Best business budgeting software: Quick overview

Before we dive into the details, here’s a sneak peek at some of the best budgeting software solutions available today:

- Cube: A spreadsheet-native FP&A tool that empowers finance teams to work directly within Excel and Google Sheets, providing real-time insights and reducing manual data tasks

- Anaplan: Integrates financial data across departments to inform decision-making

- Vena Solutions: Combines budgeting, forecasting, and reporting with a spreadsheet interface and automation features

- Oracle Cloud EPM Planning: Enables scalable financial planning with advanced analytics, supporting enterprises in making forecasts

- Datarails: Centralizes data from various sources for budgeting and reporting

- Mosaic Tech: Includes integrated planning and analytics tools for finance teams, designed to unify budgets, forecasts, and reports

- Workday Adaptive Planning: Provides collaborative planning capabilities and real-time insights to support financial management

- Prophix: Delivers performance management tools, including budgeting and forecasting, with a focus on automation and efficiency

- Centage: Offers budgeting and forecasting for small to mid-sized businesses with customization options

- Budgyt: Provides a cloud-based platform for collaborative financial planning

- Planguru: Includes budgeting and forecasting tools to support long-term financial strategy

- Float: Focuses on cash flow forecasting, helping businesses manage day-to-day financial visibility.

- OneStream: Offers corporate performance management tools, supporting budgeting, forecasting, and financial consolidation

- Jedox: Provides integrated planning and analytics features with a focus on scalability and customization

- Scoro: Combines budgeting, project management, and performance tracking in one platform for businesses seeking streamlined operations

- QuickBooks: Includes straightforward budgeting features with tracking and reporting capabilities

- FreshBooks: Offers basic budgeting functions alongside its accounting tools

- Finmark: Helps businesses forecast financial needs and adjust for potential changes

- SAP Business Planning and Consolidation: Supports budgeting, consolidations, and reporting

- Pigment: Provides collaborative budgeting and analytics features, providing visual tools for financial planning and team-based projects

- Jirav: Allows companies to model multiple financial scenarios and visualize data trends

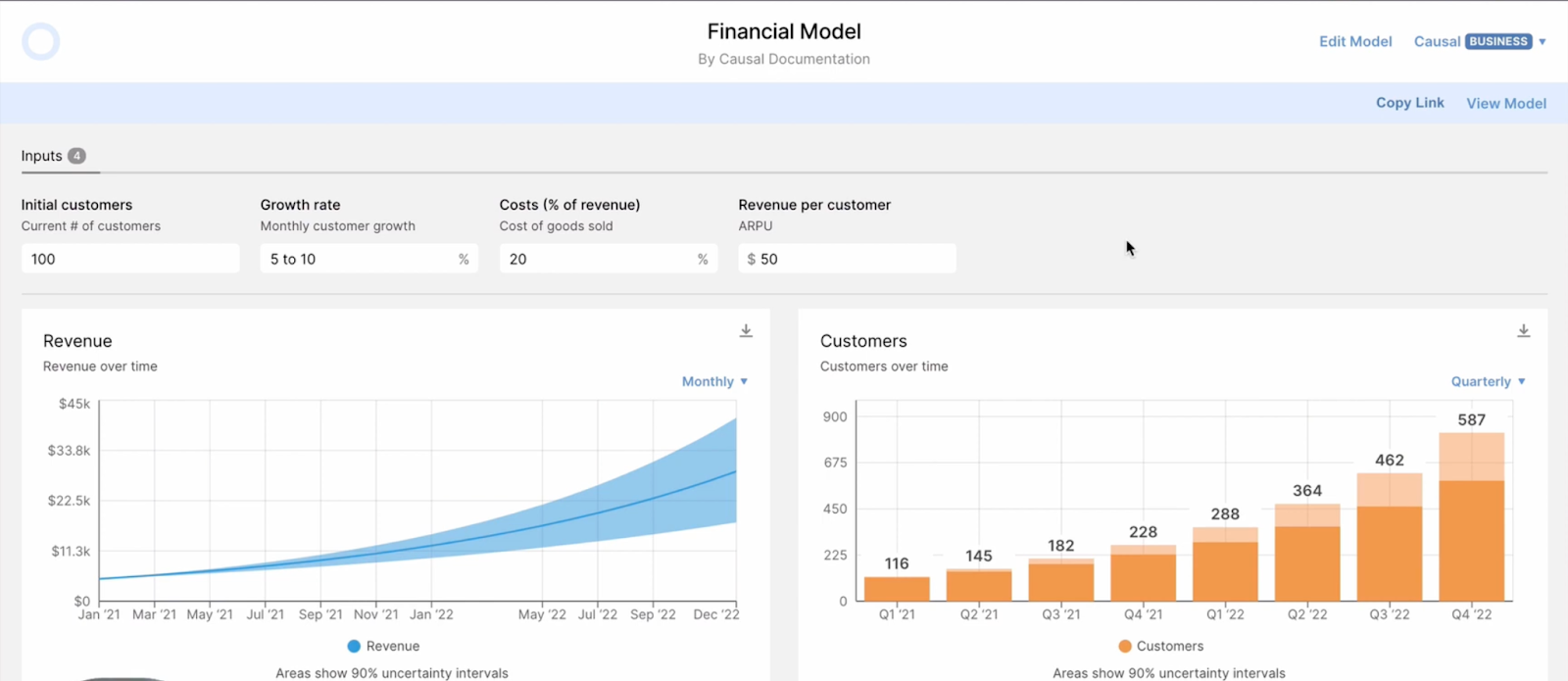

- Causal: Simplifies financial planning through scenario analysis and real-time collaboration

What is business budgeting software?

Business budgeting software tools enable businesses to quickly plan, implement, and manage business performance projections.

Currently, 92% of FP&A teams use spreadsheets every month to conduct their budgeting—but spreadsheets alone aren't a complete solution. They’re manual, unforgiving of errors, and Excel specifically was built for single users. Legacy FP&A software is just as problematic: challenging to deploy, inflexible, and hard to integrate with other tools.

There is no doubt that strategic finance teams will continue using Excel as a budgeting software solution. However, the copy-and-paste method of transmitting data from bank balances and payment platforms is cumbersome, time-consuming, and error-prone.

Enter the new generation of business budgeting software platforms. These tools solve Excel’s issues through integrations and automations that cut out unnecessary steps, reduce time spent on workflows, and increase the accuracy of data and forecasting.

Modern budgeting tools manipulate and analyze data more efficiently, in a much shorter space of time, and with far fewer mistakes.

What is business budgeting?

Business budgeting is a company’s future financial plan for a set period of time, usually a fiscal year. It measures estimations of revenue and expenses, liability payments, and risk against organizational goals and allocates resources accordingly.

Budgeting is nothing new. Historically, it was a time-consuming but necessary manual process involving basic arithmetic on abacuses, and then on handwritten ledgers. In 1985, Microsoft transformed the business budgeting process with the release of Excel, which brought electronic spreadsheets to the masses.

Excel created a symbiotic relationship, whereby extra flexibility, capacity, and accuracy allow companies to budget and grow more confidently. As they scale, the focus shifts to more detailed forecasting, multi-scenario planning, and strategic financial management. Naturally, increasingly sophisticated budgets require more powerful systems to give a business the edge over its competitors.

We now find ourselves in a form of financial arms race, with companies striving to produce the most informed budgets as simply as possible.

Benefits of the best budgeting software platforms

The benefits of robust budgeting software platforms revolve around more efficient time use, increased forecasting reliability, improved decision-making, and a greater return on investment.

Let’s take a look at the finer details.

- Integrations with other financial management systems, Excel, and Google Sheets allow you to work from a single dashboard, rather than multiple different apps. These synced interfaces eliminate data silos and give you and your team a single source of truth.

- Automated data consolidation saves you hours of busy work each month. You can use this time to focus on more strategic tasks that have a larger overall impact on your business.

- Tracking spending, especially across multiple financial accounts, highlights anomalies in your cash flow early on. This means you can spot potential issues before they escalate into bigger problems.

- Real-time analytics provide the groundwork for faster and more confident decision-making. When a crisis hits, you won’t have to wait for reports to be drawn up before you take action.

- Automated workflows such as data entry and report creation boost efficiency. This leads to faster budget preparation and more timely financial insights.

- Advanced forecasting and scenario planning anticipate potential financial outcomes so you can prepare for a series of situations simultaneously.

- Real-time key performance indicator (KPI) tracking constantly indicates whether you’re on track to meet your goals or if you need to intervene.

- Scalability allows you to grow without interruptions. As the volume and complexity of your data increases, so will the capacity of your business budgeting software.

The best business budgeting software tools

Now that you know what budgeting software tools are capable of, let’s see how they stack up against each other.

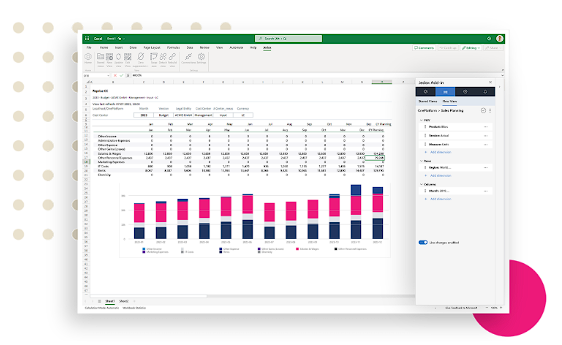

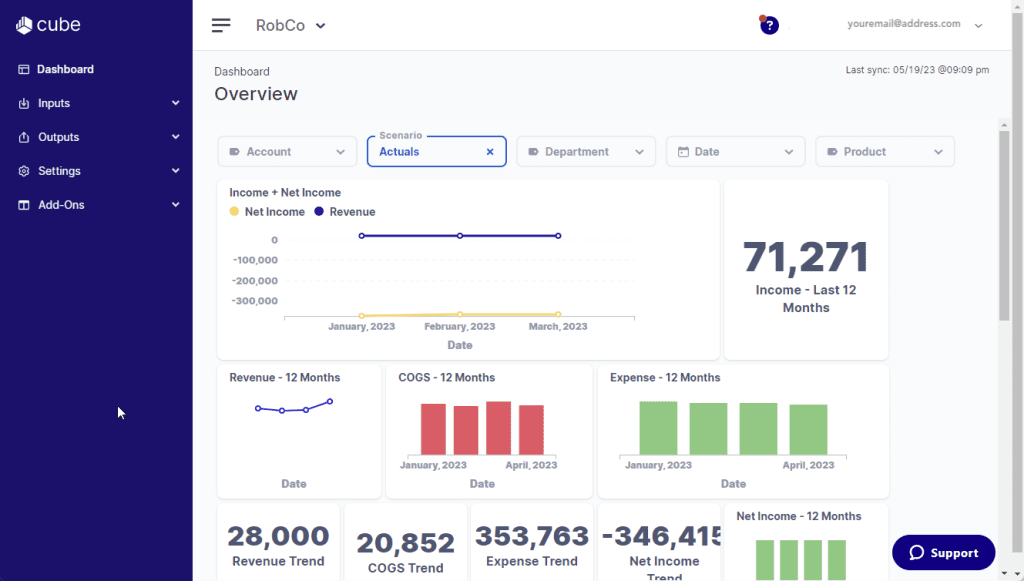

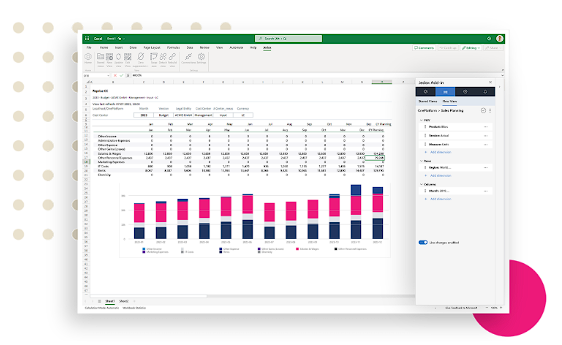

1. Cube

Cube is the real-time FP&A platform that embraces your spreadsheet. We provide a full tools platform for data management, reporting and analysis, and planning and modeling, providing you with a 360-degree view of your entire business: past, present, and future.

Cube automates all of those manual, time-intensive FP&A tasks that used to consume your days and nights and frees you up to focus on the good stuff: the high-value strategic analysis and storytelling that drives future business performance.

Here's a quick overview of Cube's benefits:

- The first spreadsheet-native FP&A software that empowers teams to drive better planning and performance without changing how they work.

- Eliminates manual work and provides the real-time insights finance needs to strategize with speed and agility.

- Pairs the flexibility and familiarity of your spreadsheets with the control and power of enterprise software.

- Implements quickly. Cube gets you up and running in days, not months, which means faster time to value at a lower cost.

- Connects with any source system, browser, and sheet in moments, so you don't have to change your work.

- Access to an award-winning customer team with deep FP&A experience.

Who it’s for:

Cube is best suited for SMBs and midmarket companies.

Features:

- Automated data consolidation connects data from numerous sources for automated rollups and drilldowns.

- Multi-scenario analysis allows you to seamlessly model how changes to key assumptions affect overall outputs.

- Endless integrations for spreadsheets (Google and Excel), accounting & finance, HR, ATS, billing & operations, sales & marketing, and business intelligence.

- Customizable dashboards give you the full ability to build and share customizable dashboards.

- Native Excel and Google Sheets integrations are compatible and bi-directional with any spreadsheet.

- Multi-currency support evaluates your financials in both your local and reporting currencies.

- User-based controls, validations, and an audit trail ensure that the correct data goes to the right people at the right time.

- Centralized formulas and KPIs store all your calculations in a central location and manage from a single source of truth.

- Drilldown and audit trail get straight to the transactions and history behind a single data cell in just one click.

➡️ See all of our features here.

Pricing:

See detailed pricing.

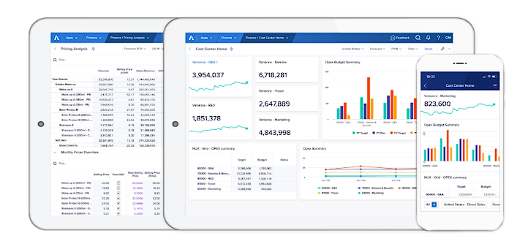

2. Anaplan

Anaplan is a cloud-based financial analysis and planning platform that enables businesses to orchestrate business performance and confidently execute financial decisions.

This software lets you plan complex financial scenarios, as well as create forecasts and long-term strategies while empowering your teams to make better, data-backed decisions.

What it is for:

This software has a powerful calculation engine and is designed for medium to large organizations needing complex financial solutions.

Key features:

- Creates and links to any number of planning streams through a central dashboard.

- Performs financial analysis down to a granular level.

- Utilizes a powerful calculation engine capable of performing huge, complex tasks.

- Easily adapts models as your business environment changes.

Pricing:

Anaplan has four different pricing plans offering increasingly complex features. They operate on a custom quote basis, so you’ll need to speak with a sales team member.

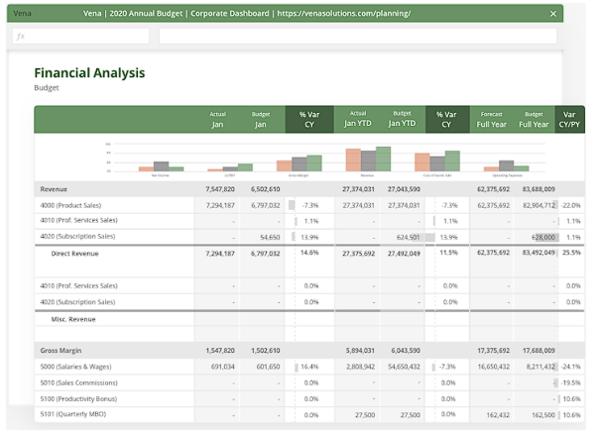

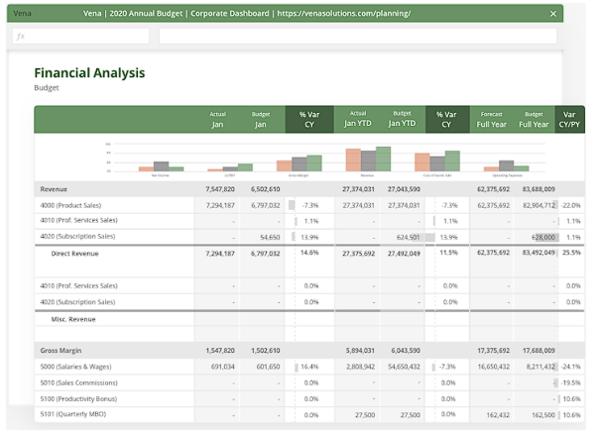

3. Vena Solutions

Vena combines the familiarity of Excel’s interface with Vena’s powerful growth engine. It is an enterprise-level financial planning software with various best-in-class capabilities to help finance teams streamline and improve their financial processes.

This software has several tools designed to help finance teams of all sizes collaborate better, simplify critical processes, and drive better data-driven solutions.

Who it’s for:

This software is designed to be an enterprise-level solution for medium to large-sized organizations and financial teams.

Key features:

- Uses Excel on the front end, which helps new users pick up and use the software.

- The cloud-based model means you can access your data from anywhere.

- Powerful and flexible reporting options help drive better decisions.

- API access enables you to export data into a BI tool of your choice.

Pricing:

Vena doesn’t provide any set monthly pricing information. You can request a demo or take a seven-day preview of their software to help you decide before committing to a plan.

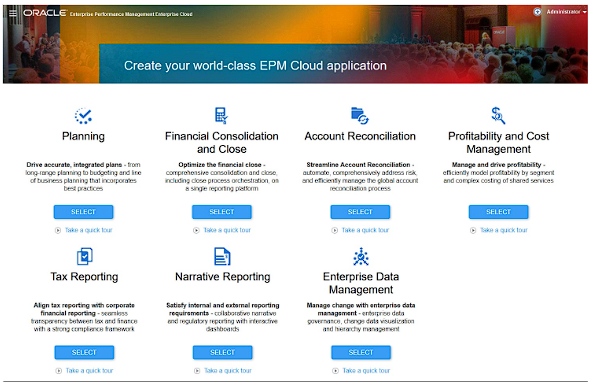

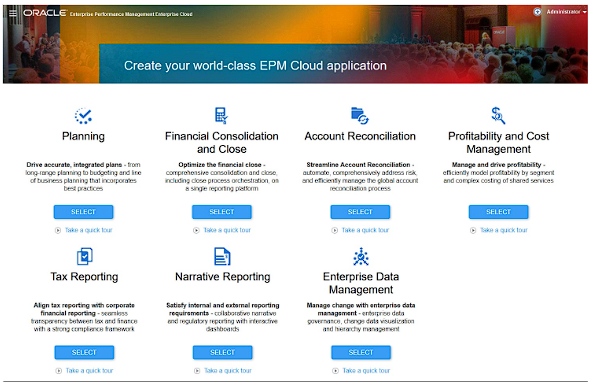

4. Oracle Cloud EPM Planning

Oracle PBCS is an EPM planning, budgeting, and forecasting platform. This software enables FP&A teams to make better decisions by creating data-backed, goal-oriented plans.

This software enables businesses to connect better across all departments, formulate robust financial strategies, and measure performance down to a micro level.

Who it’s for:

This software is designed for large enterprise-level organizations.

Key features:

- Creates a single source of truth for finance teams to work from.

- Helps drive deep insights into a business’s financial health.

- AI-powered analytics enhances data analysis and decision-making support.

Pricing:

Oracle has a complex pricing system that involves a minimum number of users and a three-year subscription. Here, we’ve included the minimum rate, but add-ons and premium services can cost much more.

- Standard cloud service: $2,500 per month ($250 monthly per user * 10 minimum users)

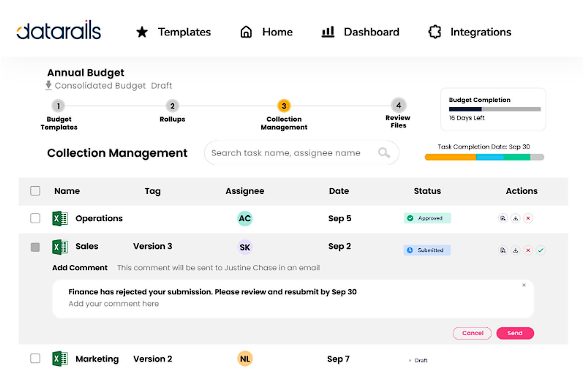

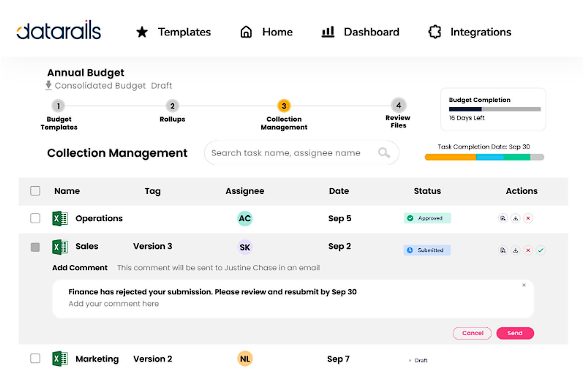

5. Datarails

Datarails is finance software designed to help users better manage data. This includes creating better budgets, forecasts, short and long-term plans, and all aspects of financial management.

Who it’s for:

Datarails is designed to help SMBs automate and streamline their financial processes. It uses Excel features, so it's only a good fit for teams who work exclusively on Excel.

Key features:

- Creates a single source of truth and enables collaboration.

- Uses Excel on the front end and is easy to use without technical knowledge.

- Helps automate repetitive tasks and reduce manual labor.

- A robust and secure platform helps reduce the chance of error.

Pricing:

Datarails does not provide any pricing plan information. You’ll need to contact their sales team for a custom quote based on your goals, users, and integrations.

Check out our complete Datarails review.

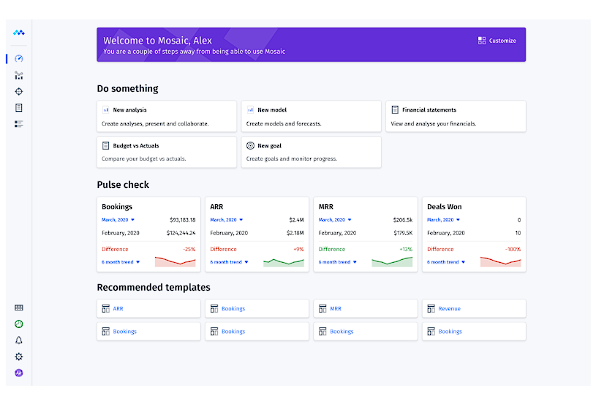

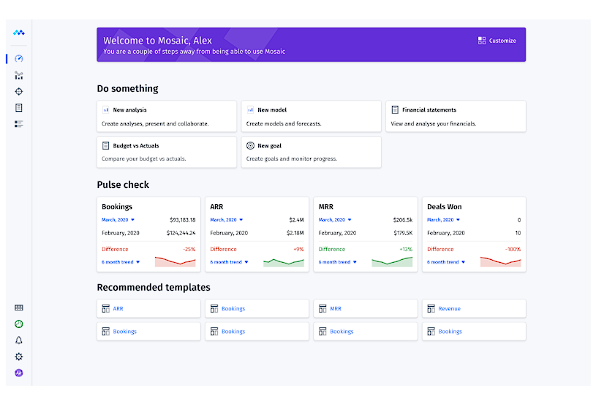

6. Mosaic Tech

MosaicTech is a strategic finance platform that consolidates insights across an organization, unifies data, aligns FP&A teams, and helps businesses make better decisions.

This software will connect with your existing tech stack, take some weight off your financial team, and streamline how you produce budgets and analyze your financial data.

Who it’s for:

This software is designed for small to medium-sized companies, helping FP&A teams better organize, manage, and analyze their financial data.

Key features:

- Multi-subsidiary consolidation connects separate instances of data.

- Built-in currency conversion and eliminations are great for companies working with multiple currencies.

- Gives quick and detailed insights into the financial health of your business.

Pricing:

Mosaic does not provide any pricing plan information. If you reach out to their sales team, they’ll give you a demo of the software and provide a custom quote.

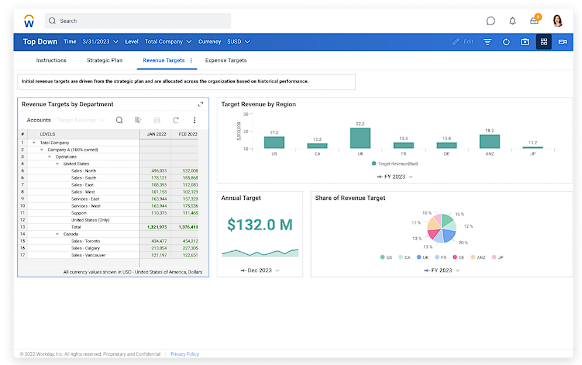

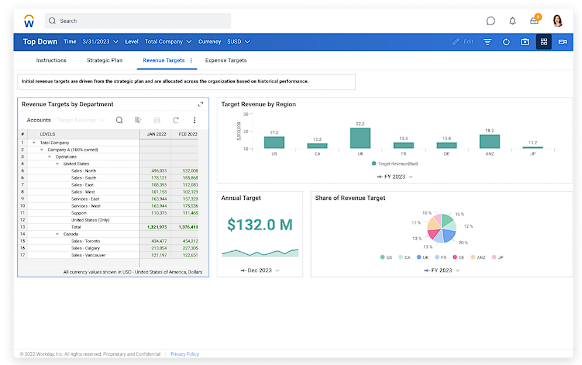

7. Workday Adaptive Planning

Workday Adaptive Planning is a budgeting and financial planning software designed to help finance and FP&A teams streamline their workflows and improve how they use their data to budget and forecast.

This software makes consolidating any number of spreadsheets and other data sources a breeze. You can organize, plan, model, budget, and quickly analyze your financial data once it’s in Workday.

Who it’s for:

This software is ideal for businesses of any size that need a modern software solution for collecting, organizing, and analyzing their financial data.

Key features:

- Easily produces balance sheets and cash flow data with a few clicks.

- Offers strong budgeting and forecasting tools.

- One-click refreshable board books, spreadsheets, and presentations.

Pricing:

Pricing is available upon request. Workday offers a free demo and a free trial if you’re interested in using the software before committing.

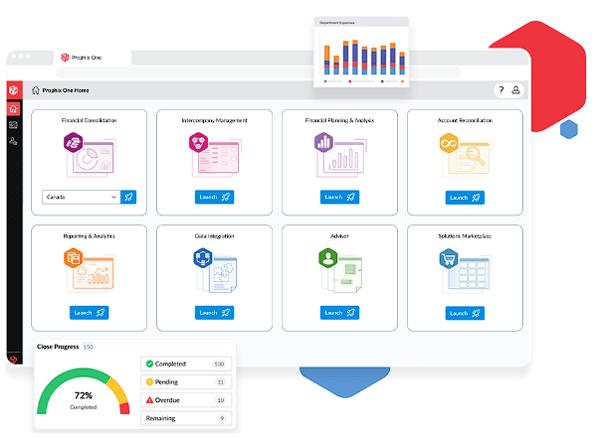

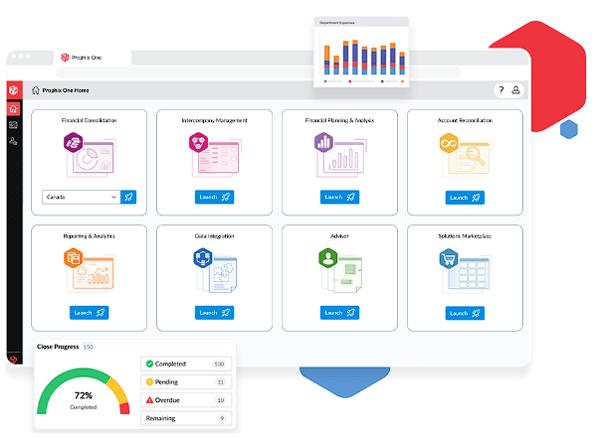

8. Prophix

Prophix is budgeting, planning, and reporting software. This software provides organizations with all the tools they need to automate and integrate their budgeting and forecasting processes. You can consolidate data, streamline workflows, and produce detailed reports on the backend.

Who it’s for:

This software is for organizations of all sizes looking for a robust budgeting solution.

Key features:

- Capable of complex financial reporting and analytics.

- Offers a clean interface with clear graphs and charts.

- Drills down into data to a fine granular level.

Pricing:

Prophix provides pricing upon request, but you can ask for a demo.

9. Centage

Centage is an intelligent planning, budgeting, and forecasting software. This cloud-based software delivers a robust suite of financial planning and analytics tools to help users gain deeper insights into their financials.

Small to medium-sized businesses can get the same level of detailed financial insights usually enjoyed by larger organizations using Centage.

Who it’s for:

This software is designed for small to medium-sized businesses that require detailed, analytical insights into their financial health.

Key features:

- Integrates with a wide range of third-party tools and apps.

- Capable of performing complex budgeting, forecasting, and financial planning tasks.

- Easy-to-use reporting and analytics tools produce insightful reports.

Pricing:

Centage does not provide any set pricing plans. You can get a quote and see a demo of the software by reaching out to their sales team.

Read our full Centage review.

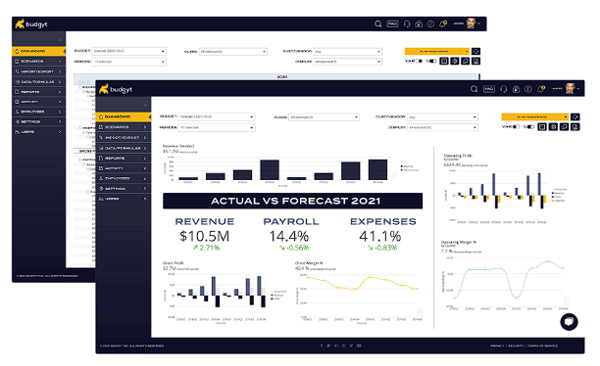

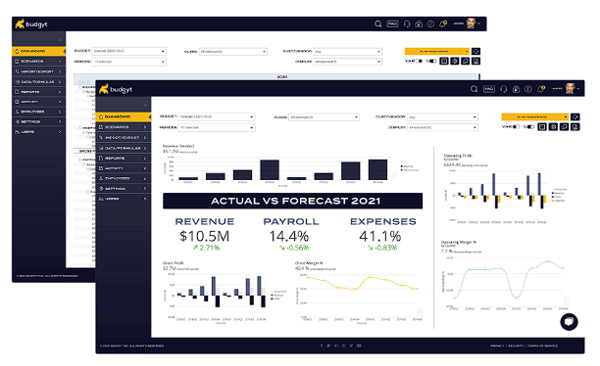

10. Budgyt

Budgyt is a budgeting and financial planning software that emphasizes simplifying, organizing, and managing data.

With an intuitive interface and a central dashboard displaying all your key financial information at a glance, anyone can take their budgeting to the next level.

Who it’s for:

This software is designed for small to medium-sized businesses and nonprofits looking for an all-in-one solution to streamline their budgeting and financial planning.

Key features:

- Easily turns all of your spreadsheets into organized databases.

- Forecasts and budgets for years into the future.

- Integrates with a long list of third-party tools and software.

Pricing:

Budgyt has started hiding its prices online but has recently displayed $199/mo to $699/mo. They also have discounted rates for nonprofits.

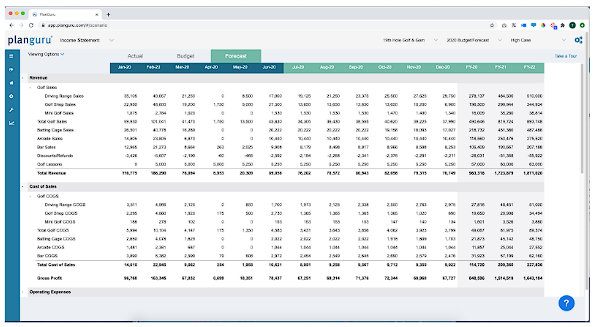

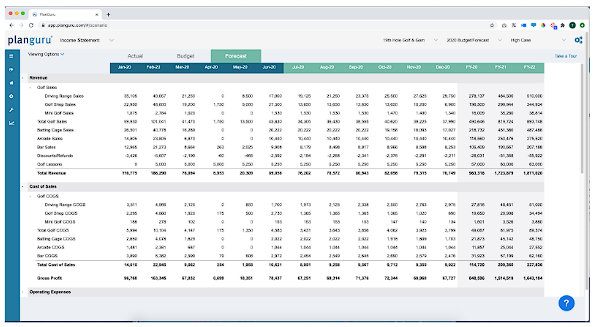

11. Planguru

Planguru is an Excel and QuickBooks-compatible budgeting software. It’s designed to help small to medium-sized businesses streamline how they organize their data and improve their budgeting.

This software enables you to forecast and budget up to 10 years into the future. It also includes cash flow projections, ratios, and financial modeling tools.

Who it’s for:

This software is ideal for small to medium-sized businesses and nonprofits.

Key features:

- Supports a wide range of budgeting and forecasting needs

- Smart scenario analysis enables you to make better financial decisions.

- Compatible with QuickBooks, QuickBooks Online, Xero, and Excel.

Pricing:

PlanGuru offers two pricing tiers:

- Single Entity: At $99/month, this tier is ideal for SMBs and nonprofits.

- Multi-Department Consolidations: At $299/month, this pricing plan is ideal for larger teams with multiple divisions, departments, or locations.

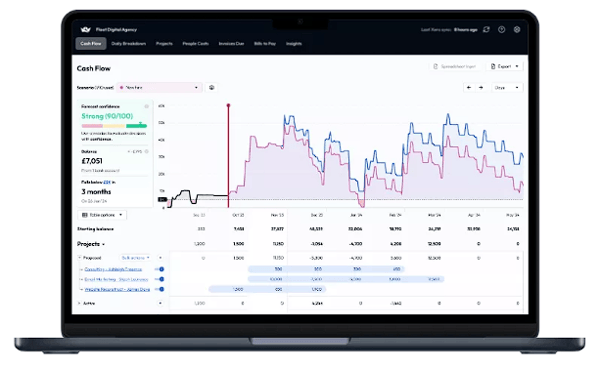

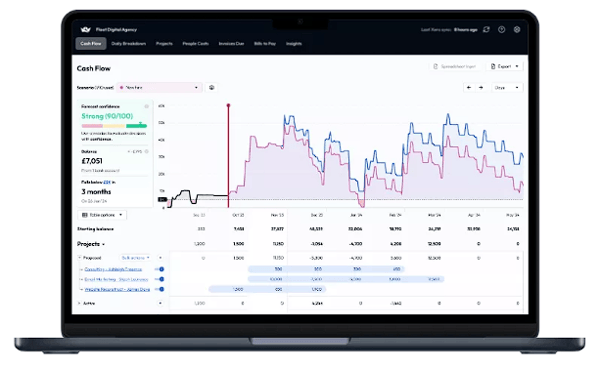

12. Float

Float is a cash flow and forecasting scenario planning software. This software helps users clearly see all future incoming and outgoing cash, create and compare “what if” scenarios, and make better financial decisions.

This software easily organizes financial information and provides financial clarity with real-time data and many smart features.

Who it’s for:

This software is for individuals and businesses using QuickBooks Online, Xero, or FreeAgent who want better insights into their financials.

Key features:

- Seamlessly integrates with QuickBooks Online, Xero, or FreeAgent.

- “What if” scenarios give data-driver insights into future cash flow.

- Strong budgeting tools help make better financial decisions.

Pricing:

Float has three pricing plans, depending on how many users and the features you want.

- Essential: $59/month for three users

- Premium: $99/month for 10 users

- Enterprise: $199/month for 100 users

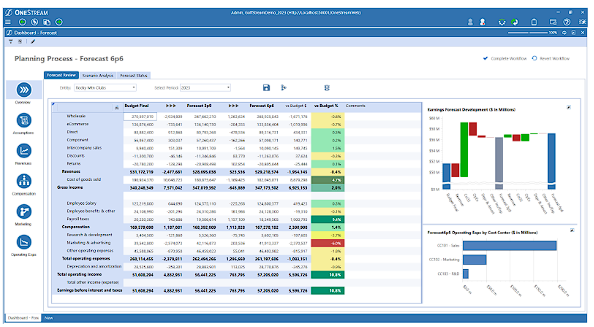

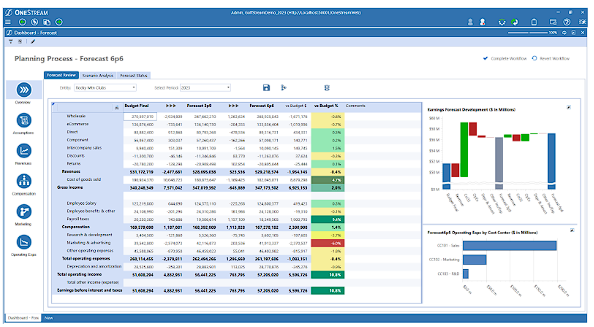

13. OneStream

OneStream is an EPM platform that combines a whole host of FP&A services in one place. It offers solutions from budgeting and forecasting to financial close and consolidation, ESG reporting and planning, and transaction matching.

Who it’s for:

OneStream is a comprehensive service for companies looking to scale. It is particularly interested in capturing clients currently using SAP and Oracle and offers dedicated migration tools to do so.

Key features:

- AI financial forecasting boosts time to value.

- Offers additional FP&A features, including planning, forecasting, and reporting.

- Easy scalability meets the needs of large, complex organizations.

Pricing:

You need to contact OneStream for a demo before finding out the pricing structure they’ll offer to your company.

14. Jedox

Jedox is a versatile FP&A solution that integrates well with existing business systems. It is dedicated to streamlining a range of finance processes through automation and AI.

Who it’s for:

Jedox pitches its product mainly at enterprise-level companies as well as for mid-market organizations.

Key features:

- Company-wide capabilities combine all your KPIs into one system.

- Integrates relatively easily with existing IT platforms.

- Runs multiple budgeting reports, all with different data.

Pricing:

Jedox has three price tiers, starting around $160 per month, but asks that you get in touch with them for full transparency.

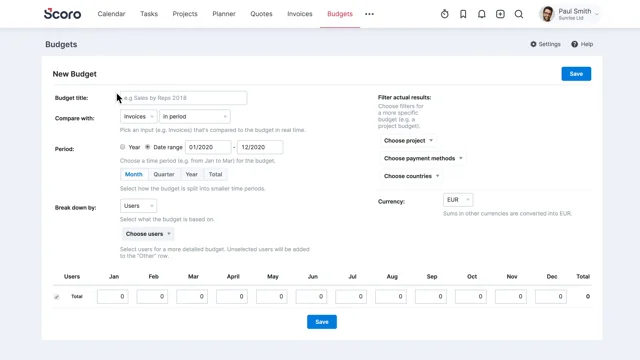

15. Scoro

Scoro is a far-reaching service that combines budgeting, project management, CRM, and reporting features for a fully united business headquarters on the cloud.

Who it’s for:

This is designed for small to medium-sized businesses seeking an all-encompassing solution to manage their financial planning, projects, and customer relationships in one place.

Key features:

- Offers a wide range of integrations with popular project management and accounting tools.

- Time tracking and billing support accurate project accounting.

- CRM features for customer relationships and closer monitoring of sales pipelines.

Pricing:

Scoro offers three pricing plans:

- Essential: $28/user/month

- Standard: $42/user/month

- Pro: $71/user/month

There is also an Ultimate plan available with custom pricing for advanced needs.

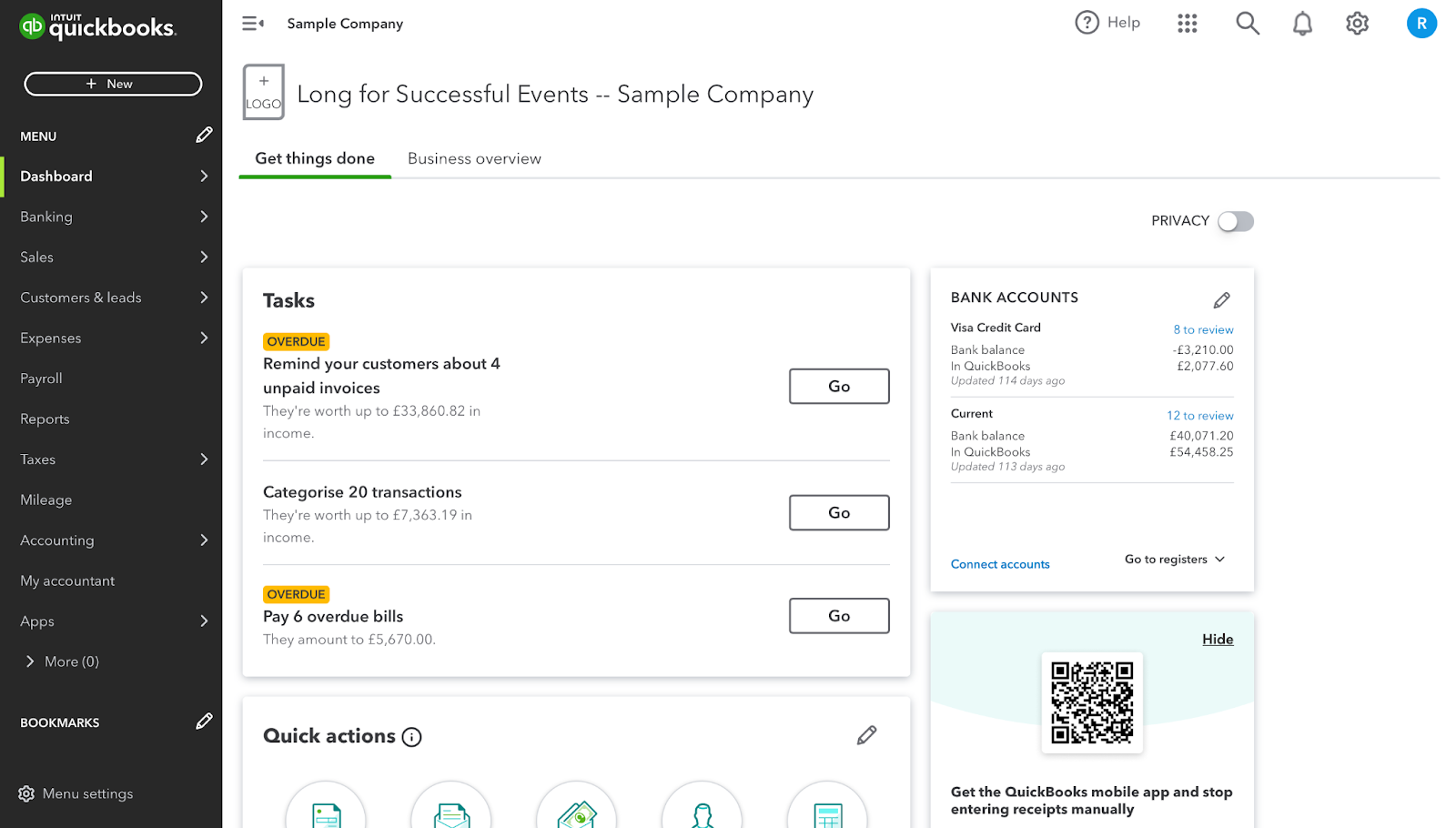

16. Quickbooks

QuickBooks is a widely used business budgeting and accounting software designed to help small and mid-sized businesses manage their finances.

Its features support budgeting, expense tracking, invoicing, and reporting, all within an accessible interface.

With integration options and a scalable structure, QuickBooks accommodates various business needs, from day-to-day expense management to more comprehensive financial oversight. This tool also offers customization to suit different business types and industries.

Who it’s for:

QuickBooks is ideal for small and mid-sized businesses seeking an affordable, user-friendly solution for budgeting, expense tracking, and basic financial reporting.

Key features:

- Multi-currency support allows businesses to manage global transactions.

- Automated invoicing generates and sends invoices to clients, reducing manual tasks and ensuring timely payments.

- Expense tracking categorizes and tracks business expenses, giving users a clear view of spending patterns and opportunities for savings.

- Cash flow management tools provide real-time insights into cash inflows and outflows.

- Integration with third-party apps like PayPal, Square, and Shopify, centralizes financial data in one place.

- The business budget app gives you access to budgeting on the go.

Pricing:

Quickbooks offers a wide range of tiers, with Payroll as an additional extra.

- Simple Start: $35 per month, suited for basic accounting and budgeting needs.

- Essentials: $65 per month, includes multi-user access and bill management.

- Plus: $99 per month, adds project tracking and inventory management.

- Advanced: $235 per month, including business analytics and advanced customization options.

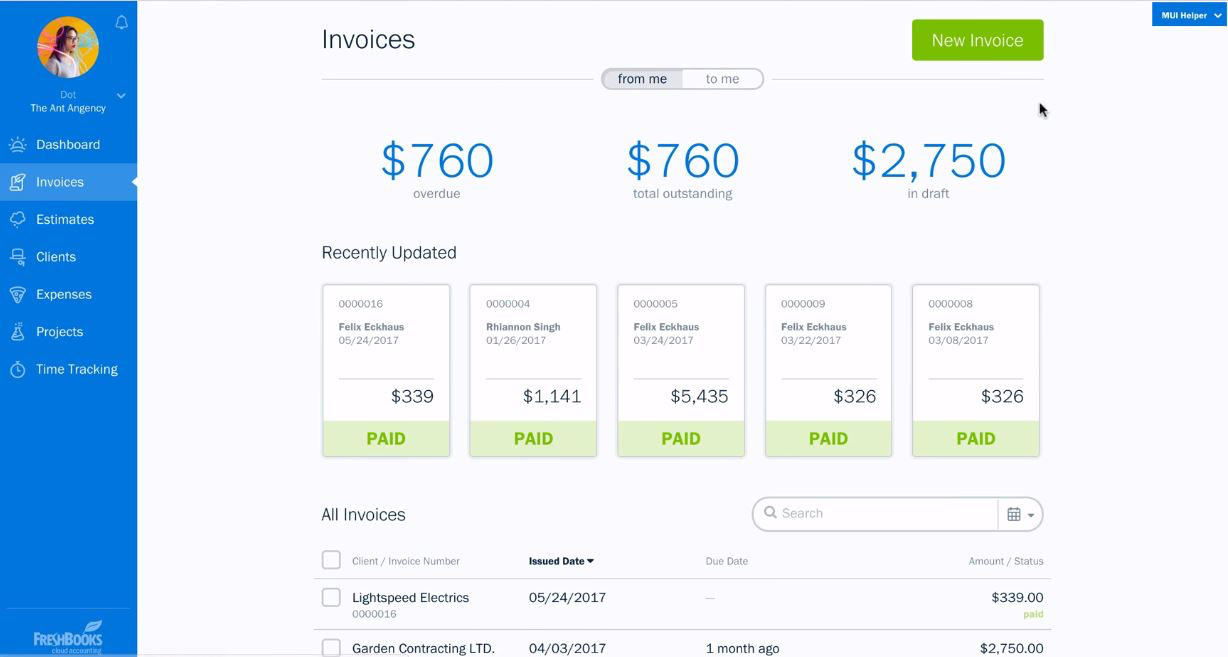

17. FreshBooks

FreshBooks is a cloud-based accounting and budgeting software for small businesses, freelancers, and service-based companies.

It provides tools for managing invoices, tracking expenses, and monitoring budgets on a simple interface that supports financial organization.

FreshBooks also offers integration with a variety of business tools, helping users stay on top of their financial data without needing advanced accounting knowledge.

Who it’s for:

FreshBooks is ideal for freelancers, small businesses, and service-based companies that need an easy-to-use budgeting and accounting solution with invoicing and reporting features.

Key features:

- Time tracking records billable hours directly within the platform for accurate billing.

- Expense management tracks and categorizes both regular and one-time expenses for better visibility into financial activity.

- Invoicing offers customizable templates and automated reminders to keep track of payments.

- Project management features allow you to track project budgets, assign tasks, and manage deadlines.

- Reports and analytics provide profit and loss statements, tax summaries, expense tracking, and more.

Pricing:

FreshBooks offers flexibility at different pricing levels, as well as add-ons and custom pricing models:

- Lite: $19 per month, for basic features like invoicing and expense tracking.

- Plus: $33 per month, which includes project tracking and time tracking capabilities.

- Premium: $60 per month, adding more advanced features like increased team access and additional reporting tools.

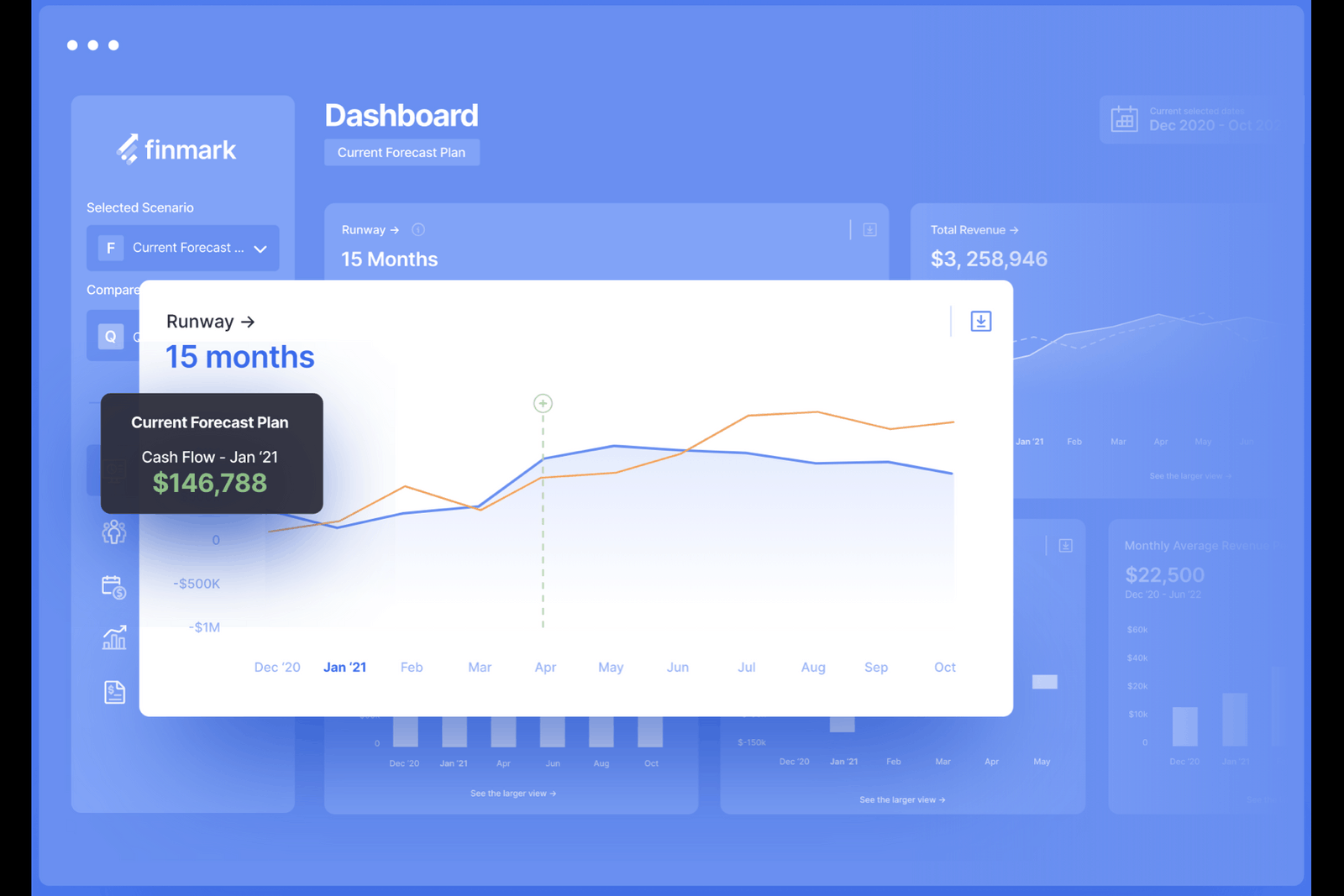

18. Finmark

Finmark is a business budget app that helps organizations manage budgets, track expenses, and forecast future financial performance.

It provides a platform for building financial models, scenario planning, and integrating with other tools to streamline financial workflows.

With a focus on scalability, Finmark is particularly useful for growing businesses that need more than just basic budgeting tools, offering insights that support data-driven decision-making.

Who it’s for:

Finmark is best suited for growing businesses, startups, and finance teams that need advanced financial planning and scenario modeling to manage their budgets and forecasts.

Key features:

- Scenario modeling allows businesses to evaluate the impact of different assumptions and external factors.

- Cash flow forecasting offers an accurate prediction of cash inflows and outflows.

- Team collaboration gets multiple users working on financial models and budgets simultaneously.

- Data integrations sync with popular accounting tools like QuickBooks and Xero.

- Customizable reporting generates tailored financial reports, including the three financial statements.

Pricing:

Finmark’s pricing depends on your current annual revenue.

- Zero annual revenue: $50 per month

- $500,000 annual revenue: $100 per month

- $1,000,000 annual revenue: $250 per month

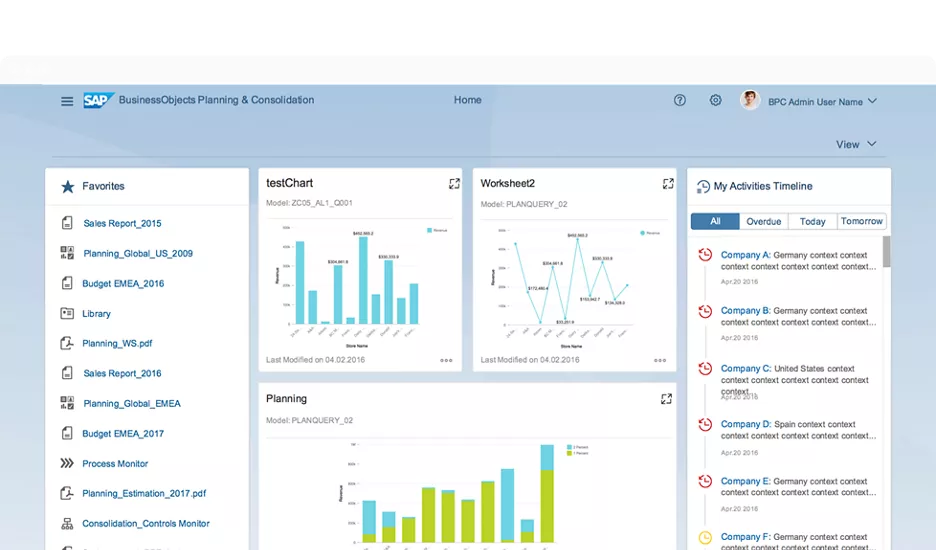

19. SAP Business Planning and Consolidation

SAP Business Planning and Consolidation (BPC) is an enterprise-level financial planning and budgeting software.

Designed for large organizations, SAP BPC integrates with SAP’s enterprise resource planning (ERP) and other business systems for comprehensive financial management across departments.

It allows finance teams to collaborate on detailed financial planning while staying compliant with accounting standards and corporate policies.

Who it’s for:

SAP Business Planning and Consolidation is intended for large enterprises that require integration across complex business systems.

Key features:

- Financial consolidation collates data from multiple departments or subsidiaries and keeps you compliant with global accounting standards.

- Budgeting and forecasting for multi-year budgets and adjusted projections based on real-time data.

- Real-time data integration links directly to SAP ERP and other business systems for consistent financial data across the organization.

- Multi-user access facilitates collaboration across different departments.

- Advanced reporting with customizable reports for financial statements and KPIs.

- Multiple scenario planning prepares for potential changes in market conditions or internal operations.

Pricing:

SAP BPC offers customized pricing based on the scale of implementation, number of users, and specific business needs, tailored to the requirements of large enterprises.

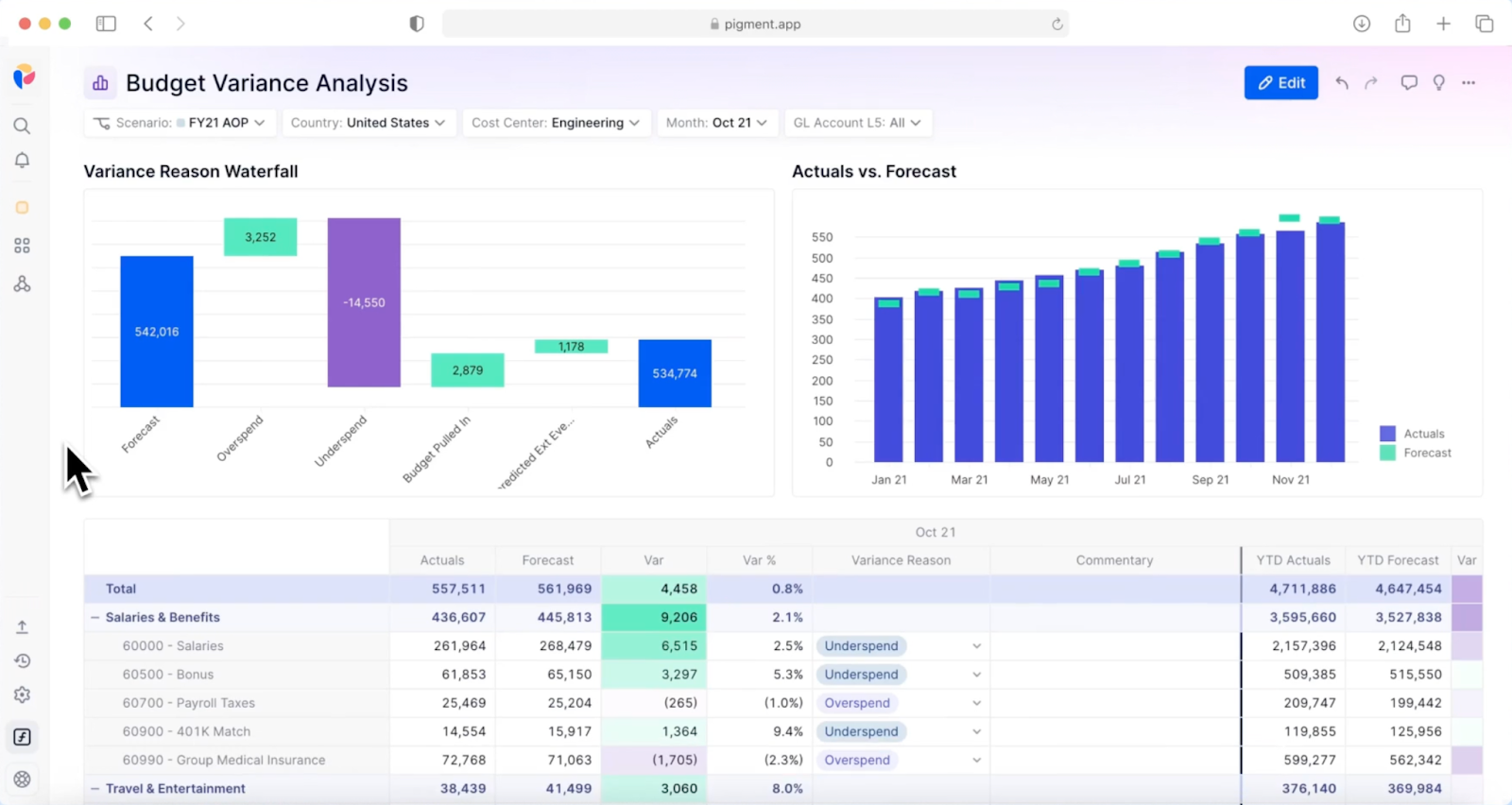

20. Pigment

Pigment is a financial planning and budgeting software designed to help businesses manage their budgeting, forecasting, and performance analysis.

Its visual interface and features allow finance teams to model data, collaborate in real time, and make informed decisions.

Pigment is suitable for organizations that require detailed financial planning with a focus on scalability, flexibility, and team collaboration, supporting businesses through complex financial processes.

Who it’s for:

Pigment is ideal for mid-sized to large businesses that value collaboration, scalability, and advanced budgeting and forecasting capabilities.

Key features:

- Pigment AI lets you question your data to verify your numbers.

- Data integration connects Pigment with a range of other business tools.

- Customizable dashboards let you design personalized financial views with specific metrics and performance indicators.

- Budget tracking monitors actual performance against budgeted figures to identify variances.

- Reporting offers balance sheets, P&L statements, and cash flow analysis.

Pricing:

Pigment offers custom pricing depending on the size of your business and other factors.

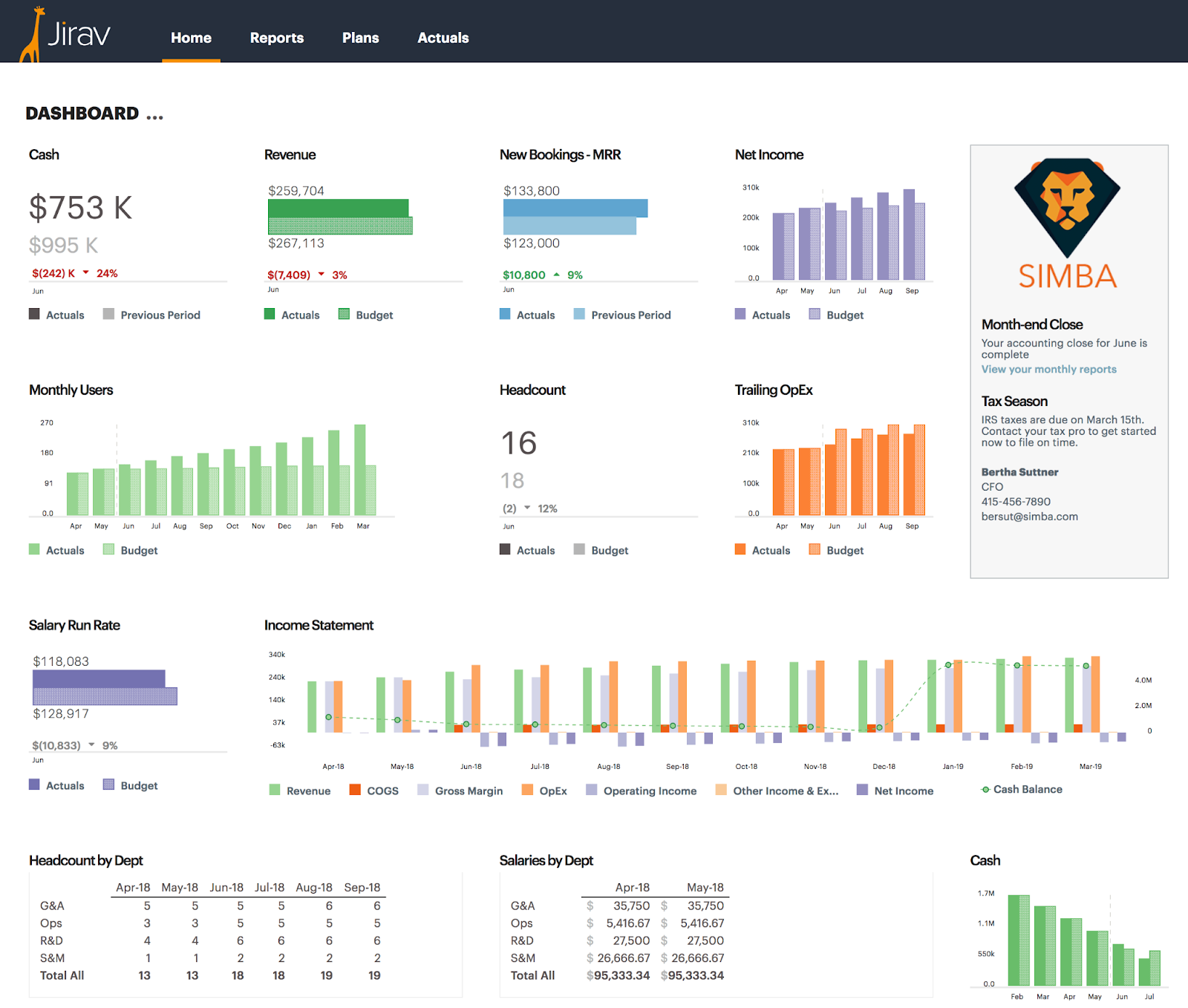

21. Jirav

Jirav is an FP&A solution that offers tools for modeling complex financial data, creating detailed budgets, and running forecasts to inform decision-making.

With an emphasis on scalability and ease of use, Jirav is suitable for businesses looking to streamline their financial processes and gain deeper insights into their financial performance.

Who it’s for:

Jirav is well-suited for mid-sized businesses and growing companies that need robust budgeting, forecasting, and reporting tools.

Key features:

- Budgeting and forecasting that uses historical data to project future financial performance.

- Driver-based modeling helps businesses evaluate the impact of various assumptions and external factors on their financials.

- Customizable reporting displays tailored financial reports on your dashboard.

- Real-time data integration connects Jirav with existing accounting, payroll, and ERP systems.

- Industry templates to standardize and scale your processes.

Pricing:

Jirav doesn’t provide specific figures or pricing tiers but estimates at least $20,000 per contract.

22. Causal

Causal is a financial planning tool that builds flexible, data-driven budgets, forecasts, and financial models.

With a coherent interface, it uses AI to create financial models based on your chart of accounts. It also connects to human resources, customer relationship management, accounting, and ERP apps.

Who it’s for:

Causal is suitable for small to mid-sized businesses, startups, and finance teams with an eye on AI.

Key features:

- Automated data integration connects Causal with other financial tools like accounting software and spreadsheets.

- Customizable dashboards provide visual representations of key financial metrics.

- Interactive reporting with variance analyses, user permissions, and live data flow.

- Scenario modeling to create multiple financial scenarios and compare them side by side.

- Enterprise-level security spans user admins, Single-Sign On, and compliance.

Pricing:

Causal provides tiers for reporting, modeling, and growth with custom pricing. However, their startup program is available for $99 per month for six months.

Features to consider when researching business budgeting software

Choosing the right budgeting software depends heavily on your business’s size, industry, and specific financial needs.

Below are key features to consider to ensure your choice aligns with your organization’s unique requirements:

Budgeting tools for small businesses

Small businesses often need budgeting software that’s easy to use, affordable, and capable of handling essential tasks without unnecessary complexity.

Key features to prioritize include:

- Straightforward data entry

- Basic forecasting

- Expense tracking

- Simple reporting to monitor cash flow and profitability

Many small businesses benefit from software that integrates with accounting platforms they may already use, like Excel or Google Sheets, helping consolidate financial management without overwhelming the team.

Best business budgeting software for small businesses:

- QuickBooks: Ideal for small businesses needing basic budgeting, expense tracking, and financial reporting. Its user-friendly interface and integration with popular accounting tools make it accessible for teams with limited financial expertise.

- FreshBooks: Designed for freelancers and small business owners, FreshBooks gives you easy-to-use budgeting and invoicing tools to manage your finances in one place without a steep learning curve.

Budgeting tools for mid-sized businesses

For mid-sized businesses, budgeting software should offer more advanced features, such as:

- Multi-user access

- Scenario planning

- Reporting customization

Growing teams with more complex budgets will need scalable tools that integrate well with other business systems (like CRM and HR platforms). This helps to unify data and improve collaboration across departments.

Best business budgeting software for mid-sized businesses:

- Cube: Cube’s FP&A platform is perfectly compatible with Excel and Google Sheets, giving mid-sized businesses real-time insights without the need to overhaul their existing workflows. Its automation and integration capabilities mean that growing teams can make decisions, plans, and reports without compromise.

- Vena Solutions: Vena combines the familiarity of a spreadsheet interface with powerful budgeting, forecasting, and reporting features. It enables finance teams to automate routine tasks, collaborate on financial plans, and integrate data from multiple sources, making it an option for growing mid-sized companies that need both flexibility and efficiency.

- Jirav: Jirav is well-suited for mid-sized companies looking for flexible budgeting, forecasting, and reporting tools. It supports scenario planning and provides customizable dashboards, making it easier to analyze data and plan for future growth.

- Workday Adaptive Planning: Workday Adaptive Planning is designed to provide collaborative planning capabilities and real-time financial insights. Its scalable features support mid-sized businesses as they grow, offering scenario modeling, customizable dashboards, and integration with other business tools to streamline financial management across departments.

Budgeting tools for enterprises

Large enterprises often require comprehensive budgeting software that can forecast complex financial scenarios, consolidate vast amounts of data across multiple departments, and integrate with ERP systems.

Key features include:

- Advanced forecasting

- Multi-scenario planning

- Real-time data analysis

- Role-based access to ensure data security across large teams.

These tools typically offer extensive customization and reporting options, allowing finance teams to tailor outputs for various stakeholders.

Best business budgeting software for enterprises:

- Cube: Cube’s flexible FP&A platform easily adapts to the needs of enterprise finance teams by integrating directly with spreadsheets like Excel and Google Sheets. It has advanced automation for data consolidation and reporting while maintaining a familiar interface, allowing enterprises to streamline financial workflows and increase forecasting accuracy without overhauling their systems.

- SAP Business Planning and Consolidation: SAP’s solution is designed for large organizations, offering robust budgeting, consolidation, and reporting capabilities. Its integration with ERP systems makes it ideal for enterprises needing centralized financial management, but it does imply migrating all of your operations to SAP tools.

- Pigment: Pigment is an enterprise-level planning and analytics system with collaboration features for large teams to work together on complex financial plans. It’s an excellent choice for companies that need a scalable solution to manage intricate budgets and forecasts across departments.

- Anaplan: Anaplan provides a connected planning platform that integrates financial data across departments and offers scenario modeling capabilities. It supports enterprise-wide collaboration and gives decision-makers consistent, real-time financial insights, making it functional for large organizations managing complex budgets and strategic planning.

Choose the best business budgeting software for your team

As you can see, there's no “one-size-fits-all” regarding business budgeting software tools. However, there are still some excellent tools on the market. Organizing data, automating workflows, and producing budgets has never been easier for finance and FP&A teams.

To choose the best budgeting software, you simply need to compare your current needs and future ambitions with what these tools offer.

For a hands-on experience, book a live demo and see how Cube can streamline your FP&A processes today.

.png)