Key takeaways on the month-end close process

- Your month-end close process should involve recording all transactions, reconciling accounts (including petty cash), and ensuring accurate accounts receivable records.

- Tracking business transactions accurately helps mitigate fraud risks and keeps your organization’s financial health up to date.

- A detailed month-end close checklist should categorize tasks, prioritize them, assign preparers and reviewers, and include a thorough review of financial statements.

- Using a month-end close checklist reduces errors, improves reporting, boosts efficiency, and ensures your company is prepared for audits.

What is the month-end close process?

The month-end close is foundational for your company's cash stability, planning ability, and financial statement accuracy. It involves your finance and accounting teams collecting, reviewing, and reconciling the previous month's transactions and financial activity.

Why is the month-end close process important?

The month-end close is an essential component of the financial reporting process. It helps finance teams to:

- Ensure financial accuracy: The month-end close process guarantees that all financial transactions are recorded accurately. This helps prevent errors, maintains consistency, and provides a clear picture of the company’s financial health.

- Support decision-making: By reviewing monthly financial reports, management can track progress, identify trends, and make informed decisions about future operations and strategies.

- Streamline the year-end close: Accurate monthly closings make the year-end close much simpler and less time-consuming, as all necessary data is already organized and up-to-date.

- Maintain compliance: Proper month-end closing ensures that financial records comply with regulatory requirements, helping avoid penalties and ensuring the company meets its obligations.

How long does the month-end close process take?

Given its regularity, the month-end close should take five to 10 days. But this isn't the case for many companies.

In fact, Accounting Today reports that 36% of their 259 surveyed accounting and finance professionals say they’ve had to reschedule out-of-work commitments during the month-end close process.

About one in five reported that the monthly close negatively affected their personal relationships.

So, what turns month-end close from a manageable process to a multi-week event? And how can you reduce monthly close time and get back to more interesting projects?

It’s all in how you approach it. You can reduce time-to-close by tackling a few recurring tasks in the right order. To help, we’ve put together a month-end close checklist that can help you end the perpetual cycle of month-end closing stress.

Month-end close process checklist

A successful month-end close process starts with proactive planning. Gathering key information in advance and tackling long-tail tasks first lets you focus on resolving issues early and ensures smoother day-to-day workflows. Here’s a checklist you can follow:

1. Prep work

Prepping for close can help you avoid many common issues at end-of-month. It fixes the last-minute scramble to find errors by heading off missing items:

- Contact vendors about invoices: Get in touch with vendors with outstanding invoices first. Waiting until the last second means they may not get back to you in time. (Your vendors experience month-end closing stress, too.)

- Check-in with Sales: Check in with your sales team to ensure deal flow and revenue are on track. Note differences between bookings and anticipated revenue. Look for changes or delays in deal structure, pricing, etc.

- Tie up budgetary loose ends: Touch base with department heads. Determine any budget gaps or surprise expenses during the previous period. Prepare a budget forecast if differences occur between budget and actuals.

2. Cash accounts

Get your cash in order in three easy steps:

- Cash reconciliation: Find discrepancies between your ledger and the bank statements. Research and resolve them. Be sure to include cash in transit in your reconciliation process.

- Organize cash transaction data: Have your reconciled transaction data for reporting. Keep it backed up and accessible for easy retrieval during audits or monthly reviews.

- Petty cash review: Don’t let your petty cash account become invisible. Reconcile petty cash against receipts. Be sure you've recorded all transactions within the account.

3. Accounting

- Reconcile AR and AP: Record and reconcile all Accounts Receivable and Accounts Payable transactions. Resolve missing or incorrectly applied payments or receipts to ensure accurate financial records. Review each account for outstanding balances and verify that all payments match their specific invoices. This helps prevent cash flow issues and enhances transparency for future audits.

4. Fixed assets

- Review fixed assets: Check on fixed asset costs or changes over the previous period. Record any sale, loss, transfer, maintenance, or depreciation instances. Make a note of any upcoming fixed asset activity (write-offs, end of useful life, etc.)

- Review inventory: Adjust inventory levels to reflect current stock counts and recent sales trends. Analyze ordering patterns and costs to align inventory with demand and reduce holding expenses. Optimize storage practices to prevent spoilage.

5. Accruals

- Record accruals: Review and record accrual adjustments in advance of month-end. Recording accruals early in the process helps you complete financial statements on time.

- Look ahead to the next period: It helps to think ahead on accruals. Spend some time at month-end to review upcoming activities. If spending isn’t going as planned, you may want to review budgeting.

- Account for prepaid expenses: Check and enter prepaid expenses. Remember to include insurance, salaries, taxes, rent, equipment leases, and other advance payments.

- Review payroll and accrued vacation: Confirm that the payroll record is accurate. Ensure the tax, gross pay, and other withholding records are correct. Assess vacation accrual records to check for accuracy.

6. Preliminary accounting and compliance reviews

- Review recognition: Rule ASC 606 changes how companies recognize revenue. Take time to review revenue recognition. Perform a sense check to ensure compliance with ASC 606.

- Take a first pass at financials: Walk through the month with accounting. Talk about issues ahead of time. This allows the team to research and resolve issues ahead of financial reporting.

7. Flux analysis

- Complete flux analyses: Flux analysis, called variance analysis, compares balances from two accounting periods to spot and analyze major differences. It can increase visibility, improve forecasting & budgeting, and boost your reporting integrity. Complete flux analysis for the previous year, quarter, period, etc.

- Document meaningful fluxes: Highlight any noteworthy flux analysis. Discuss these during your preliminary accounting review. You may also note them in the final report to the executive team.

8. Final review and preparation

- Final review: Meet with the accounting team. Tie up loose ends before starting financial statements. Note anything unusual in the accruals, fluxes, fixed asset review, and compliance reviews.

- Create and deliver financial statements: Give your financial statements a “dress rehearsal” by reviewing the general ledger for accurate transaction records. Ensure the correct record of data in key reports like balance sheets, income statements, cash flow statements, and shareholder equity statements. Flag and resolve any discrepancies.

- Perform the close: Finalize the close by preparing revenue and expense accounts to reflect accurate period-end balances. Complete the process by transferring these balances into the income summary account, then close out the income and dividends to retained earnings.

Why the extra walk-through?

It’s better to take a last pass through the numbers than to have to clarify things after delivery. Once you’re satisfied with the reports, deliver the final documents to the executive team and board.

Best practices for streamlining your month-end close process

Streamlining month-end closing is not only about saving time, it increases efficiency and satisfies accountants. The following are some best practices to observe during the month-end close process:

Automate repetitive tasks

Want to speed up your month-end reporting even more? Here are some of the month-end close tasks you can automate right now.

- Emails and reminders: Use automatic reminders to cut out repetitive manual notifications. You can automate overdue invoice reminders, remind colleagues of upcoming internal deadlines, etc.

- Marketing alignment: Bridge the gap between Finance and Marketing with transparent reporting. It can help these departments form a unified front, boosting top-line growth. Automation can simplify this process.

- Purchase orders: Procurement automation can close the gap between accounting and department heads. It can also simplify accruals and forecasting at month-end.

- Revenue recognition and ASC 606: Manually recognizing revenue and preparing compliance reporting increases month-end work. Automating these can save hours of time while reducing errors and risk.

- Flux and financials delivery: Automatically deliver flux reports and financial statements. This reduces manual reporting and creates a single source of truth for data review.

Prioritize quality and continuously improve

Automating manual processes allows you to use the time saved to focus on more important tasks and improve quality.

- Focus on accuracy vs. speed: Prioritize accuracy in financial reporting, as rushing through tasks can lead to costly errors and delays in future processes. Consistently verifying data ensures that reports reflect the company's true financial position. A focus on precision also strengthens transparency and trust among stakeholders.

- Use frequency of closing as a learning curve: Each month-end close offers insights that can improve efficiency and accuracy over time. By reviewing the challenges and bottlenecks from previous periods, teams can streamline processes for future closings.

- Try new software and techniques: Exploring new software and approaches can reveal more efficient ways to manage and automate your month-end close. Tools like Cube can automate financial tasks and help with the reconciliation process.

Apply time-management techniques

Here are some techniques that can help you save more time:

- Set and keep deadlines: Set a precise deadline for each stage of the closing process. Maintain the same schedule every month to manage the time and activities of your team.

- Use templates and checklists: Develop a standard operating procedure (SOP) to help your close process. Use checklists to follow the progress of your work and find out problems.

- Use integrating platforms: Integrate your accounting software with other platforms to automate data transfers and streamline workflows. By syncing transactions directly into your accounting system, you eliminate manual entry and reduce the chance of errors. This approach saves time and ensures that your financial data is always up-to-date, enabling smoother month-end reporting and analysis.

Implement financial software

Choosing the right financial software can simplify your month-end close process and improve overall accuracy. These tools help automate repetitive tasks, streamline data entry, and centralize information for easier reporting and analysis.

Here are some financial close software to consider:

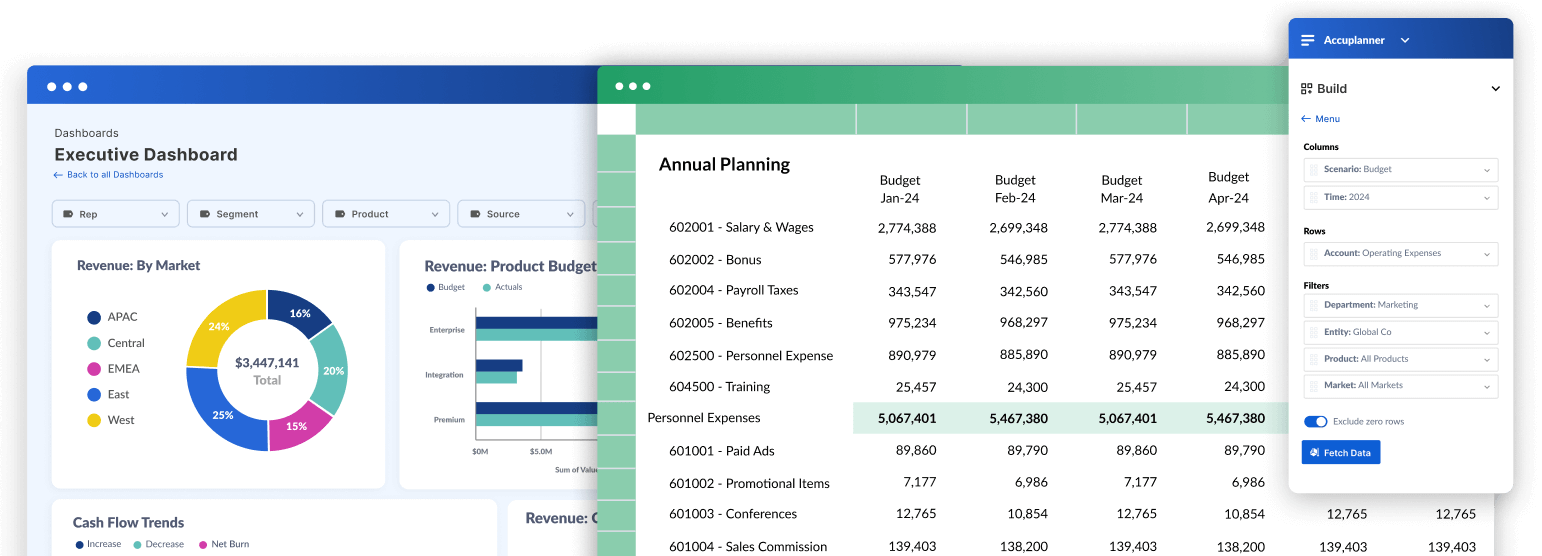

- Cube: Cube is a cloud-based FP&A platform that helps companies hit their numbers without having to sacrifice their spreadsheets. Cube helps finance teams work anywhere—integrating natively with both Excel and Google Sheets—so that they can plan, analyze, and collaborate with the ultimate speed and confidence.

Cube has the following key features:

-

- Integrates with everything: Integrate with popular ERPs (like NetSuite, Quickbooks Online, and Sage Intacct) and HRIS systems.

- Native Excel and Google Sheets integration: Leverage compatible and bi-directional integration with any spreadsheet.

- Multi-scenario analysis: Models how changes to key assumptions affect overall outputs.

- Customizable dashboards and reports: Customize dashboards and reports to display different data types from various data sources, enabling easy presentation and understanding by teams and shareholders.

- Scenario planning and analysis: Forecast the financial impact of business decisions on revenues and expenses without committing any resources first.

- NetSuite: NetSuite is a cloud-based enterprise resource planning (ERP) suite that provides companies with all the applications they need to manage their businesses.

- Anaplan: Anaplan is a business planning, forecasting, and performance management software platform that enables businesses to connect their financial, strategic, and operational planning in real time.

- Planful: Planful is a financial planning software that helps FP&A teams automate their processes. It offers intuitive collaboration, prebuilt templates, and managed workflows.

Always prep for the next closing

Make the next closing easier by:

- Building financial calendars: Include a task breakdown and deadlines for collecting all transactions, receipts, and fresh reports. You can also have a general schedule for reviewing the balance sheet.

- Improving communication: Ensure each team member knows their roles and duties. Hold meetings to confirm that teams are in agreement with the procedures.

Challenges in the month-end close process and how to avoid them

Let’s look at how you can avoid common challenges in the month-end close process.

Disorganized data management

When data is scattered across systems or lacks structure, it’s easy to lose track of critical information. This disorganization can cause delays as teams try to gather and verify data at the last minute.

Use a centralized data storage system where all financial information is stored and organized consistently. This makes it quicker to find and verify data, keeping your team on track.

No standardized processes

When team members lack a consistent approach, month-end procedures can vary widely, leading to inconsistent data and a lengthier close. Standardized processes create a clear path for each task, ensuring accuracy and accountability at every stage.

Create clear, step-by-step guidelines for each stage of the month-end close and document them to ensure consistency and reduce the chances of missing key tasks.

Manual errors

Manual tasks like data entry are time-intensive and prone to human error. These errors can disrupt reporting accuracy and create additional review cycles to correct discrepancies. Use software to automate repetitive tasks to help reduce errors and speed up the close process.

Understaffed or untrained teams

Smaller teams or untrained staff can result in errors, delays, and inefficiency during month-end closing. Invest in employing extra staff or using temporary workers to handle heavy workloads during the closing period. Also, providing comprehensive training for your current staff can prepare them with the skills required to run a month-end close process.

Non-compliance with financial regulation

Companies must follow the financial rules and regulations, government policies, and reporting obligations. Violating these rules may result in fines, loss of accreditation, and other business issues.

Regularly review compliance guidelines and implement automated compliance management systems that flag potential issues early. Keeping compliance practices up-to-date and documenting them can protect the company from regulatory risks and ensure a smoother closing process.

Download your complete month-end close process checklist

Now that you have this checklist, you'll never worry about forgetting a step during your month-end close again. The checklist covers every aspect, so you can follow the steps to ensure a well-organized close process.

Bookmark or print out this post so that you're prepared for future months!

.png)