Best FP&A software at a glance

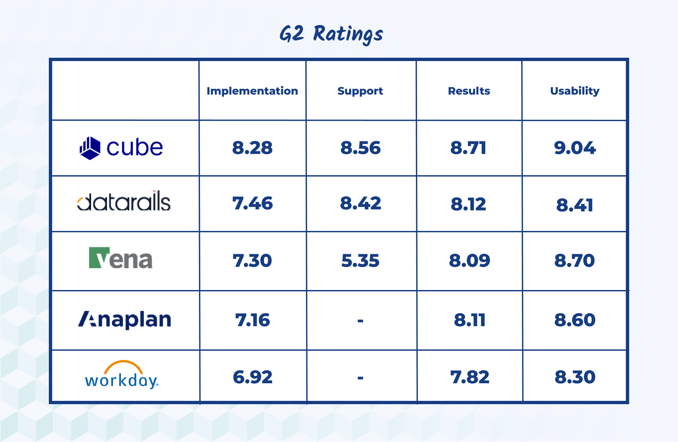

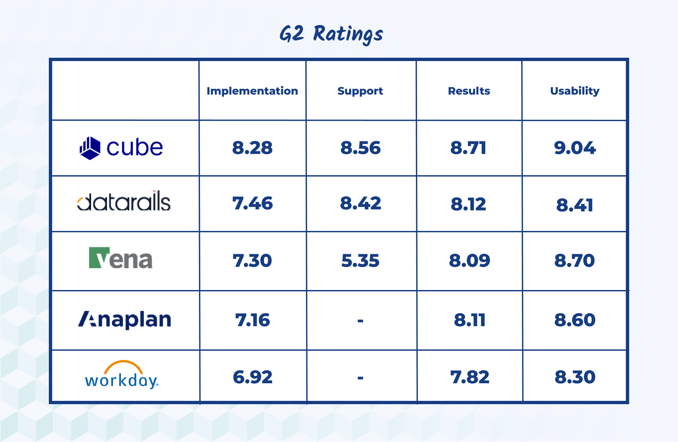

With so many options on the market, choosing the right FP&A tool can feel overwhelming. To help simplify the decision-making process, here’s a quick snapshot of top vendors based on key metrics like implementation, support, results, and usability.

This chart gives you a high-level comparison. In the following sections, we’ll explore each software in greater depth.

- Best FP&A software overall: Cube - Spreadsheet-native FP&A with AI-driven forecasting, automated variance analysis, and real-time data sync for mid-market finance teams.

- Best for basic spreadsheet modeling: Microsoft Excel - Provides a foundation of most FP&A models.

- Best for enterprise planning: Workday Adaptive Planning - Offers large-scale planning, modeling, and reporting.

- Best for large-scale transformation initiatives: Anaplan - Handles complex modeling and cross-department transformation.

- Best for financial planning: Planful - Supports ongoing, company-wide financial cycles.

- Best for Excel-based planning: Vena - Uses the Excel interface with prebuilt FP&A workflows and templates.

- Best for FP&A automation: Prophix - Automates budgeting, reporting, and consolidation.

- Best for multidimensional analytics: Oracle Essbase - Enhances existing FP&A systems in Oracle environments.

- Best for NetSuite-centric organizations: NetSuite Planning and Budgeting - Integrates with NetSuite applications with prebuilt planning workflows.

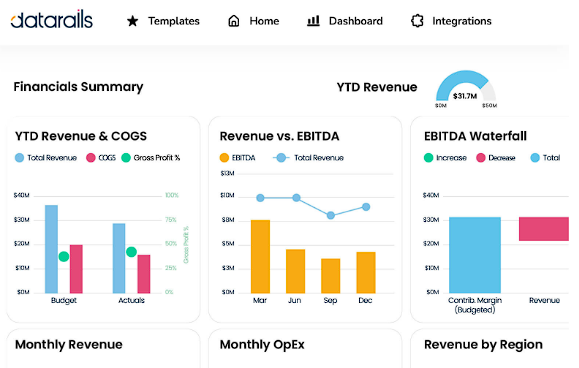

- Best for Excel-only teams: Datarails - Helps small and midsize teams automate consolidations, reporting, and budgeting.

- Best for modular integrated planning: Jedox - Allows for customizable planning, modeling, and data integration.

- Best for AI modeling on enterprise data: OneStream - Adds an AI layer on existing financial data models.

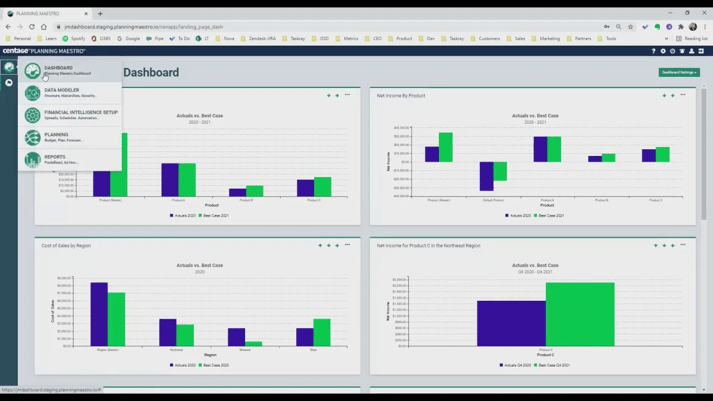

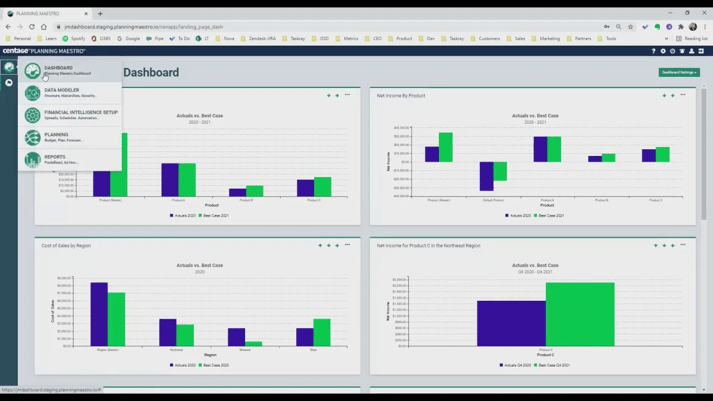

- Best for budgeting, forecasting, and expense management: Centage - Works formula-free with drag-and-drop planning.

- Best for 3-statement modeling: Mosaic Tech - Executes 3-statement modeling for SMB and growth-stage teams.

- Best for cross-team business planning: Pigment - Empowers finance, HR, and revenue teams to work together in one shared model.

- Best for SMB reporting: Jirav - Provides dashboards, forecasting, and scenario analysis for SMBs.

What is FP&A (financial planning and analysis)?

Financial planning and analysis includes the core activities that support a company’s financial health, like planning, budgeting, forecasting, budget forecasting and reporting. It also covers routine work such as financial close, consolidation, and cash-flow reporting, and strategic initiatives like scenario planning, financial modeling, and integrated planning.

When done right, FP&A tells the story of the past—and helps shape the story of what comes next. However, research shows that only 35% of FP&A time is spent on insights, while 45% still goes toward data collection and validation. This is driving a shift toward tools that cut manual work and give teams faster access to reliable information.

As Brian Kalish, FP&A subject matter expert, puts it, “Today, CFOs expect FP&A to do twice as much analysis than is currently being generated. But I don't hear anyone talking about adding twice as much staff. So how do you bridge that gap? It's going to be technology that will enable the capability to collaborate.”

AI is actively reshaping day-to-day FP&A. Tasks like checking variances, reviewing trends, or building baseline forecasts now move faster, and AI can help explain what changed and what’s driving those shifts. Instead of piecing together insights manually, teams can get clearer context behind the numbers and focus on guiding stakeholders toward the right next steps.

How do you do FP&A?

FP&A includes the following steps:

- Data gathering and budgeting: This step involves collecting financial data and creating an annual budget based on trends, economic conditions, and business goals. FP&A teams collaborate with departments to ensure budget alignment with the company’s objectives.

- Forecasting and modeling: This step involves developing forecasts and constructing models for potential scenarios, considering both internal and external factors. It enables finance leaders to explore “what if” scenarios and choose the best course of action.

- Analysis and reporting: This step compares actual performance to forecasts. FP&A teams perform variance analysis to understand deviations and communicate insights to leadership, supporting informed decision-making and strategic adjustments.

What is FP&A software?

Financial planning and analysis software solutions are financial management tools that help FP&A professionals carry out core financial processes.

They help automate manual FP&A tasks, such as data collection, consolidation and verification, planning and forecasting, budgeting, and performance monitoring and analytics.

FP&A tools help finance teams:

- Build financial models and forecasts

- Use predictive analysis to assess the impact of business decisions on profitability, cash flow, and future outcomes

- Provide advanced financial analysis and advice to organizations

- Develop multiple scenarios and create flexible integrated strategic plans

- Keep tabs on the business’s general financial performance, health, and investments

- Identify and measure risks or new opportunities for business growth

AI-powered FP&A tools also help strengthen these workflows by quickly highlighting anomalies in the data and pointing out patterns that may not be obvious at first glance. Instead of sorting through multiple reports, teams can use AI to surface the key drivers behind changes and get clearer context before updating budgets, forecasts, or executive summaries.

Of course, the functionality of FP&A software goes beyond this list. It can also integrate with other solutions you typically use, like an ERP, CRM, HRIS, or business intelligence (BI) software.

The category continues to grow as teams look for faster, more reliable ways to plan and analyze performance. Gartner research shows the global financial management software market is projected to reach over $24 billion by 2026, driven by cloud adoption, digital transformation, and the need for more agile forecasting in a volatile environment.

AI is fueling this momentum by giving FP&A teams quicker ways to surface trends, compare scenarios, and explain business changes.

Best FP&A tools: Quick overview

With so many options on the market, choosing the right FP&A tool can feel overwhelming. To help simplify the decision-making process, here’s a quick snapshot of top vendors based on key metrics like implementation, support, results, and usability.

This chart gives you a high-level comparison. In the following sections, we’ll explore each tool in greater depth.

Benefits of FP&A tools for finance teams

FP&A software can help finance teams work smarter and faster. Here are a few of the main ways it achieves this:

Reduces errors

Errors in financial reporting can expose your organization to financial losses, regulatory non-compliance, and loss of goodwill.

FP&A software improves the accuracy of financial planning and analysis by automating manual data entry and calculations prone to mistakes.

It also provides a centralized platform that integrates with various data sources, supporting consistent data input and reducing errors that occur when pulling data from different places.

Saves time

Automating repetitive tasks with FP&A software gives you and your team more time to focus on strategic decision-making processes.

Most FP&A software is cloud-based, enabling real-time updates and reporting on a single platform. Your team won't waste time sifting through multiple information databases.

Additionally, FP&A software's advanced analytical capabilities allow users to analyze more data, perform complex calculations, analyze scenarios, and conduct predictive modeling in less time than manual methods.

Centralizes data

According to a PWC survey, about 80% of FP&A tasks are being done in offline spreadsheets and databases. This creates data silos and reduces how easily you can access data.

FP&A tools provide a centralized platform for carrying out all finance-related tasks. This allows stakeholders to access information whenever and wherever they please.

Beyond preventing data silos, having centralized data also helps you maintain data integrity. FP&A software provides controls to prevent unauthorized access, data loss, or data manipulation.

How to choose the best FP&A software

FP&A software is not one size fits all—software that works great for one organization may not be the best for you. That said, there are certain functionalities that all FP&A software should provide to be useful to its users.

To make sure you choose the best FP&A software for your business, here’s what you need to keep in mind:

1. Review FP&A software features

Look for core features that match your business goals. Key functions like budgeting and forecasting help set financial targets and track progress, keeping your team aligned with goals. Scenario planning also prepares your team to handle different business situations effectively.

Automated reporting can deliver rapid insights, while AI-driven financial analysis boosts confidence in forecasts by drawing on historical data.

Additionally, make sure the software has strong integration capabilities to connect seamlessly with your existing enterprise resource planning (ERP), customer relationship management (CRM), and spreadsheet systems for less manual data entry.

2. Consider implementation time

Imagine you’ve spent considerable time searching for FP&A software. You find the perfect solution and pay for it—but then you realize it will take at least three months to fully integrate.

Yikes.

Time is money (and notoriously hard to come by), so it’s imperative to select FP&A software with a short implementation time and onboarding process.

But don't just take the software provider’s word for it—see for yourself. Try product demos and read reviews to ensure you can integrate the software into your current processes quickly.

3. Prioritize ease of use

There’s no point in adopting FP&A software with great features if it’s too difficult for non-technical people to use. Intuitive software with excellent onboarding helps the team adopt it faster, making its use feel natural over time.

Product reviews on sites like G2 and Capterra can help you find software that's easy to use.

4. Look for customization and flexibility

You’ll need the option to customize dashboards, financial models, and reports to fit your business requirements and current processes. The software should also be flexible enough to integrate data from different sources and connect with your existing systems.

Customizability and flexibility in FP&A software ensure adaptability and will support future changes in your processes, workflows, and business outcomes.

5. Prioritize data security

Maintaining data integrity is crucial to prevent unauthorized access and manipulation of your organization's financial information. Choose FP&A software that offers enterprise-grade cloud security, including customizable controls, data encryption, authorization, multi-factor authentication (MFA), and single sign-on (SSO).

Ensure the software has passed industry-standard security and regulatory compliance checks, such as the SOC 2 Type 2 examination.

6. Choose advanced analytics and reporting

Advanced analytics and reporting will enhance your decision-making and provide deeper insights into your business performance and priorities. Look for software that offers dynamic reporting, machine learning algorithms, predictive analytics, and scenario modeling.

Effective FP&A software should efficiently handle data validation, especially when importing historical data into models. Dynamic dashboards allow other departments to access and interpret data independently, reducing finance teams’ workload and making complex metrics accessible across the organization.

Additionally, choose a flexible solution capable of performing diverse types of analytics and adapting to various business models. Whether your organization is in manufacturing, logistics, or any other industry, an adaptable FP&A tool will support unique forecasting, budgeting, and reporting needs, driving data-informed growth across the board.

7. Ask about compliance support

The FP&A software should comply with relevant reporting standards, financial regulations, and data privacy requirements, such as GAAP, IFRS, and GDPR. Ensure the software allows you to automate compliance reporting tasks and generate standard reports for stakeholders and regulatory bodies.

By choosing FP&A software built with compliance in mind, you can avoid compliance risks and assure stakeholders of the business's credibility.

The best FP&A software tools

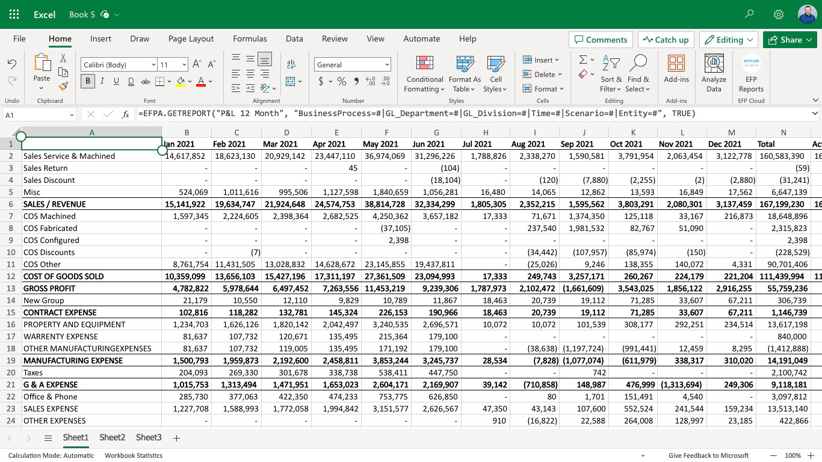

Traditionally, businesses execute FP&A using large, complex, interconnected offline spreadsheets. Perhaps no other business team has a more entrenched relationship with Microsoft Excel than FP&A.

While Excel is in some ways a match made in heaven for finance professionals (easy to use, naturally designed for financial data and calculations, flexible for any financial model, etc.), it also comes with some significant flaws that create big problems and inefficiencies at scale (e.g., highly manual, stale data, not easy to share and collaborate, few controls).

To solve these challenges, several software providers set out to build new solutions that would help FP&A teams do their jobs better, faster, easier, and more confidently. However, each FP&A solution vendor focuses on different market segments and takes a different approach to helping FP&A teams.

Some are best for larger enterprises with big IT budgets, others suit existing customers of a software provider, and others ideally suit customers who want more flexibility in their software strategy. All you need to do is find the one that’s right for you!

To help you decide, here are some of the best FP&A software providers, their key features, benefits, pricing, and more details.

1. Best FP&A for AI-powered financial intelligence: Cube

G2 Rating: 4.5/5

TrustRadius Rating: 9.2/10

Capterra Rating: 4.6/10

Best for: Mid-market finance teams that want spreadsheet-native workflows supported by powerful AI-powered insights, faster outputs, and enterprise-grade control.

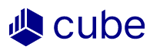

Cube is a cloud-based FP&A platform that pairs the flexibility of Excel and Google Sheets with AI-driven financial intelligence. Instead of learning a new interface, teams work in their existing spreadsheets while Cube automates data consolidation, accelerates analysis, and generates real-time, data-backed answers.

This gives FP&A teams faster visibility into performance, clearer explanations behind variances, and more time to focus on strategic planning.

Many high-growth companies (like Instride and Figment) use Cube for all their FP&A needs.

Key features:

- AI-powered forecasting: Create baseline forecasts in seconds using historical trends and structured financial data.

- Automated variance analysis: Surface key changes, drivers, and explanations without digging through spreadsheets manually.

- Spreadsheet-native modeling: Work directly in Excel or Google Sheets with bi-directional sync for models, reports, and calculations.

- Automated data consolidations: Pull data from ERPs, CRMs, HRIS platforms, and other systems into a single governed source of truth.

- Scenario planning: Build and compare multiple financial outcomes for revenue, headcount, and cost planning.

- Audit trails and user controls: Track changes, manage permissions, and maintain data accuracy across all contributors.

These FP&A software features translate to easier reporting and KPIs, more accurate forecasting and budgeting, faster close and consolidation cycles, and collaborative teamwork for more control and fewer mistakes.

Integrations: Cube is built to work directly with most finance and business systems including ERP, CRM, HRIS, Business Intelligence systems, and more. Cube has bi-directional integration with Google Sheets and Microsoft Excel, which gives customers an incredible amount of versatility to choose the user experience that is right for them and their business teams.

Limitations: Cube is not for individual business owners. It works best for mid-sized or enterprise businesses.

Pricing: Custom Pricing starts at $3,000/month

2. Best FP&A for basic spreadsheet modeling: Microsoft Excel

G2 Rating: 4.7/5

Best for: Finance teams that want full control over formulas, layouts, and custom FP&A models without switching to a new interface.

Microsoft Excel is the backbone of many FP&A models. It gives analysts the flexibility to build models, run calculations, and structure reports exactly the way they want. But Excel also comes with limitations at scale.

Data quickly becomes overwhelming, version control gets messy, and it’s difficult to collaborate across departments. That’s why most FP&A teams layer spreadsheet-native FP&A software on top of Excel to automate data calculations, reduce errors, and keep reports in sync without replacing the spreadsheet environment they rely on every day.

[Source]

Key features:

- AI-assisted analysis: Use Microsoft 365 Copilot to summarize data, generate insights, and create draft models directly inside Excel.

- Full modeling: Build formulas, operating budgets, and driver-based models.

- Formula library: Access financial, statistical, and logical functions to analyze data.

- Pivot tables and analytics tools: Slice and summarize data for reporting and trend analysis.

- Add-ins and integrations: Extend functionality with Power Query, Power Pivot, or third-party FP&A tools.

Limitations: “I dislike how non intuitive Excel is. Even people who have been using it for decades don't feel like experts at all.” - G2, Verified User

Price: $179.99 for lifetime access

3. Best FP&A for enterprise-wide planning: Workday Adaptive Planning

G2 rating: 4.3/5

Best for: Strong capabilities outside of Finance and FP&A make Adaptive Planning a good choice for large enterprises seeking a transformational, company-wide FP&A solution.

Workday Adaptive Planning, formerly Adaptive Insights, provides enterprise planning software to upgrade planning, modeling, budgeting, and forecasting. Their solutions cover financial, workforce, and sales planning to promote collaboration across the enterprise without manual spreadsheets or clunky legacy systems. Workday Adaptive Planning is a financial management solution.

Workday Adaptive Planning for finance provides explicitly flexible, scalable financial planning and analytics for large enterprises; powerful modeling for any size business; reporting that’s easy to use and always up to date, and real-time financial consolidation that accelerates your financial close.

The solution also covers FP&A solution needs for modeling, collaboration, analytics, management reporting, board reporting, scenario planning, and financial consolidation.

Key features:

- Machine learning forecasting: Employ predictive analytics and ML-driven pattern detection to improve forecast accuracy and highlight trends.

- Analytics and reporting: Build tailored reports and analyze data with customizable dashboards and interactive visualizations.

- Budgeting and forecasting: Create and compare multiple what-if scenarios and build monthly or quarterly budgets and forecasts.

- Scenario planning: Use data-driven predictive forecasting and modeling capabilities for in-depth insights.

- Strategic planning: Assess the impact of decisions across the organization with strategic planning tools.

Limitations: “Finding comprehensive training and information for Workday Adaptive Planning can be challenging for several reasons. Despite Workday offering official training resources, these may not always meet every user’s specific needs or cover advanced features in depth.” – G2, Verified User in Financial Services

Pricing: Custom quote

4. Best FP&A for large IT teams: Anaplan

Capterra Rating: 4.3/5

Best for: Anaplan is good for large enterprise customers with a strong IT team ready to lead an enterprise-scale transformation initiative.

Anaplan lets you mobilize complex scenario planning to the smallest detail, intelligently forecast the biggest picture, and empower teams to make decisions. Their enterprise-wide solutions connect your strategy to your outcomes and layers of accountability connected to a single source of truth.

For Finance, Anaplan specifically provides FP&A solutions to connect your people, data, and plans across your organization to empower the right decisions without delay.

Key features:

- PlanIQ predictive modeling: Create predictive forecasts, analyze historical drivers, and automate baseline projections.

- Revenue planning: Get visibility into your key drivers and connect revenue planning across the enterprise.

- Headcount planning: Track headcount expenses to maintain alignment with operating plans.

- Capital planning: Integrate capital projects from multiple units to inform investment decisions.

- Data integration: Integrate data types from multiple sources, like ERP and CRM systems, into a single platform.

Limitations: "The major drawback for me is the lack of native integration with external systems, which has required us to do additional work to connect external data sources through API. Anaplan announced the upcoming release of the Anaplan Data Orchestrator (ADO) which I hope will address this limitation by improving data integration and orchestration native capabilities." User review

Pricing: Custom Pricing

5. Best FP&A for financial planning: Planful

G2 Rating: 4.5/5

Best for: Planful is ideal for larger companies with big FP&A teams that want to expand their scope of influence beyond Finance.

Planful offers a cloud FP&A software platform focused on continuous planning. Their solution covers structured and dynamic planning, consolidation, and reporting. Planful’s continuous planning platform marries finance’s need for structured planning with the business’s need for dynamic planning, elevating the financial conversation and helping you make better decisions more quickly, confidently, and strategically.

For Finance, Planful highlights use cases for managing cash flow, workforce reporting, financial reporting, annual operating planning, monthly close and consolidation, and multi-dimensional analysis.

Key features:

- Predictive analytics engine: Run ML-based forecasts, detect anomalies, and surface performance trends.

- Driver-based forecasting: Get full visibility into cash balances and adjust key drivers to manage cash position.

- Data consolidation: Combine financial data from multiple sources into a single view.

- Drill-down analysis: View and analyze specific areas of business financial data.

- Cash flow and rolling financial forecasts: Predict and manage cash flow and make adjustable future projections.

Limitations: “Some things just do not seem intuitive. … Too many features of the system seem to not communicate with each other automatically.” User review

Pricing: Custom pricing

6. Best FP&A for Excel-only planning: Vena

G2 Rating: 4.5/5

Best for: Vena is ideal for companies that need the fixed process and planning guidance of pre-built FP&A solutions or that have the resources to uniquely customize those pre-built solutions for their own needs.

Vena offers a complete planning platform to unite people, processes, and systems. They offer pre-built solutions to automate time-consuming tasks so you can spend less time checking your data's accuracy.

Specific capabilities include financial planning and analysis, integrated business planning, financial reporting, regulatory compliance reporting, and financial close management. Vena focuses on helping companies support overall growth and refers to its platform as a “growth engine.”

For Finance, Vena offers “pre-configured” FP&A software that provides a prescriptive approach to corporate performance management but can be customized to meet specific business needs and industry requirements.

Key features:

- Vena Insights intelligence: Analyze historical data and receive recommendations within Excel-based workflows.

- Budgeting: Create top-down, bottom-up, zero-based, or driver-based, budgets and reduce cycle times.

- Forecasting: Build rolling forecasts and what-if analysis for future planning with advanced modeling capabilities.

- Reporting and analysis: Compare departmental financials, build ad hoc reports, and view income statements.

- Audit trails: See the history of each cell and number, and track changes and versions of documents.

Limitations: “Even with an Excel-based interface, it still has a steep learning curve. Mastering all of its features and functionalities can take time and effort.” User review

Pricing: Custom quote

7. Best FP&A for automation: Prophix

G2 Rating: 4.4/5

Best for: Prophix is best for companies with slow, manual, repeatable FP&A processes that can be easily automated and replicated using the solution’s pre-built functionality.

Prophix offers Corporate Performance Management (CPM) software to improve profitability and minimize risk by automating repetitive tasks so FP&A can focus on what matters. Their solutions help teams budget, plan, consolidate, and report automatically. They also offer cloud or on-premise solution options. For Finance, Prophix provides solutions for automating repetitive budgeting tasks and business processes, such as data imports, report generation, and allocations.

Prophix also offers the ability to detect and surface unusual transactions with text or voice.

.png?width=630&height=354&name=prophix-view%20(1).png)

Key features:

- Predictive forecasting: Carry out quarterly and rolling forecasts with predictive forecasting tools that make forecasting faster and more accurate.

- Data collection and analysis: Collect and analyze data to make informed business decisions.

- Compliance audit prep: Prepare financial records according to accepted audit standards.

- AI-driven insights: Use AI insights to make on-the-fly decisions, track performance, and drill into variances to uncover root causes.

Limitations: “It's a bit of a steep learning curve up front to learn how to build out the software.” User review

Pricing: Custom pricing

8. Best FP&A for multidimensional analytics: Oracle Essbase

G2 Rating: 4.3/5

Best for: Oracle Essbase is ideal for large enterprises with deep IT resources that already have a robust FP&A solution, have analysis teams seeking targeted analytics and modeling tools, and are already invested in Oracle back-office solutions.

Oracle Essbase allows organizations to rapidly generate insights from multidimensional data sets using what-if analysis and data visualization tools. It is a business analytics solution for analysis, reporting, and collaboration across all lines of business within your organization. You can interact with Essbase through a web or Microsoft Office interface to analyze, model, collaborate, and report.

Oracle Essbase would complement existing FP&A tools for Finance with deeper analytics and modeling capabilities. It is not a Finance-focused solution.

Key features:

- Predictive modeling tools: Access time-series forecasting and trend analysis.

- Out-of-the-box calculations: Leverage up to 100 prebuilt mathematical functions that you can apply to derive new data.

- Integration with Microsoft Office: Import financial data into an Excel spreadsheet to calculate and analyze data.

- Forecasting and scenario planning: Predict future financial performance and resource needs, and develop plans to optimize the use of financial resources.

- Visual interfaces: Create customizable charts and graphs to visualize data.

Limitations: “It is not very fast when it comes to extracting the data and in my opinion, it needs a better API. Also, there is a great need for proper documentation as there are a lot of undocumented commands.” User review

Pricing: Custom pricing

9. Best FP&A for NetSuite-only organizations: Netsuite Planning and Budgeting

G2 Rating: 4.0/5

Best for: NetSuite Planning and Budgeting is best for large companies and enterprises in limited industries with NetSuite solutions already deployed in other business areas.

NetSuite Planning and Budgeting enables organizations of all sizes to quickly adopt a world-class planning and budgeting application offering market-leading functionality across lines of business. Planning and Budgeting automate labor-intensive planning and budgeting processes and centralize company financial and operational data.

Finance teams can quickly and easily produce budgets and forecasts, model what-if scenarios, and generate reports within one collaborative, scalable solution.

For Finance, NetSuite Planning and Budgeting standard edition can facilitate company-wide and departmental budgeting with pre-built reports, templates, and capabilities. A premium edition offers a planning and budgeting solution developed for a handful of specific industries, such as nonprofits, software, agencies, and services. Expert NetSuite Services consultants must implement the premium edition.

.png?width=594&height=367&name=oracle-netsuite%20(1).png)

Key features:

- Budgeting and forecasting: Automate company-wide and departmental budgeting processes with prebuilt workflows.

- Scenario planning and modeling: Perform scenario modeling and multidimensional planning with any amount of dimensions, such as expense, product, customer, etc.

- AI-powered predictive planning: Leverage embedded AI to automate data analysis, predict algorithms, and monitor plans.

- Data synchronization: Create driver-based sales and revenue forecasts with data from all business units.

Limitations: “The drawback I have seen so far is consistently connecting and interacting with our bank accounts. The account transactions, when imported, exist only on one screen. Unlike Quickbooks, you cannot use them to post to your general ledger - you must create your own NetSuite records to match the bank records.” Review

Pricing: Custom pricing

10. Best FP&A for small teams using Excel: Datarails

G2 Rating: 4.7/5

Best for: Datarails is best for small and medium business finance teams that use Excel for FP&A.

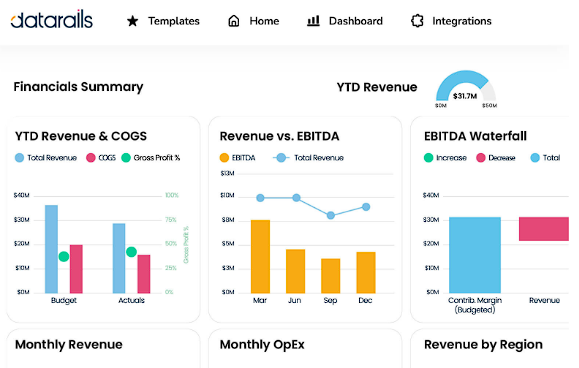

Datarails is an AI-powered FP&A platform that helps finance teams build financial models and spreadsheets and automate repetitive processes.

The platform supports data consolidation, financial reporting, scenario analysis, financial reporting, and ERP-Excel connectivity.

For finance, Datarails has a FinanceOS solution that offers cross-company alignment between the finance team and other teams in the organization. It allows users to integrate with other business solutions, such as ERPs and CRMs, and provides a consolidated platform for data management.

Key features:

- AI-powered insights engine: Surface anomalies, identify variances, and generate automated explanations.

- Consolidation: Automate data collecting from multiple software across the organization and bring it all to one place.

- Budgeting: Organize your budget collection process, and estimate costs and revenue for the entire organization.

- Forecasting: Use up-to-date financial projects to plan ahead and make data-driven decisions.

- Data visualization: Leverage graphs and charts to share data and collaborate with other teams.

Limitations: “Exporting large volumes of data or directly integrating to BI tools like Tableau could be improved. Permission management is time consuming and highly detailed. I wish there was a better way to lock an entire version with one or two clicks.” User review

Pricing: Custom pricing

11. Jedox

G2 Rating: 4.4/5

Best for: Jedox is best for building modular solutions for integrated planning and creating customized ESG reports in-house.

Jedox is a planning and performance management platform that enables users to create forecasts, budgets, and forecasts. It offers AI-assisted planning, budgeting, and analysis and lets users model attributes and create sets of business logic.

Its FP&A platform allows self-service no-code data integration from multiple sources for finance and automates transaction recording for financial statements like P&L, balance sheet, and cash flow.

Jedox has an interface similar to Excel that enables teams across departments to collaborate.

Key features:

- AI-assisted planning: Enhance forecasting, automate data-driven predictions, and support more accurate planning.

- Financial modeling: Create advanced financial models with clear predictions.

- Financial analysis: Leverage analytical tools to analyze financial performance, identify improvement opportunities, and find trends.

- Cashflow planning: Optimize cashflow management and free up resources for innovation and growth.

- Management reporting: Transform raw data into actionable insights with customizable reports and real-time data.

Limitations: “Requires investing of time into trainings (for administrators, reporters)—such solutions probably could not be simply installed and used 'from the box'. It requires time to spend for trainings/certifications provided by Jedox or other partners.” User review

Pricing: Custom pricing

12. Best FP&A for embedded AI modeling: OneStream

G2 Rating: 4.6/5

Best for: OneStream is best for building AI models on top of a business’s already existing data models.

OneStream is an enterprise finance platform that provides agile planning and reporting for finance teams. It enables users to unify their finance processes and deliver actionable analytics, forecasts, and financial signals.

The platform has an embedded AI solution that enables users to create AI models pre-built on top of their own data models. Its generative AI helps businesses query and interact with financial intelligence data with workflows and data structures.

OneStream also has an extended planning and analysis (xP&A) platform built to help finance teams align operational plans with financial performance.

Key features:

- Embedded generative AI: Build AI models directly on top of your company’s existing financial data.

- Planning, budgeting, and forecasting: Integrate data from multiple sources and model various scenarios across financial metrics.

- Reporting and analytics: Use drag-and-drop reporting tools and dashboards to analyze data and visualize trends.

- Scenario planning: Isolate key drivers like new product launches or pricing changes, model different scenarios, and create driver-based plans.

- Profitability analysis: Manage profitability scenarios with integrated visualization and reporting.

Limitations: “User interface can be challenging to use and extensive training is required to become a power user. Not an intuitive interface.” User review

Pricing: Custom pricing

13. Best FP&A for simple budgeting and forecasting: Centage

G2 Rating: 4.3/5

Best for: Centage is best for expense tracking and asset management.

Centage is a cloud-native budgeting and forecasting software that enables businesses to automate budgeting, forecasting, and reporting processes through advanced financial intelligence.

It’s a formula-free, drag-and-drop solution that lets users update statements or add new accounts without re-entering formulas.

Centage provides a web-based financial dashboard for tracking metrics, budgets, opportunities, and risks. It lets users combine and layer data from ERP, CRM, and GL systems to get an overview of their business.

Key features:

- Budgeting: Collaborate with people in real-time to build multi-dimensional budgets.

- Forecasting: Forecast and evaluate actuals to track performance.

- AI-enhanced forecasting: Apply machine learning to forecasts and budgeting.

- Consolidated reporting: Simplify the consolidation of reports and financial statements.

- Workforce planning: Build a detailed workforce budget, automate real-time salary forecasts and headcount calculations.

Limitations: “End users would like some functions similar to Excel functions.” User review

Pricing: Three pricing plans all with custom pricing.

14. Best FP&A for 3-statement modeling: Mosaic Tech

G2 Rating: 4.7/5

Best for: Mosaic suits small and medium businesses that want to maintain 3-statement models.

Mosaic is a strategic finance platform that provides real-time analytics and planning for finance teams. Users can connect their tech stack to the platform and directly integrate data from popular HRIS, CRM, ERP, and data warehouse systems.

Mosaic offers model builders, 3-statement models, and what-if scenario planning. It also has a chat-based AI tool to help users monitor their workflows, view insights, and automate tasks.

Key features:

- AI assistat: Use natural language querying and automated insight generation to surface trends, summarize performance shifts, and handle FP&A.

- Data integration: Synchronize data from ERP, CRM, and HRIS applications on a single platform.

- Automated reporting: Reduce manual report building using tailored and pre-configured metrics to create custom reports.

- Headcount planning: Forecast the cost of current and future employees and make data-driven decisions.

- Custom metrics: Bring in financial and operational data to build new metrics you can use in dashboards and reports.

Limitations: "More customized charts/tables would be a nice-to-have within Mosaic. While there is a breadth of different charts and tables, it would be nice to have the ability to customize these displays more quickly than it currently is within the tool." User review

Pricing: Custom pricing

15. Pigment

G2 Rating: 4.6/5

Best for: Pigment is best for businesses that want to build a single business plan through collaboration between finance, HR, and revenue teams.

Pigment is designed to help finance, HR, and revenue teams build flexible plans, budgets, and forecasts. The platform also connects these teams together so they can build a single business plan rather than three.

It has features like drill-down and waterfall charts that allow users to gain visibility into their business data during collaboration.

Pigment allows finance teams and CFOs to build and approve agile, integrated business plans. It provides access controls, automated workflows, and collaboration capabilities that smooth the financial planning process. It also lets finance teams build dynamic, multidimensional business models that draw data from multiple sources.

%20(1).png?width=722&height=527&name=64835ddc6c1de9e907045aa7_Finance%20dashboard%20-%20Pigment%20homepage%20hero%20(4)%20(1).png)

Key features:

- Intelligent AI planning agents: Use AI agents to scan data, detect anomalies, and build predictive models.

- Financial modeling: Model plans using intuitive syntax, auto-complete formulas, and auto-generate diagrams.

- Reporting: Build plans with business-specific visuals all connected to a single source of data.

- Collaboration: Leverage built-in collaboration features and access controls to keep everyone on the same page.

- Headcount planning: Align hiring plans with business strategy revenue objectives and salesforce capacity.

Limitations: “Complex learning curve for end users. Despite Pigment's comprehensive onboarding experience facilitated by a knowledgeable team, some end users may find it challenging to fully dive into the multitude of features offered, especially those accustomed to years of using simpler tools like Excel.” User review

Pricing: Custom pricing

16. Best FP&A for SMB reporting: Jirav

G2 Rating: 4.7/5

Best for: Jirav is best for small and medium companies and accounting firms that want to maximize operational growth.

Jirav is reporting and planning software purpose-built for small and medium businesses (SMBs) and accounting firms.

It enables users to forecast, budget, build dashboards, and generate reports that provide insights into business financial health. Users can automate their reporting and analytics and model multiple scenarios for risk situations.

For accounting and CFO teams, Jirav offers custom planning and reporting tools that help them maintain oversight of the business’s cash flow and working capital assumptions. Its scenario planning tool also supports the creation of agile scenarios that adapt to changing business strategies.

[Source]

Key features:

- Automated AI forecasting: Access JIF, a machine-learning engine that builds forecasts and enables scenario planning with minimal manual input.

- Driver-based forecasting: Model and predict future performance with more accuracy using key drivers.

- KPI monitoring: Create reports and dashboards using specific industry metrics and store them in a KPI library.

- Integrations: Integrate with existing accounting tools to centralize financial data.

- Scenario planning: Build and analyze multiple scenarios to make date-driven decisions.

Limitations: “Jirav definitely has a learning curve and it would probably be best utilized by an in-house full time person at an organization that has the capacity to continually update it. Specifically, it is time consuming to learn the drivers and how they work and learn some of the nuances of the software such as the staffing table and how to best use it efficiently. We also encountered some challenges when using Jirav such as maintenance to the software while we were using it.” User review

Pricing: Custom pricing

Benefits of FP&A tools for finance teams

Today’s finance teams are expected to spend less time collecting numbers and more time explaining what those numbers mean. Industry research shows that analysts now act more like interpreters of financial insights than traditional data processors.

Here are a few ways FP&A software supports this shift and helps teams work smarter and faster:

Reduces errors

Errors in financial reporting can lead to financial losses, compliance issues, and credibility risks. FP&A software reduces the chance of mistakes by automating data entry, consolidations, and calculations that can break in manual spreadsheets.

A centralized platform also ensures teams pull information from the same governed source, minimizing inconsistencies across departments. AI strengthens this further by flagging anomalies, surfacing unusual trends, and identifying outliers that might otherwise be missed during manual review.

Saves time

Automating repetitive FP&A tasks gives teams more time to focus on analysis, strategy, and cross-functional planning. Cloud-based systems allow for real-time updates across models and reports, which eliminates the back-and-forth of working in multiple versions of the same spreadsheet.

AI accelerates this even more by producing draft forecasts, summarizing performance changes, and helping teams compare scenarios in seconds. This reduces time spent gathering information and increases time spent acting on it.

Centralizes data

According to a PWC survey, about 80% of FP&A tasks are being done in offline spreadsheets and databases. This creates data silos and reduces how easily you can access data.

FP&A tools provide a centralized platform for carrying out all finance-related tasks. This allows stakeholders to access information whenever and wherever they please.

Beyond preventing data silos, having centralized data also helps you maintain data integrity. FP&A software provides controls to prevent unauthorized access, data loss, or data manipulation.

AI builds on this foundation by giving teams the ability to analyze larger, unified data sets quickly and surface connections or risks that may not be obvious in scattered sources.

Provides better insights

FP&A software improves visibility into performance by giving teams a clearer view of trends, budget variances, and business drivers. Instead of relying solely on manual analysis, platforms now use AI to highlight what changed, why it happened, and where teams should focus next.

AI can automatically break down variances, surface unexpected shifts, and provide narrative context that helps finance teams explain results to stakeholders. It can also speed up forecasting by analyzing historical patterns and proposing baseline projections. Together, these capabilities help FP&A teams move from reactive reporting to more proactive, insight-driven planning.

What Redditors say about FP&A software

We looked through dozens of posts on r/FPandA where finance professionals shared honest feedback on FP&A platforms. Here’s a snapshot of what they’re saying:

“Check out Cube… it’s our front runner.”

“Everything I’ve read or heard about Anaplan makes it seem like you need a dedicated person/team to maintain it.”

“250-500 person SaaS company… went with Adaptive at first. Way too bulky for our needs.”

Summary: Redditors generally appreciate tools that let them stay close to native spreadsheets like Cube. Large-scale enterprises lean toward systems like Anaplan if they have the extra headcount to back it.

How to choose the best FP&A software

FP&A software is not one size fits all: software that works great for one organization may not be the best for you. That said, there are certain functionalities that all FP&A software should provide to be useful to its users.

To make sure you choose the best FP&A software for your business, here’s what you need to keep in mind:

1. Review FP&A software features and AI functions

Start by identifying the core features your team needs, whether it’s budgeting, forecasting, reporting, and scenario planning. From there, verify how each platform uses AI to strengthen those workflows. Look for capabilities that speed up analysis, improve accuracy, and help your team get answers faster, not just surface-level automation.

It’s important to confirm that the AI is grounded in governed financial data and provides clear explanations for its outputs. You’ll also want to verify that it fits naturally into your team’s existing spreadsheet or planning processes.

Finally, ensure the software integrates smoothly with your ERP, CRM, HRIS, and spreadsheet tools so your data stays connected with minimal manual work.

2. Consider implementation time

Imagine you’ve spent considerable time searching for FP&A software. You find the perfect solution and pay for it—but then you realize it will take at least three months to fully integrate.

Yikes.

Time is money (and notoriously hard to come by), so it’s imperative to select FP&A software with a short implementation time and onboarding process.

But don't just take the software provider’s word for it—see for yourself. Try product demos and read reviews to ensure you can integrate the software into your current processes quickly.

3. Prioritize ease of use

There’s no point in adopting FP&A software with great features if it’s too difficult for non-technical people to use. Intuitive software with excellent onboarding helps the team adopt it faster, making its use feel natural over time.

Product reviews on sites like G2 and Capterra can help you find software that's easy to use.

4. Look for customization and flexibility

You’ll need the option to customize dashboards, financial models, and reports to fit your business requirements and current processes. The software should also be flexible enough to integrate data from different sources and connect with your existing systems.

Customizability and flexibility in FP&A software ensure adaptability and will support future changes in your processes, workflows, and business outcomes.

5. Prioritize data security

Maintaining data integrity is crucial to prevent unauthorized access and manipulation of your organization's financial information. Choose FP&A software that offers enterprise-grade cloud security, including customizable controls, data encryption, authorization, multi-factor authentication (MFA), and single sign-on (SSO).

Ensure the software has passed industry-standard security and regulatory compliance checks, such as the SOC 2 Type 2 examination.

6. Choose advanced analytics and reporting

Advanced analytics and reporting will enhance your decision-making and provide deeper insights into your business performance and priorities. Look for software that offers dynamic reporting, machine learning algorithms, predictive analytics, and scenario modeling.

Effective FP&A software should efficiently handle data validation, especially when importing historical data into models. Dynamic dashboards allow other departments to access and interpret data independently, reducing finance teams’ workload and making complex metrics accessible across the organization.

Additionally, choose a flexible solution capable of performing diverse types of analytics and adapting to various business models. Whether your organization is in manufacturing, logistics, or any other industry, an adaptable FP&A tool will support unique forecasting, budgeting, and reporting needs, driving data-informed growth across the board.

7. Ask about compliance support

The FP&A software should comply with relevant reporting standards, financial regulations, and data privacy requirements, such as GAAP, IFRS, and GDPR. Ensure the software allows you to automate compliance reporting tasks and generate standard reports for stakeholders and regulatory bodies.

By choosing FP&A software built with compliance in mind, you can avoid compliance risks and assure stakeholders of the business's credibility.

Best practices for implementing FP&A tools

The most successful implementations start with a clear plan and a focus on long-term adoption. Follow these best practices to help your team get value faster:

- Start with a clear needs assessment: Before evaluating any tool, outline the problems you’re trying to solve and how the software fits into your current workflow. Think through questions like: What manual steps do we want to eliminate? What systems need to connect? What does “success” look like six months from now?

- Involve the right stakeholders early: Pull in IT, operations leaders, department owners, and anyone who contributes to budgeting or reporting. Get their input to prevent surprises during rollout and ensure the tool fits the broader organization. Prioritizing only the finance team can open you up to roadblocks later.

- Prioritize training and ongoing support: Every software requires setup, onboarding, and time for teams to adjust. Plan for training sessions, reference materials, and checkpoints for end users and admins. Also confirm what support you’ll get from the vendor, including response times, onboarding resources, and help with integrations or data issues.

- Define success metrics and measure them: Set measurable goals like reducing manual consolidation time, improving forecast turnaround, or increasing reporting accuracy. Revisit them quarterly and adjust as needed. Ask for feedback from users, monitor ROI, and adjust workflows or settings as your team grows more comfortable with the tool.

Choose the best FP&A software

Finding the right FP&A platform comes down to choosing a tool that can handle your reporting, forecasting, and analysis needs without slowing your team down.

If you’re looking for an Excel or Google Sheets native platform while gaining AI-powered forecasting, consider Cube. Finance teams use it to power automated variance analysis, real-time data sync, and strong governance controls without rebuilding their models from scratch.

Still unsure? Get a free demo to see if Cube is the right fit.

.png)

.png)

.png)

.png?width=630&height=354&name=prophix-view%20(1).png)

.png?width=594&height=367&name=oracle-netsuite%20(1).png)

%20(1).png?width=722&height=527&name=64835ddc6c1de9e907045aa7_Finance%20dashboard%20-%20Pigment%20homepage%20hero%20(4)%20(1).png)

![Best financial forecasting software solutions [2026 review]](https://www.cubesoftware.com/hubfs/financial-forecasting-software-tools-1.png)

![13+ best financial analysis software for FP&A teams [2026]](https://www.cubesoftware.com/hubfs/Financial%20Analysis%20Software%20Featured%20Image.png)