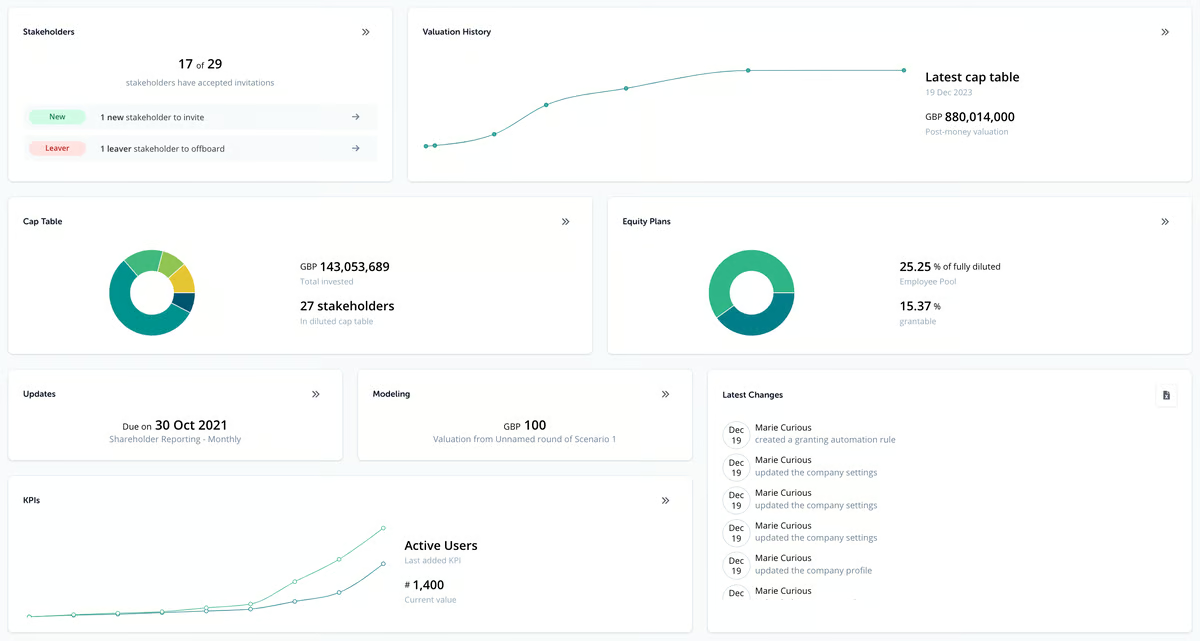

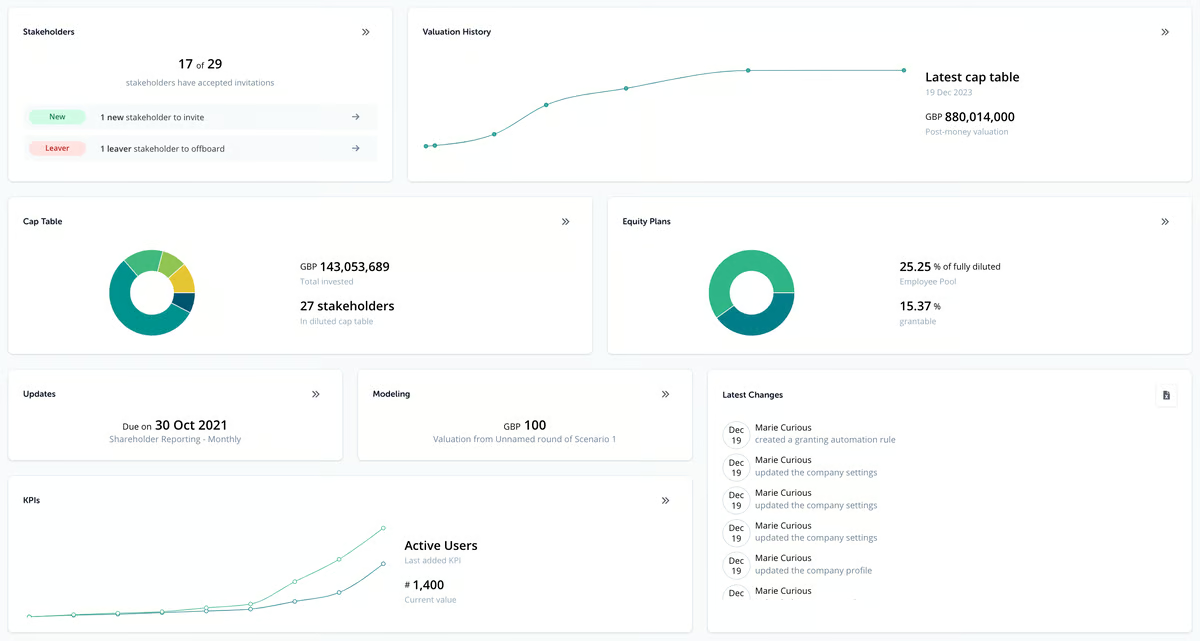

Ledgy

Source: G2

Ledgy is a software platform designed to help companies manage their equity, cap tables, and employee participation plans. It’s particularly useful for startups and scale-ups that need to handle complex equity structures, multiple funding rounds, and international employee stock options.

Ledgy provides tools for tracking ownership, managing vesting schedules, and ensuring compliance with regulatory requirements across different countries. It’s designed for finance, legal, and HR teams who need a reliable and user-friendly solution to keep their equity management organized and transparent.

FP&A software solutions

FP&A (Financial Planning & Analysis) software is designed to help finance teams with budgeting, forecasting, and analyzing financial data to support strategic decision-making.

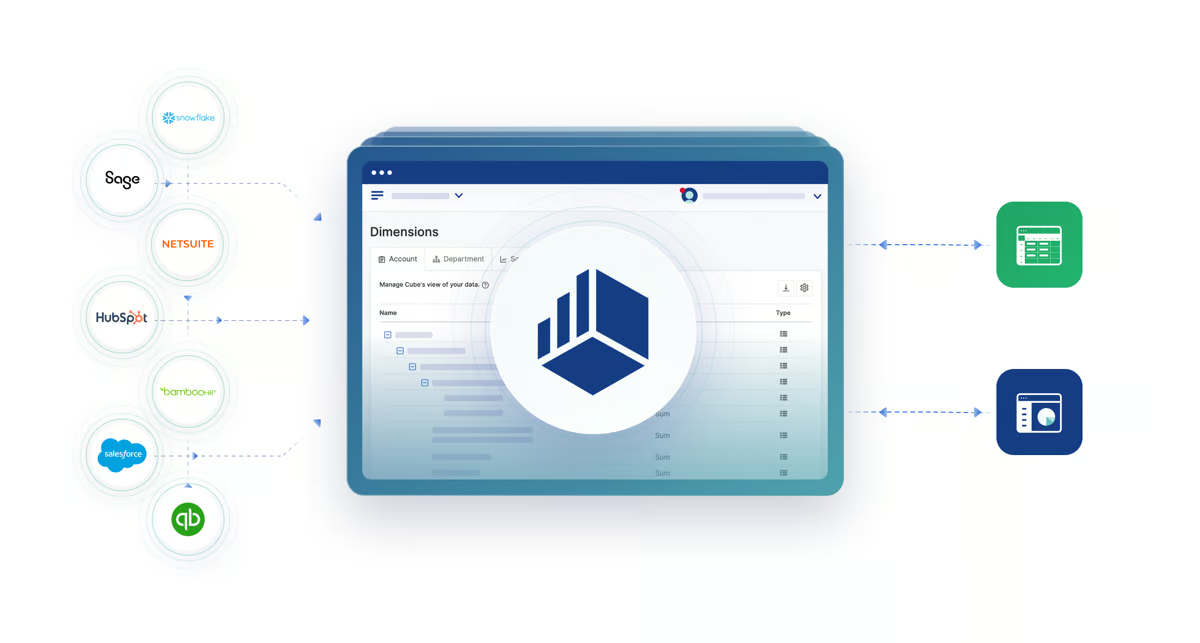

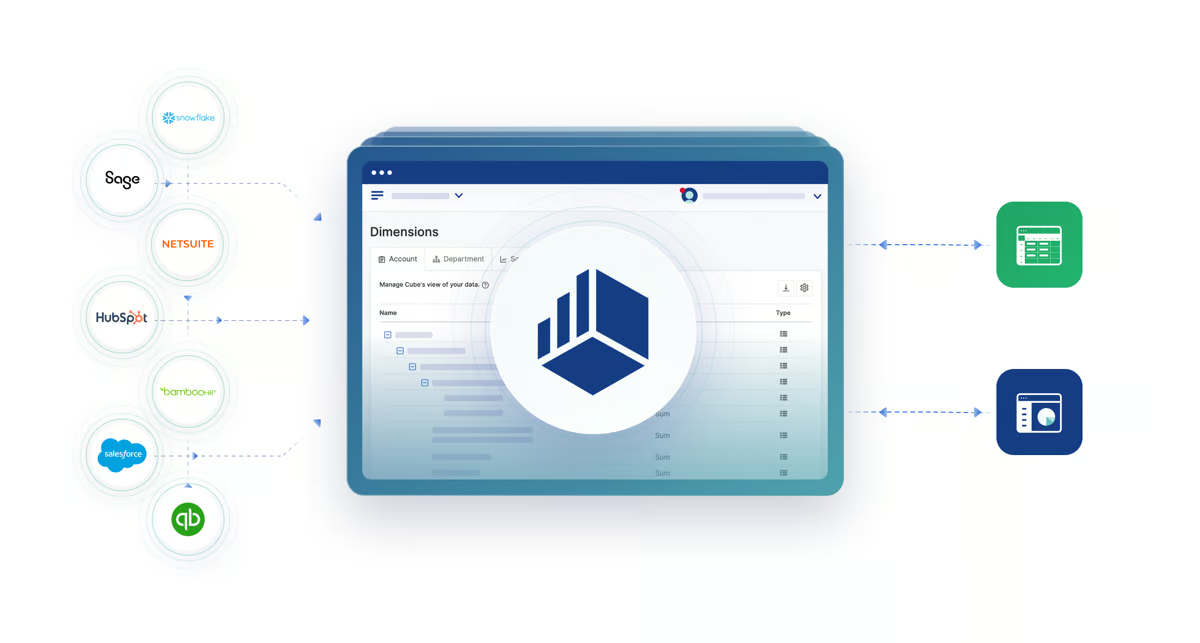

Tools like Cube enable companies to streamline their financial processes by integrating data from various sources, including cap tables, to create a comprehensive financial picture.

Source: G2

Source: G2

FP&A software is invaluable for finance leaders who need to see how different aspects of the business, like equity distribution, impact the overall financial strategy. By integrating cap table data into your FP&A software, you can model different scenarios—such as new funding rounds or employee stock option exercises—and understand their financial implications. This helps ensure that your financial planning is based on accurate, up-to-date information, leading to more informed and strategic decisions.

Here are some key benefits of using FP&A software:

- Improved accuracy: Ensures your financial plans are based on the latest data, reducing the risk of errors.

- Scenario modeling: Allows you to see how changes, like new funding rounds, impact key metrics such as cash flow and revenue forecasts.

- Strategic alignment: Helps you make decisions that align with the company’s broader financial goals, supporting long-term growth.

- Enhanced visibility: Provides a comprehensive view of how different factors, including equity distribution, influence the company’s financial health.

While cap table software is excellent for tracking ownership and equity, combining this data with your FP&A software can elevate your financial planning. By bringing cap table information into your FP&A process, you can analyze how changes in equity impact key financial metrics like cash flow, revenue forecasts, and investor returns. This helps finance leaders make decisions that are both accurate and strategically aligned with the company’s broader financial goals, which is especially important as finance roles evolve to become more strategic.

Techniques for effective cap table management

Effective cap table management goes beyond just using software—it involves applying specific techniques to ensure your cap table is accurate, compliant, and aligned with your company’s strategic goals. Here are some key techniques, along with how to implement them.

1. Regular audits and reconciliations

Regular audits involve systematically reviewing your cap table to verify that all entries, such as share counts and ownership percentages, are accurate and up-to-date. Reconciliations ensure that the cap table matches other financial records and legal documents.

Regular audits catch errors before they become major problems, such as during fundraising or exits. They help you maintain consistency across all records, which is crucial for compliance and financial reporting.

Schedule periodic audits, ideally quarterly or after significant transactions like funding rounds. During these audits, compare your cap table with source documents (e.g., stock certificates, board resolutions) and your financial statements. Address any discrepancies immediately, and update the cap table to reflect the most current data.

2. Scenario planning and forecasting

Scenario planning involves creating models to predict how different financial events—like new funding rounds, mergers, or stock option exercises—will impact your cap table and overall equity structure.

This technique helps you anticipate the effects of potential changes on ownership, dilution, and company valuation. By understanding these impacts ahead of time, you can make more informed strategic decisions.

Use financial modeling tools or FP&A software to simulate different scenarios. Start by inputting your current cap table data, then model potential changes, such as issuing new shares or converting notes into equity. Analyze how these changes would affect ownership percentages, dilution, and overall company valuation, and use this information to guide decision-making.

3. Clear communication with stakeholders

Keeping all stakeholders—such as founders, investors, and employees—informed about any changes to the cap table and what those changes mean for them.

Transparent communication helps manage expectations and prevents misunderstandings or conflicts, especially during key events like funding rounds or exits. It also builds trust and ensures everyone is aligned with the company’s goals.

Establish a communication plan for sharing updates about the cap table. This might include regular reports, meetings, or one-on-one discussions with key stakeholders. Make sure to explain how changes to the cap table will affect ownership stakes and potential returns. Use clear, simple language to ensure everyone understands the implications.

4. Documenting all equity transactions

Thoroughly documenting every equity transaction, such as stock issuances, option grants, and conversions, in your cap table.

Proper documentation is crucial for maintaining an accurate and legally compliant cap table. It provides a clear record of all decisions and actions related to equity, which is essential for audits, regulatory filings, and due diligence during financial events.

For every equity transaction, ensure that you have the necessary legal documents (e.g., stock certificates, grant agreements) and that these are accurately reflected in your cap table. Keep these documents organized and easily accessible, either through your cap table software or a secure document storage system. Regularly review and update your cap table to include all new transactions and maintain a comprehensive audit trail.

5. Implementing access controls and security measures

Setting up controls to determine who can view or edit your cap table, and ensuring that the data is protected against unauthorized access.

Cap tables contain sensitive information that must be protected to prevent unauthorized changes, data breaches, or leaks. Strong access controls help maintain the integrity and confidentiality of your company’s equity data.

Use cap table management software that allows you to set permissions based on roles. For example, give full access to your CFO, while limiting access for other employees to only view their own equity details. Implement encryption and secure login protocols to protect the data, and regularly review who has access to ensure it remains appropriate as the company evolves.

Common pitfalls in cap table management

Understanding these common pitfalls and taking steps to address them can help finance leaders maintain a reliable cap table that supports the company’s growth and strategic goals.

1. Data inaccuracies

Data inaccuracies are one of the biggest issues in cap table management. Even a small mistake, like entering the wrong number of shares or mixing up equity types, can lead to major problems.

For instance, if an investor’s ownership is recorded incorrectly, it could cause disputes during future funding rounds or when calculating returns during an exit. These errors can also throw off your understanding of ownership, leading to poor decisions.

It's crucial to keep the data in your cap table accurate to avoid these kinds of headaches. Implementing FP&A software or cap table software can make this process less cumbersome and give you confidence in the accuracy of your data.

2. Complexity with multiple rounds of funding

As your company grows and raises more money, your cap table can become complicated. Each new round of funding adds more layers—new types of shares, different terms, and additional investors. This can make it easier to miss something important, like how new shares affect existing ownership.

For example, if a new funding round dilutes the shares of early employees or founders without their knowledge, it could cause frustration or even legal issues. Managing this well is key to keeping everyone on the same page.

3. Tracking vesting schedules and employee equity

Another challenge is keeping track of employee equity, especially when it comes to vesting schedules. Employees often receive stock options or equity grants that they earn over time. If these vesting schedules aren’t accurately tracked in the cap table, it can lead to confusion about how many shares an employee actually owns.

For example, an employee might think they own a certain number of shares, only to find out later that the numbers were wrong. Keeping accurate records of vesting schedules helps avoid these issues and ensures that employees get what they’re entitled to.

4. Handling convertible notes and SAFEs

Convertible notes and Simple Agreements for Future Equity (SAFEs) can add another layer of complexity to cap table management. These instruments are used in early funding rounds with the promise of converting into equity later on. The tricky part is tracking how they will convert and what that means for the current ownership structure.

If not managed carefully, the conversion of these notes can lead to unexpected dilution or changes in control, which might upset existing investors. Regularly updating the cap table to reflect these potential changes can help avoid surprises down the road.

5. Compliance and regulatory risks

Cap tables need to meet various legal and tax requirements. Keeping the cap table up-to-date is essential to staying compliant, especially when dealing with regulators or during audits.

For example, if you don’t properly document equity grants or changes in ownership, you could face fines or penalties. Inaccurate cap tables can also lead to incorrect tax filings, which might result in financial penalties or damage to your company’s reputation.

Regularly reviewing the cap table and ensuring all transactions are recorded correctly is important to avoid these compliance risks.

Conclusion: cap table management made easy

Effective cap table management is essential for maintaining a clear and accurate picture of your company’s equity structure, supporting informed decisions, and ensuring that all stakeholders are aligned. With the right tools and techniques, you can simplify this process and focus on driving your company’s growth.

To see how Cube can streamline your financial planning and integrate cap table data into your overall strategy, request a free demo today.

.png)